Cell Separation Market Report Scope & Overview:

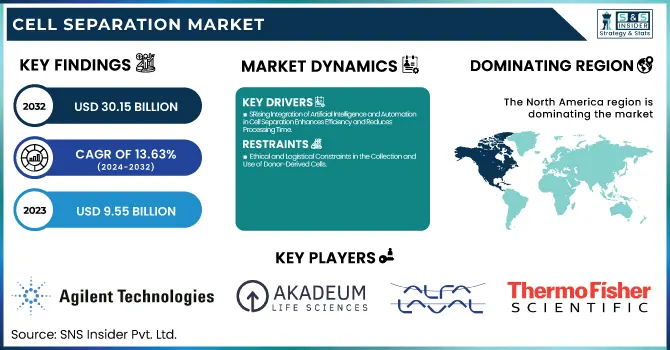

The Cell Separation Market Size was valued at USD 9.55 Billion in 2023 and is expected to reach USD 30.15 Billion by 2032, growing at a CAGR of 13.63% over the forecast period of 2024-2032.

Get more information on Cell Separation Market - Request Free Sample Report

The Cell Separation Market is evolving rapidly, driven by rising research and development investments by companies, fueling innovations in automation and precision techniques. With stringent key regulatory standards governing cell separation, compliance remains a crucial factor in product approval and commercialization. A detailed patent analysis of cell separation technologies reveals a surge in intellectual property filings, reflecting industry efforts to enhance efficiency and scalability. Looking ahead, future trends in cell separation industry point toward advancements in microfluidics, artificial intelligence, and personalized medicine, shaping the next phase of growth. Our report explores these transformative elements, providing a deep dive into the market’s dynamic landscape, where technology, regulation, and innovation converge to redefine possibilities in cell separation.

The US Cell Separation Market Size was valued at USD 2.89 Billion in 2023 and is expected to reach USD 8.57 Billion by 2032, growing at a significant CAGR over the forecast period of 2024-2032.

The U.S. Cell Separation Market is experiencing robust growth, driven by increasing biomedical research, rising demand for regenerative medicine, and advancements in biotechnology. Organizations such as the National Institutes of Health (NIH) and Biomedical Advanced Research and Development Authority (BARDA) are heavily funding cell-based research, accelerating innovation. Additionally, U.S.-based companies like Thermo Fisher Scientific and BD Biosciences are introducing cutting-edge technologies, enhancing efficiency in cell isolation. Stringent FDA regulations ensure high-quality standards, further boosting market credibility. With growing applications in cancer research, stem cell therapy, and precision medicine, the U.S. remains a leading hub for cell separation advancements.

Market Dynamics

Drivers

-

Rising Integration of Artificial Intelligence and Automation in Cell Separation Enhances Efficiency and Reduces Processing Time

The integration of artificial intelligence (AI) and automation in cell separation technologies is significantly improving efficiency, accuracy, and processing time. AI-driven imaging and machine learning algorithms allow researchers to classify, identify, and sort cells with minimal errors, ensuring high-purity separation. Automated platforms reduce human intervention, enhancing reproducibility in clinical and research settings. Companies such as Thermo Fisher Scientific and BD Biosciences are developing AI-enhanced cell separation instruments to optimize workflow efficiency. The demand for high-throughput screening in drug discovery, regenerative medicine, and cancer research is pushing laboratories toward automation-based solutions. AI-based predictive analytics is also improving process standardization, reducing reagent wastage, and lowering operational costs. Additionally, AI-powered flow cytometry and microfluidics-based sorting techniques are advancing single-cell analysis, essential for personalized medicine and immunotherapy research. As biotechnology firms and research institutions invest in next-generation AI-based platforms, the cell separation market is witnessing a transformation toward faster, more precise, and cost-effective solutions, positioning automation as a key driver for future growth in the industry.

Restraints

-

Ethical and Logistical Constraints in the Collection and Use of Donor-Derived Cells

The collection and utilization of donor-derived cells for research and therapeutic applications are subject to strict ethical and logistical constraints, impacting the growth of the cell separation market. The use of human stem cells, immune cells, and embryonic cells in separation technologies raises ethical concerns regarding donor consent, commercial exploitation, and potential misuse of biological materials. In the United States, organizations like the National Institutes of Health (NIH) and the U.S. Food and Drug Administration (FDA) enforce stringent regulations to ensure ethical compliance in cell sourcing and usage. Additionally, logistical challenges such as cell viability during transport, limited donor availability, and high storage costs complicate the large-scale adoption of cell separation in therapeutic applications. Certain religious and cultural beliefs also influence public acceptance of stem cell-based treatments, leading to restrictions in specific regions. Overcoming these barriers requires transparent ethical guidelines, advancements in synthetic and induced pluripotent stem cell technologies, and improved biobanking infrastructure to ensure a sustainable and ethical supply of high-quality cells for research and clinical applications.

