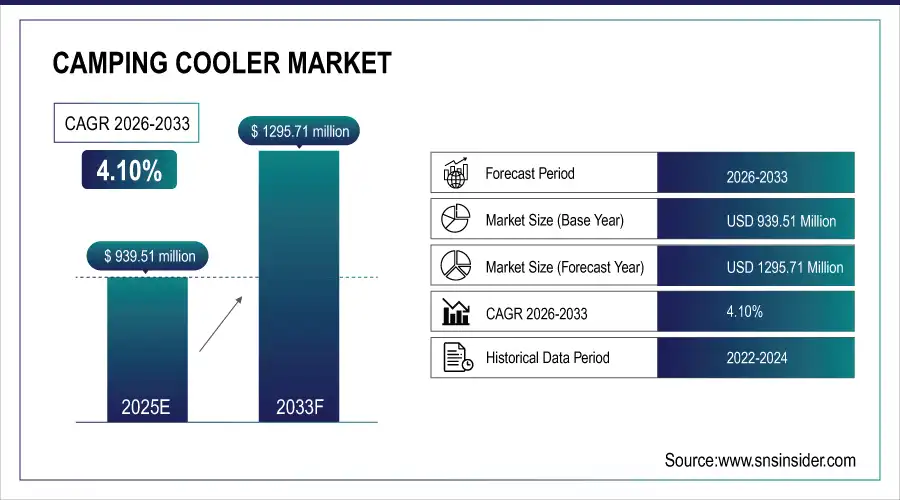

Camping Cooler Market Size & Growth:

The Camping Cooler Market Size was valued at USD 939.51 million in 2025E and is expected to grow at a CAGR of 4.10% to reach USD 1295.71 million by 2033.

The global market for camping coolers is experiencing a strong growth due to the increase in outdoor recreational activities, lifestyle changes, and innovation of products. Increasing consumer interest in camping, hiking, and off the grid travel market has generated strong demand for efficient and easy-to-carry cooling options. Better products with better insulation, light-weight materials and multi-functional usage are appealing to more and more people. Moreover, rising environmental awareness is motivating brands to use environmentally friendly materials, premiumization and aesthetic innovation are changing the game for consumer expectation and promoting re-purchase in various parts of the world.

According to research, in 2024, Millennials and Gen Z made up over 60% of global camping cooler purchases, with an emphasis on design, portability, and sustainability.

Market Size and Forecast: 2025E

-

Market Size in 2025E USD 939.51 Million

-

Market Size by 2033 USD 1295.71 Million

-

CAGR of 4.10% From 2026 to 2033

-

Base Year 2025E

-

Forecast Period 2026-2033

-

Historical Data 2021-2024

To Get more information on Camping Cooler Market - Request Free Sample Report

Camping Cooler Market Trends:

-

Growing demand for camping coolers with advanced features such as multi-compartment storage, built-in USB ports, and extended ice retention.

-

Increased focus on lightweight, durable materials and innovative insulation technologies.

-

Rising interest in personalized options in size, color, and branding to enhance user experience and loyalty.

-

Expansion of product designs catering to diverse user segments, from solo travelers to large families.

-

Integration of user-friendly accessories, such as wheels and handles, to improve portability and convenience.

-

Emphasis on eco-friendly and sustainable materials, including recycled plastics, plant-based insulation, and ethically sourced components.

-

Alignment of product offerings with environmental values and sustainable tourism trends.

-

Growing consumer loyalty toward brands that demonstrate environmental responsibility and circular economy practices.

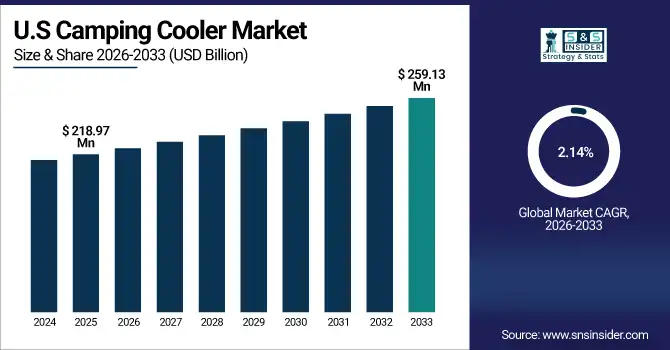

The U.S. Camping Cooler Market size was USD 218.97 million in 2025E and is expected to reach USD 259.13 million by 2033, growing at a CAGR of 2.14% over the forecast period of 2026–2033.

