Temperature Monitoring Systems Market Size & Trends:

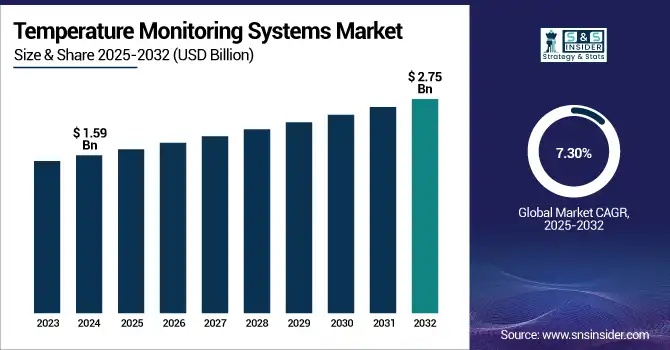

The Temperature Monitoring Systems Market size was valued at USD 1.59 billion in 2024 and is expected to reach USD 2.75 billion by 2032, growing at a CAGR of 7.30% over the forecast period of 2025-2032.

The temperature monitoring systems market is systematically increasing and is driven by advancements in technology, pressing regulations, and developing demand for temperature sensors in healthcare, pharmaceuticals, biotechnology, and the fields of food safety and agriculture. The U.S. has seen significant growth in the adoption of electronic health records, from 9.4% in 2008 to more than 89.9% in U.S. hospitals by 2021, straining for integrated temperature monitoring needs throughout the clinical environment. In pharmaceutical logistics, approximately 25% of vaccines are destroyed by cold chain breaks, revealing the extremely important demand for accurate temperature control. To mitigate this risk, regulations such as 21 CFR Part 11 and technical guidance from the WHO stipulate the need for validated temperature monitoring, especially for fragile biologics. Another factor driving the market is the increase in clinical research and biobanking, which is propelling investments in ultra-low temperature freezers and connected sensors.

To Get more information on Temperature Monitoring Systems Market - Request Free Sample Report

In Jan 2025, Sonicu was awarded a national group purchasing contract with Premier, Inc. to offer certified, wireless temperature monitoring solutions for pharmacy and hospital departments, including labs, pharmacies, and operating rooms, facilitating cost-effective compliance and improving patient safety.

The temperature monitoring systems market analysis is being transformed by technological advancements such as IoT, cloud-based connectivity, and AI-driven alert systems. Firms such as Sensaphone, Sonicu, and Kelsius are leading providers of wireless and automated technologies that minimize the risk of human error, provide round-the-clock monitoring, and meet audit criteria. Supply chain integration and cloud dashboards are standard now, so that data can be accessed at the click of a button for regulatory checks. The number of FDA 510(k) clearances for devices intended to monitor temperature and environmental conditions has grown by more than 18% from 2020 through 2023, new statistics show. In addition, global R&D investments in life sciences were estimated at around USD 260 billion in 2023, a considerable part of it earmarked for infrastructure improvements, such as observation programs.

In Nov 2024, Sensaphone unveiled its rugged, weatherproof wireless monitoring solutions for demanding industrial and healthcare applications, reflecting increased sector-wide implementation.

Temperature Monitoring Systems Market Dynamics:

Drivers:

-

Rising Demand for Automated and Real-Time Monitoring Solutions Fuels the Market Expansion

The growth of the temperature monitoring systems market is mainly attributed to the rising demand for automatic, real-time temperature monitoring solutions in the life science, food & beverage industry, and healthcare sector, among others. The increase in international distribution of vaccines, particularly after the COVID-19 outbreak, has added more demands for healthcare and vaccine companies to reliably manage temperature storage. Systems such as Real-time Monitoring that feature automatic alerting and cloud-based access are essential to help ensure compliance with certain regulations, such as the FDA’s 21 CFR Part 11 data integrity requirements. The rising spending on R&D also adds to this demand at a global level. The first is that R&D in the medical devices market exceeded USD 70 billion during 2023, much of it devoted to the development of effective temperature monitoring systems.

