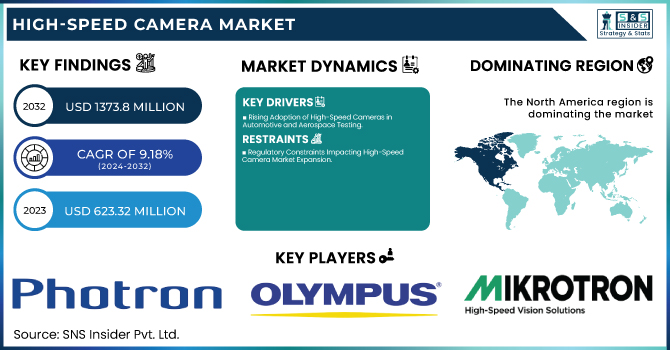

High-Speed Camera Market Size & Growth:

The High-speed Camera Market Size was valued at USD 623.32 Million in 2023 and is expected to reach USD 1373.8 Million by 2032, growing at a CAGR of 9.18% from 2024-2032. Growing need for high-speed imaging across sectors, including automotive testing, aerospace & defense, healthcare, and media is propelling the market growth. An increasing adoption of high-speed cameras across scientific research and in quality control and industrial automation also fuels market growth.

To Get more information on High-speed Camera Market - Request Free Sample Report

Advancements in sensor resolution and frame rates, as well as AI-based image processing, improve performance, while sustainability efforts give rise to energy-efficient camera systems. Also important are ongoing changes in consumer preferences, local shifts in markets, and continued investment in R&D that influence the trajectory of the industry, emphasizing drivers such as performance indicators, effect on the environment, regional adoption tendencies, and innovation-centric product exploration.

High-Speed Camera Market Dynamics:

Drivers:

-

Rising Adoption of High-Speed Cameras in Automotive and Aerospace Testing

The increasing need for precise motion analysis in automotive and aerospace testing is driving the demand for high-speed cameras. These cameras play a crucial role in crash testing, aerodynamics research, and structural integrity assessments, capturing thousands to millions of frames per second to analyze impact forces, deformation, and material behavior. In the automotive sector, regulatory bodies like NHTSA and Euro NCAP mandate rigorous crash testing, where high-speed imaging helps engineers refine vehicle safety features. Similarly, in aerospace, high-speed cameras are used in wind tunnel experiments, jet engine testing, and missile trajectory analysis, ensuring optimal performance and safety. The continuous push for autonomous vehicles, electric aircraft, and advanced propulsion systems further accelerates market growth.

Restraints:

-

Regulatory Constraints Impacting High-Speed Camera Market Expansion

The high-speed camera market faces significant challenges due to stringent export Regulations High-speed cameras, especially in the defense and aerospace verticals are double use technology having military applications; for this reason, they are a subject of stringent export regulations by governments across the globe. Government-imposed licensing requirements lead to prolonged approvals, trade restrictions, and rising compliance costs, which restrict manufacturers' ability to expand globally. U.S. Bureau of Industry and Security (BIS) provides enforcement of the Export Administration Regulations (EAR), within which high-speed imaging systems are regulated. In February 2024, BIS imposed additional restrictions on international trade based on Export Control Classification Number (ECCN) 6A293 the provisions of which prevented the use of such products for military utilization without a proper license. These rules slow down transactions, dissuade foreign purchasers and complicate export processes. As global trade policies tighten, manufacturers struggle to access international markets, hindering commercialization, innovation, and overall market growth.

