Carbon-Neutral Refrigerant Market Report Scope & Overview:

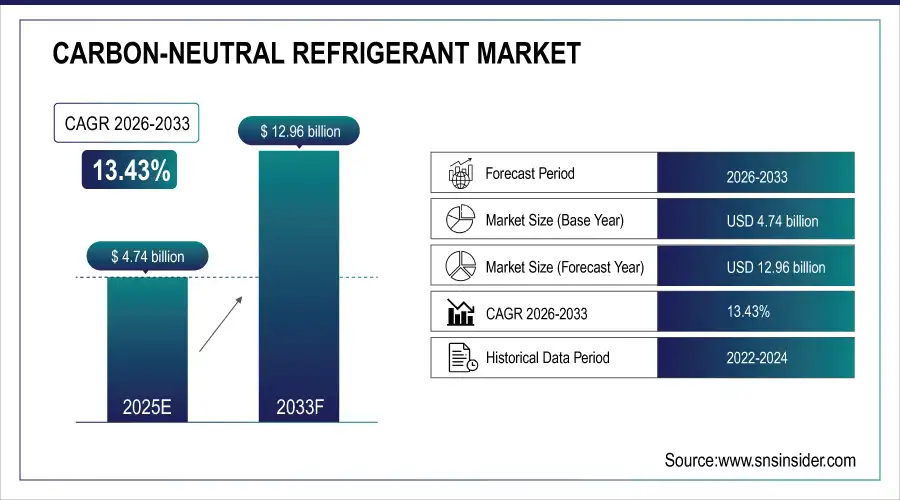

The Carbon-Neutral Refrigerant Market size was valued at USD 4.74 Billion in 2025E and is projected to reach USD 12.96 Billion by 2033, growing at a CAGR of 13.43% during 2026-2033.

The Carbon-Neutral Refrigerant Market analysis highlights the higher demand for low-GWP and environment-friendly refrigerants in the HVAC, commercial, and industrial refrigeration markets. Increasing regulatory obligations, environmental sustainability programs and utilization of HFOs & natural refrigerants drive the market. Rising R&D investments, growth in production capacities and awareness toward carbon footprint reduction further complements market growth worldwide.

Over 120 countries have ratified the Kigali Amendment to the Montreal Protocol, committing to phase down HFCs (hydrofluorocarbons) by 80–85% by 2047 relative to baseline levels.

Market Size and Forecast:

-

Market Size in 2025: USD 4.74 Billion

-

Market Size by 2033: USD 12.96 Billion

-

CAGR: 13.43% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Carbon-Neutral Refrigerant Market - Request Free Sample Report

Carbon-Neutral Refrigerant Market Trends

-

Tightening environmental rules prompt increased use of HFOs and natural refrigerants, helping curb greenhouse gas emissions and adoptions of sustainable cooling applications among industries globally.

-

Growing adoption of energy-efficient air conditioning and HVAC systems in residential, commercial, and industrial sector upsurges the demand for carbon-neutral refrigerants.

-

Many retail, food and pharma companies use carbon neutral refrigerants for environmentally friendly cold storage solutions and improved supply chain management.

-

Firms seek to sustain these trends by developing and deploying advanced, safer, low-GWP refrigerants such as blends and next-generation solutions

-

Demand is fueled by fast growing industrialization in Asia-Pacific, Latin America and Middle East regions, coupled with government initiatives to push adoption of sustainable refrigerant alternatives.

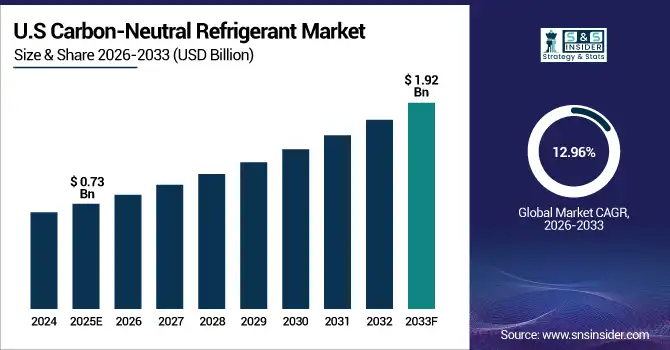

The U.S. Carbon-Neutral Refrigerant Market size was valued at USD 0.73 Billion in 2025E and is projected to reach USD 1.92 Billion by 2033, growing at a CAGR of 12.96% during 2026-2033. Carbon-Neutral Refrigerant Market growth is driven by Increasing focus on high-GWP refrigerants by regulators is accelerating the growth of carbon-neutral refrigerant in the U.S. market. Rising use of HFOs and natural refrigerants in HVAC, commercial, and industrial applications drive the market growth. Growing expenditures for green technologies and energy-efficient cooling systems drive the market growth.

