Sprinkler Irrigation Market Size & Overview:

Get E-PDF Sample Report on Sprinkler Irrigation Market - Request Sample Report

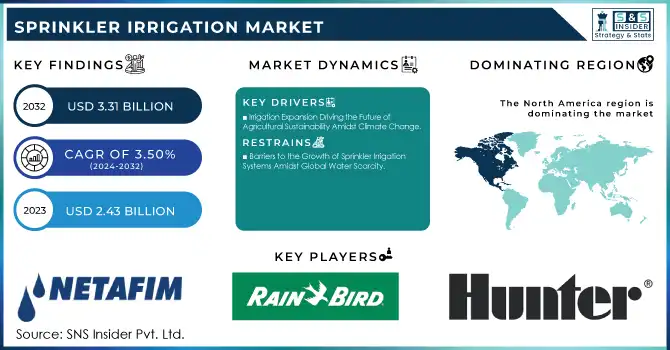

The Sprinkler Irrigation Market Size was valued at USD 2.43billion in 2023 and is expected to grow to USD 3.31billion by 2032 and grow at a CAGR of 3.50% over the forecast period of 2024-2032.

The sprinkler irrigation market is witnessing remarkable growth, driven by the increasing need for efficient water management in agriculture amid global concerns over water scarcity and sustainability. As the demand for water-efficient technologies rises, the adoption of high-efficiency irrigation systems (HEIS) is expanding globally. Over the past 13 years, India has added 11 million hectares under HEIS, displaying the country’s commitment to efficient irrigation practices. In countries like Iran and Turkey, HEIS adoption rates are notably higher, with Iran covering 24% of its total irrigated area under HEIS and Turkey reaching 38%. Government subsidies play a pivotal role in these regions, , which equates to over Rs0.2 million per acre.These incentives are crucial in making high-efficiency systems more accessible to farmers, thereby promoting water conservation and optimizing crop yield. In the United States, irrigation accounts for more than 40% of freshwater use, making efficient irrigation technologies a critical focus. GAO modeling shows that efficient irrigation scheduling can significantly reduce water use, particularly in regions such as the illustrative watershed model. Moreover, micro-irrigation systems in orchards and vineyards are becoming increasingly popular due to their ability to apply less water per acre compared to traditional irrigation methods. This trend is driven by the growing emphasis on sustainable farming practices and precision irrigation technologies, such as soil moisture sensors and weather stations, which enable real-time water management and energy efficiency. The adoption of smart sprinkler controllers that integrate with weather data and soil moisture sensors is a key growth driver in the market. These systems allow for automated irrigation, reducing water usage while boosting crop productivity, especially in water-stressed areas like New Jersey, where water-use restrictions are common. As the focus on sustainable agriculture intensifies, the sprinkler irrigation market is poised for robust growth, with increasing adoption of smart and energy-efficient solutions to ensure the long-term sustainability of water resources in agriculture. This combination of government incentives, technological advancements, and a global push for resource conservation is expected to drive the sprinkler irrigation market, making it an essential part of global agricultural sustainability efforts.

Sprinkler Irrigation Market Dynamics

Drivers

-

Irrigation Expansion Driving the Future of Agricultural Sustainability Amidst Climate Change

The growing expansion of agricultural land and the increasing need for irrigation in newly cultivated regions are driving the demand for advanced irrigation technologies, including sprinkler systems. As agricultural land expands, especially in developing regions, the pressure to meet the rising global food demand intensifies. This has led to the increased need for efficient water management practices to ensure sustainable crop yields. Irrigation, particularly sprinkler systems, has become essential in regions where water scarcity is a challenge, optimizing water use and improving crop productivity. Research highlights the impact of irrigation expansion on agricultural sustainability, with a focus on how climate change exacerbates water stress. Global food production relies significantly on rain-fed agriculture, but climate change is altering rainfall patterns, increasing water stress, and necessitating the adoption of irrigation systems. Studies suggest that irrigation expansion can alleviate the adverse effects of climate change on crop production, providing more reliable water sources and mitigating heat stress. However, irrigation systems also place pressure on freshwater resources, especially in water-scarce regions. Countries like China and the U.S. have seen rapid growth in irrigated land over recent decades, with China increasing its irrigated land from 48.9 million hectares to 68.7 million hectares since 1980. In the U.S., the use of pressurized irrigation systems has risen significantly, with systems designed to improve precision and reduce water wastage. Despite this, challenges remain due to increasing competition for water resources, declining groundwater reserves, and projected increases in drought frequency. Irrigation is crucial to ensuring agricultural resilience in arid regions, but its sustainability depends on how effectively water resources are managed in the face of climate change. This growing need for irrigation solutions, such as advanced sprinkler systems, will continue to drive market growth as agricultural practices adapt to evolving environmental conditions.

