Oxytocin Market Report Scope & Overview:

Get more information on Oxytocin Market - Request Sample Report

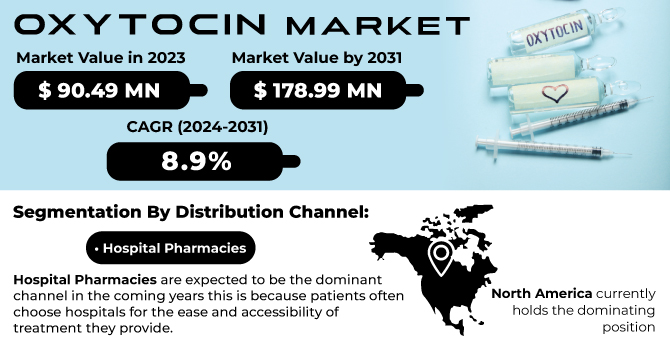

The Oxytocin Market Size was valued at USD 88.86 Million in 2023 and is expected to reach USD 191.41 Million by 2032, growing at a CAGR of 8.90% over the forecast period of 2024-2032.

The Oxytocin Market is evolving rapidly with patent expirations paving the way for generic formulations, increasing accessibility worldwide. Ongoing clinical efficacy studies continue to highlight oxytocin’s critical role in labor induction and postpartum care, strengthening its medical relevance. However, the rise of counterfeit oxytocin products in developing regions poses significant health risks, driving stricter regulatory measures. Global maternal healthcare initiatives are further shaping demand, as governments prioritize childbirth safety to reduce maternal mortality rates. Meanwhile, rising investments and funding are fueling research into stable, innovative oxytocin formulations that address storage and administration challenges. Our report explores these crucial factors, offering exclusive insights into the shifting market landscape and future growth opportunities in the Oxytocin Market.

The US Oxytocin Market Size was valued at USD 26.61 Billion in 2023 and is expected to reach USD 54.31 Billion by 2032, growing at a CAGR of 8.25% over the forecast period of 2024-2032.

The US Oxytocin Market is experiencing steady growth, driven by rising maternal healthcare initiatives, increasing childbirth rates, and strong regulatory oversight. Organizations such as the Centers for Disease Control and Prevention (CDC) and the American College of Obstetricians and Gynecologists (ACOG) emphasize the importance of oxytocin in preventing postpartum hemorrhage, boosting its demand. Additionally, FDA-approved formulations from companies like Pfizer Inc. and Hikma Pharmaceuticals ensure product quality and accessibility. Increased investments in biopharmaceutical research, along with growing awareness about safe labor induction practices, further contribute to market expansion. Our report explores these key dynamics shaping the U.S. Oxytocin Market’s present and future trajectory.

Market Dynamics

Drivers

-

Advancements in Cold Chain Logistics for Oxytocin Storage and Distribution Enhance Market Accessibility

The Oxytocin Market is witnessing substantial growth due to advancements in cold chain logistics, which have significantly improved the storage and distribution of oxytocin. Since oxytocin is a temperature-sensitive hormone, maintaining optimal conditions during transportation is crucial to preserving its efficacy. The expansion of temperature-controlled pharmaceutical supply chains has enabled healthcare providers, particularly in rural and underserved regions, to access high-quality oxytocin formulations. Companies specializing in pharmaceutical cold storage solutions are investing in innovative temperature-monitoring technologies, ensuring compliance with stringent United States Food and Drug Administration (FDA) regulations. Additionally, the integration of real-time tracking systems helps prevent degradation, reducing wastage and improving overall supply chain efficiency. With the World Health Organization (WHO) and U.S. healthcare authorities emphasizing the importance of proper oxytocin storage for postpartum hemorrhage prevention, the expansion of refrigerated supply chains is expected to be a critical driver for market growth.

Restraints

-

Complex Regulatory Compliance Landscape for Oxytocin Imposes Strict Guidelines on Production, Leading to Higher Costs and Limiting Market Entry for New Manufacturers.

