Cargo Shipping Market Report Scope & Overview:

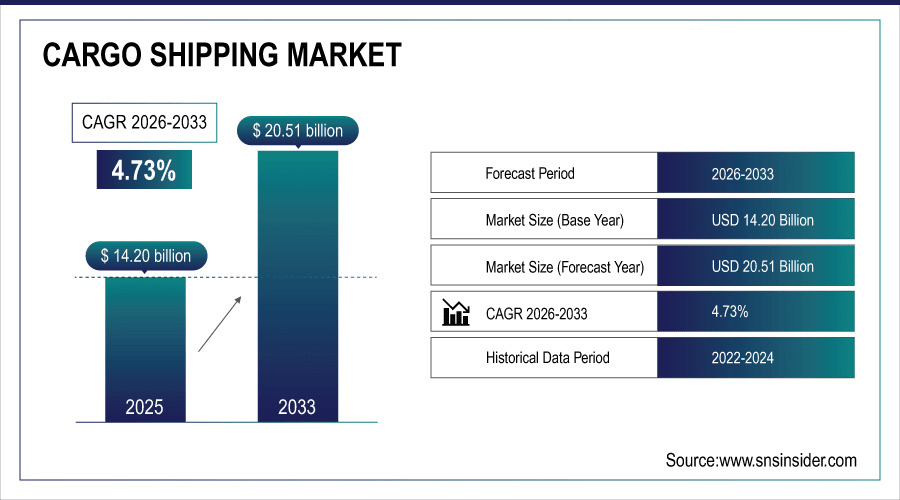

The Cargo Shipping Market Size was valued at USD 14.20 Billion in 2025E and is projected to reach USD 20.51 Billion by 2033, growing at a CAGR of 4.73% during the forecast period 2026–2033.

Cargo Shipping market analysis examines performance trends and growth across service types, including container shipping, bulk shipping, dry bulk, liquid bulk, and roll-on/roll-off. The market is divided by type of vessel, application in automotive, FMCG, chemicals, machinery & equipment, food & beverage and others, type of route channel and distribution channel including direct contracts, freight forwarder and internet inquiry. Increasing global trade, expanding e-commerce and industrial growth continue to generate on-going market demand.

Container shipping accounted for around 50% of the Cargo Shipping Market in 2025, driven by rising international trade and e-commerce shipments.

To Get More Information On Cargo Shipping Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 14.20 Billion

-

Market Size by 2033: USD 20.51 Billion

-

CAGR: 4.73% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Cargo Shipping Market Trends:

-

Global trade growth and growing e-commerce offerings lead to higher demand for container and bulk shipping services.

-

Industrialization and developments in heavy machinery production are driving demand for specialist vessels, such as tankers and roll-on/roll-off ships.

-

Tech trends like vessel tracking and automatic logistics are helping efficiency and reliability of all cargo operations.

-

Smaller companies and direct-to-consumer exporters are increasingly turning to freight forwarders and online platforms for shipping needs.

-

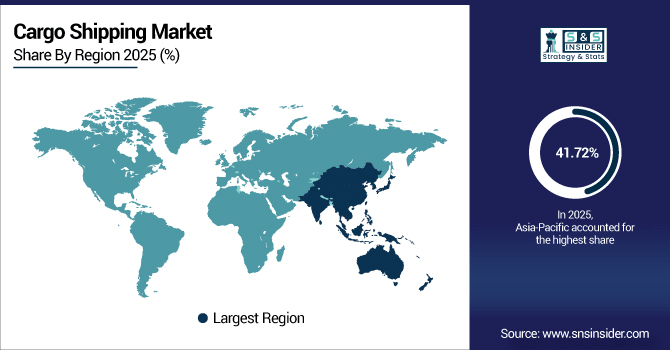

Asia-Pacific and Latin American developing regions are growing as the potential hubs of growth, which is attributed to infrastructure development, modernization of ports and increasing import export activities.

U.S. Cargo Shipping Market Insights:

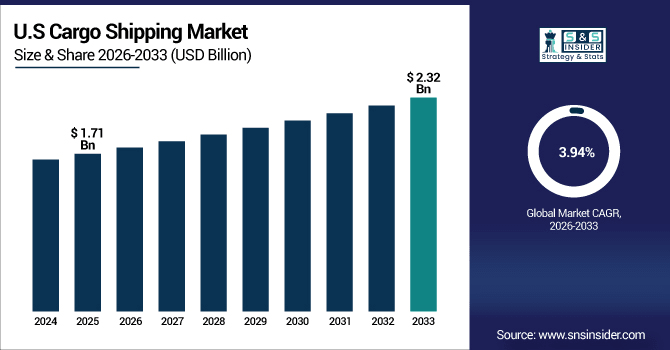

The U.S. Cargo Shipping Market is projected to grow from USD 1.71 billion in 2025E to USD 2.32 billion by 2033, at a CAGR of 3.94%. Growth is stimulated demand for industrial shipments, e-commerce growth and investment in port infrastructure, digital logistics solutions and freight forwarding services.

