Lithium Titanate Oxide (LTO) Battery Market Size Analysis:

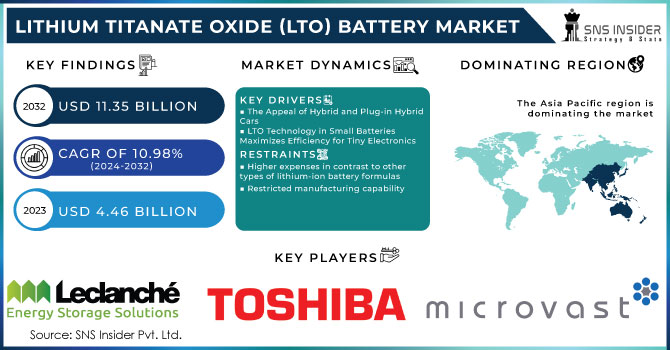

The Lithium Titanate Oxide (LTO) Battery Market size was USD 4.95 billion in 2024 and is estimated to reach USD 11.39 billion by 2032 and grow at a CAGR of 10.98% over the forecast period of 2025-2032. The increasing popularity of industrial automation is fueling the need for high-tech material handling machinery, such as electric vehicles. AGVs, AMRs, and industrial trucks are more frequently using LTO batteries due to their efficiency and environmental advantages. The long cycle life of LTO, which is over 20,000 charges, results in reduced replacements and decreased costs for companies. Moreover, government incentives and regulations are encouraging the use of LTO-powered electric vehicles and clean energy storage solutions. Prevents the development of a solid electrolyte interface layer, which hinders charging speed. As a result, LTO batteries provide quicker charging times and higher output of electricity when necessary. The LTO battery market is forecasted to see substantial growth in the future due to the increasing need for energy storage solutions.

Get More Information on Lithium Titanate Oxide (LTO) Battery Market - Request Sample Report

Advanced energy storage technologies and companies such as Altairnano are leading a transformation in the electricity grid. By offering clean energy storage solutions, they assist utilities in efficiently managing the grid. Utilities adapt traditional power plants (coal, natural gas) to respond to changes in energy generation and demand, a practice known as frequency regulation. This approach is not very effective and can add to carbon emissions. Altairnano's solution is the ALTI-ESS Energy Storage System, a smart and scalable platform that uses cutting-edge lithium-titanate technology. It reacts immediately to grid alterations by absorbing or emitting energy, reducing dependence on traditional power sources. Their focus group consists of utility companies, energy service providers, and different grid operators. The ALTI-ESS comes with remarkable characteristics: a peak discharge of 1400 amps, excellent effectiveness (86% for 1MW discharge), extended durability (over 12,000 cycles and 15 years), and flexibility with 1MW/250kWh setups. These systems have a battery management system, inverter, power electronics, controllers, and software for smooth grid connection. Essentially, Altairnano's cutting-edge energy storage solutions are enabling utilities to achieve sustainable and cost-effective grid management.

Lithium Titanate Oxide (LTO) Battery Market Highlights:

-

Growing demand for hybrid and plug-in hybrid electric vehicles (PHEVs) is boosting LTO battery adoption due to their fast charging, long lifespan, and durability.

-

Government incentives, subsidies, and initiatives like India’s "GO Electric" and the global "EV30@30" campaign are promoting cleaner transportation and increasing LTO battery demand.

-

LTO battery technology is being optimized for small electronic devices, offering space-efficient designs, longer lifespan, and faster charging for gadgets such as smartphones, wearables, and medical devices.

-

LTO batteries provide reliable energy storage solutions for renewable energy integration, supporting grid stability and sustainable energy goals.

-

The high cost of raw materials (lithium and titanium) and specialized manufacturing processes is a key restraint, limiting adoption in price-sensitive industries.

-

Advances in production efficiency and scaling are expected to reduce costs, making LTO batteries more accessible for broader applications in EVs, electronics, and renewable energy storage.