Restraints

-

Barriers to the Growth of Sprinkler Irrigation Systems Amidst Global Water Scarcity

The growing pressure on global irrigation systems, driven by population growth, food security challenges, and climate change, has underscored significant obstacles to the expansion of sprinkler irrigation. In regions like the Arabian Peninsula, where 90% of the land is affected by overgrazing and 44% is severely degraded, and Egypt, which relies entirely on surface irrigation from the Nile River, the demand for efficient irrigation systems is urgent. However, the high financial burden of implementing and maintaining advanced systems, such as those equipped with smart technologies like soil moisture sensors and weather stations, remains a substantial barrier. These systems, while effective in optimizing water usage, require skilled operators for installation and continuous management. In regions with limited infrastructure or technical training, farmers often struggle to fully utilize these systems, leading to inefficiencies and underperformance. On a global scale, irrigated agriculture accounts for roughly four-fifths of the world’s water intake. Yet, there are significant disparities in irrigation coverage. In Africa, only 4% of agricultural land is irrigated, while regions like South Asia have up to 42% under irrigation. Global water productivity also varies widely, with regions such as Central America, Sub-Saharan Africa, and South Asia exhibiting low water productivity levels of about 2 kcal per liter, compared to North America and Europe, where values range from 4 to 5 kcal per liter. Bangladesh, with the highest share of agricultural land under irrigation at 59.71%, serves as an example of better irrigation adoption. Despite the promise of micro-irrigation systems, which can achieve up to 90% efficiency, their high initial cost and need for constant monitoring make them challenging to implement, particularly in resource-constrained areas. As a result, the high upfront costs, maintenance demands, and lack of technical expertise continue to hinder the growth of sprinkler irrigation systems, particularly in low-income and developing regions.

Sprinkler Irrigation Market Segment Outlook

by Field Size

In the Sprinkler Irrigation Market, the large fields segment hold the largest revenue share of around 41% in 2023. This is due to the widespread use of sprinkler systems in large-scale agriculture, where efficient water distribution is essential for optimizing crop yields and sustainability. Large fields, often used for water-intensive crops like corn, wheat, and rice, require advanced irrigation methods to reduce water wastage and improve efficiency. Sprinkler systems offer even coverage, preventing soil erosion and runoff. The adoption of smart irrigation technologies, such as soil moisture sensors and weather stations, further drives this segment. Additionally, supportive government policies and subsidies for water conservation and sustainable farming practices continue to accelerate its growth.

by Mobility

In the Sprinkler Irrigation Market, the stationary segment dominated with approximately 61% of the revenue share in 2023. This segment is preferred for its reliability and efficiency in large-scale irrigation systems, especially in fixed installations like farms, parks, and golf courses. Stationary sprinkler systems offer consistent coverage across a designated area, ensuring uniform water distribution and minimizing wastage. They are ideal for large fields and permanent agricultural setups, where flexibility in movement is less critical. Additionally, stationary systems are often more durable and require less maintenance compared to mobile counterparts. Their ability to operate effectively across vast, fixed areas makes them the go-to choice for efficient water management in agriculture and landscaping.

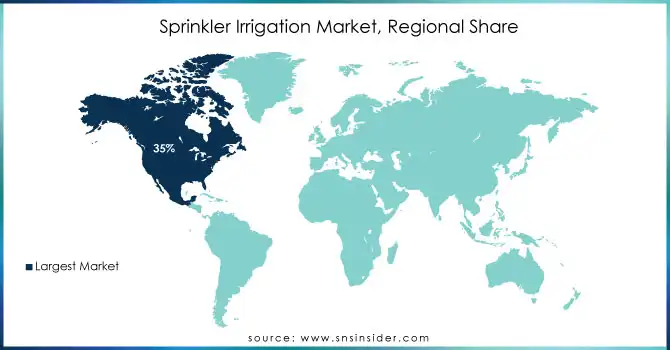

Sprinkler Irrigation Market Regional Analysis

In 2023, North America dominated the Sprinkler Irrigation Market, capturing around 35% of the revenue, with the United States leading. This is attributed to the region's advanced agricultural sector, especially in states like California, Texas, and Nebraska, where sprinkler systems are crucial for efficient water management, particularly for water-intensive crops such as corn, wheat, and cotton. The region benefits from robust infrastructure, government incentives, and policies promoting water conservation. Additionally, the adoption of innovative irrigation technologies, including smart systems with soil moisture sensors and automated controls, boosts efficiency and crop productivity. Ongoing research and development investments in precision agriculture further support North America’s market leadership, ensuring continuous growth and technological advancement in irrigation practices.

