Cardiology Information System (CIS) Market Report Scope & Overview:

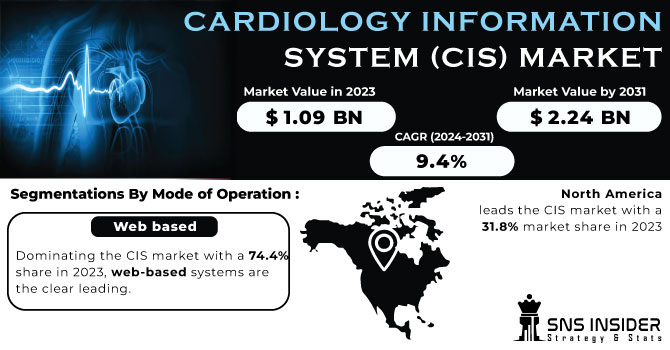

The Cardiology Information System (CIS) Market Size was valued at USD 1.09 billion in 2023 and is expected to reach USD 2.24 billion by 2031 and grow at a CAGR of 9.4% over the forecast period 2024-2031.

The cardiovascular information system market is experiencing significant growth driven by several key factors such as the global prevalence of CVD is a major concern, with heart attacks and strokes accounting for a large portion of deaths worldwide. This increasing demand for better cardiac care is fueling the need for efficient data management solutions like CVIS. Traditional methods of storing and managing cardiovascular data are becoming increasingly inefficient and error-prone.

Get more information on Cardiology Information System Market - Request Sample Report

CVIS offers a software-based solution that simplifies data collection, retrieval, and analysis, improving workflow for healthcare professionals. Moreover, the introduction of advanced CVIS features and integration with other technologies like CPACS (Cardiology Picture Archiving and Communication System) further enhances the system's capabilities and these factors are expected to continue, driving market growth. CVIS improves efficiency for cardiologists, surgeons, and hospital administrators by streamlining data management. This allows for better decision-making and potentially improves patient outcomes. Increased awareness among healthcare institutions about the benefits of CVIS is leading to higher adoption rates, further propelling market growth.

MARKET DYNAMICS

DRIVERS

-

Global Cardiac Disease Prevalence is Growing, and Stroke-Related Deaths Are Rising

The escalating number of cardiovascular disease (CVD) cases worldwide is a primary driver. With heart attacks and strokes being leading causes of death, healthcare systems require efficient data management tools like CVIS for improved cardiac care.

-

Increasing Research and Development to Create New Technologies for Cardiac Stroke Management

RESTRAINTS

-

Systems are expensive, and regulations are strict

The high upfront costs of CVIS implementation can be a barrier for some healthcare institutions. Additionally, stringent data privacy and security regulations can add complexity and cost to the process.

-

As there is no established protocol, healthcare providers are reluctant to implement CIS

OPPORTUNITIES

-

Application of Cloud-Based Solutions

Cloud-based CVIS offers a more cost-effective and scalable solution compared to traditional on-premise deployments. This opens doors for wider adoption, especially for smaller healthcare facilities.

CHALLENGES

-

Combining interoperability with integration

Integration with other healthcare technologies is beneficial, ensuring seamless interoperability between different systems remains a challenge. Data exchange needs to be smooth and secure to maximize the system's effectiveness.

IMPACT OF RUSSIA UKRAINE WAR

The Russia Ukraine war is disrupting the Cardiology Information System (CIS) market. Web-based and cloud-based systems could face internet outages, cyberattacks, or even data center issues. On-site systems might be more stable, but could suffer from lack of spare parts or damaged infrastructure. Both CVIS and CPACS systems could experience data flow disruptions and delays in updates. Overall, CIS vendors might face higher costs and delays, while the focus on data security will increase. The severity of these impacts depends on the location of the CIS system and the vendor's operations.

IMPACT OF ECONOMIC SLOWDOWN

The economic slowdown is likely to put the brakes on the CIS market as hospitals facing lesser budgets might delay adopting new web-based or cloud-based CIS systems, opting to maintain existing on-site ones. This could lead to increased maintenance costs and delays in upgrading on-site systems. Similarly, advanced features within CVIS and storage upgrades for CPACS might be postponed. Overall, the market growth might slow down, with healthcare providers seeking more cost-effective solutions and prioritizing a clear return on investment for any new CIS technology.

