Advanced Video Coding (AVC) Market Size Analysis:

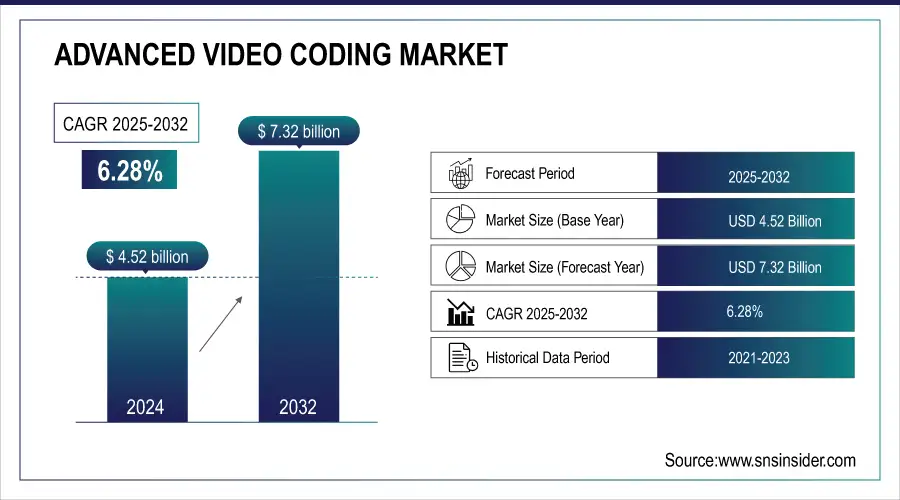

The Advanced Video Coding (AVC) Market size was valued at USD 4.52 billion in 2024 and is expected to reach USD 7.32 billion by 2032, growing at a CAGR of 6.28% over the forecast period of 2025-2032. Advanced video coding market trends are increasing adoption in OTT streaming, rising demand for 4K/8K video, and growing use in cloud-based conferencing. The increasing need for high-quality video content on OTT platforms, broadcasting, and live video streaming services propels the advanced video coding market growth. The transition to 4K and 8K resolution, VR, and immersive video experiences accelerate the adoption. Furthermore, two trends, the growing use of video conferencing at businesses, schools and in healthcare, and need for more effective compression also drives demand too. In the global market Cloud-based solution, increasing penetration of internet, and rising digital content consumption are propelling the growth of the market.

To Get more information on Advanced Video Coding Market - Request Free Sample Report

As of February 2025, streaming platforms, such as YouTube and Vimeo support uploads up to 4K resolution. Notably, Super Bowl LIX in early 2025 was broadcast in 4K HDR with Dolby Vision and Atmos a milestone for live high-resolution streaming.

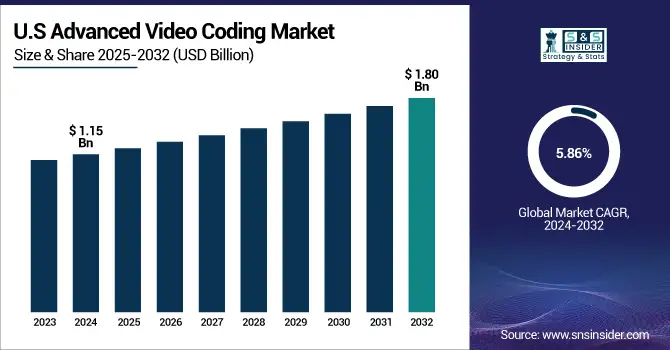

The U.S. advanced video coding market size was valued at USD 1.15 billion in 2024 and is expected to reach USD 1.80 billion by 2032, growing at a CAGR of 5.86% over the forecast period of 2025-2032. A surge in demand for OTT streaming coupled with the growing adoption of 4K/8K, remote work video conferencing, and other online digital content consumption led amidst entertainment, education, and healthcare is causing sustained growth in the U.S. Advanced Video Coding market.