Cargo Shipping Market Growth Drivers:

-

Expansion of global trade and e-commerce is driving increased demand for efficient cargo shipping solutions worldwide.

The Cargo Shipping Market is growing due to expanding global trade and rapid e-commerce adoption across emerging and developed regions. Global freight volumes are projected to grow by 1.9 billion tons by 2025, supported by increased imports, exports and industrial shipments. Growing demand for container and bulk shipping, and technological advances in vessel tracking a logistics, along with improvements to port infrastructure are increasing the efficiency, dependability and capacity of intercontinental maritime transportation.

Expansion of global trade and e-commerce drove nearly 48% of global cargo shipping demand in 2025, led by container and bulk shipping services.

Cargo Shipping Market Restraints:

-

Volatile fuel costs and port congestion are limiting cargo shipping efficiency and constraining global market growth.

Instability in fuel cost which impact nearly 30% of operational costs m is a serious challenge for the Cargo Shipping Market. The congestion of ports, and the delays at other major trade centres such as Asia-Pacific and Europe, also degrade shipping economics. Smaller regional carriers are operating under restrictions, and the move to greener shipping fuel and more stringent environmental rules is driving up compliance costs. Furthermore, international supply chain disruptions and soaring insurance premiums on ships curb market growth and profitability in general.

Cargo Shipping Market Opportunities:

-

Integration of smart shipping technologies and digital logistics platforms presents significant growth opportunities in global cargo shipping.

Trend The potential for the Cargo Shipping Market is clearer there with opportunities in smart shipping technologies and online logistics. More than 30% of all new third-party projects will include elements of real-time tracking, automation, and artificial intelligence-driven route optimization to drive efficiency and savings by 2025. Growing e-commerce, cross-border trade and industrial sharing is driving demand, while digital platforms and smart vessel management are expected to drive market revenues through 2033.

Introduction of smart shipping technologies and digital logistics solutions accounted for nearly 32% of global cargo shipping upgrades and implementations in 2025.

Cargo Shipping Market Segmentation Analysis:

-

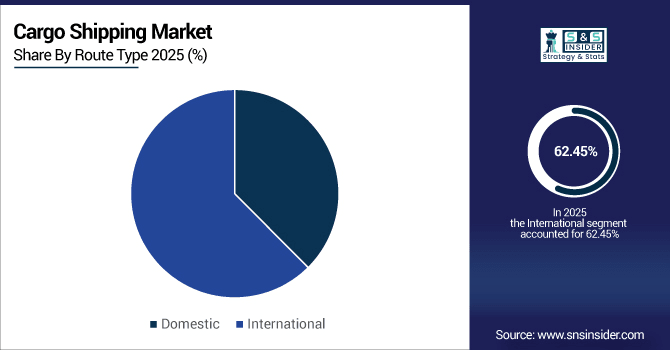

By Route Type, International held the largest share of 62.45% in 2025, while Domestic is expected to grow at the fastest CAGR of 5.22%.

-

By Service Type, Container Shipping held the largest market share of 48.75% in 2025, while Roll-on/Roll-off is expected to grow at the fastest CAGR of 5.67%.

-

By Vessel Type, Container Ships dominated with a 51.22% share in 2025, while Refrigerated Ships are projected to expand at the fastest CAGR of 6.01%.

-

By Application, Automotive accounted for the highest market share of 35.88% in 2025, and Food & Beverages is projected to record the fastest CAGR of 5.88%.

-

By Distribution Channel, Direct Contracts held the largest share of 46.39% in 2025, while Online Platforms are expected to grow at the fastest CAGR of 6.05%.

By Route Type, International Dominates While Domestic Expands Rapidly:

International shipping dominated in 2025 with around 900 million tons transported, driven by rising global trade and cross-border industrial shipments. It dominates because of large-scale industrial exports, global trade agreements, and well-established port networks. Domestic shipping handled 540 million tons and is fast-growing due to regional supply chains, e-commerce deliveries, and intra-country industrial distribution. Growth is fueled by infrastructure investments in inland waterways, updated national ports, and faster freight rail connections in Asia-Pacific, North America, and Europe.