Opportunities

-

Advancements in 3D Cell Culture and Organoid Development Expand the Scope of Cell Separation Applications

The rise of 3D cell culture and organoid development is revolutionizing biomedical research, creating opportunities for cell separation technologies to support drug discovery, toxicology testing, and disease modeling. Organoids—miniature, lab-grown organ-like structures—require the isolation of specific stem cells or differentiated cells for precise tissue modeling. Cell separation techniques such as density gradient centrifugation, magnetic sorting, and dielectrophoresis are critical in selecting high-purity cells for bioengineered tissues. Pharmaceutical companies and research institutions, including the Harvard Stem Cell Institute and the Mayo Clinic, are leveraging organoid models to study complex diseases such as Alzheimer’s, liver fibrosis, and COVID-19. The ability to generate patient-specific organoids using precision cell separation is also advancing personalized medicine and regenerative therapies. As demand for physiologically relevant 3D models grows, cell separation technologies will play a vital role in the development of next-generation drug screening platforms, presenting significant opportunities for market expansion.

Challenge

-

Risk of Cell Contamination and Loss During Separation Process in Clinical Applications

One of the biggest challenges in the cell separation market is the risk of cell contamination and loss during the separation process, particularly in clinical and therapeutic applications. Contamination can occur due to improper handling, suboptimal reagent quality, or exposure to non-sterile environments, leading to compromised cell purity and viability. This poses significant risks in regenerative medicine, immunotherapy, and stem cell transplantation, where even minimal contamination can result in immune rejection, infection, or treatment failure. Moreover, traditional separation techniques like density gradient centrifugation and filtration often lead to cell loss or mechanical stress, reducing the number of viable cells available for downstream applications. Regulatory agencies such as the U.S. Food and Drug Administration (FDA) and European Medicines Agency (EMA) impose strict quality control guidelines to mitigate contamination risks, but achieving consistently sterile and loss-free separation remains a major challenge. Addressing this issue requires investments in closed-system separation technologies, real-time contamination monitoring, and improved handling protocols to ensure safe and effective cell-based therapies.

Segmental Analysis

By Product

Consumables dominated the Cell Separation Market in 2023 with a market share of 50.3%, with Reagents, Kits, Media, and Sera as the leading subsegment. The dominance of consumables is driven by their high demand in research and clinical applications, requiring frequent replenishment for effective cell separation. Reagents, kits, media, and sera are essential for maintaining cell viability, enhancing separation efficiency, and ensuring reproducibility in experiments. The growing investment in biotechnology and pharmaceutical research, coupled with an increasing number of stem cell and immunotherapy studies, has significantly contributed to the segment’s growth. According to the National Institutes of Health (NIH), federal funding for cell-based research has been on the rise, leading to increased purchases of high-quality consumables by academic and pharmaceutical institutions. Additionally, companies like Thermo Fisher Scientific and Merck KGaA have expanded their product lines of advanced reagents and sera to meet growing research demands. The frequent use of consumables compared to durable instruments ensures a steady revenue stream, making this segment the clear market leader in 2023.

By Cell Type

Animal Cells dominated the Cell Separation Market in 2023 with a market share of 54.5%, with Differentiated Cells as the leading subsegment. Animal cells are widely used in vaccine production, pharmaceutical testing, and genetic engineering, making them crucial in the biopharmaceutical and research industries. The demand for differentiated cells, including hepatocytes, myocytes, and fibroblasts, has increased due to their applications in drug screening, disease modeling, and toxicity testing. Regulatory bodies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) require extensive preclinical testing of new drugs using animal-derived cell lines before human trials. The surge in biopharmaceutical production and vaccine development, including COVID-19 vaccines, has further boosted the demand for high-quality differentiated cells. Leading biotechnology firms such as Lonza Group and ATCC supply standardized animal cell lines to research institutions and pharmaceutical companies. With the expansion of biologics, cell-based assays, and tissue engineering, the use of differentiated animal cells remains a key driver of market dominance.