KEY MARKET SEGMENTS:

By Mode of Operation

-

Web based

-

Cloud based

-

On site

Dominating the CIS market with a 74.4% share in 2023, web-based systems are the clear leading. This popularity attributes from their ease of use like no software installation needed, just log in from anywhere. This remote access is ideal for healthcare professionals with busy schedules. Additionally, web-based systems ensure secure data storage on servers. While cloud-based solutions are gaining traction due to their cost-effectiveness, web-based systems remain the leader due to their user-friendliness and lower initial investment.

By System

-

CVIS

-

CPACS

CVIS is the leader of the cardiology information systems, holding the biggest market share and growing the fastest. It goes beyond images (like CPACS) and integrates all patient data, allowing for better analysis and quicker treatment decisions. This wider functionality is why CVIS is adopted more and continues to outpace its predecessor, CPACS. In simpler terms, CVIS is the all-in-one information hub for cardiologists, giving them a complete picture of their patients' heart health.

REGIONAL ANALYSIS

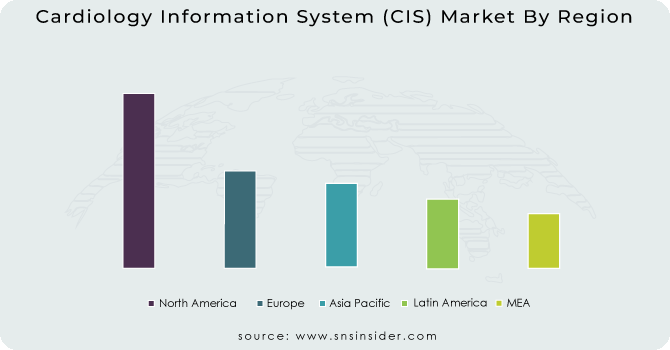

North America leads the CIS market with a 31.8% market share in 2023, driven by the high prevalence of cardiovascular diseases in the region. This is likely due to factors like shared cultural practices and economic development in the US and Canada, leading to a higher incidence of heart disease and heart failure.

Asia Pacific region is expected to experience the fastest growth at CAGR of 10.2% due to several factors such as there's a significant increase in healthcare spending, leading to more investment in research and development for cardiovascular diseases. Moreover, the presence of rapidly developing economies like India and China with improving healthcare infrastructure is boosting the market. Finally, the rising prevalence of cardiovascular diseases in this region creates a growing demand for CIS solutions to manage the increasing patient data burden.

Need any customization research on Cardiology Information System Market - Enquiry Now

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS:

Some of the major key players are as follows: GE Healthcare, Siemens Healthcare GmbH, CREALIFE Medical Technology, Honeywell Life Care Solution, Lumedx, Esasote, Cerner Corporation, Fujifilm Medical Systems, McKesson Corporation, Digisonics, Inc., Merge Healthcare Inc, Philips Healthcare, Cisco Systems and Other Players.

RECENT DEVELOPMENTS:

In September 2023, Oracle Corporation made a splash in healthcare IT with a range of new offerings. Their focus was on improving cardiac, neuro, and oncology solutions. This included a cloud-based EHR system, generative AI for data analysis, and public APIs for broader application integration. This comprehensive launch is expected to boost Oracle's healthcare sales.

In February 2023, a key development in cardiovascular care emerged. A private equity firm, Lee Equity Partners, based in New York City, joined forces with an independent cardiovascular practice in the US, the Cardiovascular Institute of the South (CIS). This collaboration resulted in the creation of Cardiovascular Logistics, a nationwide platform designed to revolutionize cardiovascular care delivery across the US.

Intelerad, a leader in enterprise imaging solutions, acquired LUMEDX Corporation in February 2021. This acquisition, following their earlier purchase of Digisonics, Inc.,

Lumedx-Company Financial Analysis

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.09 billion |

| Market Size by 2031 | US$ 2.24 billion |

| CAGR | CAGR of 9.4% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

|

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | GE Healthcare, Siemens Healthcare GmbH, CREALIFE Medical Technology, Honeywell Life Care Solution, Lumedx, Esasote, Cerner Corporation, Fujifilm Medical Systems, McKesson Corporation, Digisonics, Inc., Merge Healthcare Inc, Philips Healthcare, Cisco Systems |

| DRIVERS | • Global Cardiac Disease Prevalence is Growing, and Stroke-Related Deaths Are Rising • Increasing Research and Development to Create New Technologies for Cardiac Stroke Management |

| RESTRAINTS | • Systems are expensive, and regulations are strict. • As there is no established protocol, healthcare providers are reluctant to implement CIS.es |