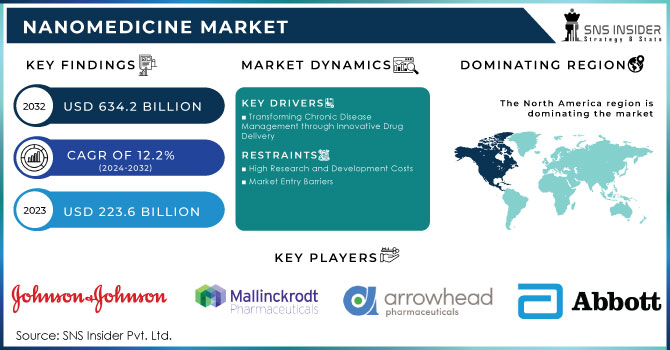

Nanomedicine Market Size & Overview:

Get more information on Nanomedicine Market - Request Sample Report

The Nanomedicine Market Size was valued at USD 223.6 billion in 2023 and is expected to reach USD 634.2 billion by 2032 and grow at a CAGR of 12.2% over the forecast period 2024-2032.

The nanomedicine market will grow significantly as increasing breakthroughs in mRNA and liposome-based vaccines increase the interest of people in nanotechnology for drug delivery. The sector is gaining attention since conventional therapeutics have already proven themselves to be inefficient at delivering solutions; nanotechnology increasingly features prominently in many medical applications. What is noteworthy, however, is the fact that major pharmaceutical companies are now playing an active role in developing new medicines based on nanoscience which would include, for example, the Marble Center for Cancer Nanomedicine's affiliate program launched in partnership with major industry participants including Alloy Therapeutics and Sanofi to foster more collaboration between academe and industry.

The increased incidence of chronic diseases and heart disease-being examples also becomes a moving force behind this market. The International Agency for Research on Cancer estimated that there were about 19.3 million new cases of cancer and 10 million deaths from cancer in 2020 across the world. The estimates are to increase to around 29.5 million new cases every year with 16.4 million fatalities by the year 2040. The Centers for Disease Control and Prevention reports that heart diseases have caused nearly 655,000 deaths yearly in the United States. The ever-increasing number of neurodegenerative diseases predominantly in the elderly calls for better treatments; for example, the incidence of Alzheimer's dementia rises exponentially with age-from 3% among those aged 65 to 74 years to 32% among those aged 85 or older.

Nanomedicine technologies are also advancing, including targeted drug delivery systems, nanoparticle-based diagnostics, and molecular nanotechnology, increasing their therapeutic potential. Government investments in nanotechnology research and development are also expected to hasten this process, like the National Science Foundation's five-year commitment of USD 84 million to improving the nation's nanotechnology infrastructure. In addition, with an increased demand for nanomedicines, strategic partnership and collaboration among industry leaders will be as critical to overcoming the challenges in drug delivery and therapeutic development that may continue to shape the market.

Nanomedicine Market Dynamics

Drivers

-

Transforming Chronic Disease Management through Innovative Drug Delivery

One of the most significant drivers for the global nanomedicine market is going to be the growing prevalence of chronic diseases, such as cardiovascular diseases, diabetes, cancer, and dementia. Nanomedicine accelerates the quick metabolism of medication in the body. This fulfills the increasing patient needs given the massive advances made in medicine and healthcare. In fact, with this sector, incredible strides have been achieved with portable imaging devices and advanced medical sensors, but still, there is a perceived gulf between the therapeutic needs of the patients and what the market currently offers. Nanomedicine will bridge this gap by transporting drugs to appropriate target sites in the right proportions and required rates, customized according to complex conditions caused by diseases.

The oncology segment has wide-open opportunities for the nanomedicine market due to enhanced global incidences of cancer. The cases of cancer are bound to continue holding the oncology segment among those with the highest profit-making application segments during the forecast period ahead. In addition, the growth of this market is also due to enhanced awareness about nanotechnology, rapid surges in cases of chronic diseases, the enhancement of technology, and increased government investments in nanotechnology in various developing countries.

