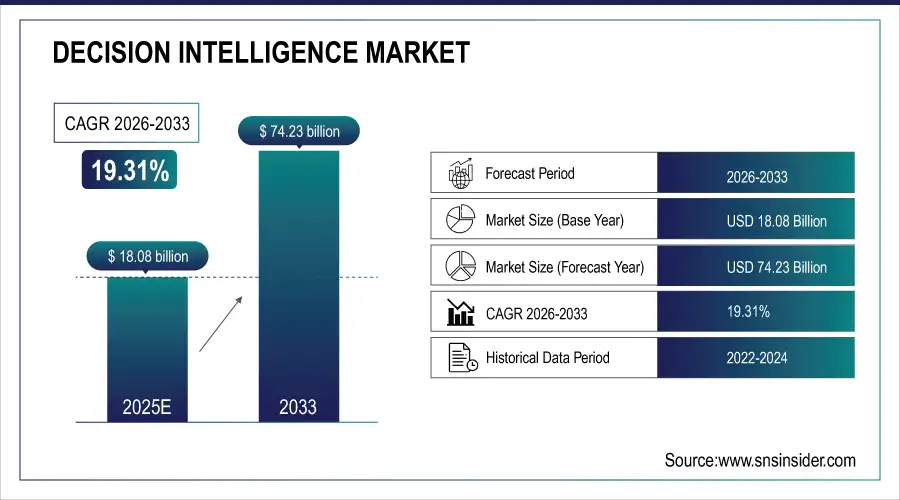

Decision Intelligence Market Size & Overview:

The Decision Intelligence Market is anticipated to reach from USD 18.08 billion in 2025E to USD 74.23 billion by 2033, growing at a CAGR of 19.31% over 2026-2033.

The Decision Intelligence Market is undergoing a significant transformation as organizations increasingly recognize the critical role of data-driven decision-making in enhancing efficiency and achieving a competitive advantage. Key factors driving this growth include the rising volume of data generated across various sectors, the increasing adoption of artificial intelligence (AI) and machine learning (ML) technologies, and the growing need for real-time insights to support strategic decision-making.

Companies are actively investing in Decision Intelligence solutions to optimize their operations, improve customer experiences, and drive innovation. For example, major firms like IBM have integrated Decision Intelligence capabilities into their Watson platform, allowing businesses to analyze large datasets and derive actionable insights. In the financial services industry, organizations are utilizing these solutions to enhance risk assessment and fraud detection, leading to greater operational efficiency and reduced losses.

Decision Intelligence Market Size and Forecast:

-

Market Size in 2025E: USD 18.08 Billion

-

Market Size by 2033: USD 74.23 Billion

-

CAGR: 19.31% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Get More Information on Decision Intelligence Market - Request Sample Report

Moreover, industries such as healthcare are harnessing Decision Intelligence to improve patient outcomes. Hospitals are using predictive analytics to anticipate patient admission rates and optimize resource allocation, resulting in enhanced care and cost reductions. Additionally, the widespread adoption of cloud computing and the growing focus on digital transformation across various industries are facilitating the implementation of Decision Intelligence solutions. Organizations can now access sophisticated analytics tools without the need for extensive infrastructure investments, making these solutions more accessible. One of the major factors attributed to growth is growing requirement for enhanced operational efficiency. According to a recent McKinsey report, organizations with decision making powered by advanced analytics can boost productivity by as much as 25%. Decision intelligence trends in 2023 sees companies like Amazon use this to quickly curate their inventory with an optimal mix of what target customers will most likely want, through data insights and analysis which improves supply chain metrics significantly.

In conclusion, the Decision Intelligence Market is positioned for remarkable growth as businesses across diverse sectors recognize the advantages of leveraging advanced analytics and AI to make informed, strategic decisions that improve performance and strengthen their competitive position.

Decision Intelligence Market Drivers

-

The synergy of decision intelligence with AI and machine learning enhances automation and decision-making capabilities.

-

Businesses are leveraging decision intelligence to make faster, informed decisions, gaining an edge over competitors.

-

The increasing shift to cloud-based solutions allows for scalable decision intelligence tools that can be accessed from anywhere.

Growth of Decision Intelligence (DI) Market size is driven by the transition to cloud-based solutions. Due to this, it enables enterprises to efficiently scale their DI tools by using the on-demand access that the cloud provides, resulting in powerful computing resources and storage without having to make large upfront infrastructure investments. Such scalability enables companies to promptly process large data sets, execute complex algorithms and provide real-time insights thus expediting decision-making and propelling operational efficiency.

Another great thing about the cloud-based DI platforms is that it allows access to anywhere so that remote and distributed teams can collaborate better. As experience of globalization makes its way into most workplaces, decision makers have up-to-date insights at the tip of their fingers from any device and location. Additionally, it improves the security of your data, aiding in regulatory compliance and disaster recovery. Cloud providers have extensive security strengths needed to deal with sensitive data. Cloud solutions also come with greater ease of use to update and scale without the legacy restructuring obstacles.

