5G Equipment Market Size & Trends:

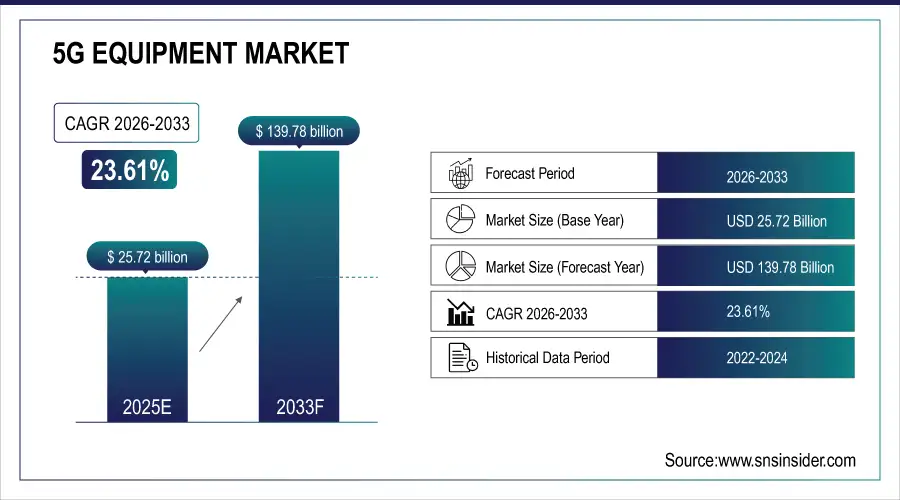

The 5G Equipment Market size was valued at USD 25.72 billion in 2024 and is expected to reach USD 139.78 billion by 2032, growing at a CAGR of 23.61% over the forecast period of 2025-2032.

5G Equipment Market trends are driven by increasing deployment of small cells, massive MIMO, and mmWave technologies. Growing enterprise demand for private 5G networks and AI-based network optimization also fuels adoption.

The global 5G Equipment market is witnessing remarkable growth owing to the rising demand for ultra-fast & low latency communication to support advanced technologies such as IoT, autonomous vehicles, smart cities and Industry 4.0. Shifting focus of telecom operators towards 5G networks helped to grow market rapidly along with the increasing demand of mobile data traffic and favorable government initiatives. The increase in demand for cloud-native and software-defined networking solutions is adding flexibility and scalability, helping make 5G deployments more efficient and cost-effective across industries and regions of the world, too.

To Get more information on 5G Equipment Market - Request Free Sample Report

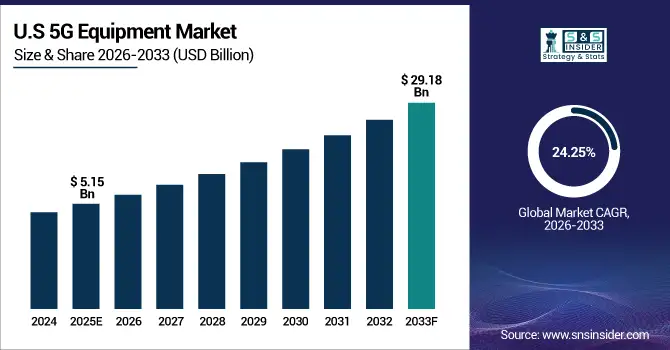

U.S. telecom operators collectively invested over USD 35 billion in 5G infrastructure in 2024, including spectrum acquisition, core network upgrades, and small cell expansion.

The U.S. 5G Equipment Market size was valued at USD 5.15 billion in 2024 and is expected to reach USD 29.18 billion by 2032, growing at a CAGR of 24.25% over the forecast period of 2025-2032. The U.S. 5G Equipment Market is growing due to increased investments by telecom giants, rising demand for high-speed connectivity, private 5G adoption, and expansion of smart infrastructure and autonomous technologies.

5G Equipment Market Dynamics:

Drivers:

-

Rising Tech Adoption and Government Support Accelerate Global 5G Equipment Demand and Infrastructure Evolution

Demand for high-speed, low-latency communication is on the rise to facilitate the use of emerging technologies including IoT, augmented reality (AR), autonomous vehicles, and smart cities, which is a major driver of the global 5G Equipment market. Telecom operator is updating the infrastructure quickly with growing demand for data consumption and user expectations. Additionally, the growth of 5G is also driven by supportive government actions in the shape of spectrum auctions, R&D funding, and digital transformation programs. Moreover, the evolution toward software-defined networking and virtualization is facilitating more flexible, cost-effective 5G deployment.

Verizon and AT&T expanded 5G Ultra-Wideband coverage to over 100 million people in the U.S. by early 2025, with thousands of new small cell installations.