Opportunities:

-

AI-Driven Market Expansion Transforming Industries Through Strategic Investments

The rapid integration of artificial intelligence (AI) across industries is driving significant market expansion, particularly in manufacturing, healthcare, and infrastructure. Governments and major tech firms are investing heavily in AI infrastructure, aiming to enhance efficiency, reduce costs, and boost economic growth. AI Growth Zones are being established to streamline planning and accelerate technology adoption, with a strong focus on high-speed imaging for quality control in manufacturing. Leading corporations, such as Vantage Data Centres and Kyndryl, have committed £14 billion in AI-driven projects, creating over 13,250 jobs. Initiatives like increasing public compute capacity by twentyfold and developing National Data Libraries are further strengthening AI capabilities, positioning industries at the forefront of automation and digital transformation. These strategic advancements are reshaping global markets, paving the way for a future driven by AI-powered efficiency and technological breakthroughs.

Challenges:

-

Shortage of Skilled Professionals Impacting High-Speed Camera Market Expansion

The implementation of these types of high-speed cameras faced a critical challenge being the lack of qualified manpower for the operation, maintenance of the high-speed camera systems. Involving advanced optics, precise calibration, and specialized imaging software, this expertise is critical for key industries such as manufacturing, aerospace, and healthcare. But that has challenged deployment and operational costs due to limited training programs and an insufficient pool of resource personnel to undertake task of deploying. Companies must invest in extensive training or rely on third-party experts, further restraining market expansion. The growing demand for high-speed imaging in quality control, diagnostics, and research intensifies the need for skilled technicians. Addressing this skills gap through targeted training initiatives, academic collaborations, and industry-led certification programs will be critical to sustaining growth and ensuring the efficient use of high-speed camera technology.

High-Speed Camera Segmentation Overview:

By Component

In 2023, the Image Sensors Segment held the largest revenue share of approximately 40% in the high-speed camera market, driven by the growing demand for sophisticated imaging solutions in applications such as industrial automation, automotive testing and scientific research. Applications of High-Speed cameras: High-Speed camera uses advanced image sensors, mainly CMOS or CCD, to catch fast motion taking place at high resolution and accuracy. CMOS sensors, which have lower power consumption, higher frame rates, and greater sensitivity than other image sensors, have thus become the most widely adopted in the market, driving growth. As industries continue to emphasize automation and real-time analysis, the dominance of the image sensors segment is expected to persist, driving further market expansion.

The Memory segment is projected to be the fastest-growing in the high-speed camera market from 2024 to 2032, driven by the increasing need for efficient data storage and processing capabilities. High-speed cameras are able to record very high frame rates and as these are frequently be termed as data hungry this requires substantial memory to capture at real time, analyse or even stream. Improved data transfer speeds in DRAM and NAND flash memory are making high-resolution video capture seamless. Growth in such as automotive testing and aerospace feeding the demand for higher capacity memory for writing functions of high end imaging applications for commercial use. Additionally, advancements in edge computing and AI-driven analytics are further driving the adoption of high-speed memory solutions, positioning this segment for rapid expansion throughout the forecast period.

By Application

The aerospace and defense segment held around 35% of the high-speed camera market in 2023, driven by its essential use in tests for missiles, ballistics, and performance analysis for aircraft. These high-speed cameras are essential for recording ultra-fast events in a variety of defense research applications, weapons testing, and even space exploration, while providing high volumes of precise and accurate data. To enhance surveillance, target tracking, and flight diagnostics, military organizations and aerospace firms are spending heavily on advanced imaging technologies. Demand is also being driven due to the increasing need for rugged cameras with high-resolution and working in extreme conditions. As defense strategies evolve, the adoption of high-speed cameras for real-time monitoring and analysis continues to expand, reinforcing the segment's market dominance.

The healthcare segment is witnessing the fastest growth in the high-speed camera market over the forecast period 2024-2032, due to the rapid advancements in medical imaging, biomechanics research, and surgical analysis. In the field of motion analysis there is a growing role for high-speed cameras used for injury rehabilitation, gait analysis or cardiovascular system physiology, as they enable accurate evaluations of both human movements and their physiological functions. Their applications in surgery, for instance, include monitoring complex surgeries in real-time for better accuracy and reduced risk.. Additionally, biomedical research benefits from high-speed imaging in cell tracking and microfluidics studies, accelerating innovation in disease diagnosis and treatment.