The US camping cooler market growth is due to growing domestic tourism, increasing participation in camping and hiking coupled with greater preference for small, insulated storage products. Furthermore, the family-led outdoor recreation trend and tailgating culture are driving demand for multi-purpose, hard-use coolers, especially among millennials and Gen Z customers looking for convenience and improved travel experiences.

According to research, a 2024 market study found that 67% of U.S. consumers prioritize portability and insulation when purchasing camping coolers.

Camping Cooler Market Growth Drivers:

-

Rapid product innovation and customization are attracting a broader range of consumers toward advanced camping cooler solutions.

Coolers for camping companies are investing heavily in incorporating advancements in insulation technology, lightweighted materials, multi-compartment designs and lots of accessories such as USB charging ports and wheels. These improvements both improve functionality and cater to users who value high tech and comfort. Personalization in size, color and branding also fosters brand loyalty. High-end coolers with longer ice retention and a variety of user-friendly details are in demand. A wider range of experiences that cater to the enthusiast who travels solo to the massive family is what leads to a bigger shift in adoption and market penetration.

According to research, in the 2024 survey, over 62% of consumers prefer camping coolers with advanced features like multi-compartment storage, built-in USB ports, and extended ice retention.

Camping Cooler Market Restraints:

-

Limited product differentiation reduces consumer incentive to upgrade or repurchase camping coolers frequently in a saturated market.

Most camp coolers available in the industry have similar properties such as insulation, interior size, and general portability, so there is not much separability in competing products. With so little to be done in terms of game-changing technology anyway, you can imagine why there has been no rush to replace what’s been sitting in our coolers. This saturation lowers the repurchase rate and stretches the product cycle. And because premium coolers are so dang durable, people won’t have to replace them often, which also slows the consumer market momentum. But with weak upgrade motivation, brands find it difficult to sustain their rate of growth and are forced to compete fiercely in terms of cost and promotion.

Camping Cooler Market Opportunities:

-

Increasing preference for eco-friendly materials creates strong demand for sustainable camping cooler alternatives.

Consumers are increasingly aligning their purchases with environmental values, fueling interest in camping coolers made with recyclable or biodegradable materials. This trend presents a major opportunity for manufacturers to shift towards eco-conscious designs, such as coolers made from recycled plastics, plant-based insulation, or ethically sourced components. As sustainable tourism gains momentum, campers actively seek gear that reduces their ecological footprint. Brands that promote green innovation and circular economy principles can differentiate themselves and tap into a growing, environmentally aware consumer base.

According to research, a 2025 report showed that 58% of consumers are more likely to remain loyal to brands that prioritize environmental responsibility.

Camping Cooler Market Segment Analysis:

By Product

The Hard Cooler segment dominated the Camping Cooler Market with the highest revenue share of about 67.80% in 2025E. Hard coolers are valued for their rugged build and extended ice retention, making them indispensable for long-duration trips. Pelican Products, Inc. has emerged as a strong player in this segment, offering rotomolded designs that withstand extreme environments. Their popularity in fishing, RV camping, and tailgating events contributes to high sales volumes. These coolers are favored for their durability, multifunctional use, and secure locking mechanisms. The Soft Cooler segment is expected to grow at the fastest CAGR of about 5.83% from 2026–2033. These lightweight, collapsible coolers cater to modern consumers seeking portable and stylish options for casual outdoor activities. AO Coolers has been gaining traction with its high-performance soft coolers that blend fashion with function. The growing urban trend of short recreational trips and outdoor social gatherings has made soft coolers popular among younger demographics. Their easy storage and travel-friendly features are driving their market appeal.