Lithium Titanate Oxide Battery Market Drivers:

- The Appeal of Hybrid and Plug-in Hybrid Cars

This is increasing the popularity of a specific type of battery known as LTO. Rising environmental worries, along with government backing such as subsidies, tax incentives, and tougher emission rules, are boosting the worldwide PHEV industry. Public outreach efforts like India's "GO Electric" and the global "EV30@30" initiative are informing customers about the advantages of PHEVs compared to conventional vehicles. More and more people are choosing electric cars that can also use gasoline (hybrids). These cars need special batteries that last a long time and charge quickly. LTO batteries are perfect for this because they are tough and can refuel fast. As more people switch to hybrids, the demand for LTO batteries is growing, helping the environment by making transportation cleaner.

- LTO Technology in Small Batteries Maximizes Efficiency for Tiny Electronics

The continuous reduction in size of electronic devices poses a perpetual dilemma on how to fit expanding features into smaller areas. This holds especially true for batteries, an essential part that frequently takes up important space in a device. Progress in LTO battery technology is providing a ray of hope. Nichicon SLB Series as an illustration. In contrast to old-fashioned LTO batteries with bulky mounting brackets, the SLB Series has longer leads for direct soldering onto circuit boards. This helps to avoid using additional parts and reduces the amount of unused space, making them ideal for the limited space found in today's electronic devices. The advantages of these space-efficient LTO batteries go well beyond just their small size. They also excel in performance, with longer lifespans that greatly reduce the frequency of replacements required. LTO batteries provide faster charging speeds than conventional lithium-ion batteries, ensuring your devices stay powered for extended periods of time. The space-efficient design, impressive functionality, and durability of LTO batteries are revolutionary for producers of small electronic gadgets. LTO technology has the potential to transform the design and power of our everyday gadgets, from smartphones and wearables to hearing aids and medical devices.

LTO Battery Market Restraints:

- Higher expenses in contrast to other types of lithium-ion battery formulas

The considerable obstacle to broader adoption is the expensive price of LTO batteries. This originates from the two primary factors raw materials and production. LTO batteries necessitate high-quality lithium and titanium, increasing material expenses. The manufacturing process requires specific methods and materials, adding to the overall cost. This increased expense poses a significant obstacle in price-conscious industries such as consumer electronics and electric vehicles. In these industries, the high initial cost of LTO batteries can be a barrier, since other lithium-ion options provide comparable performance at a lower cost. Despite its potential benefits like longer lifespan, consumers and manufacturers are not as inclined to choose LTO, but this does not diminish the future potential of LTO batteries. With the increase in production and improved manufacturing efficiency, it is anticipated that the cost will decrease, making LTO a more feasible choice for different uses.

- Restricted manufacturing capability

Special batteries called LTO batteries are great for many things because they last a long time and charge quickly. But right now, it's hard to find them because not many are made, kind of like rare diamonds. This makes them expensive and not very common yet. However, as more people want these LTO batteries, factories will likely make more of them. This will bring the price down and make them easier to find, allowing more people to use this cool battery technology.

Lithium Titanate Oxide (LTO) Battery Market Segment Analysis:

By Capacity

Above 10,000 mAH is the dominating segment with 55% of market share in Lithium Titanate Oxide (LTO) batteries market The high-capacity segment (above 10,000 mAh) is the dominant force in the LTO battery market, perfect for applications that require extended lifespans and large capacities. This is clear in electric buses, commercial vans, and high-performance EVs as these batteries improve both range and longevity. Grid storage and backup power systems depend on high-capacity LTO batteries to handle changing energy demands and unforeseen events. The increasing demand for commercial EVs and the incorporation of renewable energy sources are driving the growth of this sector. Grid storage systems and backup power solutions depend greatly on these durable batteries to manage changing energy needs and sudden power failures. Big businesses are using more electric vehicles (EVs), and more energy is coming from the sun and wind. Because of this, the need for big LTO batteries is growing even faster. As more companies use electric vehicles and clean energy becomes more popular, these big LTO batteries will likely be important for a long time.

