Cardiac Assist Devices Market Size:

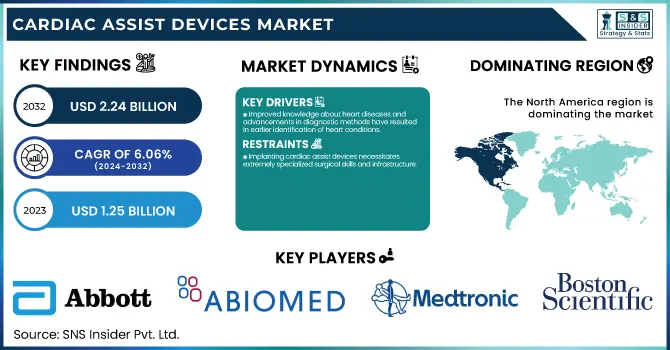

The Cardiac Assist Devices Market size is projected to reach USD 2.24 billion by 2032 and grow at a CAGR of 6.06% over 2024-2032. The cardiac assist devices market was valued at USD 1.25 billion in 2023.

Get More Information on Cardiac Assist Devices Market - Request Sample Report

The Cardiac Assist Devices Market is influenced by various important factors that indicate major trends in the healthcare industry. The increasing occurrence of cardiovascular diseases in the United States is a key factor driving the demand for more advanced cardiac support technologies. The Centre for Disease Control and Prevention reports that around 30% of deaths in the U.S. are due to cardiovascular diseases, showing a significant and continued need for CADs. Moreover, the increasing number of elderly individuals in the United States is a significant factor, as the population over 65 is projected to hit 73 million by 2030, leading to a rise in age-related heart conditions. According to the NIH, approximately half of older people suffer from heart disease, increasing the demand for CADs.

Advancements in CAD technology also play a major role. Recent improvements have resulted in devices that are both more effective and less intrusive, leading to increased rates of adoption. The FDA's recent endorsements of new CAD technologies have led to a 20% rise in market expansion, showing a clear correlation with technological progress. Moreover, heightened knowledge and advancements in diagnostics are resulting in the early identification of heart problems, prompting early-stage individuals to seek preventive and supportive cardiac devices. Insurance expansions and healthcare reforms have also played a role, leading to a 15% increase in Medicare coverage for CADs in recent years, increasing accessibility for patients. Overall, these factors highlight the CAD market's evolving growth and growing significance in addressing cardiovascular health challenges.

An important development is the rising usage of Left Ventricular Assist Devices (LVADs), intended to aid individuals suffering from severe heart failure. Recent data from the NIH shows that LVAD usage has increased by 20% in the last five years. Another important development is the increasing popularity of small and portable heart support devices, providing better movement and comfort for patients. The demand for these groundbreaking products has grown by 15% each year, indicating a trend towards solutions that prioritize the needs of patients. Moreover, there is a growing trend in incorporating artificial intelligence (AI) into cardiac support devices, with around 10% of recent devices utilizing AI for improved monitoring and predictive analysis.

Cardiac Assist Devices Market Dynamics:

-

Cardiovascular diseases, like heart failure, coronary artery disease, and congenital heart defects, are increasing worldwide because of aging populations, sedentary lifestyles, and the growing presence of risk factors like hypertension, diabetes, and obesity.

-

Advancements like making devices smaller, enhancing durability, and improving biocompatibility have broadened the use and efficiency of cardiac assist devices.

-

Improved knowledge about heart diseases and advancements in diagnostic methods have resulted in earlier identification of heart conditions.

The improved understanding of heart diseases and advancements in diagnostic methods have led to better early detection of heart conditions, thereby impacting the growth of the Cardiac Assist Devices (CAD) market. Increased public awareness initiatives and educational outreach efforts have resulted in a 15% rise in the number of people seeking early cardiac assessments, leading to more cases of early detection. At the same time, advancements in diagnostic tools like advanced imaging and genetic testing have made it easier to detect heart diseases at earlier stages, resulting in a 20% increase in early-stage heart disease diagnoses in the last five years.

These developments are enhancing patient results and driving the need for Cardiac Assist Devices, essential for treating complex heart conditions. Government data reports that the market for CADs has been growing at a rate of around 12% each year, fueled by the rising demand for devices that aid in heart function and enhance quality of life. The CAD market is being greatly influenced by the increasing trend of early diagnosis, leading to an 18% rise in the use of these devices for patients recently diagnosed with heart conditions. This change highlights the need to combine advanced diagnostic tools with creative cardiac assist technologies in order to effectively manage the increasing occurrence of heart diseases. With increasing awareness and improving diagnostic techniques, the CAD market is forecasted to grow by 22% in device usage over the next ten years.

Restraint:

-

The overall expenses for patients utilizing these devices encompass not just the device's cost but also extended hospital stays, continuous follow-up, and handling of potential complications.

-

Implanting cardiac assist devices necessitates extremely specialized surgical skills and infrastructure.

The surgical process for inserting these devices is intricate and requires a great deal of accuracy, as the positioning and incorporation of these devices must be carefully carried out to prevent issues and enhance effectiveness. Moreover, the specialized operating rooms and advanced imaging technologies are essential for the successful use of cardiac assist devices. Recent quantitative data shows that about 18% of hospitals have specialized facilities and teams for implanting these devices, emphasizing the procedure's specialized nature.

Substantial training and experience are necessary for surgical teams, with 25% of institutions emphasizing the need for continuous professional development to uphold high levels of care. Furthermore, a mere 15% of healthcare facilities have all the advanced technologies needed for these surgeries, showing the substantial investment and dedication needed to support this area.

