Healthcare IT Consulting Market Analysis:

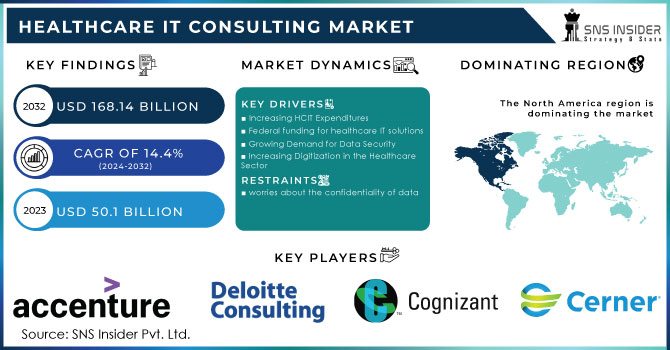

The Healthcare IT Consulting Market Size was valued at USD 50.1 billion in 2023 and is expected to reach USD 168.14 billion by 2032 and grow at a CAGR of 14.4% over the forecast period 2024-2032. This report involves industry trends, pricing analysis, patent analysis, key stakeholders, and buying behavior. The increasing adoption of EHR systems, cloud computing, AI-driven analytics, and interoperability solutions drives the market. Increasing cybersecurity concerns and the need for regulatory compliance, such as HIPAA and GDPR, are fueling demand for IT consulting services. Investments in IT infrastructure optimization and system integration are picking up due to government mandates and healthcare digital transformation initiatives. Further, AI, blockchain, and big data analytics are streamlining operations and helping improve patient outcomes.

Get more information on Healthcare IT Consulting Market - Request Sample Report

Healthcare IT Consulting Market Dynamics:

Drivers

-

Healthcare IT Consulting Market Growth Driven by Digital Transformation, Cybersecurity Needs, Regulatory Compliance, and Interoperability Challenges

As of 2023, over 89% of U.S. office-based physicians have implemented Electronic Health Records (EHRs), requiring IT consulting support for system optimization and interoperability. Moreover, telehealth adoption surged 38 times post-pandemic, necessitating consulting services for infrastructure development. Cybersecurity is now a huge concern, as 2023 saw over 700 healthcare data breaches that exposed 51.9 million patient records, such as the recent UnitedHealth Group cyberattack. The strict regulations of HIPAA, GDPR, and the HITECH Act push healthcare organizations to seek expert IT consulting for compliance and data security solutions. Despite this, there is a major challenge that affects interoperability due to 70% of the hospitals citing hindrances in the exchange of patient information, creating FHIR and API-driven integration service demand. Meanwhile, IT consultancy needs have speeded up along with value-based care models which CMS intends for 100% Medicare participation of such models in 2030, making for advanced analytics as well as AI-driven insights necessary. Emerging technologies include cloud-based solutions, blockchain for secure data management, and predictive analytics, making IT consulting indispensable in the modern transformation of healthcare.

Restraints

-

The Healthcare IT Consulting Market faces several restraints, primarily high implementation and maintenance costs associated with digital transformation.

The adoption of Electronic Health Records, AI-driven analytics, and cloud solutions comes with a big upfront investment which can be an overwhelming cost burden for small to mid-sized health providers to support the consulting service. According to the Office of the National Coordinator for Health IT, EHR implementation costs range from USD 15,000 to USD 70,000 per provider with subsequent maintenance that continues to contribute to financial burdens. Data security still poses a prominent constraint, mainly because 700+ data breaches in 2023 exposed more than 51.9 million patient records to legal penalties and reputational harm. Due to the fear of cyberattacks on healthcare organizations, many do not wish to invest much in IT consulting for interoperability failures and compliance issues with rules like HIPAA and GDPR. Besides this, resistance to change from the medical professional side and lack of skilled IT experts in healthcare-related organizations are pace-setting barriers that hinder the percentage of growth in IT consulting services.

Opportunities

-

The Healthcare IT Consulting Market presents significant opportunities, particularly in the adoption of AI, cloud computing, and value-based care models.

