Microphone Market Size & Growth:

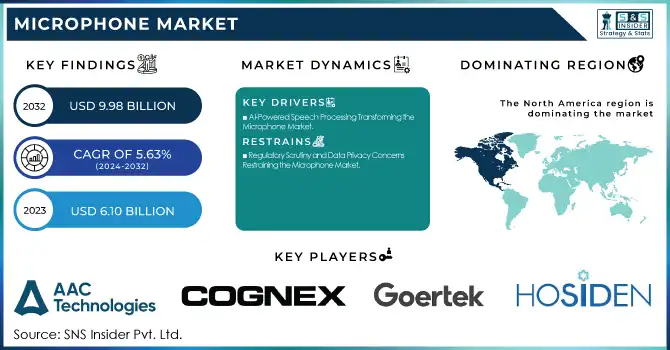

The Microphone Market Size was valued at USD 6.10 Billion in 2023 and is expected to reach USD 9.98 Billion by 2032, growing at a CAGR of 5.63 % from 2024-2032.

This growth is driven by adoption of high-performance audio solutions in consumer electronic devices, automotive applications, and industrial industries are driving the segment growth. The growing use of MEMS microphones in consumer electronics, such as smartphones, smart speakers, and wearables, is a major driver, aided by developments in noise cancellation, beamforming, and AI-powered voice recognition.

Microphone Market Size and Forecast

-

Market Size in 2023: USD 6.10 Billion

-

Market Size by 2032: USD 9.98 Billion

-

CAGR: 5.63% from 2024 to 2032

-

Base Year: 2023

-

Forecast Period: 2024–2032

-

Historical Data: 2020-2022

To get more information on Microphone Market - Request Free Sample Report

Microphone Market Trends Highlights:

-

Rising demand for content creation and streaming is driving microphone sales, with the creator economy growing over 18% annually, boosting USB and condenser microphone adoption.

-

Expansion of remote work and virtual meetings has increased headset and desktop microphone usage, with over 70% of enterprises relying on video conferencing tools.

-

Growth in smart devices and voice assistants is accelerating MEMS microphone integration, with billions of units shipped annually for smartphones and IoT devices.

-

Increasing adoption in automotive voice control systems is fueling demand, as over 60% of new vehicles integrate in-cabin voice recognition.

-

Advancements in noise cancellation and beamforming technologies are improving audio capture quality by 25–35%, enhancing use in professional and consumer applications.

The provision of microphones in IoT equipment, medical equipment, and remote conferencing systems is also contributing to market growth. We provide key insights, from adoption trends, such as the growing number of microphones per device, to miniaturized, high-SNR microphones. Performance data demonstrate advances in speed response, sensitivity, and energy efficiency. Manufacturing and supply chain data emphasize production yields, lead times, and raw material dependencies. Lastly, the energy and environmental impact of microphone production is becoming a crucial focus, with companies aiming to enhance recyclability and reduce carbon footprints.

Microphone Market Drivers:

-

AI-Powered Speech Processing Transforming the Microphone Market

The surge in AI-driven voice technologies is revolutionizing the microphone market, with high-SNR MEMS microphones becoming essential for applications requiring speech clarity, noise suppression, and real-time processing. The rising need for advanced microphones, owing to voice-controlled consumer electronics and smart IoT devices, is propelled by the popularity of voice digital assistants such as Siri, Alexa, and Google Assistant. In particular, AI-based speech modification such as Sanas’ real-time accent adaptation further highlights the growing demand for low-latency, high-fidelity microphones that maintain vocal identity while removing reverb and environmental noise. Sanas’ acquisition of InTone, expanding its IP portfolio, reflects the rising investment in AI speech processing, with its annual revenue reaching USD 21 million, a USD 3 million increase from last year. As 60% of smartphone users now engage with voice assistants regularly, up from 45% in 2023, the microphone market is rapidly evolving to meet the demand for seamless, high-accuracy voice interactions across industries.

Microphone Market Restraints:

-

Regulatory Scrutiny and Data Privacy Concerns Restraining the Microphone Market

As smart microphones continuously capture and process voice data, fears of unauthorized surveillance, data breaches, and AI-driven voice replication have surged. Stricter regulations, including GDPR, AI governance frameworks, and data localization laws, are forcing manufacturers to implement stronger encryption, on-device processing, and transparent data policies. Reports indicate that 60% of consumers express concerns over how their voice data is stored and used, leading to hesitation in adopting voice-enabled devices. Additionally, AI-powered deepfake audio and voice cloning risks are prompting governments to introduce new compliance mandates, increasing development costs and market entry barriers. As a result, microphone manufacturers must navigate complex regulatory landscapes while ensuring secure, privacy-focused solutions to maintain consumer trust and market viability.

