Central Venous Catheter Market Report Size Analysis:

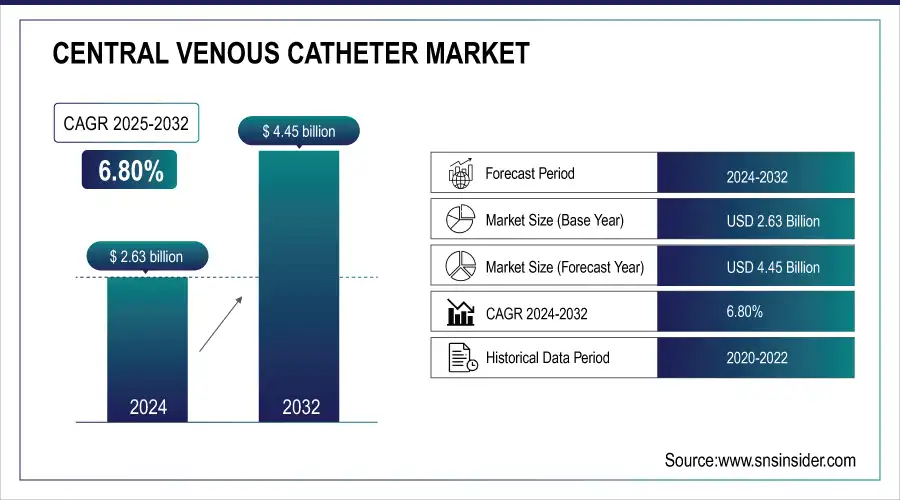

The Central Venous Catheter Market size was valued at USD 2.63 billion in 2024 and is expected to reach USD 4.45 billion by 2032, growing at a CAGR of 6.80% over 2025-2032.

The global central venous catheter market growth is undergoing a major overhaul due to an increase in the incidence of chronic diseases, a surge in surgical procedures, and an increase in demand for intravenous therapies. Rise in the aging population, rise in critical care infrastructure, and increase in the number of dialysis procedures are other factors driving the central venous catheters market. The CDC reports more than 250,000 cases of central line-associated bloodstream infections (CLABSIs) in the U.S. each year, spurring the need for innovative catheter technologies.

To Get more information on Central Venous Catheter Market - Request Free Sample Report

Cancer, chronic kidney disease (CKD), and heart-related conditions are particularly responsible for driving the demand for a CVC, as these patients need long-term venous access. There is massive research being conducted by companies to develop coatings that are antimicrobial and antithrombogenic to lower the risks of infection, with companies such as B. Braun and Teleflex leading the advancements. The U.S. market for central venous catheters is also being driven by CMS's ambulatory-care policies and growing outpatient procedures. In addition, regulatory changes, such as the CDC’s and the Joint Commission’s increased increased emphasis on CLABSI prevention mandates, are also pushing users to make compliance-based buying decisions.

In 2024, Teleflex introduced the Arrow ErgoPack Complete System with an antimicrobial technology for central lines, proving itself to be an innovator of infection prevention.

Among the key factors driving demand for central venous catheters is the growing number of FDA 510(k) clearances for catheter innovations, with at least 20 new clearances since 2022, pointing to robust R&D investment. Moreover, NIH has doubled funding to study catheter-related infection since 2020. On the supply side, the manufacturers are urging to increase production with global demand on the rise, especially in Asia Pacific, resulting in a strong global central venous catheter market pipeline. There is also a trend to use bundled service agreements between the hospital and the catheter company to control price.

In 2023, Medtronic and an outpatient surgery center teamed up to deploy AI-driven catheter placement tools to bring down misplacement rates, showcasing tech adoption in the central venous catheter market share.

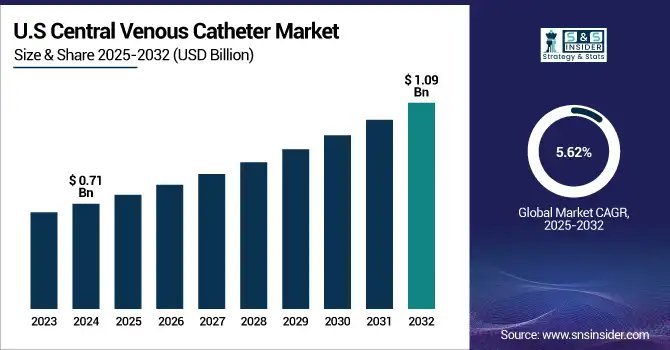

The U.S. central venous catheter market size was valued at USD 0.71 billion in 2024 and is expected to reach USD 1.09 billion by 2032, growing at a CAGR of 5.62% over 2025-2032.