By Cell Source

Adipose Tissue dominated the Cell Separation Market in 2023 with a market share of 40.2%. The increasing adoption of adipose-derived stem cells (ADSCs) in regenerative medicine, cosmetic procedures, and tissue engineering has driven the demand for adipose tissue as a primary cell source. ADSCs have shown higher proliferation rates and multipotency, making them ideal for wound healing, musculoskeletal repair, and cardiovascular therapy. According to the International Society for Stem Cell Research (ISSCR), ADSCs have gained regulatory approval for clinical trials in regenerative medicine and autologous cell therapies. Their ease of extraction compared to bone marrow stem cells further boosts their preference among researchers and clinicians. Companies such as Cytori Therapeutics and Stempeutics Research have been actively developing ADSC-based therapies for osteoarthritis, myocardial infarction, and soft tissue regeneration. The growing demand for minimally invasive cosmetic enhancements and cell-based therapies continues to solidify adipose tissue as the leading source in the cell separation market.

By Technique

Centrifugation dominated the Cell Separation Market in 2023 with a market share of 55.1%. The technique's efficiency in isolating high-purity cells with minimal contamination has made it the most widely used method in clinical research, pharmaceutical manufacturing, and biotechnology applications. Centrifugation is a fundamental technique in laboratories and is preferred for its affordability, scalability, and ability to separate large volumes of cells quickly. According to the American Association for Clinical Chemistry (AACC), centrifugation remains the gold standard for cell separation in blood banking, plasma fractionation, and in vitro diagnostics. Major players such as Beckman Coulter and Eppendorf continue to innovate high-speed and automated centrifugation systems, improving processing times and efficiency in clinical workflows. The high adoption rate across hospitals, research institutes, and biopharmaceutical companies ensures that centrifugation remains the dominant technique in the cell separation market.

By Application

Biomolecule Isolation dominated the Cell Separation Market in 2023 with a market share of 35.8%. The increasing use of cell-derived biomolecules such as proteins, nucleic acids, and extracellular vesicles in drug development, diagnostic assays, and biomedical research has driven demand for cell separation technologies. Pharmaceutical companies use biomolecule isolation to develop monoclonal antibodies, recombinant proteins, and gene therapy products. Government-backed initiatives, such as the Human Cell Atlas Project, have further fueled investments in advanced biomolecule separation techniques to support precision medicine and cancer research. Companies like QIAGEN and Bio-Rad Laboratories have introduced next-generation isolation kits and automated platforms to improve yield and purity, accelerating their adoption in both academic and industrial settings.

By End User

Pharmaceutical & Biotechnology Companies dominated the Cell Separation Market in 2023 with a market share of 48.7%. These companies extensively use cell separation for drug discovery, regenerative medicine, and biopharmaceutical production. The surge in cell-based immunotherapies, stem cell research, and vaccine development has driven investments in advanced cell separation technologies. Organizations such as the Biotechnology Innovation Organization (BIO) have reported an increase in clinical trials involving cell-based therapies, fueling demand for highly efficient cell isolation systems. Leading biopharma firms like Pfizer, Novartis, and Roche have expanded their R&D efforts in cell-based biologics, further solidifying the dominance of this segment.

Regional Analysis

North America dominated the Cell Separation Market in 2023 with a market share of 40.2%, with the United States leading the region. The dominance is attributed to robust research funding, strong presence of biopharmaceutical companies, and advanced healthcare infrastructure. The National Institutes of Health (NIH) and the Biomedical Advanced Research and Development Authority (BARDA) have significantly invested in cell therapy research and regenerative medicine, boosting the adoption of cell separation technologies. The U.S. leads in clinical trials for cell-based therapies, with organizations such as the California Institute for Regenerative Medicine (CIRM) funding multiple stem cell research projects. Additionally, companies like Thermo Fisher Scientific, BD Biosciences, and Miltenyi Biotec have established manufacturing and R&D hubs in North America, further driving market expansion. Canada has also emerged as a key player, with the Stem Cell Network (SCN) supporting national research initiatives. The presence of cutting-edge biotech startups, strong regulatory support from the FDA, and high adoption of precision medicine continue to reinforce North America’s dominance in the cell separation market.