Microphone Market Opportunities:

-

Microphones Driving Innovation in Wearable and Healthcare Technologies

The growing adoption of smart wearables, hearing aids, and AI-powered medical diagnostics is driving demand for miniature, high-performance microphones that enable seamless voice interaction and precise audio capture. Voice-based health monitoring systems, which use microphones to detect respiratory issues, heart irregularities, and neurological conditions, are becoming a key focus in healthcare. AI-driven hearing enhancement solutions are also transforming the assistive technology market, offering real-time noise suppression and personalized sound amplification. As chronic conditions are becoming more prevalent and the population ages, wearable medical devices that leverage advanced MEMS microphones are also poised for rapid adoption. This trend is fueled by regulations granting approvals for voice-based diagnostics and growing consumer confidence in health-oriented smart devices.

Microphone Market Challenges:

-

Balancing Power Efficiency and Performance as a Key Challenge in the Microphone Market

With the increasing trend of using battery-powered devices, they have to optimize the power consumed to ensure the device has good audio quality and remains active for a long time without the need to recharge. MEMS microphones in TWS earbuds, smart speakers, and medical wearables typically need to operate under low energy consumption while providing the best possible signal-to-noise ratios with real time processing. Yet these intelligent features, like enhanced noise cancelation and voice activation with AI-driven enhancements, require increased processing power, and, therefore, battery life. While engineers are investigating ultra-low-power microcontrollers and mechanisms for energy-efficient designs, the trade between efficiency and performance remains. Cost and technologic constraints continue to limit the management of the energy consumed in MEMS microphones. With ever-increasing consumer expectations for always-on voice interaction, striking the right balance between efficiency and high-fidelity audio quality will shape the future of the microphone market.

Microphone Market Segment Analysis:

By Connectivity

The XLR microphone segment captured approximately 73% of the revenue share in the global microphone market in 2023, establishing itself as a dominant player. This popularity stems from XLR microphones' superior audio quality and reliability, These microphones are popular because they provide higher quality audio and reliability than their alternatives, XLR microphones are also a good option for applications like music recording, broadcasting, and live sound. These microphones use a three-pin Jacobs’s connector for secure connections that reduce background noise in high-noise situations. Moreover, the multiple applications of XLR microphones with different devices such as and not limited to mixing consoles and audio interface also makes them more appealing in both studio and live environments. With the noise for high quality, audio still rising XLR microphones will keep their significant market share because of further technical developments in audio technology.

The USB microphone segment is poised to be the fastest-growing segment in the microphone market during the forecast period from 2024 to 2032. This growth can be attributed to the increasing demand for accessible and user-friendly audio solutions across a wide range of end-use areas, such as podcasting, content creation, remote work, and gaming. USB microphones are plug-and-play devices, making them accessible to those with little audio engineering experience. Improvements in USB microphone technology also mean better sound quality and built-in features like audio processing and noise cancellation that make them even more appealing. As organizations and consumers increasingly prioritize superior audio quality in digital communications, the USB microphone segment is likely to witness strong growth owing to its versatility and ease of use.

By Application

The consumer electronics segment dominated the largest share of revenue in the microphone market, accounting for around 49% in 2023. This dominance is primarily driven by the widespread adoption of microphones in various consumer electronics devices such as smartphones, smart speakers, laptops, and headphones. The growing demand for high-quality audio experiences in entertainment, communication, and smart home applications has fueled the integration of advanced microphones in these devices. Additionally, the rise of voice-controlled AI assistants like Siri, Alexa, and Google Assistant has further increased the need for reliable and high-performance microphones, solidifying the consumer electronics sector's position as the leading contributor to market revenue. As technology continues to evolve, the demand for innovative, high-fidelity microphones in consumer electronics is expected to sustain growth in this segment.

The industrial segment is projected to be the fastest-growing sector in the microphone market over the forecast period from 2024 to 2032. The demand for high-performance microphones used in diverse applications in manufacturing, automation, and industrial safety systems are the increase factor for the growth of this sector. In factory settings, sound level tracking, equipment diagnostics, and voice-activated control systems use industrial microphones. These upcoming trends like smart manufacturing, Industry 4.0 adoption have created an upsurge for the use of advanced audio technologies as a means to improve communication as well as monitoring abilities. Moreover, the functioning of microphones in robotics and Internet of Things (IoT) devices is enhancing their significance in industrial environments.