Central Venous Catheter Market Dynamics:

Drivers:

-

Rising Disease Burden and Technological Advancements Accelerating Demand for Central Venous Catheters

The market growth for central venous catheters is highly driven by the rising incidence of long-term venous access, such as cancer, sepsis, and chronic renal failure. More than 37 million adults in the U.S. have CKD, several of whom have upper extremity venous access problems, for whom dialysis catheters can pose life-threatening risks. In the same vein, the global number of cancer patients is anticipated to reach 28.4 million in 2040, which in turn boosts the need for chemotherapy-compatible catheters. Furthermore, the use of power-injectable catheters, 6 antimicrobial-impregnated CVCs, and 7 tunneled CVCs has simplified matters and is protecting against infection. Increased R&D investment from companies, such as Cook Medical and ICU Medical, is furthering progress in catheter design with the advent of pressure-monitor-built-in catheters, as well as new materials that prevent biofilm in the catheter.

Regulatory changes like the CDC’s new CLABSI prevention guidelines and the Joint Commission’s infection control requirements are adding additional pressure on purchasing and deployment strategies. Moreover, FDA 510(k) approval rates for new catheter designs were up 18% in the 2021-2023 period, indicating an element of expansion and supply and demand imbalances. Increasing availability of outpatient and home care is also fueling catheter use, particularly among the growing elderly population. And as hospitals and outpatient centers search for better ways to tap into blood vessels, the central venous catheter market, currently estimated at south of USD 1 billion a year, is poised to continue growing, for medical and technological reasons.

Restraints:

-

Infection Risks, Regulatory Barriers, and Skilled Workforce Shortage Hindering Market Growth

CLABSIs are still a significant challenge, with about 30,100 cases in the U.S. each year, according to the CDC, and high treatment costs and mortality rates. These complications add to health care costs and have discouraged clinicians from using long-term central venous access devices when warranted. In addition, strict regulation from agencies, such as the FDA and EMA, also means that new devices need significant clinical validation, which will inevitably make the approval timelines long and the R&D costs high. The time for development to approval for class II vascular devices is still an average of 36 months, too long for smaller central venous catheter companies to stay solvent. Also, skilled vascular access nurses or interventional radiologists are in short supply in many countries, stymying efforts to safely and effectively insert these catheters.

Training expenses and certification policies also threaten market entry, particularly in low-resource situations. Fewer centers adopt due to a lack of reimbursement and policy differences among institutions as well. Together, these factors form significant hurdles to central venous catheter market analysis, in particular for new participants and smaller medical device companies seeking expedited innovation.

Central Venous Catheter Market Segmentation Analysis:

By Product Type

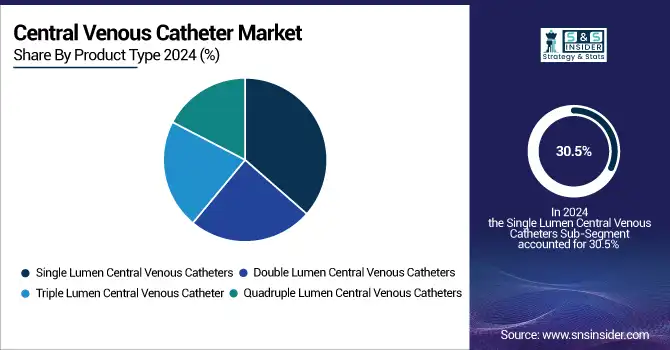

Single-lumen central venous catheters are the leading sub-segment in 2024 with 30.5% of the market share, and are sought after owing to simplicity, lower cost, and due to usage in short-term therapies, such as fluid and drug infusion in emergency and intensive care units. They also offer a reduced risk of mechanical complications when compared to multi-lumen catheters, further validating the utilization of these devices.

However, triple-lumen central venous catheters are expected to grow the fastest, as there is an increasing demand for them in cancer treatments and intensive care units, where they can deliver multiple medications, blood products, and nutrition simultaneously, making the procedure more efficient and reducing the need for multiple insertions.

By Placement Site

Internal jugular vein placement is the most preferred method in 2024 as it is being directly in line with the superior vena cava, a lesser pneumothorax risk, and the concomitant ability of this method for insertion using ultrasonography. Temporary and semi-permanent catheter placements in hospitals are the most popular scenario for this site. The subclavian vein is the fastest growing segment, increasingly favored not only because there are fewer infections but also because overall results are superior for catheter use in the long term, particularly with new tunneling approaches that reduce the risk of complications.