Carbon-Neutral Refrigerant Market Growth Drivers:

-

Rising demand for low-GWP and environmentally sustainable refrigerants across HVAC, industrial, and commercial sectors

The global market for carbon-neutral refrigerants and transport is boosted mainly by growing environmental sensitivity and the enforcement of regulations against high-GWP refrigerants. Rising adoption of HFOs, natural refrigerants and blends in HVAC, refrigeration and industrial cooling systems drive the demand. Energy efficient cooling technology investments, government support and corporate sustainability programmes drive deployments. Increasing urbanization, developments in the commercial cold chain and growing calls to lower carbon footprints continue to drive the market worldwide.

Over 120 countries have ratified the Kigali Amendment, mandating an 80–85% phasedown of high-GWP HFCs by 2047 to curb global warming. Natural refrigerants like CO₂ and ammonia now account for over 30% of new industrial refrigeration installations globally, driven by zero-GWP benefits.

Carbon-Neutral Refrigerant Market Restraints:

-

High cost and complex handling requirements of carbon-neutral refrigerants limit widespread adoption globally

The expensive production and the dedicated handling of carbon-neutral refrigerants are limiting market penetration. HFO or natural refrigerant solutions are there, but safety as regards flammability and investment costs for retrofitting hold back take up with small facilitators. Also, simply about availability and lines of supply from the emerging markets. They together impede the market diffusion, which would otherwise be faster because of promotion and environmental gains.

Carbon-Neutral Refrigerant Market Opportunities:

-

Technological advancements and emerging markets present significant growth opportunities for carbon-neutral refrigerants worldwide

There is a large untapped potential in market for new technology with low-GWP refrigerants, blends and high energy efficiency cooling. Increasing adoption in developing economies including APAC, LATAM and MEA provides new growth opportunities. Growing consumption in commercial refrigeration, cold chain logistics and environmental friendly HVAC systems has increased the product demand. Furthermore, big companies investing in R&D for safe and high-efficient refrigerants along with supportive initiatives by government bodies toward green technology creates the lucrative market opportunity for manufacturers and stakeholders operating in the global carbon-neutral refrigerant industry.

-

Mexico has adopted GWP limits of 750 for new stationary AC equipment starting in 2025, spurring uptake of R-32 and HFOs. China has mandated the phase-down of HFCs starting in 2024, targeting a 67.5% reduction by 2045, accelerating adoption of R-290 and CO₂ systems.

Carbon-Neutral Refrigerant Market Segment Analysis

-

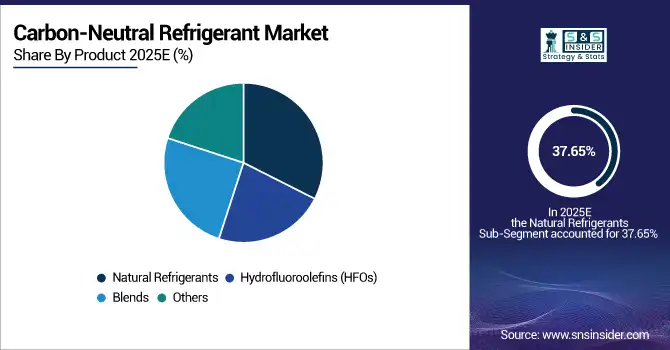

By Product: Natural refrigerants are leading the market with a 37.65% share in 2025E. Hydrofluoroolefins (HFOs) are the fastest-growing product segment, expected to grow at a CAGR of 10.50%.

-

By Application: Residential refrigeration dominates the market with a 34.13% share in 2025E. Air conditioning is the fastest-growing application, registering a CAGR of 9.80%.

-

By End-User: The food & beverage sector leads with a 35.27% share in 2025E. Pharmaceuticals are the fastest-growing end-user, growing at a CAGR of 11.53%.

-

By Distribution Channel: Direct sales hold the largest share at 44.90% in 2025E. Online sales are the fastest-growing channel, with a CAGR of 10.60%.

By Product, Natural Refrigerants Leads Market While Hydrofluoroolefins (HFOs) Registers Fastest Growth

The market is dominated by Natural refrigerants because of their low GWP and environment-friendly nature, which are increasingly being used in commercial & residential refrigeration systems. Hydrofluoroolefins (HFOs) are growing at the fastest pace owing to strict environmental norms and increasing use in next- generation air conditioning systems. Due to their low ozone depletion and high energy efficiency, they are gaining popularity with manufacturers as well as users.