By Service Type, Container Shipping Leads While Roll-on/Roll-off Expands Rapidly:

Container shipping dominated the market in 2025 with 680 million tons of cargo transported globally, driven by international trade and e-commerce. It leads due to standardized high-volume handling, efficiency, and widespread global adoption for various goods. Roll-on/Roll-off services shifted around 175 million tons and are fast-growing because of the surge in automotive and heavy equipment cargoes. Growth is fueled by increasing vehicle exports, rising cross-border trade, and port infrastructure investments in Asia-Pacific and Europe.

By Vessel Type, Container Ships Dominate While Refrigerated Ships Grow Fastest:

Container ships dominated cargo transport in 2025, handling roughly 710 million tons of goods, supported by standardization and high-volume efficiency. They dominate because of cost-effectiveness, global infrastructure compatibility, and flexibility for multiple cargo types. Refrigerated ships carried nearly 160 million tons, expanding rapidly due to rising demand for perishable food, pharmaceuticals, and temperature-sensitive goods. Growth is driven by technological advancements in cold-chain logistics, e-commerce distribution, and increasing international food trade, especially in North America, Europe, and Asia-Pacific.

By Application, Automotive Leads While Food & Beverages Records Fastest Growth:

Automotive shipments dominated cargo volumes in 2025 at 520 million tons, propelled by global vehicle exports and industrial supply chains. It leads due to consistent high-volume demand and established trade networks. Food & beverages cargo reached 210 million tons and is the fastest-growing commodity, supported by international food trade and e-commerce grocery deliveries. Rapid growth is underpinned by cold-chain improvements, rising consumer demand in emerging markets, and cross-border trade deals, particularly in Asia-Pacific and Europe.

By Distribution Channel, Direct Contracts Lead While Online Platforms Grow Fastest:

Direct contract agreements dominated cargo shipping in 2025, covering roughly 640 million tons, largely from long-term commercial deals with manufacturers, importers, and exporters. They dominate due to predictable volumes, stable revenues, and established business relationships. Online shipping platforms handled nearly 240 million tons and are fast-growing as they provide SMEs and e-commerce sellers access to digital freight booking and tracking. Growth is driven by technology adoption, rising cross-border e-commerce, and demand for flexible, transparent, and cost-effective shipping solutions globally.

Cargo Shipping Market Regional Analysis:

Asia-Pacific Cargo Shipping Market Insights:

The Asia-Pacific Cargo Shipping Market accounted for 41.72% of global cargo volumes in 2025, transporting 585 million tons, led by China (210 million tons) and India (135 million tons). Container and bulk shipping led the volume dry but refrigerated and roll-on/roll-off services also had strong gains. A surge in industrialization, growth of e-commerce shipments and extensive development of port infrastructure in megacities in the region are accelerating market growth, pushing Asia-Pacific further ahead as the biggest cargo hub at regional level.

Get Customized Report as Per Your Business Requirement - Enquiry Now

China Cargo Shipping Market Insights:

China moved 210 million tons of freight in 2025, with container and bulk shipping leading the way. Direct contracts carried about 140 million tons, with balance transported by freight forwarders and online platforms. Growth is fueled by increases in industrial output and growing e-commerce, as well as the modernization of ports and logistics infrastructure throughout the country.

North America Cargo Shipping Market Insights:

The North America Cargo Shipping Market carried around 260 million tons of cargo in the year 2025, with container and bulk shipment holding the maximum share. The growth is being driven by increased industrial output, growing e-commerce deliveries and upgrades to infrastructure in the US, Canada. The rising reliance on digital logistics platforms, direct contracts and niche shipping services like refrigerated and roll-on/roll-off vessels are improving efficiency, further the cross-border trade is underpinning market growth.

U.S. Cargo Shipping Market Insights:

The U.S. moved 120 million tons of goods around the world by container, bulk and specialized shipping services in 2025. Some 75 million tons went through direct contracts, with the rest of the 120-plus million tons passing through freight forwarders and online platforms. The growth is fueled by increasing industrial output, e-commerce shipments and investment in port modernization.

Europe Cargo Shipping Market Insights:

In 2025, the European Cargo Shipping Market moved 220 million tons of cargo with Germany leading (65 million), followed by the UK (55 million) and France (48 million). Direct contracts accounted for about 130 million tons, and the remainder was shipped through freight forwarders and other online platforms. The growth is supported by increasing industrial production, e-commerce deliveries, port modernization and utilization of specialized container & bulk shipping services across the region.

Germany Cargo Shipping Market Insights:

In 2025 Germany generated 65 million tons of cargo, with about 40 million tons provided via direct contracts and another 25 million tons via freight forwarders/online platforms. Growth is driven by climbing industrial shipments, automotive exports and the use of dedicated container, bulk and reefer shipping services across the nation.