Moreover, Asia Pacific emerged as the fastest-growing region in the Cell Separation Market, with a significant growth rate during the forecast period of 2024 to 2032, with China and Japan leading the growth. The region's rapid expansion is driven by increasing government investments in biotechnology, rising demand for stem cell therapies, and growing clinical research initiatives. China has launched multiple biotechnology development programs, including the Made in China 2025 initiative, which focuses on advancing biopharmaceutical research. The China National GeneBank and several academic institutions are heavily investing in cell-based therapies, leading to increased demand for cell separation technologies. Japan, with its strong regenerative medicine sector and favorable regulatory policies, has also witnessed a surge in stem cell-based clinical trials. The Japan Agency for Medical Research and Development (AMED) has provided significant funding for cell therapy innovations, attracting major industry players. Additionally, India’s expanding biopharma sector, supported by initiatives like Startup India and the Biotechnology Industry Research Assistance Council (BIRAC), has boosted investments in cell separation technologies. With rising healthcare expenditures, increasing R&D collaborations, and supportive government initiatives, Asia Pacific is set to experience exponential growth in the cell separation market over the coming years.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

-

Agilent Technologies Inc. (Agilent Bioanalyzer System, Agilent Cytogenomics Software)

-

Akadeum Life Sciences Inc. (Microbubble Leukocyte Separation Kit, Microbubble T Cell Isolation Kit)

-

Alfa Laval AB (Separation Systems for Biopharmaceuticals, Disc Stack Centrifuges)

-

BD (Becton, Dickinson and Company) (BD IMag Cell Separation System, BD FACSMelody Cell Sorter)

-

Bio-Rad Laboratories Inc. (S3e Cell Sorter, NGC Chromatography System)

-

Bio-Techne Corporation (EasySep Cell Separation Kits, MagCellect Cell Separation Kits)

-

Corning Incorporated (Corning Cell Strainers, Corning Spin-X Centrifuge Tube Filters)

-

Danaher Corporation (Beckman Coulter MoFlo Astrios Cell Sorter, Cytiva Sepax C-Pro)

-

F. Hoffmann-La Roche Ltd. (Roche MagNA Pure, Cedex Bio HT Analyzer)

-

Lonza Group Ltd. (CliniMACS Prodigy, Nucleofector Technology)

-

MagBio Genomics (Blood STASIS DNA Tubes, MagQuant Magnetic Beads)

-

Merck KGaA (Ficoll-Paque PREMIUM, Millex Syringe Filters)

-

Miltenyi Biotec (MACS MicroBeads, autoMACS Pro Separator)

-

PerkinElmer Inc. (Revvity) (chemagic MSM I, Cellaca MX High-Throughput Cell Counter)

-

Promega Corporation (Hematopur Cell Processing System, CelLuminate Assays)

-

QIAGEN NV (QIAcube, QIAcell Advanced Cell Isolation System)

-

Sartorius AG (Ambr 250 High-Throughput Bioreactor, Sartoflow Alpha Plus Cell Processing System)

-

STEMCELL Technologies Inc. (RoboSep Automated Cell Separator, EasySep Cell Separation Kits)

-

Terumo Corporation (Spectra Optia Apheresis System, Terumo BCT COBE 2991 Cell Processor)

-

Thermo Fisher Scientific Inc. (Dynabeads Magnetic Beads, Attune NxT Flow Cytometer)

Recent Developments

-

January 2025: Akadeum presented the Alerion system at Advanced Therapies Week 2025, gaining strong industry interest. Recognized for improving cell isolation, it was a finalist for the Tech Disruptor of the Year Award.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 9.55 Billion |

| Market Size by 2032 | USD 30.15 Billion |

| CAGR | CAGR of 13.63% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product (Consumables [Reagents, Kits, Media, and Sera, Beads, Disposables], Instruments [Centrifuges, Flow Cytometers, Filtration Systems, Magnetic-activated Cell Separator Systems (MACS)] •By Cell Type (Human Cells [Differentiated Cells, Stem Cells], Animal Cells) •By Cell Source (Adipose Tissue, Bone Marrow, Cord Blood/Embryonic Stem Cells, Others) •By Technique (Centrifugation, Surface Marker, Filtration) •By Application (Biomolecule Isolation, Cancer Research, Stem Cell Research, Tissue Regeneration, In Vitro Diagnostics, Others) •By End User (Pharmaceutical & Biotechnology Companies, Academic & Research Institutes, Hospitals & Diagnostic Laboratories, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Thermo Fisher Scientific Inc., BD (Becton, Dickinson and Company), Danaher Corporation, Merck KGaA, Miltenyi Biotec, STEMCELL Technologies Inc., Bio-Rad Laboratories Inc., Terumo Corporation, Agilent Technologies Inc., Sartorius AG and other key players |