Despite its critical role in maternal health, limited awareness among healthcare providers about the proper use of oxytocin presents a significant challenge in the market. In many regions, medical professionals may not receive adequate training on the appropriate dosing, administration techniques, and potential side effects associated with oxytocin. Insufficient knowledge can lead to administration errors, such as incorrect dosing or improper monitoring of patients during labor induction. Organizations like the American College of Obstetricians and Gynecologists (ACOG) emphasize the importance of standardized training and education for healthcare providers. Without comprehensive training programs and resources, providers may be hesitant to utilize oxytocin effectively, leading to suboptimal patient outcomes. Additionally, the absence of clear guidelines in certain healthcare settings can further contribute to inconsistencies in oxytocin administration practices. As a result, there is a pressing need for enhanced educational initiatives, workshops, and certification programs to improve awareness and understanding among healthcare professionals. By addressing this knowledge gap, healthcare providers can ensure safer oxytocin use, ultimately benefiting maternal and neonatal health outcomes.

Opportunities

-

Development Of Heat-Stable Oxytocin Formulations Presents a Crucial Opportunity to Improve Accessibility, Particularly in Regions Lacking Reliable Cold Chain Infrastructure

The development of heat-stable oxytocin formulations presents a significant opportunity for expanding the market, particularly in regions with limited refrigeration infrastructure. Traditional oxytocin products require strict cold chain management to maintain efficacy, which is not feasible in many low-income or remote areas. However, research institutions and pharmaceutical companies are investing in the creation of thermostable oxytocin formulations that can remain effective even under high-temperature conditions. The introduction of these innovative products has the potential to significantly enhance access to oxytocin, especially in developing countries where maternal health services are limited. By reducing reliance on cold chain logistics, heat-stable formulations can simplify the distribution process, ensuring that healthcare providers in underserved regions can access effective oxytocin treatments for labor induction and postpartum care. This market expansion could ultimately lead to improved maternal health outcomes and lower maternal mortality rates in high-risk areas. Furthermore, as global health organizations prioritize safe childbirth practices, the demand for heat-stable oxytocin formulations is likely to increase, presenting a lucrative opportunity for pharmaceutical companies.

Challenge

-

Significant market entry barriers, including stringent regulations and high operational costs, pose challenges for new manufacturers looking to compete in the oxytocin market.

The Oxytocin Market presents significant entry barriers for new manufacturers, primarily due to regulatory hurdles and high operational costs. The stringent requirements set forth by the United States Food and Drug Administration (FDA) for oxytocin products necessitate extensive documentation, clinical trials, and compliance with Good Manufacturing Practices (GMP). These rigorous processes can be both time-consuming and expensive, deterring new players from entering the market. Moreover, established manufacturers often have established brand recognition and distribution networks, making it challenging for new entrants to compete effectively. Financial constraints can hinder smaller companies from investing in the necessary research and development to create competitive oxytocin formulations. Additionally, potential newcomers may face challenges in securing funding and partnerships to support their market entry. As a result, the market remains dominated by a few established players, limiting innovation and competition. Addressing these entry

Segmental Analysis

By Product

In 2023, the postpartum segment dominated the Oxytocin Market with a market share of 54.8%. This dominance is primarily attributed to the critical role of oxytocin in preventing postpartum hemorrhage, a leading cause of maternal mortality. Organizations such as the World Health Organization (WHO) emphasize the importance of administering oxytocin immediately after childbirth to contract the uterus effectively and reduce blood loss. Additionally, government initiatives aimed at improving maternal healthcare outcomes have increased the focus on postpartum treatments. For instance, the Centers for Disease Control and Prevention (CDC) has developed guidelines highlighting oxytocin's benefits in managing labor and delivery complications. Such endorsements from reputable health organizations underscore the significance of postpartum oxytocin administration in improving maternal health, thus driving the segment's growth and solidifying its position in the market.

By Distribution Channel

In 2023, the hospital pharmacies segment dominated the Oxytocin Market with a market share of 50.3%. This leading position can be attributed to the critical role hospital pharmacies play in ensuring immediate access to essential medications during labor and delivery. Hospitals are often equipped with advanced facilities and trained professionals capable of managing the complexities associated with oxytocin administration, particularly for high-risk pregnancies. Furthermore, guidelines from the American College of Obstetricians and Gynecologists (ACOG) recommend the use of oxytocin in hospital settings for labor induction and management of postpartum hemorrhage. These recommendations have led hospitals to prioritize stocking oxytocin formulations, thus driving demand through hospital pharmacies. Additionally, the presence of integrated healthcare systems facilitates a streamlined supply chain, ensuring that oxytocin is readily available during childbirth, further solidifying hospital pharmacies as the primary distribution channel in the market.