AI-driven solutions in healthcare IT are gaining more ground, and AI investment in healthcare is estimated to reach USD 20 billion globally by 2025. With this potential, IT consulting firms can utilize AI to support providers in predictive analytics, automated workflows, and improvement of patient outcomes. Cloud computing is another massive opportunity, with healthcare organizations moving toward scalable and cost-effective cloud solutions. It is estimated that 80% of the U.S. hospitals will have cloud-based EHRs by 2025. Additionally, given the value-based care model, through which healthcare providers are incentivized for quality over quantity, this will initiate the demand for IT consulting services even further. For example, the Centers for Medicare & Medicaid Services anticipated a surge forward to achieving 100% participation in Medicare for value-based care models by 2030, which increases the demand for data analytics, interoperability solutions, and population health management. Also, with the increasing adoption of blockchain technology for secure health data exchange and IoT-driven remote patient monitoring, IT consulting firms have the opportunity to design innovative digital health solutions.

Challenges

-

Complex Regulatory Compliance, Interoperability Barriers, and Cybersecurity Threats are the most pressing challenges for the healthcare IT consulting market

Healthcare organizations adhere to strict data protection laws such as HIPAA of the U.S., GDPR in Europe, and the HITECH Act which leads to complexities in IT implementation requirements and routine audits. Not adhering to these standards has led to several multi-million-dollar fines, for example, when a U.S. healthcare provider was fined USD 1.25 million for HIPAA in 2023. In addition, there is interoperability, which becomes a significant impediment as about 70% of hospitals face difficulties in exchanging patient data resulting from incompatible systems and a lack of standard frameworks for integration. On the other hand, FHIR and API-led integration are being adopted, and this process seems slow due to legacy system-related constraints and changing resistances. The shortage of skilled healthcare IT professionals is another challenge. More than 40% of healthcare organizations have reported difficulties in finding qualified IT staff, thus delaying IT implementation projects. Additionally, the increasing sophistication of cybersecurity threats forces healthcare providers to continually upgrade security measures, adding to IT complexity and consulting costs. Continuous innovation, collaboration, and investment in IT consulting services will be needed to address these challenges.

Healthcare IT Consulting Market Segmentation Analysis:

By Consulting Type

The Healthcare Business Process Management (BPM) segment led the Healthcare IT Consulting Market with a 28.2% share in 2023, driven by the rising need for process automation, cost efficiency, and improved patient care workflows. With hospitals and healthcare providers focusing on streamlining revenue cycle management, claims processing, and administrative tasks, BPM solutions are in high demand. For instance, the adaptation of Robotic Process Automation within the healthcare sector saved 30-50% on administrative functions' costs for hospitals and insurance providers.

While big data analytics, AI-based insights, and predictive healthcare models would be a great growth engine, the fastest-growing segment will likely be Healthcare Enterprise Reporting and Data Analytics. At an exponential growth rate of 36% annually, health data is increasingly demanding real-time analytics for disease predictions, decision-making, and customized patient care. In addition to this, regulations and performance benchmarking have necessitated data analytics consulting investment further.

By End User

Hospitals and ambulatory care centers held the largest market share with 37.2% share in 2023, as they are the primary adopters of EHRs, cybersecurity solutions, and interoperability frameworks. The rise in digital transformation initiatives, patient data integration needs, and government mandates is pushing hospitals to seek IT consulting services. For example, more than 95% of U.S. hospitals have adopted certified EHR systems, increasing demand for IT consulting for system upgrades and data security.

On the other hand, the public and private payers segment is expected to grow at the fastest rate because of the requirement for fraud detection, claims automation, and AI-driven risk assessment. With insurance companies shifting toward value-based reimbursement models, there is an increasing demand for cloud-based claims management, blockchain-powered transactions, and advanced analytics. For instance, 80% of payers are now investing in AI-driven predictive analytics to enhance risk stratification and cost containment strategies, boosting IT consulting services in the sector.