Cloud-based DI tools are being adopted by a range of industries, including finance and healthcare, that seek to operate more efficiently, deliver better customer experiences and react to market changes. Skillset, accessibility, and security digital transformation supported with cloud in particular is a major enabler for the overall growth of the Decision Intelligence market.

Decision Intelligence Market Restraints

-

Initial setup and integration of decision intelligence systems can be expensive, limiting adoption by smaller businesses.

-

Integrating decision intelligence tools with existing legacy systems and workflows can be challenging, requiring significant technical expertise and time.

-

A shortage of professionals skilled in AI, machine learning, and advanced analytics hampers widespread implementation of decision intelligence solutions.

The shortage of professionals skilled in AI, machine learning, and advanced analytics presents a major barrier to the widespread adoption of decision intelligence (DI) solutions. DI relies on complex algorithms and data-driven insights, requiring a workforce proficient in these advanced technologies. However, the demand for such expertise far outpaces the available talent, leading to a significant skills gap. This gap hinders the implementation of DI tools, as companies struggle to recruit and retain experts capable of deploying and optimizing these systems. Without the necessary skills, businesses may underutilize DI platforms, resulting in inefficient decision-making and missed growth opportunities. Additionally, training current employees in DI technologies demands considerable time and resources, further delaying adoption. Small and medium-sized enterprises (SMEs), in particular, may lack the financial resources to hire top-tier AI specialists, placing them at a disadvantage.

As the DI market grows, the need for specialized training and upskilling becomes increasingly urgent. Addressing this talent shortage is crucial to unlocking the full potential of decision intelligence, enhancing efficiency, and maintaining competitiveness in a data-driven economy. Without a skilled workforce, market growth could stall, even with rising demand for advanced decision-making technologies.

The integration of decision intelligence (DI) tools with legacy systems is usually complex and lengthy process, requiring substantial technical expertise. Many organizations remain attached to legacy infrastructure and processes that make integration with modern DI solutions tricky. It is a resource intensive process which normally includes custom code, data migration, and workflow changes. In addition, integration needs to be handled delicately to avoid interfering with ongoing operations. This particularised skills set will provide delay or more charges. Then, SMEs are the most heavily affected by these unfinished threats due to exposed security gaps caused by their scarce technical knowledge and budgets. Organizations must successfully surmount these integration challenges so that they can benefit fully from decision intelligence.

Decision Intelligence Market Segmentation Analysis

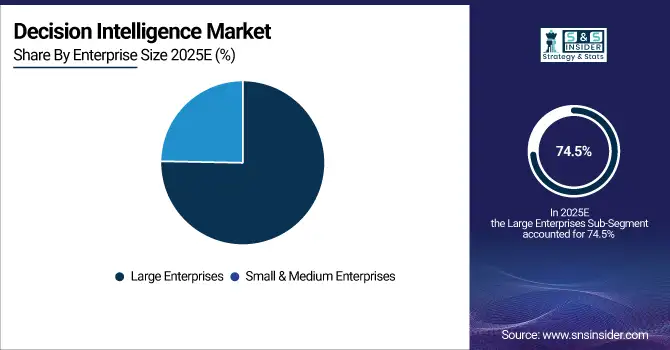

By Enterprise Type

Large enterprises segment dominated the market and held the highest market share of 74.5% in 2025. Driven by numerous aspects such as high consumer engagement and fulfillment, comprehensive data analysis and visualization, accelerated data access and discovery, low operational cost and increased productivity. These solutions are foundational in helping organizations leverage data for better-informed decision-making. Furthermore, large enterprises have more financial ability and can spend much more on decision-making solutions, which reveals the high value of these decision-making tools to their operations.

Small & Medium Enterprises (SMEs) segment is expected to grow with highest compound annual growth rate (CAGR) during the forecast period. Small and medium enterprises are recognizing the importance of data-driven decision-making solutions to get better outcomes. The reduced costs of these solutions have brought them within the reach of SMEs, as has the increasing availability of data (driven by adoption of digital technologies like social media,e-commerce, mobile devices etc.) Growing number of registries provide critical insights that enhance SME decision making and substantially drive the growth of market.

By Application

The decision automation segment dominates the market, capturing the largest revenue share in 2025. It leverages artificial intelligence, data, and business rules to improve decision-making across various sectors, leading to enhanced organizational efficiency. By automating decisions, businesses can increase productivity, reduce risks, and minimize errors. These systems provide a consistent application of rules and criteria, helping to decrease variability and enhance outcome quality. For instance, in June 2025, Alteryx launched automated decision intelligence features on the Snowflake data cloud, allowing customers to gain analytic insights through direct access to the Alteryx Analytics Cloud Platform.

Furthermore, the decision support segment is projected to experience the highest compound annual growth rate (CAGR) throughout the forecast period. This segment utilizes organizational information systems to analyze data and facilitate decision-making. It acts as a critical information system for business operations and corporate decisions, heavily depending on databases and accessible information. Therefore, the increasing adoption of big data and data-driven business software in decision support systems is crucial for driving market growth.

By Industry

In 2025, the BFSI segment led the market by providing substantial benefits, including enhancement in managing large transactional data sets and promoting investment in data infrastructure and technology. Besides, in BFSI sector decision intelligence also allows institutions to customize products and services according to individual customer requirements, which ultimately improves customer satisfaction and loyalty.

