Automotive Engineering Services Market Key Insights:

To Get More Information on Automotive Engineering Services Market - Request Sample Report

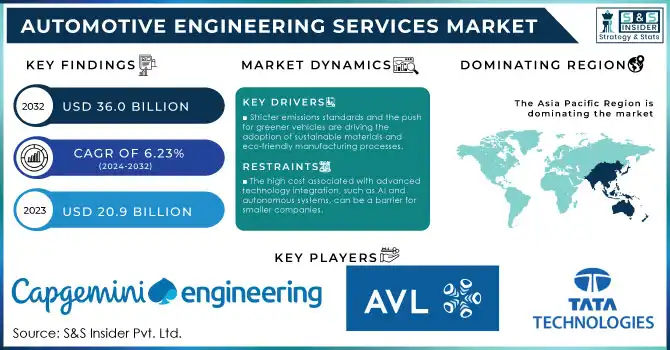

The Automotive Engineering Services Market size was valued at USD 20.9 billion in 2023 and is expected to reach USD 36.0 Billion by 2032, with a growing CAGR of 6.23% from 2024-2032.

The automotive engineering services market has been growing with robust speed and is catalyzed by the demand for innovative, and sustainable automotive solutions over the years. The main factors driving it are electric vehicle (EV) emergence, autonomous driving tech and connected car systems, which are increasingly making their way into our lives. In this respect, the EV market is driving demand for engineering services such as battery development, lightweight materials and energy-efficient systems. With a growing number of companies investing heavily in EV platforms, flush with advancements that involve state-of-the-art technology—like AI, machine learning, and 5G connectivity—that engineering demand increases exponentially. More than 14 million EVs were sold across the globe in 2023, indicative of the fast-paced growth of electric mobility and engineering services enabling the effective design and manufacturing of such vehicles.

Apart from electrification, the automotive engineering services market will be propelled by surging demand for autonomous vehicles. Corporations have directed their attention towards improved vehicle performance and safety via innovative driver-assistance systems (ADAS). The shift towards emission reduction and compliance with stringent environmental legislations is driving the innovation into lightweight materials and sustainable product processes, which are likely to present new opportunities for growth in areas like material science, crash safety testing and emission control.

Therefore, the combination of vehicle connectivity, smart manufacturing, and digital engineering tools like simulation, prototyping, and virtual testing is essential. All these developments facilitate designing, engineering, manufacturing, and testing of the vehicle, empowering companies to deliver on changing consumer demands. In addition, the shift toward further digitization in the automotive sector, along with regulatory mandates to produce cleaner, safer and more efficient vehicles, continues to drive demand for engineering services.

Coupled with investments by companies in smart manufacturing and next-gen technologies, this will keep the automotive engineering services market on a positive growth trajectory. Consequently, the market will remain robust, as other opportunities will emerge in developing technologies, such as 5G integration of cars, smart infrastructure, and next-generation autonomous driving systems.

Market Dynamics

Drivers

-

Stricter emissions standards and the push for greener vehicles are driving the adoption of sustainable materials and eco-friendly manufacturing processes.

-

The rise of connected vehicles is boosting demand for digital engineering services, such as simulation, prototyping, and software integration.

-

The rise of connected vehicles is boosting demand for digital engineering services, such as simulation, prototyping, and software integration.

Digital Engineering services, among others, are witnessing a rapid surge in demand in the automotive engineering sector owing to advances in technologies such as 5G, IoT, and AI finding their way into vehicles. When vehicles become more connected than ever, ensuring that functionality, safety, and communication across software stacks is seamless requires engineering specialization. The connected vehicle trend has increased the demand for services like simulation, prototyping, and software integration to optimize the development of connected vehicles. Simulation technologies are also an important part of development, allowing manufacturers to test and develop how individual functions should work without having to run physical prototypes, which helps avoid expensive production mistakes.

The process is also supported through prototyping which can create prototypes of vehicle physical components for more accurate validation, prove beneficial in refining designs, reduce costs and accelerate time to market for new models. Given the growing complexity of in-vehicle systems, in particular due to the nature of some autonomous driving features and over-the-air software updates, software integration is also important to ensure that systems are able to work together seamlessly. Also, with the amount of data generated by connected vehicles on the rise as well, this increased need for cybersecurity and data analytics will further increase demand for engineers to help manage and protect that data as well. Automatic vehicle engineering services market is growing rapidly to connected vehicle is plays an important factor for the growth of the market. Digital engineering services can be vital for designing and optimizing these complex systems to enable connected, autonomous, and data-driven vehicles to be developed more effectively and safely.