Advanced Video Coding System Market Dynamics:

Drivers:

-

Technological Advancements and Cross Industry Demand Accelerate Growth of the Global Advanced Video Coding Market Globally

The global advanced video coding Market is primarily driven by the increasing need for precise, compact, and high-sensitivity radiation detection across multiple industries. In healthcare, rising adoption of advanced diagnostic imaging and radiation therapy fuels demand. Nuclear power plants require stringent safety and monitoring systems, while defense and security sectors invest heavily in portable and high-performance radiation sensors. Additionally, technological advancements in nanomaterials, such as nanowires, quantum dots, and carbon nanotubes, enable enhanced sensor efficiency, miniaturization, and rapid response, further accelerating market growth. Industrial monitoring in oil, gas, and manufacturing sectors also drives adoption, ensuring regulatory compliance and workplace safety.

Around 85% of hospitals globally, now utilize some form of digital imaging technology, underpinning the demand for precise radiation detection

Restraints:

-

Emerging Codecs and Interoperability Challenges Threaten the Long Term Dominance of Advanced Video Coding Globally

One of the biggest restraints in global advanced video coding market is new and better codecs, such as HEVC (H.265) and AV1 that gives better compression and performance. Which brings about that technological shift, as AVC may eventually start to be used less and less for certain applications. Moreover, interoperability challenges across platforms and devices can be an issue as existing systems may not have fully adopted changing standards and, therefore, limits seamless integrability.

Opportunities:

-

Cloud Powered AI Enhanced Advanced Video Coding Unlocks Global Opportunities in Streaming Healthcare and Enterprise Communication

One big potential win is combining AVC with cloud-based processing and AI-driven optimization for video. As internet penetration continues to grow worldwide, especially in emerging markets, the increasing need for adaptive streaming and lower latency video delivery, provides a significant opportunity for growth. Moreover, other fields including health care and surveillance, which demand lossless or near-lossless compression in very important applications, create another pathway for innovation. With the transition to digital-first everywhere experiences, rising enterprise video adoption, AVC acts as the foundational technology making live, scalable, secure, and high-performance global video communication possible.

By 2025, video streaming accounted for ~57.9% of total internet traffic, with average users spending ~96 minutes daily on streaming. This growth underscores the need for adaptive bitrate and low-latency delivery.

Challenges:

-

Ultra HD and Real Time Demands Expose Advanced Video Coding Limitations for Future Scalability

Ultra-HD formats including 4K, 8K, plus immersive VR/AR video can be data intensive, and AVC was never intended to be exceptionally efficient for these workloads. This makes AVC long-term unsuitable, particularly for real-time apps, such as cloud gaming, healthcare, and surveillance, where low latency, scalability, and adaptability are critical.

Advanced Video Coding (AVC) Market Segmentation Analysis:

By Compression Technique

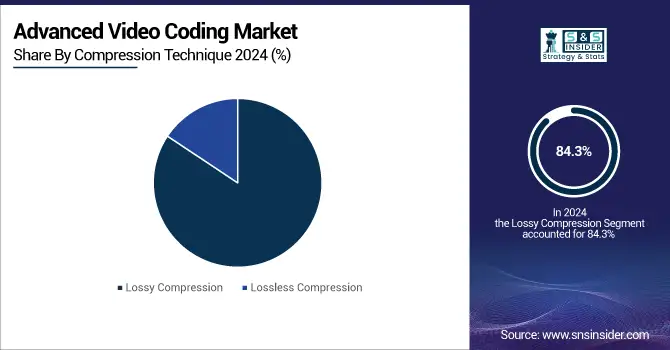

In 2024, global lossless compression represented a share of 84.3% of the total Advanced video coding market. The reason for this predominance stems from the fact that it is widely used in over-the-top (OTT) platforms, video streaming, broadcasting, and social media applications, wherein reducing the file size becomes essential for seamless delivery and less bandwidth consumption. The lossy compression offers an ideal compromise with respect to quality and efficiency, so that it is the technique of choice for consumer–oriented services that must provide smooth playback and a scalable content distribution.

