Narrowband IoT (NB IoT) Chipset Market Size :

Get more information on Narrowband IoT (NB-IoT) Chipset Market - Request Sample Report

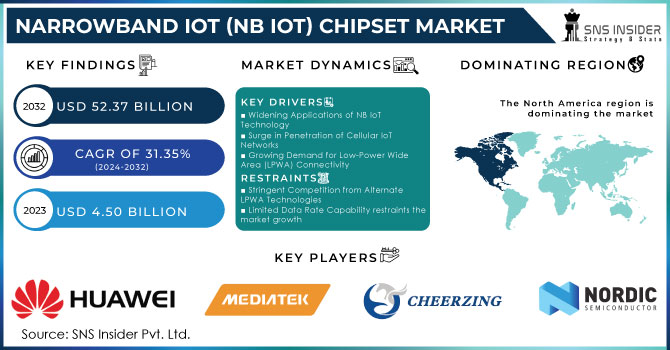

The Narrowband IoT (NB IoT) Chipset Market Size was valued at USD 4.50 billion in 2023 and is expected to reach USD 52.37 billion by 2032 and grow at a CAGR of 31.35% over the forecast period 2024-2032.

Rising demand for IoT landscape due to its low power consumption, and wide area connectivity is significantly influencing the Narrowband IoT Chipset Market. According to the IoT Analytics State of Spring 2023 report, the connected IoT devices are expected to grow by 16% as compared to 2022 i.e. around 16.7 billion and it is to become more than 20 billion by 2027. In 2021, the IoT investments in India tripled to US$ 15 billion across both technology products and services components. Global IoT connectivity is driven mainly by Wi-Fi, Bluetooth, and cellular IoT. However, these technologies require high bandwidth and speed to work properly. But Narrowband IoT chipsets require narrow bandwidth and deep network penetration to work for long-term connectivity. This focus on efficient and flexible results makes the NB IoT chipsets ideal for applications. For Example, Qualcomm launched a series of NB IoT chipset devices, one among them is QNE, which are known for their low power consumption and compact sizes.

NB IoT operates on cellular networks, offering wider coverage and better penetration compared to traditional short-range options like Bluetooth. Additionally, NB IoT boasts extended device lifespans due to its frugal power consumption, allowing for deployments in remote locations or scenarios where frequent battery changes are impractical. Network service providers are actively rolling out NB IoT services, creating a robust foundation for device development and deployment. This growing infrastructure fosters trust and encourages businesses to invest in NB IoT solutions. Various Governments worldwide are heavily investing in smart grid solutions, transportation systems, and environment monitoring initiatives to develop their infrastructures. These projects require sensors and devices that can efficiently collect and transmit data that aligns with the strengths of NB IoT devices. According to the case study by GSMA for IoT and Essential Utility Services: India Market; the smart utility Internet of Things (IoT) connections will total 3.5 billion globally by 2030, up from 1.7 billion in 2021. Growth will be particularly strong in developing countries, where many companies are still in the early stages of their IoT journeys. In Sub-Saharan Africa, for example, smart utility connections will increase almost six-fold between 2021 and 2030, reaching 152 million. And it is expected to grow nearly 30% of IoT connections by 2030 in the region.

Advancements in the 5G network can also empower the Narrowband IoT Chipset Market further. The integration of NB IoT with 5G infrastructure could unlock various new possibilities for critical applications requiring ultra-reliable, and less-lagging communication. Gatehouse Satcom, a leading satellite communication company said that the finalization of 3GPP’s Release 17 satellite has marked a significant milestone in the 5G technology with the introduction of space-based 5G Narrowband IoT (NB IoT) and direct-to-device connectivity. This development declares the growing interest in satellite-based 5G services, which brings new demands on NB IoT system architecture to ensure uninterrupted network coverage across extensive geographical areas and to address existing connectivity challenges globally.

The Narrowband IoT Chipset Market is growing due to a confluence of factors, including the growing adoption of NB IoT technology by telecom operators, the benefits of NB IoT for low-power communication, and the increasing demand for smart solutions across various industries. As external influences like smart infrastructure development and 5G integration continue to evolve, the Narrowband IoT Chipset Market is poised for a future characterized by sustained growth and innovation.

Narrowband IoT (NB IoT) Chipset Market Dynamics:

Drivers

- Widening Applications of NB IoT Technology

NB-IoT chipsets offer low power consumption, long-range connectivity, and higher connected data rates suitable for many applications. For utilities such as water, gas, or electricity NB IoT helps in smart metering installation which allows real-time monitoring and increases efficiency. Deploying several sensors and creating opportunities such as smart parking solutions, environmental monitoring systems, connected street lights, etc., makes easy management of resources leading to better citizen services. One of the industrial applications for NB IoT is a tool that helps automate some operations in factory and oil and gas fields, where tools are monitored periodically from remote sites to factories. The downtime is reduced and operations are optimized with NB IoT chipsets performing maintenance operations on the sensor data collected. NB IoT chipsets link sensors that can detect soil moisture, temperature, and nutrient levels, thereby enabling precision farming practices to ensure efficient crop yields and resource management processes. It also helps in tracking livestock and remotely manages irrigation systems. In the global logistics system, NB IoT can support real-time tracking of goods as well as vehicles and assets being transported. This leads to more efficient logistics, and fewer chances of theft, and the data it gathers helps for optimal delivery routing.

