Cell Culture Market Report Scope & Overview:

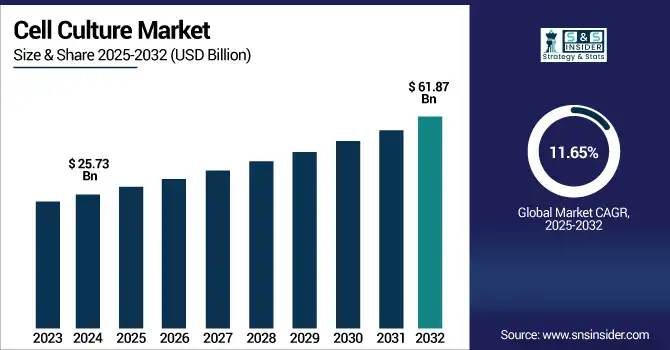

The cell culture market size was valued at USD 25.73 billion in 2024 and is expected to reach USD 61.87 billion by 2032, growing at a CAGR of 11.65% over the forecast period of 2025-2032.

To Get more information on Cell-Culture-Market - Request Free Sample Report

The global cell culture market is growing rapidly due to the increasing use of regenerative medicine, biologics, and vaccines. Growing R&D spending in the biotechnology and pharmaceutical industries and development in cell-based therapy drive the market growth. The increasing use of cell culture in drug discovery, cancer studies, and precision medicine also provides a rationale for its application. Furthermore, the development of media formulations, automation, and scalable bioprocessing platforms is making cell culture increasingly efficient and core to life sciences research and production.

The U.S. cell culture market size was valued at USD 7.11 billion in 2024 and is expected to reach USD 16.51 billion by 2032, growing at a CAGR of 11.16% over the forecast period of 2025-2032.

The cell culture market in North America is led by the U.S., which leads due to its high biotechnology infrastructure, R&D funding, and the heavy concentration of pharmaceutical and biotech companies. It also leverages a strong academic and clinical research environment to support the adoption of advanced cell culture techniques in drug development, regenerative medicine, and the manufacture of biologics.

Market Dynamics:

Drivers

-

Increasing Biologics and Biosimilars Demand is Anticipated to Propel Market Growth

There is a global increase in the prevalence of chronic conditions, including cancer, autoimmune disorders, and diabetes, that has increased the demand for biologic treatments, which are more specific and potent than conventional drugs. Biologics, such as monoclonal antibodies, vaccines, and recombinant proteins, are manufactured with cell culture technology due to they depend on living cells to create complex biological molecules. Moreover, in recent years, the patents for many blockbuster biologics have expired, which is also driving the market for biosimilars (biologic copies), adding to the demand for cell culture systems. Increasing demand for high-quality, scalable cell culture. Between these and other biopharmaceutical companies scaling up production, the demand for high-quality, scale-up cell culture platforms is increasing rapidly.

-

Technological Advancements in the Culture Systems Market are Fueling the Market Growth

Major strides in cell culture technology are making it more clinically and commercially relevant and more streamlined. 3D culture systems more accurately reflect the in vivo conditions, providing better models for drug testing and investigation of the disease. Microcarrier culture with bioreactors provides the high-density cell cultivation necessary for large-scale biologics manufacture. Furthermore, serum-free & chemically defined media also provide lower variability and increase consistency, which is demanded by strict regulatory regulations. Automation solutions such as robotics for liquid handling and in-process monitoring devices decrease manual errors and increase the speed of operation. These developments are driving increased acceptance of cell culture within pharmaceutical production, educational research, and clinical laboratories.

Restraint

-

Contamination Risk and Technical Complexity are Restraining the Market Growth

The cell culture industry faces the risk of contamination, and technical expertise is needed to keep cells and cultures free from contamination in sterile and controlled environments is constraining the cell culture market growth. Even small breaks in aseptic technique, such as not wearing a lab coat at the hood or not autoclaving reagents, can cause a contamination of your culture with bacteria, fungi, or mycoplasma. Contaminated cultures can affect not just the results of an experiment, but may lead to the loss of the precious cell lines, reagents, and time for bringing research and finished product to market.

In any case, the culture of many cell types, particularly primary cells, stem cells, or co-culture systems, can require a high level of expertise and experience. These cells are often temperature, pH, and media composition sensitive, and careful control and monitoring procedures are followed to maintain their proper condition. Where trained personnel and SOP are not available in the laboratory, the risk of failure becomes even higher, thereby making the procedure somewhat unreliable and costly. This barrier is particularly challenging in low-resource settings or for new biotech companies.

