Display Controller Market Size & Growth Trends:

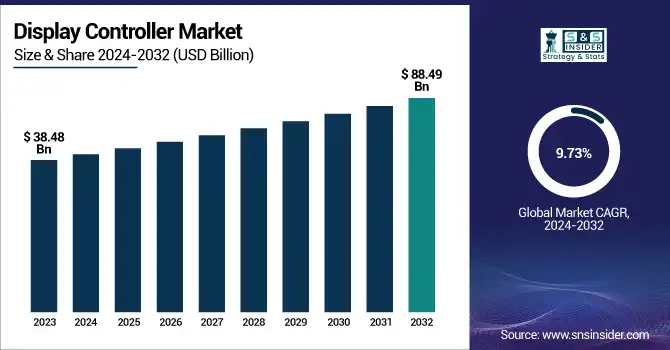

The Display Controller Market was valued at USD 38.48 billion in 2023 and is expected to reach USD 88.49 billion by 2032, growing at a CAGR of 9.73% over the forecast period 2024-2032. Display controller market trends are rapidly advancing with the demands for dual display seamless and seamless multi-display support, high refresh rates, and low power architectures. Fab capacity utilization still, with the ability to drive OLED, LCD, and microLED controllers all on the same optimized production lines of chip drive, remains a key factor.

To Get more information on Display Controller Market - Request Free Sample Report

We are seeing supply chain metrics that show increased demand, semiconductor shortages, and partnerships with other industries to ensure stable sourcing of components. AI-based display controllers are becoming popular with functions such as real-time image enhancement, power efficiency, and adaptive display technologies, creating a new opportunity in emerging markets including automotive, gaming, and smart devices. The U.S. display controller market witnessed a lot of activity, due to the rising adoption of advanced display technologies into increasing applications in consumer electronics and automotive sectors. High-resolution displays spread to other mobile devices like smartphones, tablets, and infotainment systems, spurring the need for advanced display controllers. Display industry insiders such as Texas Instruments and Novatek Microelectronics emphasized innovations for performance and efficiency.

The U.S. Display Controller Market size was valued at USD 7.27 Billion in 2023. One of the major drivers of the U.S. display controller market includes the rising requirement for high-definition displays in consumer electronics such as smartphones, tablets & automotive infotainment systems. A wave of innovations is being driven by new AR/VR, gaming, and AI-driven display technologies. New developmental offerings in OLED, microLED, and energy-efficient controllers are also driving market growth.

Display Controller Market Dynamics

Key Drivers:

-

Rising Demand for Advanced Display Controllers Across Consumer Electronics Automotive Gaming and Industrial Sectors

Growth in the demand for high-performance display solutions in several industries is accelerating the growth of the display controller market. The widespread adoption of consumer electronics from smartphones to tablets, laptops, and smart TVs is still a central force, with various manufacturers embedding OLED, AMOLED, and microLED display tech networks and technologies. Moreover, the automotive industry is seeing increasing applications for digital dashboards, driver assistance systems, and infotainment solutions due to the rise of EVs and self-driving vehicles. The gaming and entertainment industry is also playing a major role there is an increasing demand for high-resolution and multi-display setups (both gaming consoles and VR/AR devices). In addition to this, the growing industrial automation sector, healthcare imaging systems, and aerospace displays are also contributing to the market growth with demand for superior quality visualization to drive operations.

Restrain:

-

Challenges in Display Controller Market Including High-Resolution Processing Multi-Display Synchronization and Power Efficiency

The display controller market faces several key challenges, including the growing complexity of display technologies. However, with the rising consumer demand for 4K, 8K, OLED, and AMOLED displays, manufacturers are struggling to create a controller that can affordably and efficiently process this large amount of graphical data without causing latency problems. Multi-display systems are also common in gaming as well as automotive and industrial applications, but they can be tricky to implement because each screen has to work in a synchronized way, creating a need for advanced processing capabilities. Besides, power consumption and heat dissipation are still challenges, especially in the case of high-end gaming displays, automotive displays, and AR/VR systems where overheating can reduce performance and lifetime.