- Surge in Penetration of Cellular IoT Networks

With cellular networks gaining wider reach to 4G LTE, and the deployment of 5G NR will further enable NB IoT chipsets to be integrated with a better infrastructure. NB IoT uses existing cellular infrastructure with minor changes which means network operators can provide support at low cost. Dedicated networks for low-power IoT applications are less necessary due to the underlying scalability of cellular networks and their ability to easily handle more NB IoT devices with time. They also come with built-in security features such as user authentication, and data encryption which are vital for secure communication in IoT applications. The near-ubiquitous coverage of wireless networks ensures that NB IoT devices can run smoothly across different geographical boundaries. This is key to asset tracking and logistics use cases where you have assets moving across international borders.

- Growing Demand for Low-Power Wide Area (LPWA) Connectivity

The exponential growth of IoT devices necessitates technologies that offer long-range connectivity while minimizing power consumption. NB IoT chipsets are designed for ultra-low power consumption, enabling devices to operate for years on a single battery charge. This eliminates frequent battery replacements and reduces maintenance costs for large-scale IoT deployments. By minimizing power consumption, NB IoT chipsets contribute to lower battery costs and smaller device form factors. This translates to cost-effective solutions for a wider range of IoT applications. Compared to traditional Bluetooth or Wi-Fi, NB IoT offers significantly wider network coverage, allowing devices to connect even in remote locations. This is crucial for applications like smart agriculture, environmental monitoring, and connected infrastructure. NB IoT utilizes a narrow bandwidth for communication, minimizing congestion on cellular networks. This ensures reliable connectivity for a massive number of low-data-rate IoT devices.

Restraints

- Stringent Competition from Alternate LPWA Technologies

NB IoT chipsets have a strong presence in the market but also face challenges from other Low-Power Wide-Area (LPWA) technologies such as LoRaWAN and LTE-M. Also, LoRaWAN coverage extends farther than NB IoT and it is indicated for deployments in far-off or scarcely populated areas. Moreover, it functions in the unlicensed spectrum which can lower costs for some use cases. LoRaWAN offers lower data rates that may become a problem in high-density use cases. LTE-M is slower than NB IoT chipsets and supports modem downlink/uplink speeds of 300/375 kbps. It also uses existing LTE infrastructure, meaning that in some cases it may be cheaper and faster to deploy.

- Limited Data Rate Capability restraints the market growth

While NB IoT has low power consumption and wide-area connectivity, it is also limited in data rate capability. NB IoT is optimized for small short packets of data, which means it's not too practical if you need to pass large loads of continuous data in/out regularly. Higher data rates are often needed by applications such as video surveillance, real-time traffic monitoring, or industrial automation. I think it is likely that NB IoT will struggle to see adoption in these sectors due to its limitations here. However, NB IoT may not fully serve the increasing demand for data-driven applications across sectors. That could put a restraint on market expansion in high data throughput types of segments.

Narrowband IoT (NB IoT) Chipset Market Segment Overview:

By Deployment

The guard band provides a spectrum that can be used for LTE carriers which makes the segment dominating during the forecasted period. NB IoT carriers can be deployed in the LTE guard band without impacting the capacity of an adjacent, co-channel E-UTRA (LTE) FDD or TDD deployment. The guard-band option enables the use of spectrum at the channel edges of existing LTE carriers. The guard-band deployment consumes less mobile broadband capacity over the fact of it than in-band. Benefits like no extra spectrum cost, reuse of antenna system and RF module, and better coexistence performance over in-band mode offer vital potential to grow guard band deployment for NB IoT.

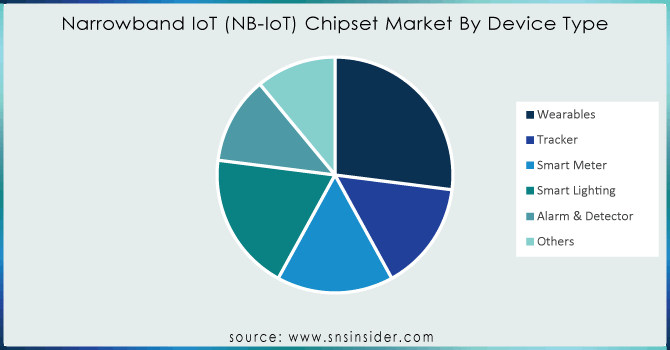

By Device Type

The market has been further divided into alarms & detectors, smart parking, smart meters, intelligent lighting, trackers, wearables and others based on type of device. In view of the rapidly increasing demand for sports, fitness equipment and medical devices related to personal care and diagnostics, the wearables segment held a dominant market share. While the increase in disposable income, together with increased awareness of health and fitness, is promoting this.