Restraints

-

The high cost associated with advanced technology integration, such as AI and autonomous systems, can be a barrier for smaller companies.

-

There is a growing need for engineers with expertise in advanced technologies, but the shortage of skilled professionals limits the market's potential.

-

There is a growing need for engineers with expertise in advanced technologies, but the shortage of skilled professionals limits the market's potential.

A major challenge for this market is the lack of skilled personnel, particularly those skilled in advanced technologies like artificial intelligence (AI) and machine learning (ML), and autonomous systems. About EV requirements as the automotive industry transforms to support electric vehicles (EVs), connected cars, and autonomous driving technologies, the need for engineers with specialized skills has skyrocketed. Even so, industry transformation has outpaced the growth of talent pools and talent — which, if unaddressed, risks stalling the sector’s growth potential.

There is an acute shortage in the domain of things such as autonomous vehicle systems, battery development for EVs, and software integration, all of which require engineers with specialized skill sets and knowledge that sits across various disciplines. As indicated in the latest industry reports, engineers working in software development, data analytics, and cybersecurity and system integration are increasingly in demand. But there just aren't enough people with the right skills to meet the needs of increasingly ambitious automotive companies that are scrambling to innovate and get new technologies ready for sale.

The OEMs will then have a multi-layered R&D division, unlocking billions worth of value but creating a risk where the shortage of engineers can create a bottleneck in product development. This is particularly impacting engineering service providers where the lack of attraction and retention of talent, can lead to delays, cost escalations and inefficiencies. In addition, as the complexity of vehicle systems grows, the automotive engineering services market needs people with advanced software and data science skills, as well as integration capabilities with AI.

This, in turn, has led to many companies either training and upskilling existing engineers or working with educational institutions to address the skills gap. Nevertheless, this gap will continue to be a major impediment to the automotive engineering services market, as shortage of qualified workforce will provide near-term restraints to the growth of automotive engineering services market.

Key Segment Analysis

By Type

The mechanical segment dominated the automotive engineering services market and represented significant revenue share in 2023. The automotive industry is increasingly competitive and requires prototyping in mechanical manufacturing so as to achieve accurate manufacturing results and turnaround times that save on costs in the end. The mechanical segment has been continually growing as an increasing propensity of customers to avail of convenience will lead OEMs to continue to focus on innovation by investing in the methods of production.

The software segment is growing rapidly at the highest CAGR in the market. The bulk of this demand is attributed to the increasing common usage of software applications in vehicles. The changing landscape of the automotive industry, specifically, the rise of connected car services, has also greatly increased the need for a software engineering workforce. Moreover, the embedded systems segment has seen massive growth as modern vehicles demand more features, which leads to increased complexity and connectivity.

By Location

In 2023, the in-house segment accounted for the largest share of automotive engineering service provider overall market, as most of the complex automotive engineering services such as powertrain design and engine and transmission systems are preferred to be like to be developed inside the hub of major Original Equipment Manufacturer (OEMs), as these designs and optimizations are log-in-dependent and require various methods and specialization that can be carried out within the hub for optimum results. It can also maintain the secrecy of design specifications. This also includes data security for technological advancements and automotive designs, which also makes market dominance.

Due to increasing focus from the leading companies to outsource its designs and commercial projects to reduce the overall costing, the outsource segment is expected to grow at the highest growth rate. Moreover a company with minimum capital investment will tend to opt for outsourcing with the immediate delivery of solution and products without such high capital investment.