Microphone Market Regional Outlook:

North America dominated the microphone market with a significant revenue share of approximately 41% in 2023, driven by robust demand across various sectors such as consumer electronics, automotive, and industrial applications. The region benefits from advanced technological infrastructure, high consumer spending on audio devices, and the presence of major microphone manufacturers. Countries like the United States and Canada are at the forefront of innovation, with continuous investments in research and development, particularly in AI-driven voice technologies and smart devices. Furthermore, the growing trend of remote work and online communication has accelerated the adoption of high-quality microphones in conferencing systems and personal devices. As North America leads in technological advancements and consumer adoption, it is poised to maintain its dominance in the microphone market in the coming years.

The Asia-Pacific region is expected to experience the fastest growth in the microphone market during the forecast period from 2024 to 2032, driven by rapid technological advancements and increasing demand for audio solutions across various industries. Countries like China, Japan and India are driving this growth, with the increasing adoption of smartphones, smart speakers and other consumer electronics. With the rise of artificial intelligence-powered technology such as voice recognition and smart home devices, the demand for high-performance microphones has increased dramatically. These factors into the growing requirements for innovative audio equipment in the region is growing entertainment and gaming industries. Global demand for microphone is witnessing a shift towards growth as more of the global investments are being channeled into infrastructure and technological innovation in the Asia-Pacific region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Microphone Companies with their product:

-

AAC Technologies (China) [Microphones, Acoustic Components]

-

BSE (South Korea) [Microphones, Audio Modules]

-

Cognex Corporation (USA) [Machine Vision, Industrial Sensors]

-

Gettop Acoustic (China) [Microphones, MEMS Sensors]

-

Goertek (China) [Microphones, Wearable Audio Devices]

-

Hosiden Corporation (Japan) [Microphones, Connectors]

-

Infineon Technologies (Germany) [MEMS Microphones, Semiconductor Solutions]

-

Microscan Systems Inc. (USA) [Barcode Scanners, Machine Vision]

-

STMicroelectronics (Switzerland) [MEMS Sensors, Microcontrollers]

-

TDK Corporation (Japan) [MEMS Microphones, Electronic Components]

-

ZillTek Technology (Taiwan) [MEMS Microphones, Audio ICs]

-

Omron (Japan) [Sensors, Industrial Automation]

-

Texas Instruments (USA) [Analog & Embedded Processors, MEMS Sensors]

-

Sonion (Denmark) [Hearing Aid Components, MEMS Microphones]

List of suppliers of raw materials and components for microphone manufacturing:

-

TSMC

-

GlobalFoundries

-

Robert Bosch GmbH

-

Infineon Technologies

-

STMicroelectronics

-

Dupont

-

3M

-

Toray Industries

-

Mitsubishi Chemical

-

Hitachi Metals

-

Arnold Magnetic Technologies

-

Nippon Steel

-

JFE Steel

-

Murata Manufacturing

-

TDK Corporation

-

Kyocera

-

Texas Instruments

Recent Development:

-

On June 28, 2024, TDK announced general availability of InvenSense brand MEMS sensors for IoT, wearables, and robotics. The T5838 MEMS microphone, with a low-noise PDM (pulse density modulation) output and designed for use in high-volume mixed-signal and audio applications, was also introduced.

-

On November 25, 2024, Infineon Technologies enhanced the AI-driven interaction on with high-SNR MEMS microphones. Their XENSIV™ MEMS microphones today improve audio in consumer devices, from TWS earbuds to smart speakers to hearing aids.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 6.10 Billion |

| Market Size by 2032 | USD 9.98 Billion |

| CAGR | CAGR of 5.63% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Connectivity (USB Microphones, XLR Microphones) • By Application (Automotive, Commercial Security and Surveillance, Consumer Electronics, Industrial, Medical, Noise Monitoring and Sensing) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | AAC Technologies (China), BSE (South Korea), Cognex Corporation (USA), Gettop Acoustic (China), Goertek (China), Hosiden Corporation (Japan), Infineon Technologies (Germany), Microscan Systems Inc. (USA), STMicroelectronics (Switzerland), TDK Corporation (Japan), ZillTek Technology (Taiwan), Omron (Japan), Texas Instruments (USA), Sonion (Denmark). |