Viral Vector Manufacturing Market Report Scope & Overview:

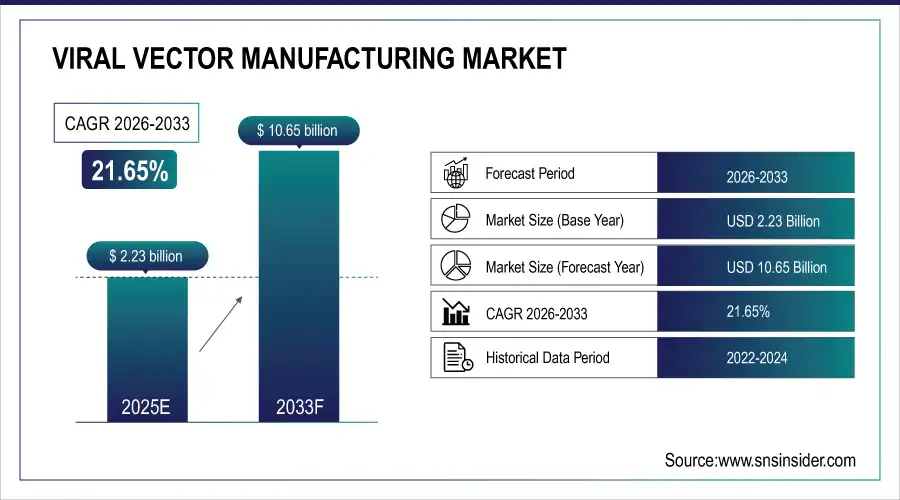

The Viral Vector Manufacturing Market size was valued at USD 2.23 Billion in 2025E and is projected to reach USD 10.65 Billion by 2033, growing at a CAGR of 21.65% during 2026-2033.

The Viral Vector Manufacturing Market analysis highlights the increasing demand for gene therapies, the CMO trend and advancements in viral vector platforms. Prominent trends in the market include increase in manufacturing capacities, regulatory approvals and strategic partnerships of main players to address clinical and commercial demands worldwide.

In 2025, over 1,200 gene therapy clinical trials were active globally, with more than 70% relying on viral vectors—primarily AAV and lentivirus—driving unprecedented manufacturing demand.

Market Size and Forecast:

-

Market Size in 2025E: USD 2.23 Billion

-

Market Size by 2033: USD 10.65 Billion

-

CAGR: 21.65% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Viral Vector Manufacturing Market - Request Free Sample Report

Viral Vector Manufacturing Market Trends

-

Growing dependence on CMOs (contract manufacturing organizations) as biopharma firms shift focus from in-house viral vector manufacture to expand efficiently and gradually cut costs.

-

Leverage of new viral vectors (next generation), and automated bioreactors, and high-titers systems for manufacturing improve effectiveness and quality.

-

Increasing number of gene therapy clinical trial activity worldwide is leading to an increased demand for viral vector manufacturing capacity.

-

Partnerships, mergers and acquisitions between CMOs and biotech companies help to quickly drive innovation, expand capacity and market access.

-

Faster commercialization of viral vector therapies is enabled by fast approvals and favorable regulatory environment in key markets.

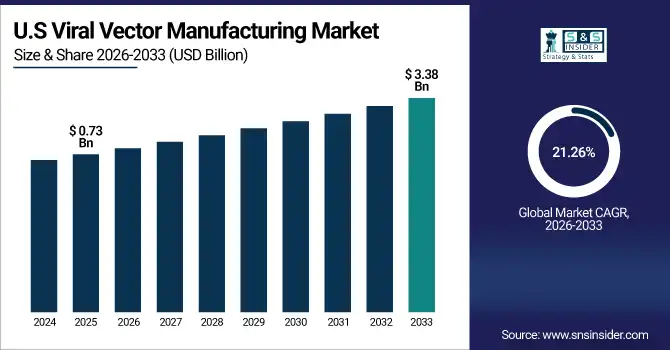

The U.S. Viral Vector Manufacturing Market size was valued at USD 0.73 Billion in 2025E and is projected to reach USD 3.38 Billion by 2033, growing at a CAGR of 21.26% during 2026-2033. Viral Vector Manufacturing Market growth is driven by rapid growth due to a surge in gene therapy development, increased outsourcing trend to CMOs, and technological advancements for the production of vectors. Robust government support, increased clinical trial deployment and strategic partnerships among the prominent suppliers are driving business growth.