Opportunity:

-

AI IoT and 5G Driving Smart Displays Growth in Wearables Foldables and Emerging Global Markets

The market opportunities stem from the integration of AI and IoT with smart displays allowing gesture and voice-controlled interfaces across various applications. Advancements in flexible and low-power displays reveal a high growth potential and are most promising for wearable and foldable smartphones. In addition, the increasing use of 5G networks will increase the demand for high-speed, low-latency displays and drive the demand for advanced display controllers. Asia-Pacific and Latin America are also the land of opportunity, with rapid urbanization and digitalization in the region driving demand for next-gen display technologies.

Challenges:

-

Challenges in Display Controller Integration Across Smart Devices Automotive Healthcare and Evolving Interface Technologies

Another key restraining factor is compatibility and integration problems between devices and platforms. With the growing utilization of smart displays, artificial intelligence-enabled interfaces, and internet-of-things (IoT) connected devices, interoperability without friction is a must, and friction is hard because of differences in software and hardware standards as well as communication protocols. In automotive and healthcare applications, the development complexity is compounded by stringent safety and regulatory mandates where display controllers must meet rigorous performance and reliability thresholds. Further, the fast-paced nature of display interface technology evolution amplifies that challenge, forcing manufacturers to stay one step ahead of new trends that arise while also making sure that the products have a long enough lifespan.

Display Controller Industry Segment Analysis

By Type

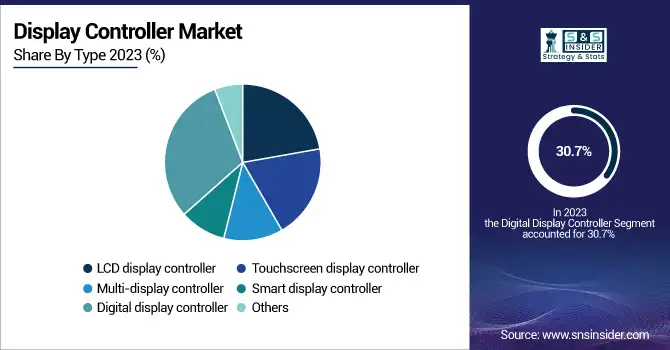

The Digital Display Controller segment held the largest Digital Display Market share in 2023, accounting for 30.7% of the total share. This was supported, in part, by its extensive use in consumer electronics, automotive, industrial automation, and healthcare areas. This was further propelled by increased consideration of high-resolution displays, interactive panels, and multi-display setups. Moreover, continued improvements in AI-enabled machine vision and real-time image processing propelled the segment further, especially for gaming, infotainment, and other medical imaging purposes.

The Smart Display Controller segment is projected to grow at the fastest CAGR from 2024 to 2032, attributed to the growing penetration of AI, IoT, and voice-controlled smart displays. By combining gesture recognition with adaptive brightness control and real-time processing, automotive infotainment systems, smart home devices, and industrial control panels are now offering more and more modules with increased usability within the millimeter band. Smart display controller sales are expected to increase substantially as tablets and other displays move towards increasingly automated, connected, and energy-efficient display solutions.

By End Use

The display controller market was dominated by the Consumer Electronics segment in 2023, which accounted for 33.7% of the total share. This dominance is attributed to the proliferation of smartphones, tablets, laptops, smart TVs, and wearables that require highly integrated display controllers to deliver high-resolution displays and optimized power management. Expansion of this segment was also driven by increasing demand for OLED, AMOLED, and microLED displays, and deployment of AI capability for image enhancement, adaptive refresh rate, and other technology incorporated by manufacturers. In addition, this is largely due to the increase in gaming monitors and AR/VR.

The Aerospace & Defence segment is anticipated to expand at the highest CAGR between 2024 to 2032 owing to rising investments in advanced cockpit displays, military-grade HUDs, and high-resolution surveillance systems. With the increasing demand for rugged, high-performance display controllers in extreme environments and new trends such as AI-powered real-time data visualization in defense applications, the need for innovative and high-quality display solutions rises.