Segmentation Analysis:

By Product

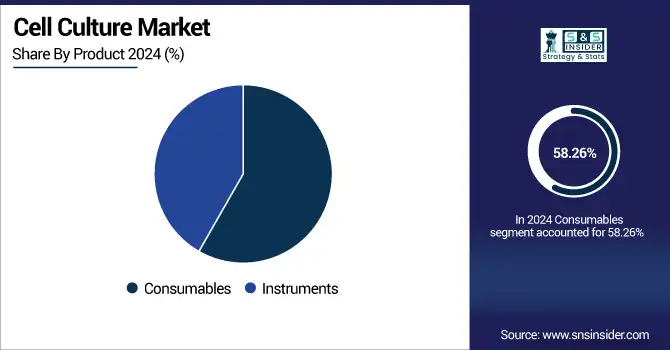

The Consumables segment dominated the cell culture market share in 2024 with a 58.26%, owing to its repetitive requirement and essential usage in day-to-day laboratory needs. This ranges from reagents, media, sera, pipettes, flasks, and all common consumables being replaced in research, clinical, and biopharmaceutical settings. Driven by the increasing demand for cell-based experience and the growth in the biologics and vaccine market, the demand for high-quality consumables remained high. Given their low-cost scalability combined with their role in promoting efficient growth and maintenance of cells, they have become indispensable in academic and commercial laboratories.

The media subsegment of consumables is anticipated to grow at the highest rate during the forecast period, owing to the development of serum-free, chemically defined, and specialty media formulations. These media minimize variation and increase reproducibility in both cell-based research and manufacturing, and are ideal for use in the development of therapeutics, vaccines, and stem cells. The advent of precision medicine and cell and gene therapy has also stimulated the requirement for specialized and high-performing media designed for unique cell lines. Further, an increasing number of regulations related to the removal of animal-based products will augment the adoption of next-generation media products.

By Application

The biopharmaceutical production segment dominated the cell culture market in 2024, owing to high demand for biologics such as monoclonal antibodies, recombinant proteins, vaccines, etc. Cell culture is essential for the production of these therapeutics, due to the need for controlled and reproducible environments for developing biological products of high purity at scale. Particularly, the increasing incidence of chronic diseases and cancer has made pharmaceutical companies invest heavily in biologics production. There are continuous upgrades of commercial large-scale cell culture/ bioreactor systems that also contribute to more efficient commercial production, asserting the determinant role of this segment.

The diagnostics segment is expected to grow at the fastest rate during the forecast period, owing to the enhanced use of cell-based assays in the diagnosis of diseases, cytogenetics, and personalized medicine. Cell culture methods are critical for diagnostics, including prenatal testing, cancer diagnostics, and infectious disease testing. Increasing prevalence of chronic and infectious diseases globally and increasing need for rapid and precise diagnostics are expected to drive the growth of the cell culture-based diagnostics market. Integration of cell culture with molecular diagnostics and automation tools is further increasing the throughput and sensitivity, driving the growth of this application segment.

By End User

The pharmaceutical & biotechnology companies dominated the cell culture market in 2024 with a 56.20%, as cell-based platforms are being widely used in culturing cells to test new drugs by various pharmaceutical and biotechnology industries, which is propelling the growth of the market. These firms employ sophisticated cell-culture technology to manufacture monoclonal antibodies, recombinant proteins, and other cellular-based agents in commercial quantities. The growing need for personalized medicine alongside cell and gene therapies is compelling the market leaders, such as pharma and biotech giants, to make substantial investments in automated culture systems, serum-free media, and scalable bioprocessing technologies, accentuating their dominance over the market.

The research & academic institutes segment is anticipated to grow at the fastest CAGR in the forecast years, attributed mainly to the increasing number of basic and applied research studies in fields such as oncology, neuroscience, stem cell biology, and regenerative medicine. With life science research funding growing globally, these institutions are integrating sophisticated cell culture systems for the biochemical research of disease mechanisms, drug response, and tissue engineering. Increasing collaborations between academia and industry, along with rising availability of service providers offering cell culture as a service in emerging economies, are also driving the adoption in this segment.