By Application, Residential Refrigeration Dominate While Air Conditioning Shows Rapid Growth

Residential Refrigeration segment is dominated the market for carbon-neutral refrigerants is largely residential driven, with households looking out to comply with energy efficiency norms by adopting green cooling systems. Meanwhile air conditioning segment growing fastest due to urbanization, severe weather and government incentives for low-GWP refrigerants are driving expansion in the air conditioning sector. Both sectors mirror the broader movement toward sustainable cooling that has seen consumers and commercial companies opt for products with a lower carbon footprint.

By End-User, Food & Beverage Lead While Pharmaceuticals Registers Fastest Growth

Food & beverages are the leading end-user in the carbon-neutral refrigerant market; cold storage, refrigeration and transportation need proper cooling, which would be efficient and environmentally friendly. The pharmaceuticals category is growing fastest, due to the demand for temperature-controlled storage that vaccines and medications require. Increase in regulation by industry towards low GWP refrigerants and increase in awareness for environmental sustainability in these industries, are some of the key drivers to growth across different end-user segment.

By Distribution Channel, Direct Sales Lead While Online Sales Grow Fastest

Direct sales have dominated the carbon-neutral refrigerant market, as commercial customers and industrial end-users maintain strategic partnerships with the manufacturers. Online sales are growing the most quickly, driven by rising e-commerce penetration as well as small-sized buyers’ accessibility to co2 refrigerants and growing awareness of environment-friendly alternatives. Faster acquisition and easier comparison of products can be facilitated by online platforms leading to faster adoption in the residential sector and niche industrial applications.

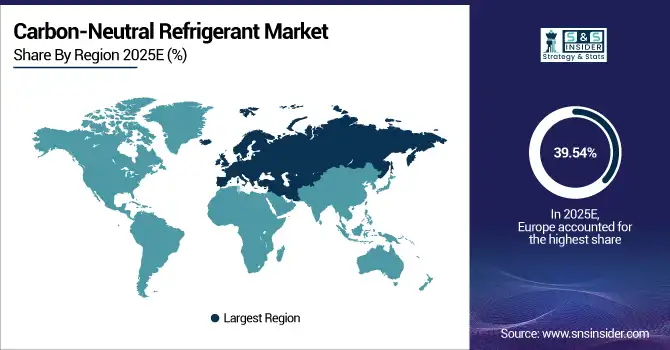

Carbon-Neutral Refrigerant Market Regional Analysis:

Europe Carbon-Neutral Refrigerant Market Insights

In 2025E Europe dominated the Carbon-Neutral Refrigerant Market and accounted for 39.54% of revenue share, this leadership is due to the strict EU laws of refrigerants and emissions. Natural refrigerants are also used extensively in both residential and as well as the commercial application. Key European powers – Germany, France and UK are major boost to market growth. The focus on environmental footprint and carbon neutrality fosters innovation in HFO based solutions. Strong R&D funding in the region and government supports for green technologies are other advantages.

Get Customized Report as per Your Business Requirement - Enquiry Now

Germany Carbon-Neutral Refrigerant Market Insights

Germany is leading market for the carbon-neutral refrigerant industry in Europe. The state has strict policies regarding use of refrigerants and energy efficiency.” Industrial and commercial applications are major targets for the adoption of carbon-neutral refrigerants.

Asia-pacific Carbon-Neutral Refrigerant Market Insights

Asia-pacific is expected to witness the fastest growth in the Carbon-Neutral Refrigerant Market over 2026-2033, with a projected CAGR of 14.15% due to rapid industrialization and urbanization. Growing residential and commercial refrigeration need surge the penetration of carbon-neutral refrigerants. Strict government regulations on GWP and energy efficiency drive market penetration. Others, including India, Japan and South Korea are making investments in sustainable cooling technologies.

China Carbon-Neutral Refrigerant Market Insights

China is dominated the region with adoption in both industrial and residential verticals. Stringent refrigerant-emission regulations by the government on low-GWP substations are a contributing factor. The ever-increasing demands in food, beverage and pharmaceutical industries are the key driving factors.

North America Carbon-Neutral Refrigerant Market Insights

In 2025E, North America emerged as a promising region in the Carbon-Neutral Refrigerant Market, due to environmental regulations such as the U.S. EPA’s SNAP program. Residential refrigeration and commercial air conditioning is being adopted. Low-GWP refrigerants are promoted by corporate sustainability initiatives in all sectors. The area is rich in technology and supply chain networks.

U.S. Carbon-Neutral Refrigerant Market Insights

The U.S. is the largest market in North America, where HFOs and natural refrigerants find extensive use. Strict federal and regional regulations continuously encourage the use of low-GWP refrigerants. Its end users are mainly food & beverage and pharmaceutical respectively.