Furthermore, sectors such as food safety are gradually moving towards more advanced cold chain logistics monitoring based on increasing consumer demand for fresh and sanitation-assured products. Companies such as Sensaphone are at the forefront of this change with equipment rated to deal with even as low as -80°C, useful in avoiding spoiled goods and supply wastage. Within healthcare, hospitals are also implementing these systems as part of their wider digital transformation priorities, with automated monitoring solutions seen as a key aspect of operational efficiency.

Restraints:

-

High Installation and Maintenance Costs Hamper the Market Growth

One of the key challenges of the temperature monitoring systems market trends is the high installation costs and high maintenance costs. The price of advanced monitoring devices may be prohibitive for smaller companies and hospital facilities, especially in the developing world. For example, establishing an ultra-cold storage facility equipped to track temperatures during vaccine storage frequently requires significant up-front capital expenditures for hardware and/or software, amounting to thousands of dollars.

In addition, periodic calibration, software, and system maintenance add to the overhead. According to research by the International Pharmaceutical Expo (IPX), this means that while 80% of major pharma companies have adopted temperature monitoring systems, only 50% of smaller companies in growth economies have been able to invest due to issues regarding cost. And then, there’s the significant cost of providing adequate training for employees to successfully use the systems, which costs more money. These are dampening factors for more widespread use of these technologies, especially in scarce resource settings; they may even restrain the temperature monitoring systems market growth in some areas.

Temperature Monitoring Systems Market Segmentation Analysis:

By Product

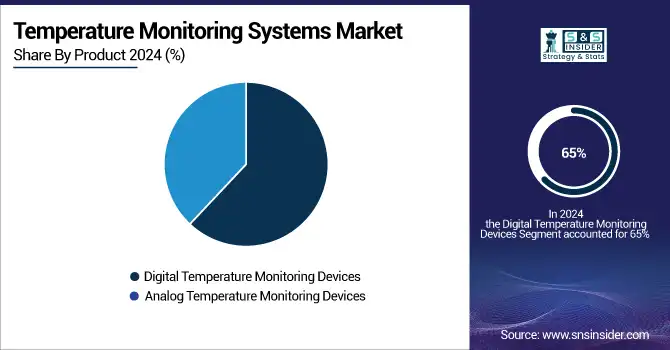

In 2024, the digital temperature monitoring devices segment held the dominant position in the temperature monitoring systems market. With accuracy, easy usage, and ecosystem of the health & pharma industry, the digital product held over 65% in the market share. These instruments provide real-time data logging, cloud connectivity, and automatic alerts, making them suitable for when accurate and/or continuous monitoring is required, for instance, in vaccine storage, cold chain logistics, and in critical care systems. Digital system proliferation is fueled by a growing need for regulatory compliance and enhanced data integrity, especially under strict standards such as the FDA's 21 CFR Part 11. Moreover, the increasing adoption of automation for hospitals and healthcare purposes, where the systems are moving toward complete digital, is also expected to stimulate the growth of this segment.

Analogue temperature monitoring devices are growing at a slower pace, but remain steady. This market segment is experiencing an increased demand for simple, low-end solutions where high-end, high-tech solutions are not required, for instance, in small industry or non-critical areas.

By Type

The non-contact thermometer segment dominated the market in 2024, with a temperature monitoring systems market share of over 70%. In the era of COVID-19, non-contact thermometers' popularity came with the capacity to provide fast, accurate temperature readings without touching, which is ideal in situations of hygiene sensitivity. The Healthcare industry, mainly hospitals and clinics depended heavily on non-contact thermometers for patient screening, also at high traffic locations. Their user friendliness and the increasing attention towards cross-infection control within the health industry have furthered their popularity. Furthermore, the increase of home care settings and the user-friendly nature of non-contact devices have also contributed to their use.

The contact thermometer segment is anticipated to register significant growth owing to the increasing adoption of digital contact thermometers for improved precision and multifunction capabilities. Such devices, commonly implemented in clinical settings, have increasingly become more popular as they are affordable and are more consistent with smart health care systems nowadays.