Regional Analysis

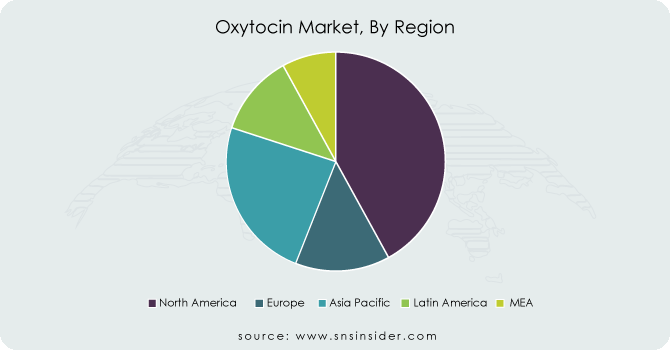

In 2023, North America emerged as the dominant region in the Oxytocin Market, capturing a market share of 38.2%. The dominance of this region is primarily driven by the presence of advanced healthcare infrastructure, robust regulatory frameworks, and high awareness levels regarding maternal health issues. The United States leads the market, with organizations such as the Centers for Disease Control and Prevention (CDC) actively promoting safe childbirth practices and effective postpartum care. Furthermore, the FDA has approved multiple oxytocin formulations, ensuring their availability in healthcare settings. According to recent statistics, nearly 4 million births occur annually in the United States, significantly contributing to the demand for oxytocin. Additionally, Canada is witnessing increasing maternal healthcare investments, focusing on reducing maternal mortality rates, which further supports the growth of the oxytocin market. Overall, the combination of governmental support and healthcare advancements positions North America as a key player in the global oxytocin market.

On the other hand, the Asia Pacific region has emerged as the fastest-growing area in the Oxytocin Market, with significant growth expected during the forecast period. The Asia Pacific region is gaining momentum due to several factors, including rising birth rates, increasing awareness of maternal health, and improving healthcare infrastructure. Countries like India and China are experiencing rapid urbanization, which has led to better access to maternal healthcare services and oxytocin products. According to the World Bank, maternal mortality rates in India have seen a decline due to effective oxytocin administration during childbirth. Moreover, governmental initiatives in the Asia Pacific region are promoting safe delivery practices, thereby increasing the demand for oxytocin. As healthcare facilities expand and healthcare professionals receive enhanced training on oxytocin usage, the Asia Pacific region is poised for significant growth, reflecting its commitment to improving maternal health outcomes.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

-

AdvaCare Pharma

-

Bimeda Group (Veterinary oxytocin producer)

-

Endo International plc (Par Sterile Products, LLC)

-

EVER Pharma

-

Ferring Pharmaceuticals / Ferring B.V.

-

Fresenius Kabi LLC / Fresenius Kabi AG

-

Grindeks

-

Hikma Pharmaceuticals PLC

-

JHP Pharmaceuticals

-

Karnataka Antibiotics and Pharmaceuticals Limited (KAPL)

-

Merck & Co., Inc.

-

Novartis AG (Sandoz Division)

-

Par Pharmaceutical

-

Pfizer Inc.

-

Sun Pharmaceutical Industries Ltd.

-

Teva Pharmaceutical Industries Ltd.

-

Viatris Inc. (Mylan N.V.)

-

Weefsel Pharma

-

Wockhardt Ltd.

-

Yuhan Corporation

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 88.86 Million |

| Market Size by 2032 | USD 191.41 Million |

| CAGR | CAGR of 8.90% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product (Antepartum (before childbirth), Postpartum (after childbirth)) •By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Drug stores, Online Pharmacies) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Pfizer Inc., Hikma Pharmaceuticals PLC, Fresenius Kabi LLC / Fresenius Kabi AG, Endo International plc (Par Sterile Products, LLC), Teva Pharmaceutical Industries Ltd., Novartis AG (Sandoz Division), Ferring Pharmaceuticals / Ferring B.V., Sun Pharmaceutical Industries Ltd., Wockhardt Ltd., AdvaCare Pharma and other key players |