Healthcare IT Consulting Regional Outlook

North America held the largest market share of 43.8% in 2023 because of advanced healthcare infrastructure, high rates of digital adoption, and the need for stringent regulatory compliance. In 2023, over 89% of office-based physicians in the United States have adopted EHRs, and this creates an increased demand for IT consulting services in the optimization and interoperability of these systems. Cybersecurity issues also continue to be a driving factor, with more than 700 healthcare data breaches in 2023, compelling organizations to seek expert consulting services for risk assessments and compliance with HIPAA, HITECH, and GDPR. The existence of key market players along with significant investments in cloud computing, AI, and telehealth solutions continues to cement the position of North America.

The Asia-Pacific region will be the fastest-growing region, boosted by increasing healthcare expenses, government-backed digital health initiatives, and ever-expanding hospital networks. China, India, and Japan are investing heavily in telemedicine, AI-driven diagnostics, and cloud-based health solutions in large numbers, creating tremendous opportunities for IT consulting firms. There is also a growing acceptance of FHIR-based interoperability standards and digital payment solutions, and hence the space for expert consultant services.

Need any customization research on Healthcare IT Consulting Market - Enquiry Now

Key Players and Their Offering Products Related to Healthcare IT Consulting

-

Accenture plc – (HealthTech Solutions, Digital Health Transformation, Cybersecurity Solutions, Cloud EMR Solutions)

-

Atos SE – (Digital Healthcare Services, Cloud Health Solutions, Healthcare Process Management)

-

Deloitte Touche Tohmatsu Limited – (Healthcare Strategy Consulting, Analytics Solutions, Technology Integration Services)

-

Genpact – (Healthcare Process Management Solutions, Healthcare Analytics Solutions)

-

HCL Technologies Limited – (Digital Healthcare Transformation, Healthcare IT Services, System Integration)

-

Infosys Limited – (EHR Solutions, Telemedicine Platforms, Digital Health Solutions)

-

IBM Corporation – (IBM Watson Health, AI-driven Health Insights, Data Analytics Solutions)

-

Koninklijke Philips N.V. – (Digital Health Technologies, Patient Monitoring Systems, Healthcare IT Consulting Services)

-

NTT DATA Corporation – (Healthcare IT Services, Data Analytics Solutions, Digital Transformation Services)

-

Oracle Corporation – (Cloud Healthcare Applications, Data Management Systems, Healthcare Analytics Solutions)

-

Siemens Healthineers AG – (Digital Health Solutions, Healthcare IT Consulting, Healthcare Workflow Optimization)

-

Tata Consultancy Services Limited – (Digital Transformation in Healthcare, Patient Engagement Solutions, Healthcare IT Services)

-

Allscripts Healthcare Solutions – (EHR Systems, Population Health Management Solutions, Healthcare Information Systems)

-

Cerner Corporation – (EHR Solutions, Population Health Management Solutions, Health Information Systems)

-

Cognizant – (Healthcare IT Infrastructure Solutions, Digital Transformation Services, AI-driven Healthcare Solutions)

-

McKesson Corporation – (Healthcare Management Software, Operational Efficiency Solutions, IT Consulting Services)

Recent Developments:

In Feb 2025, CSI Companies, a prominent provider of staffing, consulting, and workforce management services in the Healthcare IT sector, acquired MedSys Group, a leading Healthcare IT consulting firm based in Plano, Texas. This acquisition strengthens CSI’s Healthcare IT services, allowing them to offer more comprehensive solutions to a broader client base.

| Report Attributes | Details |

|---|---|

|

Market Size in 2023 |

USD 50.1 Billion |

|

Market Size by 2032 |

USD 168.14 Billion |

|

CAGR |

CAGR of 14.4% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Consulting Type [HCIT Change Management, Healthcare Business Process Management, HCIT Integration and Migration, Healthcare/Medical System Security Set-Up and Risk Assessment, Healthcare Enterprise Reporting and Data Analytics, Others] |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Accenture plc, Atos SE, Deloitte Touche Tohmatsu Limited, Genpact, HCL Technologies Limited, Infosys Limited, IBM Corporation, Koninklijke Philips N.V., NTT DATA Corporation, Oracle Corporation, Siemens Healthineers AG, Tata Consultancy Services Limited, Allscripts Healthcare Solutions, Cerner Corporation, Cognizant, McKesson Corporation. |