Cassava Bags Market Cassava Bags Market Report Scope & Overview:

Get More Information on Cassava Bags Market - Request Sample Report

The Cassava Bags Market Size was valued at USD 67 million in 2023 and is projected to reach USD 130.62 million by 2032 and grow at a CAGR of 7.7% over the forecast periods 2024 -2032.

The cassava bag market is projected for significant growth driven by several factors. Rising environmental awareness, particularly concerning plastic pollution in the food and beverage industry due to online delivery, is fueling demand for biodegradable alternatives.

Cassava bags' biodegradability, safety for marine life, and lower carbon footprint compared to traditional plastics are key selling points. Additionally, government regulations aimed at reducing plastic use are creating opportunities.

The food and beverage industry is a key area for cassava bags, driven by the surge in online food delivery and the resulting mountain of plastic takeout containers and bags. A Zomato report highlights this trend, projecting Indian food delivery platforms to reach a staggering 80 million monthly active users , with ambitions to double that number in the coming years. This explosive growth in online food delivery is expected to significantly benefit the cassava bag market. However, the market faces challenges such as complex manufacturing processes requiring expensive equipment, potential methane production in landfills, and the need for specific weather conditions for proper decomposition. L'Oreal's partnership with EcoNest PH for sustainable packaging highlights the potential of cassava bags in the cosmetics industry as well. Overall, the market presents promising opportunities for growth due to its eco-friendly nature and increasing consumer preference for sustainable solutions.

MARKET DYNAMICS

KEY DRIVERS:

-

Increased public concern about the environment is leading to a shift towards more sustainable practices.

Fueled by growing concerns about plastic pollution's harm to our environment and health, consumers are increasingly seeking eco-friendly alternatives like cassava bags. This shift towards sustainability reflects a rising public consciousness about the impact of packaging choices.

-

Consumers, driven by a growing desire for a healthier planet, are increasingly making conscious choices

RESTRAINTS:

-

Public awareness about cassava bags remains low.

-

Switching to cassava bags is initially costlier due to R&D and supply chain adjustments.

Several factors contribute to the higher initial cost of switching to cassava bags. These include ongoing research and development (R&D) to optimize production processes and material science. Additionally, establishing a new supply chain for cassava-based materials requires infrastructure investment and navigating new logistics compared to established plastic production.

OPPORTUNITY:

-

Cassava bags are improving in affordability, versatility, and availability thanks to ongoing R&D in materials, processing, and design.

-

E-commerce, consumer trends, and sustainability are reshaping retail.

The retail industry's growing focus on sustainability is driving a shift towards eco-friendly packaging like cassava bags. This trend pushes manufacturers and suppliers to adapt and offer greener options to meet retailers' evolving needs.

CHALLENGES:

-

Cassava bag production faces challenges due to limited cassava crop availability and a lack of processing infrastructure.

-

Cassava bag production involves a more intricate process compared to the simpler methods used for regular plastics.

Regular plastic manufacturing typically relies on a well-established, high-volume production line, whereas cassava bags often involve additional steps such as sourcing the cassava starch, purifying it, and combining it with other bio-based materials. This can make cassava bag production less scalable at present.

IMPACT OF RUSSIA UKRAINE WAR

The war has caused significant increases in energy and fertilizer prices. Cassava cultivation likely wouldn't be exempt from these cost hikes. This could lead to increased cassava bag production costs, making them potentially less competitive compared to other packaging options. With concerns about global food security and potentially higher import costs, some countries, particularly those dependent on wheat imports like Nigeria, might prioritize boosting domestic production of alternative food sources like cassava. This could lead to increased demand for cassava, potentially benefiting the cassava bag market as a byproduct.

IMPACT OF ECONOMIC SLOWDOWN

During an economic slowdown or recession, rising food prices can disproportionately affect the cassava bag market, particularly in developing economies like those in Africa. As food becomes more expensive, especially staples like cassava, people in poverty may prioritize buying the food itself over pricier packaging options like cassava bags. This could lead to a decrease in demand for these bags, particularly for non-essential uses like shopping bags for discretionary purchases. The price competitiveness of cassava bags compared to traditional plastics will be a significant factor influencing consumer behavior. However, in the long term, the focus on food security could lead to increased cassava production, potentially benefiting the cassava bag market as a byproduct. Additionally, if cassava remains a staple food source during a recession, the market could see a rebound in demand once economic conditions improve.

KEY MARKET SEGMENTS

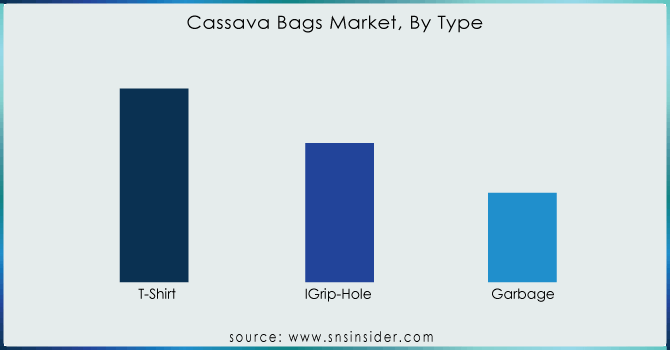

By Type

-

Grip-Hole

-

T-Shirt

-

Garbage

T-shirt bags dominates in the cassava bag market, capturing a around 57% of market revenue. This dominance reflects the preference of eco-conscious consumers and companies seeking to promote sustainability. For these companies, choosing cassava-based materials for T-shirt bags, boosting their brand image while aligning with evolving consumer preferences.