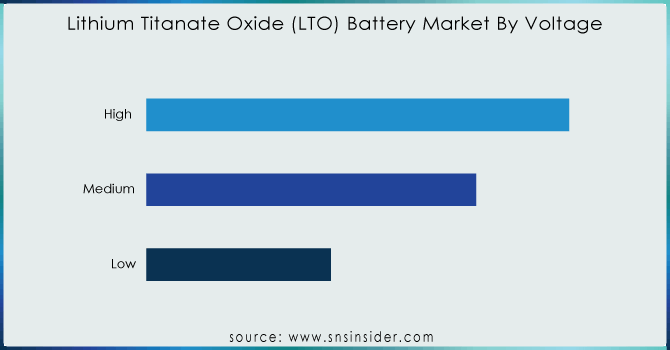

By Voltage

By Voltage, High voltage is dominating segment with 45% of market share in Lithium Titanate Oxide (LTO) batteries market high voltage powerhouse is designed for tasks that require high power and a long reach. High voltage LTO batteries are the preferred option for applications requiring efficiency and long-lasting performance, such as faster charging in electric vehicles and powering equipment in marine, aerospace, and industrial automation sectors. High voltage LTO batteries are also the preferred power source for equipment in challenging industries such as marine, aerospace, and industrial automation. High voltage LTO batteries are expected to continue being dominant in the LTO battery market due to the focus on efficiency and uptime in these industries.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Lithium Titanate Battery Market Regional Analysis:

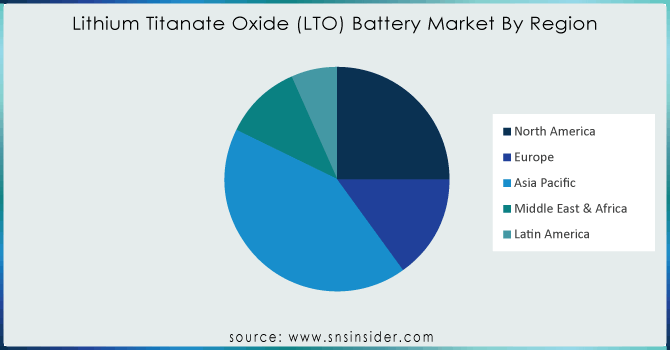

Asia-Pacific Lithium Titanate Oxide (LTO) Battery Market Trends

Asia-Pacific dominates the largest share market with 50% of market share. The Asia Pacific region is at the forefront of the LTO battery market because of the increasing popularity of electric vehicles and a strong emphasis on clean energy. Government initiatives to integrate solar and wind energy into the energy system require dependable long-term energy storage driving growth in the region. The growing electric vehicle (EV) sector and a powerful drive for sustainable energy options. The rising appeal of EVs leads to a high need for batteries that last longer and charge quicker, a need met by LTO batteries. Reliable long-term storage solutions are required for government efforts to incorporate renewable energy sources such as solar and wind into the power grid. LTO batteries, known for their impressive long lifespan and capacity to manage varying energy needs, are proving to be a game-changer for the area's goals in clean energy. The combination of these factors establishes Asia Pacific as the clear frontrunner in the LTO battery market.

North America Lithium Titanate Oxide (LTO) Battery Market Trends

The market for lithium Titanate oxide batteries in North America is quickly growing, showing a 20% increase. Government support for electric vehicles and investment in clean energy infrastructure. The government is giving people money to buy electric cars, which makes them more appealing. This is good news for a special type of battery called LTO! LTO batteries charge super-fast and last a long time, perfect for electric cars. Another reason LTO batteries are getting more popular is the rise of clean energy sources like solar and wind. These sources don't always produce the same amount of energy, so we need ways to store it. LTO batteries can handle these ups and downs, making them valuable for North America's switch to cleaner energy! In short, government support for electric cars and the rise of clean energy are making LTO batteries more important than ever.

Europe Lithium Titanate Oxide (LTO) Battery Market Trends

Europe shows steady growth in the LTO battery market, driven by strong government policies promoting electric mobility and renewable energy integration. Increasing EV adoption, along with initiatives for energy storage solutions to stabilize the grid, are creating significant opportunities for LTO batteries. Their reliability, fast charging, and long cycle life make them a preferred choice for the region’s clean energy and transportation goals.

Latin America Lithium Titanate Oxide (LTO) Battery Market Trends

Latin America’s LTO battery market is expanding due to increasing EV adoption and renewable energy projects. Governments are encouraging clean energy use, creating demand for reliable energy storage solutions. LTO batteries’ long lifespan, quick charging capabilities, and adaptability to varying energy demands make them an attractive option to support the region’s sustainable energy transition.