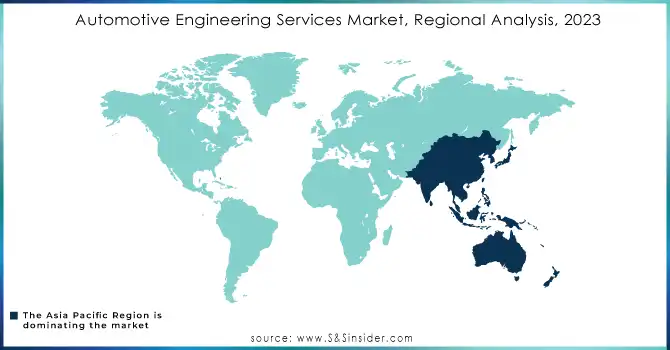

Regional Analysis

Asia Pacific hold the largest and fastest growing global automotive engineering services market share in 2023 and throughout the forecast period. Some leading automotive OEMs find availability of labor in the Asian region (India & China) and outsource production and other operations there. Thus, automotive ESO service providers are channelling their focus. India provides a cost advantage of 15-26%. India has opened up a highly competitive market to global OEMs, serving a plethora of global segments. Stringent emission regulations globally have seen Auto OEMs like Kia, BYD, MG entering the Indian market. Initiatives like FAME, Make in India, and NATRIP provide further impetus to manufacturing plants, infrastructure projects, and acceptance of EVs in the region. The manufacturing is also encouraged through the number incentives and subsidies given by Central and State governments. Asia pacific market is expected to have a steady CAGR growth and is expected to dominate the market share led by China, Japan, India, and South Korea.

Europe is expected to become the second fastest-growing region during the forecast period. However, the automotive comfort market may experience slower growth due to the high costs associated with driver comfort features and the increasing demand for autonomous vehicles. On the other hand, North America and the Rest of the World (RoW), including the Middle East, are expected to see growth driven by the rise in new electric vehicle (EV) sales in these regions.

Do You Need any Customization Research on Automotive Engineering Services Market - Inquire Now

Key Players

The major key players are

-

Tata Technologies – ProConnect Automotive Suite

-

AVL List GmbH – AVL Powertrain Engineering Solutions

-

Capgemini Engineering – Autonomous Driving Solutions

-

Altran (Capgemini) – ADAS and Electric Vehicle Development Solutions

-

Continental AG – ContiSense Tire Pressure Monitoring System

-

Magna International – Magna e-Drive Systems

-

BASF – BASF Lightweight Materials

-

Ficosa International – Ficosa Rear-View Camera System

-

Bentley Systems – OpenRoads for Vehicle Infrastructure Design

-

Roush Enterprises – Roush Mustang Performance Packages

-

Ricardo plc – Ricardo E4C Electric Powertrain

-

Daimler AG – Mercedes-Benz EQ Electric Vehicles

-

Harman International (Samsung Electronics) – Harman Kardon Automotive Audio Systems

-

Bosch Engineering GmbH – Bosch Vehicle Control Systems

-

Hella GmbH & Co. KGaA – Hella Adaptive Headlights

-

ZF Friedrichshafen AG – ZF Electric Drive Axle

-

Honda R&D Co. Ltd. – Honda e Electric Car

-

Mitsubishi Electric – Mitsubishi Electric Automotive Controllers

-

Siemens Digital Industries Software – Simcenter 3D for Automotive Design

-

EDAG Engineering GmbH – EDAG CityBot Electric Vehicle Concept

Recent Developments

-

March 2024 - Bosch showcased new safety and driver assistance systems, leveraging artificial intelligence (AI) and machine learning for enhanced vehicle autonomy

-

February 2024 - Magna introduced advancements in electric vehicle (EV) powertrain systems, focusing on efficiency improvements and integration with autonomous driving technologies.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 20.9 Billion |

| Market Size by 2032 | USD 36.0 Billion |

| CAGR | CAGR of 6.23% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Body Engineering, Chassis Engineering, Powertrain Engineering, Safety Systems, Infotainment Systems, Others) • By Type (Mechanical, Embedded, Software • By Location (In-house, Outsource) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Tata Technologies, AVL List GmbH, Capgemini Engineering, Altran (Capgemini), Continental AG, Magna International, BASF, Ficosa International, Bentley Systems, Roush Enterprises, Ricardo plc, Daimler AG, Harman International (Samsung Electronics) |

| Key Drivers | • Stricter emissions standards and the push for greener vehicles are driving the adoption of sustainable materials and eco-friendly manufacturing processes. • The rise of connected vehicles is boosting demand for digital engineering services, such as simulation, prototyping, and software integration. |

| Restraints | • The high cost associated with advanced technology integration, such as AI and autonomous systems, can be a barrier for smaller companies. • There is a growing need for engineers with expertise in advanced technologies, but the shortage of skilled professionals limits the market's potential. |