Viral Vector Manufacturing Market Growth Drivers:

-

Increasing Demand for Gene Therapy and Advanced Viral Vector Solutions

The viral vector manufacturing market growth is increasing due to use of gene therapy globally. Increasing incidence of genetic diseases and cancers is driving the demand for viral vectors in clinical and commercial purposes. There is a trend among pharmaceutical and bio tech companies to externalize production as the requirement for high-quality, scalable manufacturing grows. Ongoing technological innovations such as high-output viral vector platforms and automated bioreactor systems are increasingly improving efficiency of production and shorten the time to deliver gene therapies to patients globally.

In 2025, over 30 gene therapies using viral vectors reached commercial launch globally, with oncology and rare genetic diseases accounting for more than 80% of approved indications.

Viral Vector Manufacturing Market Restraints:

-

High Manufacturing Costs and Regulatory Complexities Limiting Market Expansion

High cost associated with viral vector production such as raw materials, specific equipment, and skilled manpower hampers the market. Complicated regulatory regimes in the U.S., EU and Asia present obstacles to approval, extending timelines and compliance costs. Variation in fermentation efficiency, contamination risk and reliance on expensive quality control practices are additional barriers for scalability. Small biotech companies frequently find it difficult to invest in high-end facilities which can lead to delayed market penetration and overall expansion despite rising demand for therapy.

Viral Vector Manufacturing Market Opportunities:

-

Expansion of Contract Manufacturing Organizations and Advanced Vector Technologies

The viral vector manufacturing market offers opportunities with the expansion of CMOs offering production services for vectors that are scalable and of high quality. Rising partnerships among biotech companies and CMOs support fast expanding need for clinical and commercial scale. The development of new viral vector platforms like AAV and lentiviral vectors facilitates higher titers with concomitant lower production costs. Emerging markets and increasing pipelines gene therapy offer opportunities for market participants to create new facilities, enhance operations, and tap into the adoption trends of therapies at global level.

In 2025, global CMOs allocated over $5 billion to expand viral vector manufacturing facilities, with more than 40 new GMP suites commissioned to support commercial-scale gene therapy production.

Viral Vector Manufacturing Market Segment Analysis

-

By diseases, cancer led the market with a 48.25% share in 2025, while genetic disorders were the fastest-growing segment, registering a CAGR of 18.14%.

-

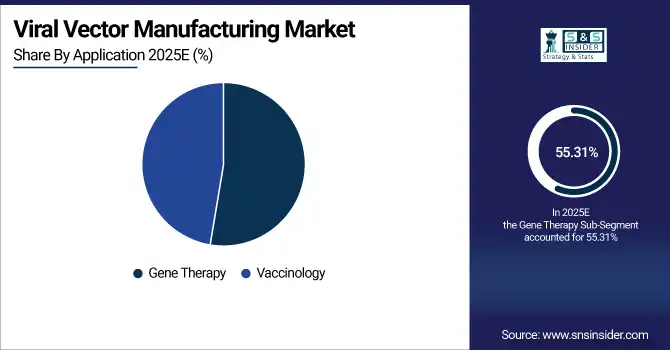

By application, gene therapy dominated with a 55.31% share in 2025, whereas vaccinology was the fastest-growing segment, with a CAGR of 16.53%.

-

By type, adeno-associated viral vectors led the market with 34.23% in 2025, while lentiviral vectors registered the fastest growth at a CAGR of 15.47%.

-

By mode of manufacturing, in-house manufacturing held 51.68% of the market in 2025, while CDMOs were the fastest-growing segment, recording a CAGR of 17.44%.

By Diseases, Cancer Leads Market While Genetic Disorders Registers Fastest Growth

By Diseases, Cancer segment is dominate the viral vector manufacturing market owing to a high occurrence of different types of cancer and an increasing requirement for innovative gene therapies developed for treating oncologic diseases. Elevating oncology - focused research, clinical trials and therapeutic developments create significant demand for viral vectors. The fastest-growing segment, is genetic disorder, as investing around gene editing and therapy of rare hereditary disorders picks up. Increasing awareness, government programs, and increasing diagnostic rates also drive adoption in this segment.

By Application, Gene Therapy Dominate While Vaccinology Shows Rapid Growth

The gene therapy segment holds the largest revenue share in the viral vector manufacturing market with a widespread use in clinics, increasing availability of approved therapies and growing demand from patients for personalized treatment. Viral vectors are necessary to serve as carriage method of therapeutic genes into the cells safely and effectively. While, vaccinology is rapidly expanding with development of new viral vector-based vaccines for infectious diseases increasing production demands. Governments and pharma companies are pouring billions of dollars into boosting vaccine production capabilities around the world.