Latin America (LATAM) and Middle East & Africa (MEA) Carbon-Neutral Refrigerant Market Insights

The Carbon-Neutral Refrigerant Market is experiencing moderate growth in the Latin America (LATAM) and Middle East & Africa (MEA) regions, due to the consistent pace on account of rising industrialization and urbanization. Uses are mostly in food & beverage storage and commercial refrigeration. Environmental regulations are increasingly being enforced by governments, increasing the usage of low-GWP refrigerants. Increasing awareness about climate change and sustainability aids market growth.

Carbon-Neutral Refrigerant Market Competitive Landscape:

Honeywell is a world leader in low-GWP refrigerants, which includes natural refrigerants and HFO alternatives. The firm specializes in renewable technologies for residential, commercial and industrial use. It is only by investing heavily in R&D and forming strategic partnerships that Honeywell will be able to position themselves within the market place, remain relevant as well as adhere to global environmental laws and driving energy efficient cooling solutions.

-

In April 2025, Honeywell introduced the Honeywell Protonium™ suite, an AI-powered platform designed to enhance the efficiency and scalability of green hydrogen production, aligning with its broader sustainability goals.

Daikin al the world’s No. 1 air conditioning company. The company is focusing on natural refrigerants and low-GWP HFOs. Its presence is enhanced by continued innovation in residential, commercial and industrial applications. Compliance of regulations, advanced technology and presence worldwide aids in the movement of Daikin's in carbon neutral refrigerant market.

-

In March 2025, At ISH 2025, Daikin showcased innovations like the Daikin Altherma 4 generation and CO₂ VRV systems, emphasizing low-carbon heating and cooling solutions for diverse building types.

The Chemours Company is a leader in fluor products, including a portfolio of more sustainable refrigerant solutions, the HFO-based carbon-neutral refrigerants. It is an adopted technology across residential, commercial and industrial categories due to its orientation towards innovation, sustainability and regulatory compliance. Through partnerships and global manufacturing capabilities Chemours is committed to delivering innovative refrigerant solutions where they matter most.

-

In September 2025, the company announced the development of a low-GWP retrofit approach using Opteon™ YF (R-1234yf) to replace R-134a in older vehicles, aiming to reduce global warming potential.

Arkema offers refrigerants able to replace former high GWP HFCs as well as low GWP HPFO solutions which positively impact the environment. Powerful R&D investment furnishes eco-friendly product innovation. The firm addresses a range of residential, commercial and industrial markets in accordance with the Environmental Standards.

-

In June 2025, The company implemented the Net Zero Initiative methodology, in collaboration with Carbone 4, to measure and improve its customers' environmental performance, contributing to a more sustainable, low-carbon industry.

Carbon-Neutral Refrigerant Market Key Players:

Some of the Carbon-Neutral Refrigerant Market Companies are:

-

Honeywell International Inc.

-

Daikin Industries, Ltd.

-

The Chemours Company

-

Arkema S.A.

-

Linde plc

-

Air Liquide S.A.

-

Sinochem Group Co., Ltd.

-

Mitsubishi Electric Corporation

-

Johnson Controls International plc

-

Emerson Electric Co.

-

A-Gas International Limited

-

Toshiba Carrier Corporation

-

Panasonic Corporation

-

Trane Technologies plc

-

Gree Electric Appliances Inc.

-

Bitzer SE

-

Danfoss A/S

-

Mayekawa Mfg. Co., Ltd.

-

National Refrigerants, Inc.

-

Shanghai Zhongsu Gas Co., Ltd.

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 4.74 Billion |

| Market Size by 2033 | USD 12.96 Billion |

| CAGR | CAGR of 13.43% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Hydrofluoroolefins (HFOs), Natural Refrigerants, Blends, and Others) • By Application (Commercial Refrigeration, Industrial Refrigeration, Residential Refrigeration, Air Conditioning, and Others) • By End-User (Food & Beverage, Pharmaceuticals, Automotive, Retail, and Others) • By Distribution Channel (Direct Sales, Distributors/Wholesalers, Online Sales, and Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Honeywell International Inc., Daikin Industries, Ltd., The Chemours Company, Arkema S.A., Linde plc, Air Liquide S.A., Sinochem Group Co., Ltd., Mitsubishi Electric Corporation, Johnson Controls International plc, Emerson Electric Co., A-Gas International Limited, Toshiba Carrier Corporation, Panasonic Corporation, Trane Technologies plc, Gree Electric Appliances Inc., Bitzer SE, Danfoss A/S, Mayekawa Mfg. Co., Ltd., National Refrigerants, Inc., Shanghai Zhongsu Gas Co., Ltd. |