Need any customization research on Cassava Bags Market - Enquiry Now

By Category

-

Organic

-

Conventional

The organic segment leads the cassava bag market at 60% share, appealing to both eco-conscious brands and health-focused consumers. Brands promoting sustainability can leverage this segment's focus on responsible sourcing and minimal chemical use, potentially driving further growth across various markets.

By End User

-

Food & Beverages

-

Animal Feed

Food and beverages dominating with 61% market share in cassava bag usage. These bags are popular for packaging fresh produce, snacks, and ready-to-eat meals due to their excellent moisture resistance, which helps maintain food freshness and quality.

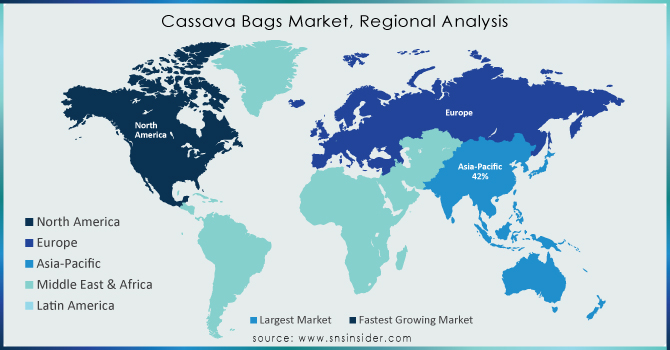

REGIONAL ANALYSIS

The Asia Pacific region dominates the cassava bag market with share of 42% due to a confluence of factors such as a large population with rising disposable income, growing environmental awareness about plastic pollution, and increasing consumption of processed foods. This booming market benefits from being located in major cassava-producing countries like Thailand, Indonesia, China, and Vietnam. These countries not only manufacture cassava bags but have also developed lightweight varieties for export. Additionally, China's use of cassava extract for biofuel production further promotes sustainability in the region by reducing greenhouse gas emissions and reliance on imported fuels. Moreover, the textile industry's adoption of cassava to enhance thread quality contributes to the overall improvement of cassava bags in the Asia Pacific.

North America is projected for solid cassava bag growth due to rising environmental awareness and high packaged food consumption. Additionally, Brazil's production capacity and growing beauty and hospitality industries in the Americas will contribute to market expansion. South Africa aims to cultivate cassava with NGO support (SHA) since 2016. In Nigeria, Bakeries are adopting cassava flour for bread production due to lower costs and simpler ingredients.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key players

Some the major players in Cassava Bags Market are Avani Eco Affinity Supply Co, Biopac India Co. Ltd., Envigreen Biotech India Pvt. Ltd, Affinity Supply Co., Biogreen Bags Co. Ltd, SainBag No Plastic International Pty Ltd, SandBag, IMillionotplasticbag, Baolai Packaging Co., Ltd., Urban Plastik Indonesia, Baolai Packaging Co., Ltd., Tipa, Henan Baolai Packaging Co., Ltd. And Others Players.

RECENT DEVELOPMENT

-

Cassava Bags Australia won a global sustainability competition in May 2023, beating out hundreds of other eco-friendly startups. This win highlights their dedication to environmentally friendly practices.

-

DRDO, along with Acharya Nagarjuna University and Ecolastic, developed and launched plant-based, food-safe biodegradable packaging solutions in July 2021.

-

ALPLA Group partnered with Slovak bioplastics leader Panara in July 2021, acquiring a minority stake to advance biodegradable packaging solutions, including bags.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 67 Mn |

| Market Size by 2032 | US$ 130.62 Mn |

| CAGR | CAGR of 7.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Grip-Hole, T-Shirt, Garbage), By Category (Organic, Conventional) • By End User (Food & Beverages, Animal Feed) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Avani Eco Affinity Supply Co, Biopac India Co. Ltd., Envigreen Biotech India Pvt. Ltd, Affinity Supply Co., Biogreen Bags Co. Ltd, SainBag No Plastic International Pty Ltd, SandBag, IMillionotplasticbag, Baolai Packaging Co., Ltd., Urban Plastik Indonesia, Baolai Packaging Co., Ltd., Tipa, Henan Baolai Packaging Co., Ltd. |

| Key Drivers | • Increased public concern about the environment is leading to a shift towards more sustainable practices. • Consumers, driven by a growing desire for a healthier planet, are increasingly making conscious choices |

| Key Restraints | • Public awareness about cassava bags remains low. • Switching to cassava bags is initially costlier due to R&D and supply chain adjustments. |