Get Customized Report as per your Business Requirement - Request For Customized Report

By Application

The narrowband-IoT (NB IoT) market is leading in the healthcare industry and is anticipated to remain predominant over the outlook period 2022-2030. This is due to the plethora of benefits that NB IoT provides for healthcare use-cases. For example, by utilizing NB IoT the medical devices like heart rate monitors and blood pressure can be used for patient monitoring from remote locations. NB IoT can also be used for inventory management in hospitals, medical equipment tracking and more.

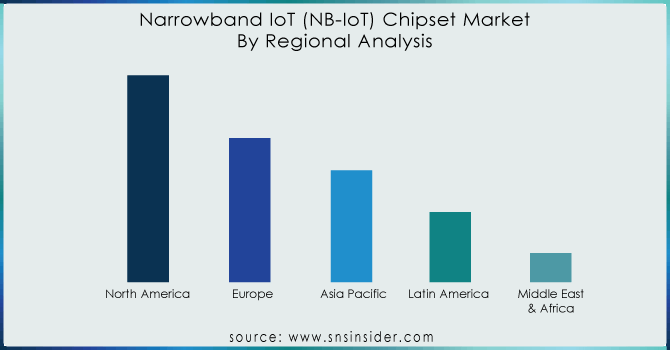

Narrowband IoT (NB IoT) Chipset Market Regional Analysis:

North America held the biggest market share in 2023 and is expected to keep growing at a rapid pace of 44.15% CAGR. This is due to several factors, including the presence of major telecom providers with expertise in NB IoT solutions, a high concentration of tech-savvy consumers, and widespread adoption of new technologies across various sectors.

Europe is the fastest-growing market, driven by the increasing use of NB IoT in cars and transportation. Being a major player in the global NB IoT industry due to the large number of major corporations and early adoption of the technology, the UK has the biggest market share followed by Germany.

Asia-Pacific is also expected to grow due to factors like the expansion of high-speed internet infrastructure, growing internet usage, and government initiatives promoting smart cities. China has the biggest market share in this region, while India is seeing the fastest growth.

KEY PLAYERS:

The Key Player in Global Narrowband IoT (NB-IoT) Chipset Market are Huawei, RDA, MediaTek, Cheerzing, Altair Semiconductor (Sony Group Company), Intel, Telit Communications, Nordic Semiconductor, Sequans Communications, Qualcomm, ZTE, Sanechips, u-blox, Samsung, Sierra Wireless, Sercomm, Quectel, Verizon Wireless, AT&T Inc, Ericcson Corporation, and Other Players

Recent Development:

- In January 2024, Iridium shifted its strategy to direct-to-device satellite connectivity for smartphones. They're now developing an NB IoT-based service called Project Stardust, which leverages 3GPP 5G standards for broader compatibility.

- In April 2024, Renesas released the RH1NS200 NB IoT chipset specifically designed for Indian cellular networks. This chipset aims to capture the growing smart metering market in India and supports "Make in India" initiatives.

- In February 2024, BT launched a nationwide NB IoT network covering 97% of the UK population. This move anticipates the significant growth expected in the global IoT market.

- In April 2021, Reliance Jio deployed India's first commercial NB IoT service for smart meters, partnering with Tata Power Delhi Distribution.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 4.50 Billion |

| Market Size by 2032 | US$ 52.37 Billion |

| CAGR | CAGR of 31.35% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Deployment (Standalone, in-band, guard-band) • By Device Type (Wearables, Tracker, Smart Meter, Smart Lighting, Alarm & Detector, Others) • By Application (Healthcare, Infrastructure, Building Automation, Manufacturing, Safety and Security, Agriculture, Automotive and Transportation, Energy and Utilities, Consumer Electronics) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Huawei, RDA, MediaTek, Cheerzing, Altair Semiconductor (Sony Group Company), Intel, Telit Communications, Nordic Semiconductor, Sequans Communications, Qualcomm, ZTE, Sanechips, u-blox, Samsung, Sierra Wireless, Sercomm, Quectel, Verizon Wireless, AT&T Inc, Ericcson Corporation, and Other Players. |

| Key Drivers | • Widening Applications of NB IoT Technology • Surge in Penetration of Cellular IoT Networks • Growing Demand for Low-Power Wide Area (LPWA) Connectivity |

| Restraints | • Stringent Competition from Alternate LPWA Technologies • Limited Data Rate Capability restraints the market growth |