By Volume

The 50–75 quart segment dominated the Camping Cooler Market with the highest revenue share of about 32.27% in 2025E. These coolers offer an optimal balance between capacity and portability, making them ideal for group camping trips. Camping cooler companies such as YETI Holdings Inc., known for its durable, high-capacity coolers, have seen strong demand in this size range due to its superior insulation technology. The popularity of vehicle-based camping and extended outdoor stays further drives demand for mid-range coolers that can accommodate multiple days’ worth of supplies. The <25 quart segment is expected to grow at the fastest CAGR of about 5.73% from 2026–2033. These smaller coolers are preferred by solo travelers, hikers, and bikers seeking lightweight and compact storage solutions. Coleman Company, Inc. is capitalizing on this trend by offering affordable, portable coolers ideal for single-day outings. Their compact size and convenience appeal to casual users and first-time campers. Increased participation in day hikes and urban picnics further supports demand for this segment, especially among millennials.

By Application

The Dry Camping segment dominated the highest Camping Cooler Market share of about 42.22% in 2025E. In off-grid camping scenarios, reliable cooling is essential due to the lack of electric alternatives. Grizzly Coolers, known for their rugged and bear-resistant models, is widely used among dry campers for extended ice retention. The surge in van life and self-reliant camping has made these coolers indispensable. Consumers prioritize long-lasting insulation and durability, making this segment particularly strong in wilderness and remote camping applications. The Backpacking segment is expected to grow at the fastest CAGR of about 5.48% from 2026–2033. Backpackers demand lightweight, compact coolers for short trips or long treks. IceMule Coolers offers roll-top soft-sided models that are gaining popularity in this space due to their ergonomic design. The focus on mobility and weight efficiency aligns perfectly with backpacking needs. As eco-tourism and minimalist travel grow, these portable options are being favored for their combination of insulation performance and backpack compatibility.

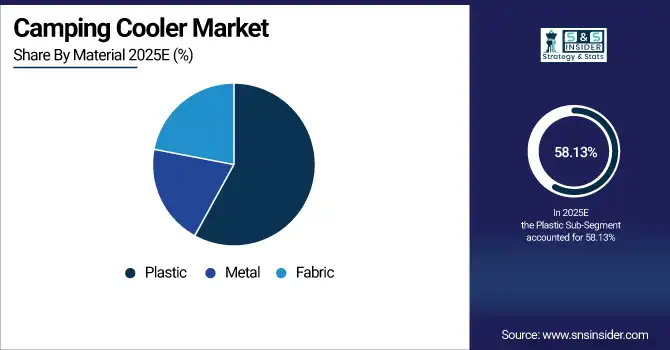

By Material

The Plastic segment dominated the Camping Cooler Market with the highest revenue share of about 58.13% in 2025E. Plastic coolers are cost-effective, lightweight, and resistant to outdoor elements, making them widely used by casual and frequent campers alike. Rubbermaid Commercial Products has established its presence with a range of durable plastic coolers designed for recreational use. Their ease of manufacturing and functional versatility contribute to continued dominance. The segment benefits from affordability and widespread retail availability in various sizes and formats. The Fabric segment is expected to grow at the fastest CAGR of about 5.47% from 2026–2033. Fabric coolers offer foldability, ease of use, and aesthetic flexibility, appealing particularly to style-conscious consumers. Arctic Zone, a brand by California Innovations, has driven this segment forward with lightweight, stylish coolers enhanced by thermal-reflective technology. The ability to combine fashion with functionality makes fabric coolers ideal for informal gatherings, festivals, and quick getaways. The growing demand for lifestyle-oriented gear supports the segment's accelerating growth.

Camping Cooler Market Regional Analysis:

North America Camping Cooler Market Insights

North America dominated the Camping Cooler Market with the highest revenue share of about 38.46% in 2025E. The region's strong outdoor recreation culture, including camping, tailgating, and fishing, continues to fuel sustained demand for high-performance coolers. Consumers in the U.S. and Canada often prioritize durability, insulation, and large storage capacities, which aligns with the prevalence of road trips and RV travel. A well-established retail network, widespread e-commerce penetration, and high consumer spending on recreational gear further contribute to North America's leading position in the global market.

Get Customized Report as per Your Business Requirement - Enquiry Now

-

The U.S. leads the North American camping cooler market due to its established outdoor culture, high participation in camping and RV travel, advanced retail infrastructure, and strong consumer demand for durable, insulated products across various recreational and tailgating activities.

