Cellular Modem Market Size & Growth Analysis:

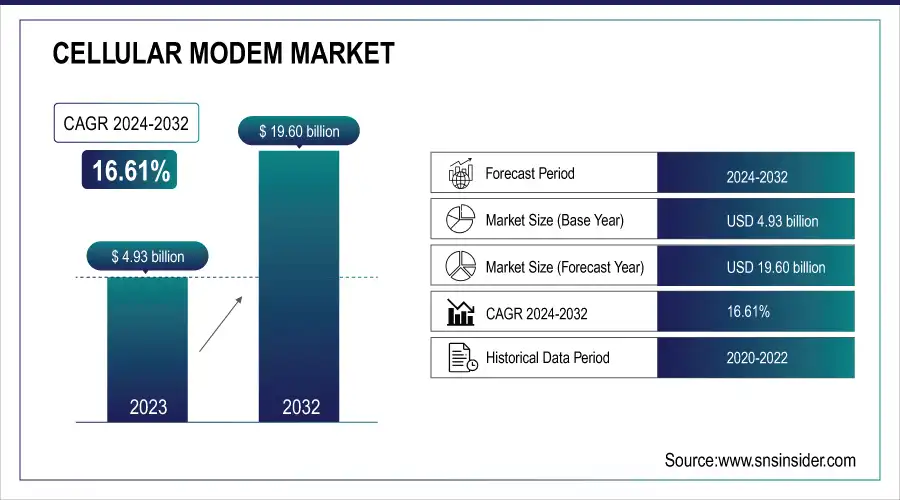

The Cellular Modem Market was valued at USD 4.93 billion in 2023 and is expected to reach USD 19.60 billion by 2032, growing at a CAGR of 16.61% over the forecast period 2024-2032.

Cellular Modem Market Specific changes in fables utilization driven by continuous demand for embedded and multi-mode modem units across the IoT, automotive, and industrial applications segment are impacting rapidly the Cellular Modem Market. Increasing scalability utilization diversified and exponential growth supported with superior benefits creates a favorable growth trend of transition from 4G LTE to new era technologies like 5G and LPWAN that brings the most of advantages of connectivity in terms of faster and reliable connectivity. These modems are designed to use as little power as possible while offering as much performance as possible (ideal for battery-powered and remote devices). Also, firmware updating is more common, and some devices, particularly at the high end, receive over-the-air updates at least every few months to address security, compatibility, and functionality needs. U.S. 5G mid-band coverage was greater than 210M people in 2024, and LTE-M and Cat 4 maintained their dominance in IoT module deployments. The data also revealed 92% smartphone penetration indicating healthy device-connected trends.

To Get more information on Cellular Modem Market - Request Free Sample Report

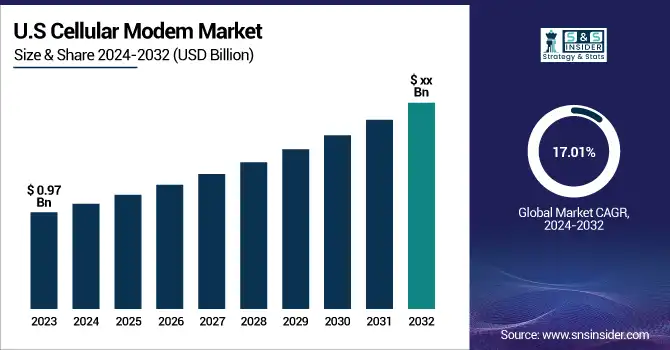

The U.S. Cellular Modem Market is estimated to be USD 0.97 Billion in 2023 and is projected to grow at a CAGR of 17.01%. The U.S. Cellular Modem Market is driven by rapid communications development of 5G infrastructure in the country, increasing prevalence of connected devices across the automotive and healthcare sectors, growing requirement for high-speed mobile internet amidst a rising population, and advancements to support increasing IoT applications. The ongoing digital transformation across industries is further boosting the integration and innovation of modems.

Cellular Modem Market Dynamics

Key Drivers:

-

Rising IoT Adoption and 5G Deployment Accelerate Cellular Modem Integration Across Key Industry Verticals

The growing IoT and M2M communication in various industries like automotive, manufacturing, and healthcare is significantly driving the cellular modem market. As the number of connected devices expands, demand for dependable, high-speed wireless connectivity is on the rise, and cellular modems cover such needs seamlessly. In addition, the deployment of 5G networks is driving a transition from wireline to wireless infrastructures, which in turn enhances the penetration of embedded modems into smart devices, cars, and industrial equipment. Furthermore, governmental projects and programs designed to promote smart city development, remote monitoring, and digital transformation across industries also contribute to market growth.