Regional Analysis:

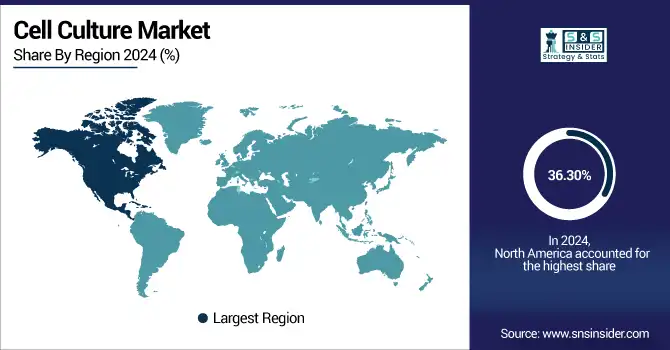

North America dominated the global cell culture market with a 36.30% market share in 2024 on account of the strong presence of the biotechnology and pharmaceutical sector in the region. The area contains a dense population of major market participants, research institutions, and academic institutions involved in cellular-based research and drug development. Positive government policies, substantial R&D investments, and mature regulatory systems also contribute to innovation and product development. Moreover, the penetration of new technologies, including bioreactors and automation platforms, has driven scalability and efficiency, further strengthening the dominance of North America in the market.

The Asia Pacific region is expected to grow at the fastest CAGR during the forecast period due to the expansion of the biotechnology and pharmaceutical sectors in China, India, South Korea, and Japan. Growing investment in healthcare infrastructure, government support for life sciences research, and rising demand for biologics and vaccines are the other key growth drivers. In addition, strong growth is being observed in academia and clinical research development, particularly backed by a strong talent pool and cost-effective manufacturing processes.

The cell culture market trends in Europe are growing due to the increasing demand for biopharmaceuticals, regenerative medicine, and the development of innovative cell-based therapies. Leading this growth are countries such as Germany, the UK, and France, which have the benefit of robust R&D facilities, supportive regulatory environments, and synergistic partnerships between academia and biotech companies. Moreover, progress in 3D cell culture, serum-free media, and lab automation is also driving innovation and adoption for pharmaceutical and clinical research use, bolstering the region’s standing in the global market.

The cell culture market analysis in Latin America is growing significantly, driven by investments in biotechnology infrastructure and pharmaceutical research capacities from countries such as Brazil and Argentina. There’s a growing need for cell-based assays and biologics development in the region, especially among academic institutions and early-stage biotech companies.

The MEA region has a steady growth in the cell culture market. Governments such as those of Saudi Arabia, South Africa, and the UAE are at the forefront of this trend, with policies promoting research in regenerative medicine and vaccine manufacturing. Urban centers do have the advantage of better laboratory facilities and international collaboration, but the urban-rural divide and the current budget cuts would restrict the cascade of such services in a wide region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

The cell culture market companies are Thermo Fisher Scientific, Merck KGaA, Sartorius AG, Danaher Corporation, Corning Incorporated, Lonza Group AG, Eppendorf SE, Becton, Dickinson and Company (BD), HiMedia Laboratories, FUJIFILM Irvine Scientific, and other players.

Recent Developments

-

September 2024 – Merck, a science and technology global leader, declared that its key Cell Culture Media (CCM) manufacturing sites have been EXCiPACT cGMP certified as Pharmaceutical Auxiliary Materials (PAMs). This denotes the first industry company to be so recognized, signifying compliance with stringent quality levels for the manufacture of non-sterile excipients.

-

February 2024 – Danaher Corporation, an industry-leading science and technology company, made a strategic partnership with Cincinnati Children's Hospital Medical Center to advance patient safety. The partnership is concentrated on one of the leading reasons for failure in clinical trials, with the goal of enhancing clinical outcomes and the efficiency of trials.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 25.73 Billion |

| Market Size by 2032 | USD 61.87 Billion |

| CAGR | CAGR of 11.65% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Consumables, Instruments) • By Application (Biopharmaceutical Production, Drug Development, Diagnostics, Tissue Culture & Engineering, Cell and Gene Therapy, Toxicity Testing, Other Applications) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Thermo Fisher Scientific, Merck KGaA, Sartorius AG, Danaher Corporation, Corning Incorporated, Lonza Group AG, Eppendorf SE, Becton, Dickinson and Company (BD), HiMedia Laboratories, FUJIFILM Irvine Scientific, and other players. |