Conversely, the IT & Telecom segment is expected to hold the highest CAGR throughout the forecast period. The rise of data availability and the adoption of technologies such as artificial intelligence, machine learning, and statistical analysis are driving this growth. Such innovations enable the enterprise to find patterns and trends in data that ultimately drive improved decision-making and provide valuable insights to clients. Additionally, IT and telecommunications play an important role in keeping data safe and making sure companies are following privacy laws. Sensitive data protection. Essential for decision intelligence, maintaining trust and compliance with regulations. As a result, these elements are projected to play a substantial role in driving the growth of this segment over the forecast period.

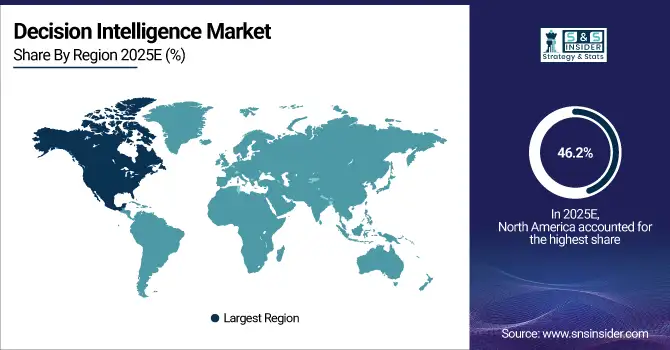

Decision Intelligence Market Regional Analysis

North America dominated the market with largest revenue share of 46.2% in 2025. The increase owes much to the expanding use of technology in multiple fields in the US and Canada. It has also built up excellent R&D capacity in AI technologies and supportive policies promoting the development of it in the region. In addition, leading companies such as IBM, Google and Microsoft are raising their investments to deliver & optimize market-leading product offerings and drive company growth which keeps on proving the dominance of North America in ASIC Market through innovation advancements.

Do You Need any Customization Research on Decision Intelligence Market - Enquire Now

Asia Pacific will witness strong growth in the forecast period, due to escalating digitalization, development in analytical and AI technologies, and focus towards data-driven approach. With the evolution of economies in this region, enterprises are becoming more cognizant about using decision intelligence solutions to make data-driven decisions and hence adoption is skyrocketing. Moreover, countries under Asia Pacific are slowly deploying next-gen technologies including: machine learning, AI, cloud computing and big data analytics for decision making purposes that helps organizations to handle large data volumes effectively while performing analysis.

Decision Intelligence Market Key Players

The major key players are

-

IBM - IBM Cloud

-

Google - Google Cloud Platform

-

Microsoft - Microsoft Azure

-

SAP - SAP HANA

-

Salesforce - Salesforce Einstein

-

Oracle - Oracle Cloud Infrastructure

-

SAS Institute - SAS Viya

-

Alteryx - Alteryx Designer

-

Qlik - Qlik Sense

-

Tableau - Tableau Desktop

-

TIBCO Software - TIBCO Spotfire

-

Informatica - Informatica Intelligent Cloud Services

-

Domo - Domo Business Cloud

-

FICO - FICO Decision Management Suite

-

Teradata - Teradata Vantage

-

Sisense - Sisense Fusion

-

ThoughtSpot - ThoughtSpot Search & AI-Driven Analytics

-

Quantexa - Quantexa Decision Intelligence Platform

-

AWS (Amazon Web Services) - Amazon SageMaker

-

ServiceNow - ServiceNow IT Service Management

Decision Intelligence Market Hardware Suppliers

-

Lenovo

-

Intel

-

Dell Technologies

-

Hewlett Packard Enterprise (HPE)

-

Cisco Systems

-

Sun Microsystems

-

HP Inc.

-

Acer

-

Dell Technologies

-

Cisco Systems

-

IBM

-

Amazon Web Services (AWS)

-

Cisco Systems

-

Dell Technologies

-

Amazon Web Services (AWS)

-

NVIDIA

-

Supermicro

-

Cisco Systems

Recent Developments

February 2024: USEReady teamed up with CRG Solutions to strengthen its presence in India, aiming to meet the rising demand for advanced data analytics, business intelligence, and data intelligence solutions.

January 2024: FICO unveiled more than 20 new innovations in its FICO Platform, aimed at empowering businesses to make better-informed decisions. This AI-driven platform assists organizations in combining data and analytics for meaningful insights.

| Report Attributes | Details |

| Market Size in 2025E | US$ 18.08 Bn |

| Market Size by 2033 | US$ 74.23 Bn |

| CAGR | CAGR of 19.31% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Decision Support, Decision Augmentation, Decision Automation) • By Enterprise Type (Large Enterprises, Small & Medium Enterprises) • By Industry (IT & Telecommunications, BFSI, Transportation & Logistics, Retail & Ecommerce, Consumer Goods, Construction, Government, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | IBM, Google, Microsoft, SAP, Salesforce, Oracle, SAS Institute, Alteryx, Qlik, Tableau, TIBCO Software, Informatica, Domo, FICO, Teradata |