Canned Lamb Market Report Scope & Overview:

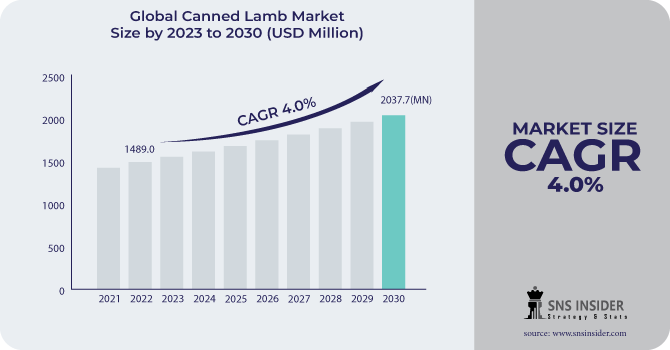

The Canned Lamb Market size was USD 1489.0 million in 2022 and is expected to Reach USD 2037.7 million by 2030 and grow at a CAGR of 4.0 % over the forecast period of 2023-2030.

Canned lamb is cooked lamb meat that has been canned and sealed in a can. It is a quick and inexpensive method to eat lamb that can be utilized in a variety of meals. Canned lamb is often made from trimmed and sliced lamb into small pieces. The lamb is then roasted until soft before being packaged in cans with a minimal amount of liquid. The cans are then sealed and pressure-baked, which destroys any bacteria and increases the shelf life of the lamb.

Canned lamb normally has a shelf life of several years and does not require refrigeration. This makes it an excellent choice for folks with limited cupboard space or who want a handy and non-perishable source of protein.

Based on distribution channels, Supermarkets and hypermarkets held the largest market share in 2022 as they are becoming increasingly popular due to the availability of a diverse selection of consumer items, daily needs, and food and beverages under one roof, as well as convenient operating hours.

Also, the online segment would have the fastest CAGR of 4.4%. The online category is predicted to increase at a high rate throughout the projection period, owing to the several benefits it offers, such as convenience, a diverse product offering, and cheap pricing.

MARKET DYNAMICS

KEY DRIVERS

-

Long shelf life of canned lamb meat

-

Rising consumption of meat

Lamb is high in protein and other necessary nutrients and can be used to prepare a variety of recipes. Canned lamb allows you to consume meals without having to prepare or defrost them. These items are easy to use, making them excellent for persons who lead a busy lifestyle. Rising economic levels in developing countries are driving the demand for lamb. This rising demand is opening up new markets for canned lamb producers.

RESTRAIN

-

Public health concern for lamb

Antibiotics are frequently used in lamb production. Antibiotic misuse can contribute to the development of antibiotic-resistant microorganisms. Antibiotic-resistant bacteria can make treating infections more difficult, which can lead to major health consequences. Lamb is high in cholesterol. This indicates that eating lamb can raise your cholesterol levels, increasing your risk of heart disease and stroke. Foodborne diseases such as Salmonella and E. coli can taint lamb. These microorganisms can cause food poisoning, which can result in several health issues such as diarrhea, vomiting, and fever.

OPPORTUNITY

-

Health benefits of canned lamb

-

Targeting new markets

Rapid economic growth and rising earnings in developing countries are driving up demand for meat, particularly lamb. Canned lamb is a practical and economical way for developing-country customers to enjoy lamb. Lamb-based ethnic cuisines, such as Indian and Middle Eastern cuisines, are becoming increasingly popular in developed countries. This rising popularity is opening up new markets for canned lamb producers. Canned lamb producers can also target new sectors, such as the food service business and the pet food market, which could contribute to increasing demand for canned lamb products.

CHALLENGES

-

Competition from other meats

-

Packaging defects may result in product contamination

The Food Safety and Inspection Service (FSIS) of the United States Department of Agriculture revealed that packaging problems can lead items to become contaminated without showing any apparent symptoms of contamination, placing individuals who consume them at risk of severe health hazards. The potentially tainted cans may cause serious to life-threatening health risks and diseases. Packaging flaws like as leaks, dents, rust, and faulty sealing can all lead to contamination. Many times, these products are recalled by particular authorities with public health concerns. This recall can create chaos which indirectly impedes the market growth.