Restrain:

-

Legacy System Challenges and Connectivity Gaps Hinder Seamless Growth of Cellular Modem Market

one of the key restraints impacting the growth of the cellular modem market is the integration complexity of modems with legacy systems, especially for industrial and infrastructure applications. Numerous enterprises are still using older gear designed long before existing cellular technologies were even thought of, which would make upgrading, both technically and in terms of time, an arduous process. Moreover, issues of network availability and dependability, particularly in isolated or less-developed areas, can restrict adoption. Even with the move to 4G and 5G networks, poor connectivity in some areas would be a potential danger for applications that demand reliable and stable communication.

Opportunity:

-

Rising Automation and Industry 4.0 Adoption Unlock New Opportunities for Cellular Modem Innovation Globally

Cellular modem manufacturers are presented with high prospects for growth with the increasing need for automation across industries and increasing penetration of Industry 4.0 in developing economies. Compact, low-power and high-performance cellular modules are starting to catch on as industries dealing with remote data transmission gain a foothold, particularly in agriculture, energy, and healthcare applications. In addition, progress in LPWAN technologies and reduction in cellular connectivity solution costs will also drive new applications in rural and underdeveloped geographies. For ultra-low latency, mission-critical applications, the evolution from 5G to beyond provides opportunities for new designs for modems that can come many years down the road.

Challenges:

-

Security Concerns and Rapid Tech Shifts Challenge Cellular Modem Deployment in Sensitive Industry Environments

Cellular modems are most accurate for cellular networks, but using them in sensitive sectors such as healthcare, finance, and government poses a major challenge due to security and data privacy issues. With modems more integrated into a larger ecosystem of connected devices, the potential for things like cyberattacks, data breaches, and unauthorized access is increasing. Implementing end-to-end encryption, enabling secure firmware updates, and complying with local data protection laws are requirements that can be technically challenging. On top of that, technological advancements move fast and the markets are dynamic with short lifecycles as well as the solutions for competitive needs, meaning that products need to be innovatively redesigned continuously to stay competitive. This challenge is further aggravated by the requirement of interoperability with multiple networks and the need to comply with various countries and regions, making product development and deployment more challenging.

Cellular Modem Industry Segmentation Analysis

By Type

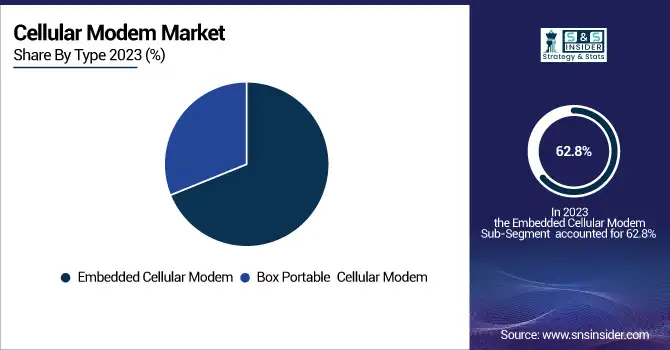

The Embedded Cellular Modem segment accounted for 62.8% of the total market in 2023. The demand for compact, power-efficient solutions that can be integrated into devices has led to their adoption in automotive, industrial, and IoT applications. They provide real-time data transmission, remote monitoring, and machine (M2M) communication, which suits industries adopting digital transformation and automation.

Box Portable Cellular Modem is expected to grow at the highest CAGR from 2024 to 2032. These traditional PBXs are growing largely because of the flexibility of their plug-and-play capabilities and the increasing demand for mobile professionals, enterprises, and field service operations. Box portable modems are as box practical oftentimes to be, and arsenic accelerating High-Speed Internet Passage continues to beryllium successful tremendous demand, especially successful locations where fixed infrastructure is limited. Their simplicity of deployment and functionality across many networks make them ideal for mobile and temporary connections.

By Technology

In 2023, the 4G LTE segment hold the largest share, accounting for 53.5% of the cellular modem market. The reason for its supremacy lies in the mature infrastructure, extensive global availability, and the fact that it has proven reliable for decades in different applications from consumer electronics and automotive systems to industrial automation. While 4G LTE is a mature technology, offering an optimal combination of performance, latency, and power consumption, it still underpins the majority of connected devices.