Latin America Cargo Shipping Market Insights:

The Latin America Cargo Shipping Market is expected to grow at a CAGR of 6.06% during 2026–2033, transporting 210 million tons of cargo in 2025. Roughly 125 million tons were transported under direct contracts, while the freight forwarders and online platforms handled 85 million tons. Industrial shipments, cross-border trade and port infrastructure are fueling growth.

Middle East and Africa Cargo Shipping Market Insights:

The Middle East & Africa Cargo Shipping Market generated 95 million tons of cargo volume in the year 2025, with 55 million tons being transported on direct contracts and 40 million via freight forwarders or online marketplaces. Growth is supported by increasing industrial shipments, growth of trading corridors and investment in port infrastructure and logistics improvement.

Cargo Shipping Market Competitive Landscape:

The company has some 850 vessels and, as of 2025, the company’s ships have a combined capacity of 6.47 million TEU which establishes it as the largest container shipping line in the world today. It boosts this by strategic acquisitions, fleet modernisation and ultra large container vessels like the MSC Irina-class. Covering 155 countries, MSC commands the world’s shipping through extensive routes, cargo volumes and investments in digital logistics and operational productivity.

-

In February 2025, MSC introduces iReefer, a sophisticated temp-controlled cargo monitoring system for containers. It gives you live feedback about location, temperature and humidity to maintain perishable goods in an optimal condition.

Maersk runs a fleet of 707 ships with total capacity of 4.5 million TEU. It leads with its logistics and supply chain solutions. In 2025, it also invested in 60 new LNG-powered ships to lessen its environmental impact. Maersk is leading the way with a global presence in key trade lanes, sustainability initiatives and a fleet expansion strategy, while diversification into logistics aids stability against shipping market turbulences.

-

In June 2025, Maersk launched the Maersk Trade & Tariff Studio, a digital platform that taps AI to handle tariffs and customs compliance. It provides live updates and predictive analytics for efficient worldwide supply chain options.

CMA CGM operates 593 vessels totaling 4.5 million TEU in capacity, dominating global container shipping. The company is also looking to broaden its logistics business beyond shipping by buying such companies as Freightliner UK. CMA CGM’s plan is based around rail and ports synergies, digitalising operations and improving sustainability. This will enable the company to retain its leading positions in volumes transported, comprehensively cover shipping needs and reinforce its presence on key global trade routes.

-

In September 2025, CMA CGM purchased Freightliner UK to enhance logistics services by rail. The merger brings together shipping, rail and trucking services for complete end-to-end transportation options.

Cargo Shipping Market Key Players:

Some of the Cargo Shipping Market Companies are:

-

Mediterranean Shipping Company (MSC)

-

A.P. Moller – Maersk

-

CMA CGM Group

-

COSCO Shipping Lines

-

Hapag-Lloyd AG

-

Ocean Network Express (ONE)

-

Evergreen Marine Corporation

-

Hyundai Merchant Marine (HMM)

-

ZIM Integrated Shipping Services

-

Yang Ming Marine Transport Corporation

-

Wan Hai Lines

-

Pacific International Lines (PIL)

-

Shandong International Transportation Corporation (SITC)

-

X-Press Feeders

-

Regional Container Lines (RCL)

-

Korea Marine Transport Corporation (KMTC)

-

Sea Lead Shipping

-

Unifeeder

-

IRISL Group

-

Sinokor Merchant Marine

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 14.20 Billion |

| Market Size by 2033 | USD 20.51 Billion |

| CAGR | CAGR of 4.73% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service Type (Container Shipping, Bulk Shipping, Dry Bulk, Liquid Bulk, Roll-on/Roll-off, Others) • By Vessel Type (Container Ships, Tankers, Bulk Carriers, General Cargo Ships, Refrigerated Ships, Others) • By Application (Automotive, FMCG, Chemicals, Machinery & Equipment, Food & Beverages, Others) • By Route Type (Domestic, International) • By Distribution Channel (Direct Contracts, Freight Forwarders, Online Platforms) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Mediterranean Shipping Company (MSC), A.P. Moller – Maersk, CMA CGM Group, COSCO Shipping Lines, Hapag-Lloyd AG, Ocean Network Express (ONE), Evergreen Marine Corporation, Hyundai Merchant Marine (HMM), ZIM Integrated Shipping Services, Yang Ming Marine Transport Corporation, Wan Hai Lines, Pacific International Lines (PIL), Shandong International Transportation Corporation (SITC), X-Press Feeders, Regional Container Lines (RCL), Korea Marine Transport Corporation (KMTC), Sea Lead Shipping, Unifeeder, IRISL Group, Sinokor Merchant Marine |