Lossless compression is expected to grow at the highest CAGR during 2025-2032 due to its wider application in healthcare, surveillance, and industrial applications, where data accuracy is critical. While high-resolution formats, such as 4K, 8K and immersive VR/AR continue to gain traction, industries thirsting for near-lossless video are gravitating toward lossless compression.

By Component

The software segment accounted for 48.3% of global Advanced video coding market share in 2024. Software-based codecs and video processing platforms have driven widespread adoption in OTT streaming, broadcasting and enterprise video applications, which is ultimately what has fueled this leadership. With the delivery of software solutions that offer flexibility with easy scaling, regular updates to stay ahead with standards, and within cost, streaming providers, content distributors, and enterprises are aligning their choice toward software solutions for efficient and cost-effective video compression technologies in the future.

Over 2025-2032, services are projected to hold the fastest growth rate. Demand for niche services is being driven by growing dependence on cloud video delivery, managed streaming services, and AI-fueled optimization. As enterprises, healthcare providers, and government agencies select outsourced video solutions to provide secure, scalable, and real-time video communication, services represent the fastest-growing segment.

By End-Use Industry

The global Advanced video coding market was dominated by media & entertainment segment with a share of 53.8% in 2024. In recent years, with the rise of OTT platforms, live streaming services, online gaming, and digital broadcasting, the demand for effective video compression has increased significantly. As the voracious appetite for 4K/8K video, HDR and immersive content experiences continues to build, media companies are increasingly dependent on AVC to provide seamless delivery across devices and networks. This capability toward maintaining quality with bandwidth efficiency has secured a competitive edge for it in the segment.

The healthcare sector is expected to see the fastest CAGR growth in the AVC market, during the period of 2025-2032. The increasing use of telemedicine, bedside and remote diagnostic devices, and virtual training solutions is supporting the growth of the market for lossless and near-lossless compression. Radiology, surgery assistance, and patient consultations require the better quality of imaging and video transmission. Consequently, as AI and cloud platforms continue to be integrated into healthcare, AVC enables seamless, instantaneous, secure video communication, which in turn makes the healthcare sector one of the prime growth propellers in the coming years.

By Application

Video streaming had accounted for a 48.7% share of the global advanced video coding market in 2024. Growing OTT platforms, social media content, esports and live broadcasting have created a very high demand of video compression over the last one decade. Bandwidth use, in optimum, is also essential to equalize for the on-demand, high-resolution needs of consumers, including 4K and 8K streaming. This allows for seamless playback, minimizing buffering; therefore, AVC has become the standard for streaming services that want to deliver the highest-quality user experience to a wider range of devices and networks.

During 2025−2032, the video conferencing will grow at the maximum CAGR in the Advanced video coding market. As hybrid and remote work continues, telemedicine and virtual classrooms become more popular, the need for reliable low-latency video communication also grows. Conferencing solutions that deliver clarity while being less bandwidth intensive are being relied on by Enterprises, Education, and Healthcare providers alike. As cloud integration, AI-powered optimization, and adaptive streaming in real-time continue to evolve, AVC will be one of the cornerstones for providing scalable, secure, and robust video conferencing services globally.

Advanced Video Coding Market Regional Outlook:

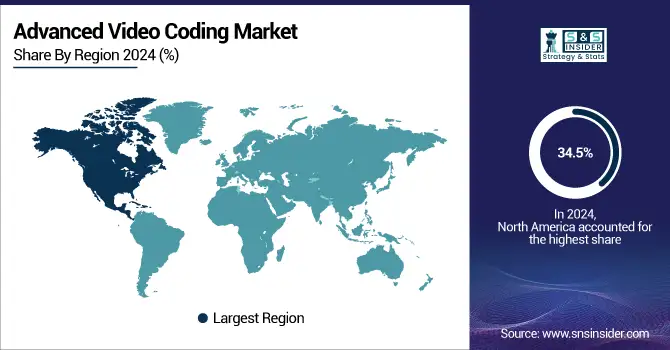

North America held the largest share in the Advanced video coding market in 2024, accounting for 34.5% of the market, owing to this region's high penetration of OTT platforms along with 4K/8K content and demand for cloud-based video solutions. Advanced internet infrastructure, growing enterprise adoption of video conferencing, and rapid integration of AI-powered optimization for streaming and broadcasting solutions bolsters the robust growth of this region. A rise in strong adoption in healthcare, such telemedicine and diagnostics further drives the market growth making North America the leader in AVC deployment.

Get Customized Report as per Your Business Requirement - Enquiry Now

In 2024, North America Advanced video coding market led by the U.S., where massive streaming market, matured digital ecosystem, enterprise video utilization, and progressive investments in cloud-based video infrastructure driven prolific growth.

The advanced video coding market is projected to expand at the highest CAGR of 21.4% during the forecast period over 2025-2032 in Asia Pacific. Rising internet penetration, growing OTT platform demand, and the shift to 4K/8K video streaming will all drive growth. Accelerated adoption from the growth of smartphone usability, digital-first government initiatives, and growing enterprise adoption of video conferencing. In addition, the rapid proliferation of telemedicine and continued growth of e-learning platforms are providing strong growth opportunities fuelling the most dynamic and fastest evolving AVC market globally.

In 2024, the Asia Pacific AVC market was dominated by China, supported by the ever-expanding streaming user base and further 5G deployment and robust digital infrastructure built for AI-driven video compression technology advances.

In 2024, Europe advanced video coding market is also likely to be the largest market of European region owing to large broadcasting industry, rapid uptake of 4K/8K content and high demand for efficient compression technologies to deliver high-quality audio & video over lower bandwidth will drive the market in the European region. It is the increasing adaptation for OTT Platforms, rise in sports streaming, and growth for enterprise video business tools drives the market.

Advanced Video Coding (AVC) Companies are:

The Key Players in Advanced Video Coding Market are Harmonic Inc., Ateme SA, V-Nova International Ltd., Google LLC, Microsoft Corporation, Apple Inc., Amazon Web Services Inc., Cisco Systems Inc., Ericsson AB, Huawei Technologies Co. Ltd., Qualcomm Incorporated, Broadcom Inc., NVIDIA Corporation, Intel Corporation, MediaKind, NetInsight AB, Imagine Communications, Ittiam Systems Pvt. Ltd., MainConcept GmbH, and DivX LLC.

Recent Developments:

-

In March 2025, Harmonic introduced innovative origin server capabilities via its VOS® and XOS media solutions, offering a hybrid model that seamlessly integrates on-premises and cloud storage for optimized streaming workflows, showcased at the 2025 NAB Show.

-

In 2024, Google began implementing the open-source AV1 decoder libdav1d in Android 14 beta, enabling more efficient AV1 playback even on devices lacking hardware decoders.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 4.52 Billion |

| Market Size by 2032 | USD 7.32 Billion |

| CAGR | CAGR of 6.28% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Software, and Services) • By Compression Technique (Lossy Compression, and Lossless Compression) • By End-Use Industry (Media & Entertainment, Security & Surveillance, Healthcare, Education & E-learning, and Others (Corporate, Government, etc.)) • By Application (Video Streaming, Video Conferencing, Broadcasting, and Others (Digital Storage, Video-on-Demand, etc.)) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Harmonic Inc., Ateme SA, V-Nova International Ltd., Google LLC, Microsoft Corporation, Apple Inc., Amazon Web Services Inc., Cisco Systems Inc., Ericsson AB, Huawei Technologies Co. Ltd., Qualcomm Incorporated, Broadcom Inc., NVIDIA Corporation, Intel Corporation, MediaKind, NetInsight AB, Imagine Communications, Ittiam Systems Pvt. Ltd., MainConcept GmbH, DivX LLC. |