The fastest growth rate for the 5G market (CAGR from 2024 to 2032) is expected due to the rapid shift of the market towards 5G. Advanced applications requiring ultra-low latency, high bandwidth, and real-time connectivity, such as autonomous vehicles, remote surgeries, and smart cities, are propelling 5G adoption. While telecom operators are increasing 5G network infrastructures and device makers are incorporating 5G-capable modems, this will enable higher-than-ever performance and performance levels in mission-critical and high bandwidth environment use cases.

By Vertical

In 2023, the Automotive & Transportation segment held the largest cellular modem market share at 26.3%. This is primarily due to the growing adoption of cellular connectivity as a used solution across connected vehicles, telematics, fleet management systems, and automotive infotainment systems. As digital technologies are increasingly adopted by the automotive industry in the interest of safety, navigation, and remote diagnostics, automotive manufacturers have embedded cellular modems and other types of sensors to facilitate real-time information exchange on the fly.

The Industrial & Manufacturing segment is projected to exhibit the highest CAGR from 2024 to 2032. Strong low-latency cellular connectivity is in high demand driven by the proliferation of Industry 4.0 and smart factories that leverage automation and robotics. Cellular modems are emerging as a lighthouse for predictive maintenance, remote monitoring, and the ability to control industrial machinery in real time. Cheap cellular modems are needed to facilitate the rising use of mobile broadband as manufacturers converge on operational efficiency, pushing out digital transformation initiatives inside factories to connected and intelligent production environments.

Cellular Modem Market Regional Outlook

In 2023, the Asia-Pacific cellular modem market led the world with a significant market share of 33.8% complemented by fast-paced industrialization, a foundational consumer electronics segment, and extensive adoption of IoT. The development and adoption of smart infrastructure, connected vehicles, and digital manufacturing are being led by countries such as China, Japan, South Korea, and India. Such as, China has ramped up in enhancing 5G infrastructure and boosting Smart city projects which in turn drove demand for embedded cellular modems. Increasing smartphone penetration and government initiatives like Digital India have fast-tracked the adoption of cellular connectivity across sectors including agriculture, healthcare, and transport in communities both urban and rural.

Get Customized Report as per Your Business Requirement - Enquiry Now

The region that is expected to register the highest CAGR during the forecast period from 2024 to 2032 is North America, which is a result of major investments in advanced technologies, early adoption of 5G, and a growing ecosystem of connected devices. In particular, the U.S. is seeing more and more cellular modems in vehicles, industry automation, and telehealth. And like Tesla which uses embedded cellular connectivity for live vehicle updates and remote diagnostics, Verizon and AT&T are deploying 5G infrastructure to enable IoT and smart manufacturing efforts. The expansion of such high-speed connectivity solutions is anticipated to promote significant regional penetration.

Key players Listed in the Cellular Modem Market are:

-

Qualcomm (Snapdragon X75)

-

MediaTek (T800 5G Modem)

-

Intel (XMM 7560)

-

Samsung (Exynos Modem 5300)

-

Huawei (Balong 5000)

-

Apple (Apple 5G Modem - in development)

-

UNISOC (V510)

-

Sierra Wireless (EM9191 5G)

-

Telit Cinterion (FN980m)

-

Quectel (RM520N-GL)

-

Thales (PLS83-W)

-

u-blox (TOBY-R510)

-

Cavli Wireless (C10GS)

-

Fibocom (FM150-GL)

-

Nordic Semiconductor (nRF9160).

Recent Trends

-

In March 2025, Qualcomm unveiled its latest X85 5G Modem-RF, featuring AI-enhanced performance with peak download speeds of 12.5 Gbps and support for global 5G bands.

-

In February 2025, MediaTek launched its M90 5G-Advanced modem, featuring AI-powered enhancements, dual 5G SIM support, and peak download speeds of 12Gbps.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 4.93 Billion |

| Market Size by 2032 | USD 19.60 Billion |

| CAGR | CAGR of 16.61% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Embedded Cellular modems, Box Portable Cellular modems) • By Technology (2G, 3G, 4G LTE, 5G, LPWAN) • By Vertical (Agriculture, Automotive & Transportation, Building Automation, Consumer Electronics, Energy & Utilities, Healthcare, Industrial & Manufacturing, Retail, Telecommunications) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Qualcomm, MediaTek, Intel, Samsung, Huawei, Apple, UNISOC, Sierra Wireless, Telit Cinterion, Quectel, Thales, u-blox, Cavli Wireless, Fibocom, Nordic Semiconductor. |