Middle East & Africa LTO Battery Market Trends

The Middle East & Africa region is gradually adopting LTO batteries, driven by growing investments in renewable energy projects such as solar farms and wind installations. LTO batteries’ ability to withstand high temperatures, offer long life, and provide stable energy storage makes them suitable for the region’s harsh environmental conditions. Government initiatives to diversify energy sources are further boosting market growth.

Lithium Titanate Battery Companies are:

-

Toshiba Corporation

-

Leclanché SA

-

Gree Altairnano New Energy Inc.

-

Clarios

-

AA Portable Power Corp

-

LiTech Power Co., Ltd.

-

Nichicon Corporation

-

Zenaji Pty Ltd.

-

Panasonic Corporation

-

BYD Company Ltd.

-

Hitachi Chemical Co., Ltd.

-

Samsung SDI Co., Ltd.

-

EAS Batteries Co., Ltd.

-

Faradion Limited

-

A123 Systems, LLC

-

Sinopoly Battery Limited

-

Microtex Energy Pvt. Ltd.

-

Boston-Power, Inc.

Lithium Titanate Oxide (LTO) Battery Market Competitive Landscape:

Nichicon Corporation, established in 1950 in Japan, is a leading manufacturer of capacitors, batteries, and electronic components. The company specializes in high-performance lithium-ion and LTO batteries, offering reliable, long-lasting energy solutions for consumer electronics, industrial applications, and renewable energy systems. Nichicon is recognized for innovation and quality in energy storage.

-

In June 2023 To help companies design products that use small, rechargeable lithium Titanate batteries (like those in the SLB series, Nichicon released evaluation boards in June 2023. These boards simplify the process by letting engineers set up a power supply. All they need to do is put the SLB battery on the board and connect it to a device that generates power from the environment (like solar panels or wind turbines).

EVage Motors, founded in 2020 in India, is an electric vehicle startup specializing in all-electric commercial trucks. Their flagship FR8 delivery van, built on the proprietary 4ME modular chassis, features lightweight construction, ultra-fast charging, and long battery life. EVage aims to revolutionize last-mile logistics with sustainable, efficient EV solutions.

-

In November 2022 Last Mile Electric Vehicle company EVage Recently partnered With Toshiba for Supply of rechargeable lithium ion cells which will allow it to build the first million mile battery that can be charged within 20 minutes. They are the first who deploy lithium titanium oxide ( LTO) cells into commercial delivery vans.

Leclanché SA, founded in 1909 and headquartered in Yverdon-les-Bains, Switzerland, is a leading provider of high-quality energy storage solutions. The company specializes in lithium-ion and lithium-titanate oxide (LTO) cells, offering integrated battery systems for e-mobility, stationary energy storage, and specialty applications. With over 110 years of innovation, Leclanché is the only listed pure-play energy storage company globally, combining German engineering with Swiss quality

-

In June 2021, Leclanché SA introduced an M3 power module with high energy and power density compared to the previous module. The company’s module offers a very-high cycle life of up to 20,000 cycles (LTO) or 8,000 cycles (G/NMC), significantly reducing total ownership cost, making it ideal for commercial applications.

| Report Attributes | Details |

| Market Size in 2024 | USD 4.95 Billion |

| Market Size by 2032 | USD 11.39 Billion |

| CAGR | CAGR of 10.98% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Capacity ( Below 3,000 MAH, Above 10,000 MAH, 300-10,000 MAH) • By Voltage ( Low, Medium , High) • By Application (Consumer Electronics , Automotive, Aerospace, Marine, Medical, Industrial, Power, Telecommunication) • By Material (Lithium ,Titanate, Graphite, Metal Oxide) • By Component [ Electrodes( Cathode, Anode), Electrolytes] |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Microvast Holdings, Inc., Toshiba Corporation, Leclanché SA, Gree Altairnano New Energy Inc., Clarios, AA Portable Power Corp, Log9 Materials, LiTech Power Co., Ltd., Nichicon Corporation, Zenaji Pty Ltd., Panasonic Corporation, BYD Company Ltd., Hitachi Chemical Co., Ltd., Samsung SDI Co., Ltd., EAS Batteries Co., Ltd., Faradion Limited, A123 Systems, LLC, Sinopoly Battery Limited, Microtex Energy Pvt. Ltd., Boston-Power, Inc. |