By Application

Chemotherapy is the application segment leader in 2024, operating with a 49.8% market share on account of increasing cancer burden and the necessity for long-term and frequent intravenous access to administer cytotoxic agents. Central venous catheters (CVCs) are the cornerstone of oncological treatment and are particularly used for the administration of vesicant and irritant cytostatic agents.

The blood transfusions application segment is likely to experience the highest growth attributed to the growing shift toward hematologic procedures and surgeries necessitating immediate and multiple transfusions, rendering CVCs suitable for use in high volume infusion while providing stability.

By End User

The Hospitals & Clinics segment holds a dominating share among end-users in 2024, with 40.2% of the market due to a large patient population flowing to their respective departments, trained healthcare workers, and the preferences for advanced Vascular Access devices. They are nerve centers for chemotherapy, dialysis, and critical care.

Ambulatory Surgical Centers (ASCs) are projected to be the fastest-growing category, which is facilitated by the regulatory green lights for performing CVC in outpatient settings and the advantages of cost and recovery time. Therefore, they are preferred by both patients and healthcare providers for the administration of non-complex intravenous therapies.

Regional Analysis:

North America accounted for the largest share in the central venous catheters market, owing to the well-developed healthcare infrastructure, early uptake of advanced vascular access technology, and higher number of procedures. The U.S. dominates as there is a high patient pool with chronic conditions, including cancer and kidney failure, and the extensive usage of central venous access in the ICU and oncology. In the U.S. in 2024, a large proportion of the global procedures were high even in acute care and outpatient facilities. CVC use in Canada is increasing due to increasing investment in minimally invasive care, and Mexico is growing based on improved access to healthcare and an increased demand for infusions.

Get Customized Report as per Your Business Requirement - Enquiry Now

Europe is the second largest region in the Central Venous Catheter market due to a rapidly increasing aging population and rising prevalence of diseases that require prolonged venous access. Germany is the largest contributor supported by high procedure volume, strong hospital infrastructure, and ongoing investment in infection control technology. The U.K. is the largest market in the region and is growing at the fastest pace in the region, as the country is actively working toward reducing catheter-related bloodstream infections and raising the level of patient safety across the country. France and Italy are close behind, making extensive use of CVCs in oncology and intensive care, with others, such as Poland and Turkey, increasing adoption through more generous healthcare spending.

The Asia Pacific market is growing at the highest CAGR in the global Central Venous Catheter market due to increasing incidence of chronic diseases, growing healthcare spending, and rising awareness of the advantages of vascular access. China is the dominant region owing to the modernization of hospitals, leading and increased procedures and government-held reform in healthcare. India is the fastest-growing market with the highest pool of cancer and CKD patients, and increased access to central line placements in tertiary and district-level hospitals. Japan and South Korea, meanwhile, remain in a good place with a focus on advanced catheter materials and infection-prevention protocols.

Central Venous Catheter Market Key Players:

Leading central venous catheter companies operating in the market are ICU Medical, B. Braun SE, BD (Becton, Dickinson and Company), Poly Medicure, Lepu Medical, Teleflex, VOGT Medical, ZOLL Medical, EETA Surgical, QMD, Kimal, Medtronic, Rex Medical, Asahi Kasei Corporation, AngioDynamics, Merit Medical Systems, CorMedix, and Access Vascular.

Recent Developments in the Central Venous Catheter Market:

In November 2023, BD launched the SiteRite 9 Ultrasound System, engineered to enhance clinician efficiency and accuracy in placing central venous catheters and other vascular access devices. The system features advanced imaging, a 15.6-inch touchscreen, and integration with needle tracking and tip confirmation technologies for improved outcomes.

In November 2023, CorMedix Inc. received FDA approval for DefenCath, a catheter lock solution intended to reduce catheter-related bloodstream infections in adult hemodialysis patients. This approval marks a major milestone in infection prevention for central venous catheter users.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 2.63 billion |

| Market Size by 2032 | USD 4.45 billion |

| CAGR | CAGR of 6.80% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Single Lumen Central Venous Catheters, Double Lumen Central Venous Catheters, Triple Lumen Central Venous Catheter, and Quadruple Lumen Central Venous Catheters) • By Placement Site (Internal Jugular Vein, Femoral Vein, and Subclavian Vein) • By Application (Chemotherapy, Drugs and Fluid Administration, Blood Transfusions, and Others) • By End User (Hospitals & Clinics, Ambulatory Surgical Centers, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | ICU Medical, B. Braun SE, BD (Becton, Dickinson and Company), Poly Medicure, Lepu Medical, Teleflex, VOGT Medical, ZOLL Medical, EETA Surgical, QMD, Kimal, Medtronic, Rex Medical, Asahi Kasei Corporation, AngioDynamics, Merit Medical Systems, CorMedix, and Access Vascular. |