By Type, Adeno-associated Viral Vectors Lead While Lentiviral Vectors Registers Fastest Growth

Adeno-associated segment dominates the market in 2025, due to the most prevalent vectors for several reasons, including their lack of pathogenicity, sustained gene expression and demonstrated efficacy in a wide variety of therapeutic indications. They are versatile in treating rare genetic diseases and cancers, helping keep demand robust. The fastest-growing category is lentiviral vectors, driven by progress in ex-vivo therapies, CAR-T treatments, and new dimensions in regenerative medicine. Rapid evolution of the viral vector manufacturing market increase in viral vectors production, combined with continuous advances in technologies and a high therapeutic potential, makes manufacturing for lentiviral vectors one of the fastest growing areas within this market.

By Mode of Manufacturing, In-House Manufacturing Lead While CDMOs Grow Fastest

In-house manufacturing segment dominates the market due to as Big Biotech and pharma prefer to keep quality control and accountability within. Strategic partnerships also drive the market growth across geographies. Meanwhile, contract development and manufacturing organizations (CDMOs) growing fastest due to propelled by trends such as more outsourcing, capacity limitations, and demand for scalable cost-effective commercial production. CDMOs are crucial to smaller companies and start-ups for gaining access to advanced manufacturing technologies, minimizing capital investment and pace clinical trial timelines.

Viral Vector Manufacturing Market Regional Analysis:

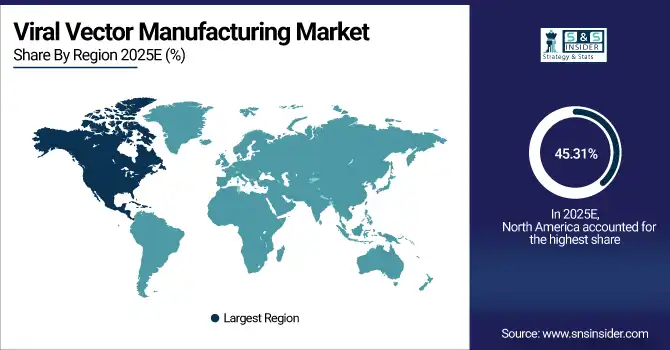

North America Viral Vector Manufacturing Market Insights

In 2025 North America dominated the Viral Vector Manufacturing Market and accounted for 45.31% of revenue share, this leadership is due to the developed infrastructure, supportive regulator environment, and high penetration of gene therapies. The United States and Canada are home to major CMOs and biotechs specializing in high-volume vector production. Strong technological innovation is underpinned by significant R&D investment and a deep clinical trial pipeline.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Viral Vector Manufacturing Market Insights

The U.S. is the leading market for viral vectors in North America owing to high incidences of cancer and genetic disorders. Key biotech organizations and CMOs are making significant investments in production capability and innovative manufacturing solutions. An intense emphasis towards CAR-T therapies and gene therapy pipelines is driving the demand for vectors.

Asia-pacific Viral Vector Manufacturing Market Insights

Asia-pacific is expected to witness the fastest growth in the Viral Vector Manufacturing Market over 2026-2033, with a projected CAGR of 22.39% due to the rapid adoption of gene therapeutics and increasing clinical trial activity. Australia, Japan and South Korea are building new manufacturing capacity to satisfy local and global demand. Investing in new Viral Vector technologies and favorable government initiatives to boost market growth. There is cheap manufacturing and a large market for skilled labor.

China Viral Vector Manufacturing Market Insights

China is becoming a major player in viral vector production, investing heavily into gene therapy and biotechnology infrastructure. These subsidies to innovation and research in biotech helped support construction of new factories. Clinical testing for cancer and rare genetic disorders are helping to fuel demand for high-quality viral vectors.

Europe Viral Vector Manufacturing Market Insights

In 2025, Europe emerged as a promising region in the Viral Vector Manufacturing Market, due to a well-developed biotechnology infrastructure and government funding. Countries, Germany France and the U.K. are ramping up viral vector capacity in line with the increasing clinical demand. Strong R&D in gene therapy and vaccine development is market growth propeller. Strategic partnerships with local and international CMOs improve manufacturing productivity.

Germany Viral Vector Manufacturing Market Insights

Germany is the leading country in Europe for viral vectors production thanks to its robust biotech ecosystem and well-educated workforce. Greater numbers of clinical trials for gene therapies and personalized medicines require access to high quality viral vectors.