By Spectrum

The 3D segment dominated the high-speed camera market, accounting for approximately 43% of total revenue in 2023. This dominance is driven by the rising penetration of 3D imaging across application segments demanding accurate motion detection, depth detection, and real-time object tracking. 3D high-speed cameras are used in industries like automotive, aerospace, health care, and manufacturing for applications such as quality control, crash testing, biomechanics studies, and machine vision. The ability to capture highly detailed spatial data makes these cameras indispensable in scientific research and industrial automation. Advancements in AI and machine learning further enhance 3D imaging capabilities, driving innovation in augmented reality (AR), robotics, and defense applications. The growing demand for enhanced visualization and accuracy in high-speed imaging solidifies the 3D segment’s leading position in the market.

The X-ray segment is projected to be the fastest-growing in the high-speed camera market from 2024 to 2032, due to its growing applications in medical imaging, industrial inspection, and scientific research. Tool for X-ray high-speed photography: high frame rate camera with soft X-ray Capability-P0571, where high-resolution images can be obtained in NDT, aerospace components and biomechanics applications. These cameras have begun to be used towards the latter category increasingly in the healthcare sector, such as in advanced diagnostics, cardiovascular studies, and bone fracture assessments.. Additionally, industries such as semiconductor manufacturing and material science rely on X-ray imaging for precision quality control. Technological advancements, such as enhanced sensor sensitivity and AI-driven image processing, further accelerate adoption. As demand for high-speed, high-precision imaging grows across multiple sectors, the X-ray segment is set to experience significant expansion.

By Frame

The 1,000–10,000 FPS segment dominated the high-speed camera market with approximately 40% of the revenue share in 2023. The demand for high-speed cameras can be seen in sectors like automobiles testing, aerospace, manufacturing, and scientific research, where accurately capturing high-velocity events is a must. With a balance of resolution, frame rate, and cost, cameras in this FPS range are perfect for applications across the crash testing, fluid dynamics, and component failure studies. The increasing need for quality control, predictive maintenance, and motion analysis in manufacturing augment the adoption in the industrial automation sector. Advancements in sensor technology and image processing have enhanced the performance of these cameras, increasing their efficiency in critical applications. With ongoing technological developments, the 1,000–10,000 FPS segment is expected to maintain its market dominance.

The 30,000 - 50,000 frames per second (FPS) segment is anticipated to be the fastest-growing in the high-speed camera market from 2024 to 2032. This growth can be attributed to the increasing demand for advanced imaging solutions in various other applications, including scientific research, industrial automation, and sports analysis. High-speed cameras working within this frames-per-second range allow scientists and engineers to document fast-paced phenomena with great precision and detail, yielding critical insights into kinematics and quality assurance. Moreover, improved sensor technology and processing capability are lowering the cost and availability of these cameras enabling their widespread adoption across all industry verticals. As the need for precise and high-resolution imaging continues to rise, this segment is poised for significant expansion during the forecast period.

High-speed Camera Market Regional Outlook:

In 2023, North America held the largest share of the high-speed camera market, accounting for approximately 40% of the total revenue. This dominance can be attributed to several factors, including the region's strong emphasis on research and development, particularly in sectors such as automotive, aerospace, and healthcare. The presence of leading technology companies and manufacturers further enhances innovation and competition in the market. Moreover, the high growth of the high-speed imaging systems for motion analysis, product test and sports broadcast is likely to push large amount in such segment. As industries continue to realize the benefit of high-speed cameras for accurately capturing fast events, the North America market share is set to improve with each passing year.