Because manufacturers need raw materials in huge amounts for the production of nanomedicines, those players hold favorable growth prospects. Although the global nanomedicine industry is still not very concentrated concerning suppliers of technology and nanomaterials, the small number of suppliers poses an expected supply gap that manufacturers solve by long-term contracts with pre-negotiated terms to get raw materials for a steady supply in domestic markets. High investment in becoming a significant player in the nanomedicine market, which is highly dependent on high-tech technology and research, has prevented new players from entering it. Despite this hindrance, the market is rapidly expanding as the development and research activities continue to rise globally.

Restraints

-

High Research and Development Costs

-

Market Entry Barriers

The niche nature of nanomedicine, coupled with significant initial investments and uncertainties regarding potential profits, deters many companies from entering the market, limiting competition and growth opportunities.

Nanomedicine Market - Key Segmentation

by Application

Drug delivery dominated the nanomedicine market in 2023, and the sector held a significant share of 34.09%. This was primarily attributed to the incessant increase in most chronic and infectious diseases, such as cancer and COVID-19, along with enhanced awareness of nanomedicine's potential applications. Also, rising research studies on the capabilities of nanomedicine in drug delivery further fortified this area. For example, in March 2023, a novel drug delivery system that will selectively deliver anticancer drugs to children with brain tumors was reported by scientists from Memorial Sloan Kettering Cancer Center and Mount Sinai Health System.

Therapeutics is expected to account for the highest growth rate during 2024-2032, with a CAGR of 12.79%. The driver behind this is the number of products designed for treating varied conditions. The Earnings for this category are based on drugs, devices, and delivery systems for drugs. Additionally, other factors that would drive the market over the forecast period include the advancements in technology which help to create nanotherapeutics that can cross biological barriers.

by Indication

The clinical oncology segment dominated 32.4% of the market share in 2023. The main reason for such dominance can be attributed to the growing incidence of cancer that has resulted in high numbers of products being currently developed in various clinical stages, along with advancements in therapeutic particles and devices. Clinical oncology comprises a broad category of active and passive targeting strategies in cancer: all these position it for further growth across the forecast period.

The segment of infectious disease is likely to witness a high compound annual growth rate of 12.3% by 2032. Growth in this segment is driven by rising demands for the development of fast, efficient, and cost-effective therapies against infectious diseases. Nanomedicine is considered to be a new hope for treatment as it provides target-directed precision with fewer side effects. Such is the case with nanomedicine, whose potential to successfully target a broad spectrum of infectious diseases will bring new avenues for growth in the nanomedicine industry.

by Molecule Type

The market share of nanoparticles dominated in 2023 at a remarkable 76.3%. This is mainly attributed to the various advantages different types of nanoparticles offer and the increased applications of metal and metallic oxide particles in PDT to treat infectious diseases and cancer. Many companies are engaged in innovation and development activities regarding new technologies using nanoparticles. For example, in January 2022, NaNotics LLC reported its partnership with the Mayo Clinic to study a subtractive nanoparticle known as NaNot, intended to selectively target the soluble form of the immune inhibitor PD-L1 produced by tumors.

On the other hand, the nanotubes segment is expected to experience a high compound annual growth rate of 10.9% between 2024 and 2032. This growth trend has been a result of increasing demand for products made from nanotubes in various medical applications. Nanotubes can perform so many things because they can couple with chemical moieties and act as scaffolds. For instance, carbon nanotubes can be added to tissue engineering scaffolds to enhance the properties of scaffolds and improve tissue regeneration. These new applications of nanotubes contribute to the growth in this sector of the nanomedicine business.

