Off-highway Electric Vehicle Market Size & Overview:

Get More Information on Luxury Yacht Market - Request Sample Report

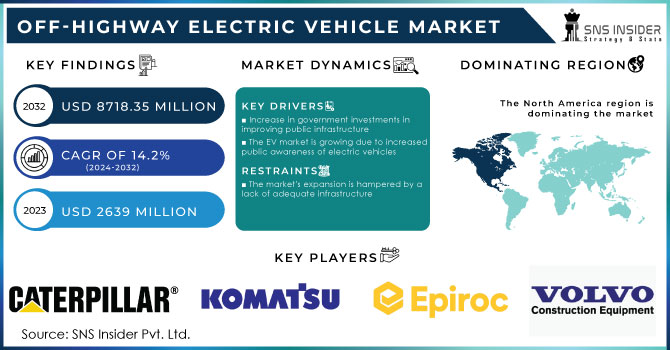

The Off-highway Electric Vehicle Market Size was valued at USD 2639 million in 2023 and is expected to reach USD 8718.35 million by 2032 and grow at a CAGR of 14.2% over the forecast period 2024-2032.

Electric cars designed for off-road operations are known as off-highway electric vehicles (OHEVs). Agriculture tractors, mining trucks, lawnmowers, and construction equipment used in off-highway applications with electric power are examples of off-highway electric vehicles. This includes expanded use in agricultural, construction, and infrastructure projects, among other things. Because of the rising demand for such vehicles, electric vehicle (EV) manufacturers have been able to raise the production of off-highway vehicles, contributing to the global market's growth. Due to the rising demand for electric cars around the world, the worldwide off-highway electric vehicles market is expected to develop over the forecast period.

Tiny construction vehicles are the only vehicles that are fully electrified. To conduct heavy-duty mining tasks, mining dump trucks must have a large power output and battery capacity. Because current battery technologies are unable to produce the requisite power output, major mining dump trucks are forced to use the hybrid-electric drive. Off-highway heavy-duty vehicle electrification is on the rise, and OEMs are eager to learn how this new trend may complement their existing business models. The trend toward electrification of automobiles is likely to gain traction in the future years, thanks to variables favoring electric vehicles.

MARKET DYNAMICS:

KEY DRIVERS:

-

Increase in government investments in improving public infrastructure

-

The off-highway electric vehicle industry is growing due to lower upgrade costs and increased efficiency

-

The EV market is growing due to increased public awareness of electric vehicles

-

Growing demand for low-noise, emission-free construction equipment

RESTRAINTS:

-

The market's expansion is hampered by a lack of adequate infrastructure

-

The adoption of electric off-highway vehicles is the loss of productivity owing to long charging times

OPPORTUNITIES:

-

New continual innovations in the industrial sector provide a broader potential

-

Hybrid vehicles' fuel economy improves, encouraging the market's growth

-

Long-range and fast-charging battery technology development

CHALLENGES:

-

Electric off-highway vehicles are costly due to the high cost of the electric battery, which poses a significant market hurdle

-

Compatibility, interchangeability, and standards concerns

IMPACT OF COVID-19:

Due to the COVID-19 pandemic, the worldwide off-highway industry will have a –3.3% decline in 2020. The COVID-19 epidemic has had a considerable impact on the heavy equipment business, with some manufacturers closing down plants and others considering leveraging their resources to meet the need for medical supplies. Lockdowns are being established around the world to stop the spread of the disease, which has had a huge impact on building and mining projects. When the market reopens, key market actors are aware that output levels will be reduced to conform to safety precautions. Furthermore, clients whose businesses are harmed by the pandemic will spend less.

Market, By Type:

The global market is divided into BEV, HEV, and PHEV based on the type segment. In 2023, the Hybrid Electric Vehicle (HEV) segment had the biggest market share of 62%, and it is expected to continue dominating the market from 2022 through 2030. The hybrid electric vehicle is intended to supplement the use of internal combustion engines by combining them with an electric drivetrain.

Market, By Application:

According to the application segment, the global market is divided into construction, mining, and agriculture. In 2023, the construction segment had the highest revenue share of roughly 42%. Electric construction equipment, such as electric loaders and excavators, are included in this sector. The agriculture category is expected to grow at a 35% compound annual growth rate.

Market, by Power Output:

Based on the power output segment, the global market has been divided into <50 hp, 50-150 hp, 150-300 hp, and >300 hp. Motors of less than 50 horsepower are commonly used in small electric off-highway vehicles. As a result, the market for 50 hp is expected to be the largest market category globally in terms of power output.

MARKET SEGMENTATION:

By Type:

-

BEV

-

HEV

-

PHEV

By Application:

-

Construction

-

Mining

-

Agriculture

By Power Output:

-

<50 hp

-

50-150 hp

-

150-300 hp

-

>300 hp

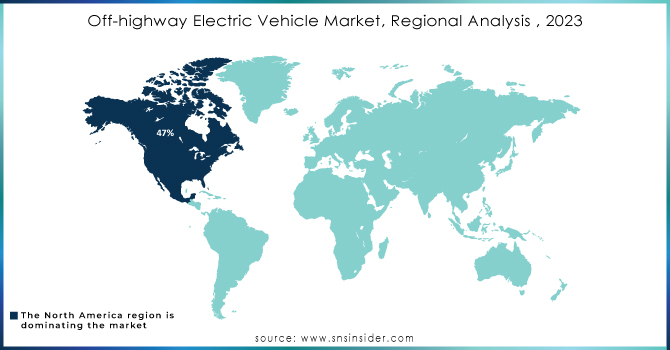

REGIONAL ANALYSIS:

In 2023, the North American market accounted for 47% of total revenue, and it is expected to continue dominating the industry from 2024 through 2031. Furthermore, the region's growing construction industry is driving up demand for off-highway electric equipment. The Asia Pacific market is expected to grow at the fastest rate, with a CAGR of 46.6%. Due to an increase in infrastructure spending, countries like India and China performed well in 2022. Due to the presence of several OEMs, cheap labor costs, low production costs, and the availability of improved manufacturing facilities in the country, China is a key contributor to the manufacturing of construction equipment.

Get Customized Report as per your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

-

North America

-

The USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

The UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

KEYPLAYERS:

Caterpillar (US), J C Bamford Excavators Ltd., Epiroc (Sweden), Komatsu Ltd. (Japan), Volvo Construction Equipment (Volvo CE) (Sweden), CNH Industrial N.V., Doosan Corporation, Hitachi Construction Machinery (Japan), Deere & Company, and Sandvik (Sweden). are some of the affluent competitors with significant market share in the Off-highway Electric Vehicle Market

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 2639 Million |

| Market Size by 2032 | US$ 8718.35 Million |

| CAGR | CAGR of 23% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Type (BEV, HEV, PHEV) • by Application (Construction, Mining, Agriculture) • by Power Output (<50>300 hp) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Caterpillar (US), J C Bamford Excavators Ltd., Epiroc (Sweden), Komatsu Ltd. (Japan), Volvo Construction Equipment (Volvo CE) (Sweden), CNH Industrial N.V., Doosan Corporation, Hitachi Construction Machinery (Japan), Deere & Company, and Sandvik (Sweden) |

| Key Drivers | Increase in government investments in improving public infrastructure. The off-highway electric vehicle industry is growing due to lower upgrade costs and increased efficiency. |

| RESTRAINTS | The market's expansion is hampered by a lack of adequate infrastructure. The adoption of electric off-highway vehicles is the loss of productivity owing to long charging times. |