Restraints:

-

Integration Challenges and Spectrum Disparities Hamper Seamless Global Deployment of 5G Equipment and Networks

The complexity of network integration and interoperability between different vendors and legacy systems (one of the key restraints in the 5G Equipment Market) Maintaining performance, signalling handovers, and continuity when transitioning between 4G and 5G is a major area of technical complexity for both capacities. Furthermore, the disparity between global and domestic spectrum policies and processes can cause delays and inefficiencies in deployments, particularly in emerging markets.

Opportunities:

-

Private 5G Networks Unlock Growth in Enterprises Across Emerging Markets Fueled by Digital Transformation Trends

There is considerable potential in private 5G networks among enterprise use cases, including private 5G networks for secure, near-instantaneous communication inside factories, logistics hubs, and healthcare facilities. Asia-Pacific, Latin America, and the Middle East are home to emerging markets ripe for growth with a combination of continuous digitalization and initial low levels of 5G penetration.

As of early 2025, over 2,500 enterprises worldwide have deployed or are piloting private 5G networks, particularly in manufacturing, ports, logistics, and healthcare

Challenges:

-

Security, Cyber Threats, and Talent Gaps Challenge Scalable 5G Adoption Across Enterprises and Smart Cities

Security and privacy issues are a significant hurdle, especially for minimizing our reliance on ultra-reliable, low-latency communication within enterprise and government applications. As the number of connected devices increases, it exposes the smart city to cybersecurity attacks, making it more susceptible to Cyberattacks and thus it requires advanced threat detection and mitigation strategies. Also the lack of skilled people for the management, installation, and optimization of 5G networks may clipping the widespread adoption and scale rollouts.

5G Equipment Market Segmentation Analysis:

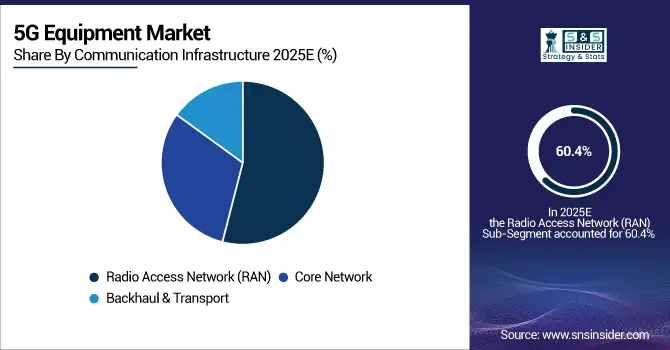

By Communication Infrastructure

Radio Access Network (RAN) dominated the global 5G equipment market with a significant 60.4% share in 2024, driven by widespread deployment of macro and small cells, massive MIMO, and beamforming technologies. RAN components are critical for enabling seamless wireless communication and handling the exponential increase in mobile data traffic. Telecom operators prioritized RAN investments to ensure broad 5G coverage and capacity in both urban and rural areas, particularly in early deployment phases.

The Core Network segment is expected to register the fastest CAGR from 2025 to 2032, fueled by the transition from non-standalone to standalone 5G architecture. This evolution enables advanced capabilities such as network slicing, ultra-low latency, and cloud-native infrastructure, opening new opportunities in enterprise-grade applications, autonomous systems, and real-time analytics.

By Equipment Type

Macro Cell Equipment held the dominant position in the 5G equipment market with a 32.3% share in 2024, primarily due to its role in delivering wide-area coverage and supporting the early phases of 5G deployment. Telecom operators relied heavily on macro cells to upgrade existing towers and expand their 5G footprint across urban, suburban, and rural regions. These high-power base stations are essential for ensuring stable connectivity over large distances, especially in less densely populated areas.

Massive MIMO (Multiple Input Multiple Output) is expected to witness the fastest CAGR from 2025 to 2032, driven by its ability to dramatically boost network capacity and spectral efficiency. As demand for ultra-fast, high-density connectivity rises particularly in urban and enterprise environments Massive MIMO technology will be critical in meeting performance expectations for latency, throughput, and reliability.

By Frequency Band

The Sub-6 GHz frequency band dominated the 5G equipment market with a 62.4% share in 2024, driven by its balanced capabilities in coverage and capacity. This band supports broader geographic reach and better signal penetration through obstacles like walls and buildings, making it ideal for early 5G rollouts in both urban and rural areas. Telecom operators across the globe prioritized Sub-6 GHz deployments to ensure stable, nationwide 5G service during the initial phase of infrastructure expansion.

The Above 6 GHz (mmWave) segment is expected to record the fastest CAGR from 2025 to 2032, as demand grows for ultra-high-speed, low-latency communication in densely populated and high-traffic environments. mmWave technology enables massive bandwidths and gigabit-level speeds, making it crucial for advanced applications such as AR/VR, smart factories, and autonomous transport systems.