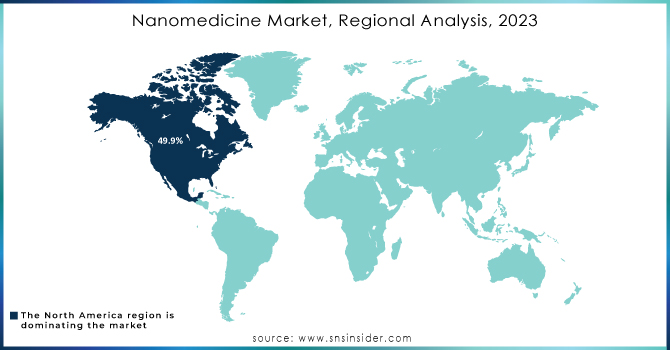

Nanomedicine Market Regional Analysis

In 2023, North America captured a dominating market share of 49.9%, which is also directed toward growth by increased collaboration between established companies and emerging nanomedicine start-ups. Moreover, strong government authority support along with growing R&D spending also supports the market in the region. North America also houses a high number of manufacturing companies that are involved in strategic collaborations in the nanomedicine domain. As an example, Advanced NanoTherapies in October 2020 raised seed-round funding worth USD 5.3 mn to accelerate the development of its nanoparticle-focused drug delivery platform aimed at the treatment of peripheral artery disease and other applications.

The Asia Pacific market has the highest CAGR of 14.0% from 2024 to 2032. Growth is driven by an increase in awareness of nanomedicine and public involvement in consensus conferences related to nanoscience and nanotechnology. For example, there is the International Conference on Nanoscience and Technology, China (ChinaNANO 2022) conducted in Beijing in August 2022. At this conference, there was a target of the presentation of scientific breakthroughs, significant progress in several industries, technologies, and new opportunities and challenges at the forum.

Need any customization research on Nanomedicine Market - Enquiry Now

Key Players Offering Diagnostics/Drugs

-

Mallinckrodt Pharmaceuticals

-

Arrowhead Pharmaceuticals, Inc.

-

CombiMatrix Corporation

-

Celgene Corporation

-

Nanospectra Biosciences, Inc.

-

GE Healthcare

-

Merck & Co., Inc.

-

Pfizer, Inc.

-

Sigma-Tau Pharmaceuticals, Inc.

-

UCB SA

-

Nanosphere, Inc.

-

Leadient BioSciences Inc.

-

Invitae Corporation

-

DiaSorin S.p.A., and others.

Research Institutes Working on Nanomedicines

-

National Institutes of Health (NIH)

-

Massachusetts Institute of Technology (MIT)

-

Johns Hopkins University

-

Stanford University

-

University of California, San Francisco (UCSF)

-

Harvard University

-

University of Pennsylvania

-

Memorial Sloan Kettering Cancer Center

-

Mount Sinai Health System

-

Institute of Nanotechnology

-

European Molecular Biology Laboratory (EMBL)

-

Scripps Research Institute

-

University of Illinois at Urbana-Champaign

-

National Institute of Standards and Technology (NIST)

-

Duke University

-

University of Cambridge, and others.

Recent Developments

In March 2023, Moderna partnered with Generation Bio to leverage its proprietary cell-targeted lipid nanoparticle delivery system for developing non-viral genetic therapies aimed at treating immune systems and liver-related conditions.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 223.6 Billion |

| Market Size by 2032 | USD 634.2 Billion |

| CAGR | CAGR of 12.2% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Therapeutics, in-vitro Diagnostics, Drug Delivery, In-vivo Imaging, Implants) • By Indication (Clinical Oncology, Infectious diseases, Clinical Cardiology, Orthopedics, Others) • By Molecule Type (Nanoparticles, Nanoshells, Nanotubes, Nanodevices) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Johnson & Johnson Services, Inc., Mallinckrodt Pharmaceuticals, Teva Pharmaceutical Industries Ltd., Arrowhead Pharmaceuticals, Inc., Abbott Laboratories, CombiMatrix Corporation, Celgene Corporation, Nanospectra Biosciences, Inc., GE Healthcare, Merck & Co., Inc., Pfizer, Inc., Sigma-Tau Pharmaceuticals, Inc., UCB SA, Nanosphere, Inc., Leadient BioSciences Inc., Invitae Corporation, DiaSorin S.p.A., and Others |

| Key Drivers | • Transforming Chronic Disease Management through Innovative Drug Delivery |

| Restraints | • High Research and Development Costs • Market Entry Barriers |