Display Controller Market Regional Outlook

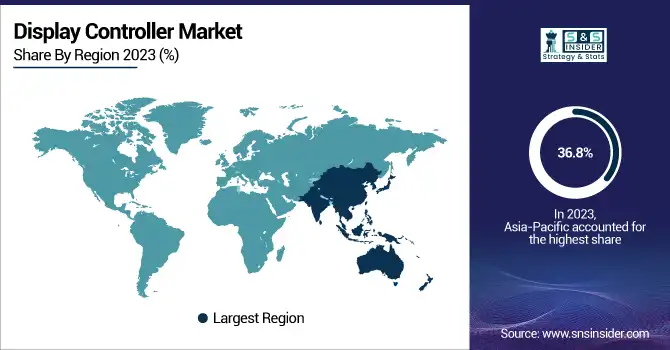

In 2023, Asia-Pacific dominated the display controller market with a 36.8% market share, driven by a massive base of consumer electronics companies, automotive industries, and industrial automation companies in the region. Market expansion was spurred on by China, Japan, South Korea, and India, whilst leading, AMOLED, and microLED companies –the likes of Samsung, LG, Sony, and BOE Technology– helped to push innovative display devices to a wider audience. Asia-Pacific retained the territory lead, thanks to increasing demand for smartphones, smart TVs, gaming monitors, and automotive displays. Besides, automotive manufacturers such as Toyota and Hyundai have incorporated automotive display controllers in their digital dashboards and infotainment systems, which is augmenting market growth. The other big driving factor was how fast China has moved toward EVs, with companies like BYD and NIO adopting advanced display technologies.

During 2024-2032, North America is expected to grow with the highest growth at a CAGR owing to innovations taking place in the automotive, aerospace, and defense display systems. Automakers such as Tesla, Ford, and General Motors are embedding new AI smarts with smart display controllers in next-gen EV/AVs. On top of that Boeing and Lockheed Martin are betting on high-performance cockpit displays, and Mil5790 HUDs, improving their defense feature set. High-refresh-rate and multi-display controllers are also benefiting from demand from the gaming and entertainment sector, including companies such as Microsoft (Xbox) and NVIDIA. The growing consumer demand for next-gen display controllers in smart homes, medical imaging, and industrial automation is expected to propel the growth of the region toward 5G, AI, and IoT adoption.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players Listed in Display Controller Market are:

-

Synaptics (TouchPad)

-

Himax Technologies (CMOS Image Sensors)

-

BOE Technology (LCD Panels)

-

Coretronic Corporation (DLP Projectors)

-

Daktronics (LED Video Displays)

-

AMX LLC (Video Switchers)

-

Texas Instruments (Display Interface ICs)

-

STMicroelectronics (Touchscreen Controllers)

-

NXP Semiconductors (LCD Drivers)

-

Analog Devices (Video Signal Processors)

-

Renesas Electronics (Display Controllers)

-

Parade Technologies (DisplayPort Timing Controllers)

-

Rohm Semiconductor (LED Drivers)

-

Novatek Microelectronics (TFT LCD Drivers)

-

MediaTek (Smartphone Display Chips)

Recent Trends

-

In March 2025, Himax Technologies, Tata Electronics, and PSMC signed an MoU to advance display semiconductor solutions in India, supporting the "Made in India" initiative.

-

In May 2024, BOE Technology showcased AI-powered display innovations and green technology at SID Display Week 2024, featuring glasses-free 3D displays, AIoT applications, and energy-efficient solutions.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 38.48 Billion |

| Market Size by 2032 | USD 88.49 Million |

| CAGR | CAGR of 9.73% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (LCD display controller, Touchscreen display controller, Multi-display controller, Smart display controller, Digital display controller, Others) • By End Use (Aerospace & Defence, Automotive, Consumer electronics, Gaming & entertainment, Healthcare, Industrial control, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Synaptics, Himax Technologies, BOE Technology, Coretronic Corporation, Daktronics, AMX LLC, Texas Instruments, STMicroelectronics, NXP Semiconductors, Analog Devices, Renesas Electronics, Parade Technologies, Rohm Semiconductor, Novatek Microelectronics, MediaTek. |