By End-Use Industry

Telecom operators led the global 5G equipment market with a 57.3% share in 2024, driven by large-scale investments in nationwide 5G infrastructure rollouts. These operators focused on upgrading base stations, deploying small cells, and expanding core network capabilities to deliver seamless, high-speed connectivity to consumers and businesses. Their central role in network deployment and spectrum acquisition has positioned them as the backbone of global 5G expansion, particularly during the initial implementation stages.

Enterprises, especially those in smart manufacturing and smart cities, are expected to witness the fastest CAGR from 2025 to 2032, as they adopt private 5G networks to enable real-time automation, intelligent monitoring, and IoT integration. This shift toward localized, high-performance networks will accelerate adoption in sectors like logistics, energy, and healthcare, unlocking new levels of efficiency and digital transformation.

5G Equipment Market Regional Outlook:

Asia Pacific dominated the global 5G equipment market with a 37.5% share in 2024, driven by rapid infrastructure development, large-scale investments, and aggressive 5G rollouts by telecom operators. The region benefits from a high concentration of technology vendors, government support, and rising demand for advanced connectivity across industries. Countries such as China, South Korea, and Japan have been at the forefront of 5G adoption, enabling smart city development, industrial automation, and IoT expansion. The presence of leading equipment manufacturers and early spectrum allocation further strengthen the region’s leadership in the global 5G ecosystem.

Get Customized Report as per Your Business Requirement - Enquiry Now

China dominated the Asia Pacific market, due to its extensive 5G base station deployment and aggressive national rollout strategy.

North America is expected to grow at the fastest CAGR of 24.3% from 2025 to 2032 in the 5G equipment market, driven by rapid advancements in telecommunications infrastructure, strong enterprise adoption, and government-backed spectrum availability. The region is witnessing significant investments from major telecom providers to expand small cell networks, implement standalone 5G core systems, and enable private 5G networks for industrial use. Demand for ultra-reliable, low-latency connectivity across sectors like automotive, healthcare, and smart cities is accelerating adoption. Innovation from key technology players also supports the region's strong growth trajectory during the forecast period.

The United States dominated the North American market, fueled by extensive 5G rollouts, enterprise applications, and federal support for digital infrastructure expansion.

Europe is experiencing steady growth in the 5G equipment market, supported by coordinated regulatory policies, spectrum allocation, and strong public-private partnerships. The region is focused on advancing 5G use cases in smart manufacturing, transportation, and energy management. Countries like Germany, the UK, and France are leading deployments, with growing interest in private 5G networks among industrial players. The European Union’s Digital Decade initiative and cross-border collaborations are further accelerating the development of secure, high-performance 5G infrastructure across the continent.

Latin America and the Middle East & Africa are emerging regions in the 5G equipment market, showing increasing momentum due to ongoing digital transformation and infrastructure investments. Governments and telecom operators are gradually deploying 5G networks to support smart cities, industrial automation, and improved connectivity. Brazil, Saudi Arabia, and the UAE are leading regional rollouts with pilot projects and early commercial services. Despite infrastructure and regulatory challenges, rising mobile demand and international partnerships are creating significant growth opportunities across both regions.

5G Equipment Companies are:

The Key Players in 5G Equipment Market are Huawei, Ericsson, Nokia, Samsung, ZTE, Cisco, NEC, Fujitsu, Qualcomm, Intel, CommScope, Mavenir, Airspan, Casa Systems, Sercomm, Keysight, VIAVI, Analog Devices, Qorvo, and Infovista.

Recent Developments:

-

In 2024, Huawei announced plans to introduce a full suite of commercial 5.5G equipment in 2024, aiming for peak downlink speeds of 10 Gbps and support for up to 100 billion IoT connections.

-

In February 2025, Ericsson delivered 100,000 Massive MIMO 5G radios to Bharti Airtel across 12 Indian circles in just over 500 days, reinforcing its commitment to energy-efficient and scalable radio infrastructure.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 25.72 Billion |

| Market Size by 2032 | USD 139.78 Billion |

| CAGR | CAGR of 23.61% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Communication Infrastructure (Radio Access Network (RAN), Core Network, and Backhaul & Transport) • By Equipment Type (Macro Cell Equipment, Small Cell Equipment, Distributed Antenna Systems (DAS), Massive MIMO, and Beamforming Equipment) • By Frequency Band (Sub-6 GHz, Above 6 GHz (mmWave), and Others (Unlicensed/Shared Spectrum)) • By End-Use Industry (Telecom Operators, Enterprises (Smart Manufacturing, Smart Cities), Defense & Government, Healthcare, Automotive, and Energy & Utilities) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Huawei, Ericsson, Nokia, Samsung, ZTE, Cisco, NEC, Fujitsu, Qualcomm, Intel, CommScope, Mavenir, Airspan, Casa Systems, Sercomm, Keysight, VIAVI, Analog Devices, Qorvo, and Infovista. |