Asia-Pacific is expected to be the fastest-growing region in the Sprinkler Irrigation Market during the forecast period from 2024 to 2032. This growth is driven by the region’s increasing agricultural demands, especially in countries like China, India, Australia, and Southeast Asia, where efficient water management is becoming increasingly critical due to population growth, water scarcity, and climate change. Asia-Pacific is home to many emerging economies where agriculture is a key economic sector, and the need for modern irrigation systems is rising to meet food security goals. In countries like India and China, large-scale farming operations are investing heavily in advanced sprinkler irrigation systems to improve water efficiency and crop yields, particularly in areas facing drought or water shortages. Additionally, government initiatives and subsidies in countries such as India and Australia, aimed at promoting water-saving irrigation technologies, are encouraging adoption. The Asia-Pacific region is also seeing rapid technological advancements in irrigation systems, including the integration of smart technologies like automated controls and soil moisture sensors. This shift toward precision irrigation ensures that water is used efficiently, improving agricultural productivity while conserving valuable resources.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

Key Players

Some of the major key players in Sprinkler Irrigation Market with their product:

-

Netafim (Drip Irrigation Systems, Sprinkler Systems)

-

Rain Bird Corporation (Sprinkler Systems, Drip Irrigation Solutions)

-

Hunter Industries (Sprinkler Heads, Controllers, Drip Irrigation Products)

-

Valmont Industries (Center Pivot Irrigation Systems, Sprinkler Systems)

-

Lindsay Corporation (Zimmatic Pivot Irrigation Systems, Sprinkler Systems)

-

John Deere Water (Sprinkler Irrigation Systems, Drip Irrigation Solutions)

-

Toro Company (Sprinkler Systems, Drip Irrigation Products)

-

Jain Irrigation Systems (Drip and Sprinkler Irrigation Systems)

-

Irritrol Systems (Sprinkler Systems, Controllers)

-

T-L Irrigation (Pivot Irrigation Systems, Sprinkler Systems)

-

SPX Flow (Sprinkler Irrigation Systems, Valves)

-

WASCO (Sprinkler Systems, Irrigation Accessories)

-

Pico Irrigation (Drip Irrigation Systems, Sprinkler Products)

-

Reinke Manufacturing (Center Pivot Irrigation Systems, Sprinkler Systems)

-

Agrico (Drip Irrigation Products, Sprinkler Systems)

-

Komet Irrigation (Sprinkler Systems, Irrigation Valves)

-

The Toro Company (Sprinkler and Drip Systems, Turf Irrigation Solutions)

-

Bauer Irrigation (Sprinkler Systems, Agricultural Irrigation Solutions)

-

Vyrsa (Sprinkler Irrigation Systems, Agricultural Irrigation Equipment)

-

Nelson Irrigation Corporation (Sprinkler Systems, Turf Irrigation Solutions)

List of 20 suppliers of raw materials for the sprinkler irrigation market:

-

Dow Chemical Company

-

BASF SE

-

Reliance Industries Limited

-

LG Chem

-

SABIC

-

Formosa Plastics Corporation

-

ExxonMobil Chemical

-

Dupont

-

Chevron Phillips Chemical

-

Solvay

-

Chevron

-

Plastika Kritis S.A.

-

Hanwa Chemical Corporation

-

PolyOne Corporation

-

Kaneka Corporation

-

Mitsui Chemicals

-

China National Petroleum Corporation (CNPC)

-

Eastman Chemical Company

-

Indian Oil Corporation

-

Trinseo

Recent Development

-

19th September 2024 - Netafim South Africa has launched GrowSphere, a revolutionary all-in-one irrigation system designed to enhance efficiency and sustainability. This advanced system combines digital farming technologies with precision irrigation and fertigation management, offering real-time control to improve agricultural productivity.

-

15th January 2024 – Hunter Industries has introduced the Wireless Valve Link, utilizing LoRa Wireless Radio Technology to eliminate the need for additional copper wiring in the field. This innovation simplifies installation, saving time, money, and labor, and enhances system reliability by avoiding common issues like wire degradation and lightning damage.

-

9th May 2024 – A sprinkler system was credited with extinguishing a small fire at a John Deere building in Waterloo early Thursday morning. Firefighters confirmed the system had already contained the fire before their arrival, allowing crews to focus on ventilation and water removal.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.43 Billion |

| Market Size by 2032 | USD 3.31 Billion |

| CAGR | CAGR of 3.50% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Centre pivot irrigation systems, Lateral move irrigation systems, Solid set sprinkler systems, Others) • By Crop Type (Cereals, Oilseeds & pulses, Fruits & vegetables, Others) • By Field Size (Small fields, Medium-sized, large fields) • By mobility (Stationary, Towable) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Netafim, Rain Bird Corporation, Hunter Industries, Valmont Industries, Lindsay Corporation, John Deere Water, Toro Company, Jain Irrigation Systems, Irritrol Systems, T-L Irrigation, SPX Flow, WASCO, Pico Irrigation, Reinke Manufacturing, Agrico, Komet Irrigation, Bauer Irrigation, Vyrsa, and Nelson Irrigation Corporation are key players in the sprinkler irrigation market. |

| Key Drivers | • Irrigation Expansion Driving the Future of Agricultural Sustainability Amidst Climate Change. |

| Restraints | • Barriers to the Growth of Sprinkler Irrigation Systems Amidst Global Water Scarcity. |