By End-user

Healthcare facilities dominated the end-user category with more than 60% of the share in 2024. The market is led by temperature management systems due to the crucial role that temperature monitoring plays in the healthcare industry, including vaccine storage, drug supply, and patient care in ICUs and other critical areas. Digital transformation projects in hospitals and the widespread use of electronic health records (EHR) are now creating a greater need for fully integrated temperature monitoring systems that eliminate human intervention.

Home care settings are expected to grow at a higher CAGR, due to the increasing geriatric population and demand for home-based healthcare services. As the trend is increasingly moving towards home healthcare, especially for older patients who need continuous temperature monitoring, there will be a strong demand for non-invasive and user-friendly digital temperature monitoring products.

Temperature Monitoring Systems Market Regional Insights:

The North America region in the global temperature monitoring systems market accounted for the largest share in 2024 due to the presence of sophisticated healthcare infrastructure, stringent regulatory procedures, and increased use of digital technologies in the clinical sector. The U.S. temperature monitoring systems market size was valued at USD 0.59 billion in 2024 and is expected to reach USD 0.90 billion by 2032, growing at a CAGR of 5.66% over the forecast period of 2025-2032, as a result of the high government emphasis on patient safety, increasing demand for remote monitoring devices, and high healthcare per capita spending. More than 90% of American hospitals have installed electronic health record systems incorporating temperature monitoring, allowing for better, real-time surveillance of patient data. Canada is growing via federal programs driving digital health adoption, and Mexico is proliferating in public hospitals as a result of investment in primitive monitoring technologies. The U.S. is the regional frontrunner in terms of R&D spending and regulatory approvals, many of which have been cleared by the FDA for wireless temperature monitoring systems in the past years.

Europe is a lucrative market with a strong healthcare infrastructure, a growing geriatric population, and IoT-based medical device adoption. Germany accounted for the leading position in the region on account of a significant network of advanced technology-equipped hospitals and the presence of players such as Braun and Geratherm. In 2024, the German market was also responsible for more than 20% of the European market. France and the UK come next with more use of temperature monitoring devices in primary care and outpatient departments. The UK government’s backing of AI in healthtech and telemedicine is driving significant digital transformation. Eastern Europe (also including Poland and Turkey) has recently been identified as a low-cost manufacturing destination with growing market opportunities due to better healthcare access and more developed infrastructure.

The Asia Pacific is the fastest-growing region in the temperature monitoring systems market due to growing healthcare awareness, urbanization, and heavy investment in digital health. Aggressive government initiatives to modernize healthcare infrastructure and increasing demand for hospital automation drive the market in the region. Significantly, local manufacturing and greater government attention for temperature-sensitive pharmaceutical logistics were the reasons behind China, which is the largest market in 2024. India is growing at double digits, fuelled by the widening of private healthcare and surging demand for home care devices. Japan, being a technology-first market, is also investing heavily in AI-based monitoring systems, with the most interest being from elder care.

Get Customized Report as per Your Business Requirement - Enquiry Now

Temperature Monitoring Systems Market Key Players:

Leading temperature monitoring systems companies in the market are Philips, Masimo, Omron Healthcare, Geratherm, Braun Healthcare, A&D Company, Toshiba, 3M, Exergen, Medtronic and Others.

Recent Developments:

-

In May 2025, LoneStar Tracking launched an advanced temperature monitoring system aimed at improving cold chain management across industries such as food, pharmaceuticals, and logistics. The system provides real-time temperature data with wireless connectivity, enabling remote monitoring and alerts to ensure product safety and compliance during transportation and storage.

-

In February 2025, Researchers at the University of Glasgow introduced a chipless wireless temperature sensor designed to reduce electronic waste. Utilizing a flexible plastic material enhanced with carbon fibers, these sensors eliminate the need for traditional semiconductor chips, offering a more sustainable solution for temperature monitoring in various applications.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.59 Billion |

| Market Size by 2032 | USD 2.75 Billion |

| CAGR | CAGR of 7.30% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Digital Temperature Monitoring Devices, Analog Temperature Monitoring Devices) • By Type (Contact, Non-Contact) • By End-user (Healthcare Facilities, Home Care Settings, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Philips, Masimo, Omron Healthcare, Geratherm, Braun Healthcare, A&D Company, Toshiba, 3M, Exergen, Medtronic, and Others |