The Europe region is projected to be the fastest-growing market for high-speed cameras during the forecast period from 2024 to 2032. This growth is driven by the increasing adoption of the high-speed imaging technology in several sectors such as automotive, Defence and research industry. In particular, the automotive sector is putting money towards high-speed cameras for crash testing and for advanced driver-assistance systems (ADAS). Moreover, Europe has strong R&D offering as well, bolstered by both EU and government funding, driving innovation in the imaging technology sector. Scientific research and sports analysis are also boosting the region's rapid growth in the popularity of high-speed cameras. As industries prioritize precision and efficiency, Europe's high-speed camera market is expected to experience significant expansion in the coming years.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

Some of the major Key Players in High-Speed Camera Market along with their product:

-

Photron Ltd. (Japan) – (FASTCAM Nova, FASTCAM SA-Z, FASTCAM Mini UX)

-

Olympus Corporation (Japan) – (i-SPEED 7 Series)

-

NAC Image Technology (Japan) – (MEMRECAM ACS Series, MEMRECAM Q Series)

-

Mikrotron GmbH (Germany) – (EoSens 4CXP, EoSens 25CXP+)

-

Excelitas Technologies Corp. (USA) – (pco.dimax CS4, pco.dimax HD)

-

Fastec Imaging (USA) – (TS5, IL5, HS Series)

-

Vision Research Inc. (USA) – (Phantom VEO, Phantom T-Series, Phantom TMX 7510)

-

Optronis GmbH (Germany) – (CamRecord CR, CL Series)

-

iX Cameras Inc. (Canada) – (i-SPEED 203, i-SPEED 5 Series)

-

AOS Technologies (Switzerland) – (S-Motion, L-Series)

-

Baumer (Switzerland) – (CX Series, LX Series)

-

Hypersen Technologies (China) – (HPS-HSC Series)

-

Mega Speed Corporation (Canada) – (MS100K, MS130K)

-

Shimadzu Corporation (Japan) – (HyperVision HPV-X2)

-

Ximea (Germany) – (xiB-64, xiC Series)

List of Suppliers who provide raw material and component in High-speed Camera Market:

-

Sony Semiconductor Solutions

-

ON Semiconductor

-

Teledyne e2v

-

Hamamatsu Photonics

-

STMicroelectronics

-

TSMC

-

Micron Technology

-

Samsung Electronics

-

Corning Inc.

-

Edmund Optics

Recent Development

-

Sept. 5, 2024 – Specialized Imaging launched the SIMX, an advanced ultra high-speed framing camera capable of capturing up to 1 billion fps with a 1320 x 1024 pixel sensor resolution. Featuring up to 16 intensified optical channels, 50lp/mm system resolution, and 10,000x gain adjustment, it supports applications in nanotechnology, medical research, particle analysis, and automotive testing.

-

November 10, 2024 – Aconity3D optimized PBLM process stability with Mikrotron high-speed CMOS cameras for real-time monitoring. This enhances precision in additive manufacturing for industries like automotive, medical, and aerospace.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 623.32 Million |

| Market Size by 2032 | USD 1373.8 Million |

| CAGR | CAGR of 9.18% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component(Image Sensors, Processors, Lens, Memory, Fans And Cooling, Others) • By Application(Automotive & Transportation, Consumer Electronics, Aerospace & Defense, Healthcare, Media & Entertainment, Others) • By Spectrum(3D, Infrared, X-ray, Visible RGB) • By Frame Rate (250 - 1000 FPS, 1000 - 10000 FPS, 10000 - 30000 FPS, 30000 - 50000 FPS, Above 50000 FPS) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Photron Ltd. (Japan), Olympus Corporation (Japan), NAC Image Technology (Japan), Mikrotron GmbH (Germany), Excelitas Technologies Corp. (USA), Fastec Imaging (USA), Vision Research Inc. (USA), Optronis GmbH (Germany), iX Cameras Inc. (Canada), AOS Technologies (Switzerland), Baumer (Switzerland), Hypersen Technologies (China), Mega Speed Corporation (Canada), Shimadzu Corporation (Japan), Ximea (Germany). |