Latin America (LATAM) and Middle East & Africa (MEA) Viral Vector Manufacturing Market Insights

The Viral Vector Manufacturing Market is experiencing moderate growth in the Latin America (LATAM) and Middle East & Africa (MEA) regions, due to the rising gene therapies and rare diseases knowledge. Brazil, South Africa and the UAE are beginning to enhance capacities of clinical trials, production. Collaborations with CMOs across the world enable to overcome technology and infrastructure lacunae. Market growth is backed by investment in regulatory bodies and training of workers with skills.

Viral Vector Manufacturing Market Competitive Landscape:

Lonza is one of the leading viral vector and GMP manufacturers for gene therapy and vaccine developers worldwide. It offers in-house and contract manufacturing of products with the use of cell culture processing rooted upon enhanced bioreactor technology. It is a significant and strategic player with a global approach, regulatory track record for commercial viral vectors and deep partnerships in clinical viral vector capacity.

-

In October 2025, Lonza introduced new GMP-grade cytokine and media systems designed to enhance scalability, consistency, and efficiency in viral vector and cell therapy production. This advancement aims to support the growing demand for gene therapies and improve manufacturing processes.

Thermo Fisher Scientific offers complete viral vector services ranging from early development and process/analytical formulation, through scale up. Its experience in high-productivity production platforms, automated processes and regulatory support for gene therapy pipelines can be found around the world. With a broad global setup and strong CMO partners, the company is well placed as a significant player in the growing viral vector manufacturing space.

-

In September 2025, Thermo Fisher Scientific partnered with Dr. Park CDMO to equip a new viral vector manufacturing facility. This collaboration reflects the increasing importance of robust viral vector manufacturing as cell and gene therapies move from research to clinical and commercial use.

Charles River Laboratories Provides end-to-end viral vector solutions, including preclinical development and GMP manufacturing of gene therapies. It provides process development, scale up and quality control through to reliable supply for clinical trials, all of which is delivered as integrated solutions. strategic partnerships and investments in leading-edge facilities ensure charles river can efficiently support an expanding global need.

-

In July 2025, Charles River Laboratories announced a strategic collaboration with Elly's Team to drive rare disease gene therapy development. This partnership aims to advance the development of gene therapies for rare diseases by leveraging combined expertise and resources.

Fujifilm Diosynth Biotechnologies is a leading company in the development and manufacture of viral vectors for gene therapies and vaccines offering large-scale GMP manufacturing services. The company focuses on state-of-the-art process development, high-output production and quality control. Strategic partnerships with biotech and pharmaceutical companies across the globe continue to reinforce its position in the market, serving both clinical and commercial viral vector supply requirements.

-

In April 2024, Fujifilm Diosynth Biotechnologies announced plans to expand its biopharmaceutical manufacturing facility in Holly Springs, North Carolina. The expansion entails an additional $1.2 billion investment and the creation of 680 new jobs, aiming to increase cell culture production to 750,000 liters.

Viral Vector Manufacturing Market Key Players:

Some of the Viral Vector Manufacturing Market Companies are:

-

Lonza

-

Thermo Fisher Scientific

-

Charles River Laboratories

-

Fujifilm Diosynth Biotechnologies

-

Catalent

-

Kaneka Eurogentec

-

Merck KGaA (MilliporeSigma)

-

Oxford Biomedica

-

uniQure NV

-

Spark Therapeutics (Roche)

-

Cytiva (Danaher)

-

Yposkesi (Servier)

-

Viralgen Vector Core

-

Aldevron

-

Vibalogics

-

Waisman Biomanufacturing

-

Novasep

-

Genezen

-

bluebird Bio

-

REGENXBIO

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 2.23 Billion |

| Market Size by 2033 | USD 10.65 Billion |

| CAGR | CAGR of 21.65% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Diseases (Cancer, Genetic Disorders, Infectious Diseases, and Others) • By Application (Gene Therapy and Vaccinology) • By Type (Adenoviral Vectors, Adeno-associated Viral Vectors, Lentiviral Vectors, Retroviral Vectors, and Others) • By Mode of Manufacturing (In-House Manufacturing and CDMOs) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Lonza, Thermo Fisher Scientific, Charles River Laboratories, Fujifilm Diosynth Biotechnologies, Catalent, Kaneka Eurogentec, Merck KGaA (MilliporeSigma), Oxford Biomedica, uniQure NV, Spark Therapeutics (Roche), Cytiva (Danaher), Yposkesi (Servier), Viralgen Vector Core, Aldevron, Vibalogics, Waisman Biomanufacturing, Novasep, Genezen, bluebird Bio, REGENXBIO |