IMPACT OF RUSSIA-UKRAINE WAR

Russia is a significant supplier of lamb, and the war has hampered the production and exports of canned lamb. Russia exported 147,000 tonnes of lamb in 2021, accounting for around 13% of global lamb exports. As the war has interrupted the supply of energy and other inputs, canned lamb companies' production costs have risen. The war has also resulted in higher lamb prices since lower supply has increased demand. The war has also affected demand for canned lamb, as people tighten their belts in reaction to increased living costs.

IMPACT OF ONGOING RECESSION

The recession has influenced the canned lamb market as it has resulted in increases in meat prices, transportation costs, packaging costs, other raw materials, and processing costs. The Food and Agriculture Organization of the United Nations (FAO) predicts that global lamb consumption will fall by 2% in 2023 as a result of the current recession. A recession can be especially damaging to the canned lamb industry for small and medium-sized firms (SMEs). As meat prices continue to decline, farmers are selling their weakest cattle for as little as a few dollars per head. The average price of lamb in the first quarter of 2022 was 14% more than at the same time in 2021.

MARKET SEGMENTATION

By Distribution Channel

-

Supermarkets and Hypermarkets

-

Convenience Stores

-

Independent Retailers

-

Online

By End-User

-

Human

-

Animal

.png)

REGIONAL ANALYSIS

North America had the biggest revenue market share in 2022 and is expected to continue to dominate the market during the forecast period. The growing consumer interest in healthy living, as well as the fact that meat is one of the primary sources of iron, zinc, and other vital minerals, has resulted in a major increase in demand for meat products in North America.

Asia-Pacific is predicted to grow at the fastest rate of 6.0 % in the forecast period. Fresh food products, such as fresh meat, are preferred by Asian consumers over packaged foods. The demand for these products is expanding significantly in Countries like China, Japan, and South Korea. The growth of the canned lamb market in Asia Pacific is being driven by rising disposable incomes, a growing population, and changing dietary habits.

Europe is the largest market for canned lamb, accounting for a major market for global market share. The demand for canned lamb in Europe is driven by high disposable incomes and a Westernized diet. The major players operating in the European canned meat market are Tyson Food Inc., JBS Foods, Hormel Foods Corporation, Danish Crown A.M.B.A., Pronas, and Zwanenberg Food Group.

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

Some major key players in the Canned Lamb Market are MREdepot.com, Hound & Gatos, Earth Paws Private Limited, Evangers Dog & Cat Food Company, Inc., Wellness Pet Company, Inc., LemonSalt, Fromm Family Foods, LLC., Calibra, SmartHeart Malaysia, Leos Pet Her Hakk Sakldr, FountainVest, Stahly Quality Foods, Fortan GmbH & Co. KG., and other key players.

Earth Paws Private Limited-Company Financial Analysis

RECENT DEVELOPMENTS

In July 2023, The Austin, Minnesota-based firm added maple-flavored SPAM to its flavor lineup. Hormel Foods believes that a breakfast-focused flavor will become an appealing option among canned meat buyers.

In March 2023, Eviosys announced the opening of a rectangular can manufacturing line in Turkey due to rising consumer demand and an increasing meat industry. The new three-piece rectangular can line, supported by a €1.5 million investment, combines sustainable metal packaging, a light, infinitely recyclable tinplate, and the quality and dependability Eviosys is known for.

In January 2023, Carniprod Tulcea, one of Romania's top meat processors, is on the verge of being acquired by Scandia Food, the leader in the canned meat-based market, which recently purchased Agra's from Alba Iulia.

| Report Attributes | Details |

| Market Size in 2022 | US$ 1489.0 Million |

| Market Size by 2030 | US$ 2037.7 Million |

| CAGR | CAGR of 4.0 % From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2019-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Independent Retailers, Online) • By End-User (Human, Animal) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | MREdepot.com, Hound & Gatos, Earth Paws Private Limited, Evangers Dog & Cat Food Company, Inc., Wellness Pet Company, Inc., LemonSalt, Fromm Family Foods, LLC., Calibra, SmartHeart Malaysia, Leos Pet Her Hakk Sakldr, FountainVest, Stahly Quality Foods, Fortan GmbH & Co. KG. |

| Key Drivers | • Long shelf life of canned lamb meat • Rising consumption of meat |

| Market Opportunity | • Health benefits of canned lamb • Targeting new markets |