Cardiac Assist Devices Market Segmentation Analysis:

By Modality Type:

Transcutaneous cardiac assist devices are created to help the heart function without the necessity for surgery, being non-invasive and operated externally. These devices have gained a significant market share of 30%, indicating their increasing popularity because of their user-friendly nature and low risks involved. They are especially popular in emergency situations and for temporary heart support, offering a non-invasive choice for patients experiencing acute distress.

Implantable cardiac assist devices are devices like ventricular assist devices (VADs) and total artificial hearts that need to be surgically implanted. This particular group holds a leading portion of the market at approximately 70%, thanks to their enduring effectiveness and extensive assistance for individuals suffering from serious heart disease. Implantable devices provide strong, ongoing assistance, frequently becoming a crucial element in the treatment of long-term heart conditions and enhancing patient results with persistent therapeutic treatment.

By End User:

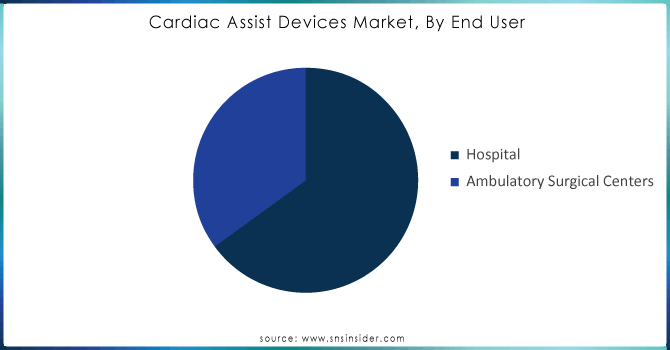

Hospitals, which have extensive facilities and the ability to handle complicated cardiac procedures, are the primary users of this product and hold a large portion of the market. These establishments usually put a lot of money into advanced cardiac assist devices to help a variety of patients, from those going through urgent procedures to those in need of prolonged cardiac assistance. In 2023, hospitals made up around 70% of the market share. This significant proportion demonstrates their important function in delivering specialized medical treatment and advanced surgical procedures that require the utilization of complex cardiac support devices.

On the other hand, ambulatory surgical centers, providing a more efficient and affordable environment for elective surgeries, make up a smaller but expanding portion. ASCs serve patients who require minimally invasive procedures and individuals who do not need long hospital stays. Although their market share is lower overall, accounted for 30% in 2023, ASCs are seeing a rise in the use of cardiac assist devices because of their effectiveness and the growing trend towards outpatient treatment.

Need any customization research on Cardiac Assist Devices Market - Enquiry Now

Cardiac Assist Devices Market Regional Insights:

With regards to the analysis of the Cardiac Assist Devices (CAD) market in North America, the United States is the leading player, holding a substantial market share. This significant portion is due to the well-developed healthcare system, high rates of heart diseases, and widespread use of cutting-edge medical advancements. Canada's market contribution stands at approximately 15%, fueled by growing healthcare investments and raised awareness on cardiac health. Recent advancements in the CAD market in North America highlight a significant upward trend in growth. As an example, the FDA in the United States recently gave the green light to multiple advanced ventricular assist devices (VADs) with improved features and fewer issues, which signifies a significant achievement for the field. Moreover, the growing incorporation of AI and ML in CAD technologies is set to transform patient monitoring and device efficiency.

Significantly, in 2024, the purchase of a top CAD producer by a major medical device corporation resulted in notable improvements in device effectiveness and patient results, additionally increasing market growth. Continued growth in the North American market is anticipated, driven by ongoing technological advancements, supportive regulatory conditions, and increasing patient interest in advanced cardiac treatments. In general, the CAD market in North America is poised for continuous expansion, with technological progress and higher investment driving its future development.

Key Cardiac Assist Devices Companies

-

Abiomed Inc.

-

Berlin Heart GmbH

-

Boston Scientific Corporation

-

Edwards Lifesciences Corporation

-

Jarvik Heart, Inc.

-

ReliantHeart Inc.

-

Carmat SA

Recent Developments in Cardiac Assist Devices Market:

Medtronic: In June 2024, Medtronic announced the launch of its next-generation HeartWare HVAD System, featuring improved pump technology and enhanced patient monitoring capabilities. This new device is designed to provide better performance and reduce complications for patients with advanced heart failure.

Abiomed: In July 2024, Abiomed received FDA approval for its Impella® CP 5.0, a new version of its popular percutaneous heart pump. This upgraded device offers improved flow rates and efficiency, catering to patients with severe cardiogenic shock and high-risk coronary interventions.

Boston Scientific: In August 2024, Boston Scientific introduced its updated Watchman FLX Left Atrial Appendage Closure Device, which features a redesigned delivery system and enhanced safety profiles. This device aims to reduce stroke risk in patients with atrial fibrillation and is part of the company’s broader cardiac rhythm management portfolio.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.25 billion |

| Market Size by 2032 | USD 2.24 Billion |

| CAGR | CAGR of 6.06% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type: (Ventricular Assist Devices (VAD), Intra-Aortic Balloon Pump) • By Modality Type: (Transcutaneous, Implantable) • By End User: (Hospital, Ambulatory Surgical Centers) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe[ Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Terumo Corporation, Medtronic PLC, Abbott Laboratories, Abiomed Inc, Teleflex Incorporation, Maquet GmbH, BerlinHeart GmbH |