Asia Pacific Camping Cooler Market Insights

Asia Pacific is expected to grow at the fastest CAGR of about 5.55% from 2026–2033. Rapid urbanization, rising disposable incomes, and shifting lifestyle trends are boosting participation in outdoor activities like camping and hiking. The increasing popularity of adventure tourism and weekend getaways among younger demographics is driving demand for compact and affordable coolers. Growth in digital retail infrastructure and greater awareness of Western recreational trends are expanding product accessibility. Local manufacturers and the influence of social media are also playing a key role in promoting outdoor gear adoption across the region.

-

China dominates the Asia Pacific market owing to its large population, rising middle class, growing interest in leisure travel, and rapid urbanization. Expanding e-commerce channels and increasing outdoor recreation among younger consumers are accelerating cooler adoption across both urban and suburban regions.

Europe Camping Cooler Market Insights

Europe’s camping cooler market is growing steadily, driven by increased interest in caravan travel, eco-tourism, and cross-country outdoor exploration. Countries like Germany, France, and the UK show strong demand due to well-developed camping infrastructure. Rising environmental awareness is also encouraging demand for eco-friendly, sustainable cooler solutions tailored for both short getaways and long-distance road trips.

-

Germany dominates the European camping cooler market due to its extensive camping infrastructure, strong RV culture, and high participation in outdoor activities. Consumers favor durable, high-quality coolers, and the country’s central location supports cross-border camping, boosting consistent product demand across seasons.

Latin America (LATAM) and Middle East & Africa (MEA) Camping Cooler Market Insights

The Middle East & Africa camping cooler market is led by the UAE, driven by a strong outdoor lifestyle, desert tourism, and high-income consumers seeking premium cooling solutions. In Latin America, Brazil dominates due to its vibrant camping culture, growing adventure tourism, and increasing demand for portable, climate-resilient cooler products.

Camping Cooler Market Key Players:

The Camping Cooler Market Companies are are Igloo Products Corp., YETI Holdings Inc., The Coleman Company Inc., Pelican Products Inc., ORCA Coolers, RTIC Outdoors, Engel Coolers, Grizzly Coolers, K2 Coolers, AO Coolers, Arctic Zone, Stanley (PMI Worldwide), Bison Coolers, OtterBox, Canyon Coolers, Frosted Frog, RovR Products, Rubbermaid (Newell Brands), Blue Coolers, IceMule Coolers. and Others.

Competitive Landscape for Camping Cooler Market:

Grizzly Coolers is a U.S.‑based manufacturer of premium, rotomolded camping and outdoor coolers engineered for durability, long ice retention, and rugged use. Founded in Decorah, Iowa, its products including hard‑ and soft‑sided coolers are designed for outdoor enthusiasts and backed by lifetime warranties

-

June 2025, Grizzly launched its 400-quart rotomolded cooler, offering unmatched durability and bulk ice storage for hunters, outfitters, and remote wellness camps demanding extreme outdoor performance.

RTIC Outdoors is an American outdoor gear brand based in Houston, Texas, known for high‑performance camping coolers and accessories sold direct‑to‑consumer. Founded in 2015 by twin brothers Jim and John Jacobsen, the company offers rugged rotomolded and soft‑sided coolers, drinkware, and outdoor products “Overbuilt. Not Overpriced.” and has expanded its reach through retail partnerships and brand growth.

-

April 2025, RTIC unveiled its 22-quart Ultra-Light Wheeled Cooler, featuring a retractable handle and high portability, earning a 4.9/5 rating and strong sales across camping and urban outdoor markets.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 939.51 Million |

| Market Size by 2033 | USD 1295.71 Million |

| CAGR | CAGR of 4.10% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2021-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Volume (< 25 quart, 25-50 quart, 50-75 quart, 75-100 quart, > 100 quart) • By Product (Hard Cooler, Soft Cooler, Others) • By Application (Dry Camping, Backpacking, Off-road/RV Camping, Others) • By Material (Plastic, Metal, Fabric) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | The Camping Cooler Market Companies are are Igloo Products Corp., YETI Holdings Inc., The Coleman Company Inc., Pelican Products Inc., ORCA Coolers, RTIC Outdoors, Engel Coolers, Grizzly Coolers, K2 Coolers, AO Coolers, Arctic Zone, Stanley (PMI Worldwide), Bison Coolers, OtterBox, Canyon Coolers, Frosted Frog, RovR Products, Rubbermaid (Newell Brands), Blue Coolers, IceMule Coolers. and Others. |