Cervical Cancer Diagnostic Tests Market Report Scope & Overview:

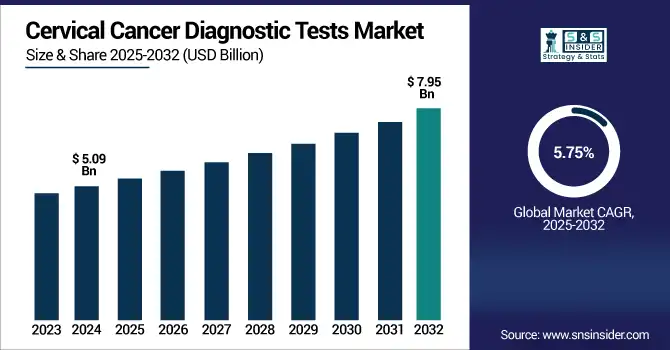

The cervical cancer diagnostic tests market size was valued at USD 5.09 billion in 2024 and is expected to reach USD 7.95 billion by 2032, growing at a CAGR of 5.75% over 2025-2032.

To Get more information on Cervical Cancer Diagnostic Tests Market - Request Free Sample Report

The cervical cancer diagnostic tests market momentum is being bolstered by increasing awareness, advancement of technology, and active efforts by the government and private sectors. Globally, cervical cancer is the fourth most frequently diagnosed type of cancer in women, and more than 600,000 new cases and 340,000 deaths were recorded in 2023 (WHO). This has increased the demand for early diagnosis solutions, thereby accelerating the adoption of molecular diagnostics, including HPV DNA testing, blood-based biomarkers, and menstrual blood screening technologies. Corporations are developing self-collection products – for instance, Quest Diagnostics introduced an FDA-approved self-collection kit for HPV specimens, increasing access to testing services for underserved communities. Roche, meanwhile, has brought in biomarker-based tests that can forecast the progression of disease with more sensitivity.

In April 2025, AIIMS researchers unveiled a ddPCR-based blood test capable of tracking cervical cancer therapy efficacy by detecting circulating HPV DNA, enabling real-time monitoring and early relapse detection.

There is a massive R&D investment over the board with the likes of DNA Wellness, who plan to invest ₹200 crore for the setup of 100 cervical cancer screening labs in every state of India and in another well-known instance recently Hera Biotech acquired Herafem, a point-of-care cervical diagnostic platform helping you to screen faster and scale. Regulatory approvals are also playing a vital part in the cervical cancer diagnostic tests market growth. Iota Diagnostic announced its CDSCO approval for the India launch of its cervical cancer screen. Besides, in Delhi, we have recently introduced the country's first indigenous HPV test kit, which drastically brings down import dependence and makes the supply chain more efficient.

Both in terms of the provider and demand side, less than 30% of eligible women in low- and middle-income countries (LMIC) are screened for cervical cancer, showing substantial untapped market potential. The WHO sets targets of 90% of girls being fully vaccinated with the HPV vaccination and 70% being screened by age 35 and again by age 45 by 2030, and provides considerable policy coherence. All these factors, alongside increasing spending on healthcare and government support, are expected to boost the cervical cancer diagnostic tests market size over the forthcoming years, notably in developing economies.

In Feb 2025, Metropolis Healthcare, in collaboration with Roche Diagnostics India, launched high-risk HPV DNA self-sampling testing to accelerate and decentralize cervical cancer screening across India.

Table: Emerging Technologies in Cervical Cancer Screening (2023–2025)

|

Technology |

Description |

Adoption Trend |

Use Case |

|

AI-Assisted Cytology |

AI to analyze cytology slides for anomalies |

Rising in Europe, the USA |

Reduces pathologist workload |

|

Menstrual Blood Testing |

Self-collection of menstrual flow for HPV |

Emerging in India |

Home-based non-invasive testing |

|

ddPCR for HPV DNA |

Quantification of HPV DNA in blood |

Trial stage in Asia |

Therapy response tracking |

|

Smart Colposcopy Devices |

Mobile imaging + AI analysis |

Pilots in Africa/EU |

Low-resource area diagnostics |

|

HPV Self-Sampling Devices |

Kits for at-home HPV testing |

Expanding globally |

Enhances access and compliance |

Table: Regulatory Approvals and Guidelines Update for Cervical Cancer Diagnostics (2023–2025)

|

Country/Region |

Regulatory Body |

Approved Test/Update |

Approval Date |

Impact Summary |

|

India |

CDSCO |

IOTA M‑Strip Menstrual Blood HPV Test |

May 2024 |

First self-sampling menstrual test approved |

|

USA |

FDA |

Quest Diagnostics HPV Self-Collection Kit |

March 2024 |

Enables home-based screening nationwide |

|

Europe (EU) |

EMA |

CE Mark for AI-Assisted HPV Cytology Systems |

Feb 2024 |

Fast-tracked adoption of AI tools |

|

South Africa |

SAPHRA |

Digital Pap + HPV co-testing |

July 2023 |

Expansion of the national screening program |

|

Japan |

PMDA |

Liquid-based cytology automation tools |

June 2024 |

Streamlined lab diagnostics |

Market Dynamics:

Drivers:

-

Growing Demand for Innovative Diagnostics, Improved Patient Compliance, and Supportive Health Policies are Fueling Market Expansion

The strong transition towards non-invasive diagnostics, AI-based screening devices, and better integration into clinical workflow is driving the cervical cancer diagnostic tests market. Innovations like AI-assisted colposcopy, such as MobileODT’s EVA system, take decision support to the frontline and increase the diagnostic accuracy of images by between 20–25%. Furthermore, image analysis platforms with AI systems are being tested in clinical trials in Europe and the U.S to assist in faster triaging decisions. The supply and demand are shifting, and increasingly, patients also prefer at-home sample collection kits, so companies like BD and SelfScreen are getting in. The Bill & Melinda Gates Foundation pledged more than USD 10 million to AI-powered digital screening solutions that would work in low-resource settings.

Regulators, such as the U.S. FDA and those responsible for CE Marking in Europe, are speeding their process of approval process for AI-based cervical screening systems with fast-track programs. Rising partnerships between digital healthcare platforms and pathology labs are another innovation and access booster. These initiatives are enhancing both detection and early treatment, ensuring that cervical cancer screening is more inclusive, timely, and scalable across a wide range of demographics, helping to narrow the gap in the cervical cancer diagnostic tests market in the years to come.

Restraints:

-

Lack of Laboratory Infrastructure, Skilled Workforce, and Awareness Continues to Hinder Market Adoption, Especially in Underserved Areas

The cervical cancer diagnostic tests market is restricted due to various restraints such as a dearth of healthcare infrastructure, particularly in low and middle-income countries (LMICs). Cervical cancer screening. In LMICs, where less than 15–25% of women eligible for screening have been screened, the WHO estimated that more than 85% of cervical cancer deaths occur. There are no cytology laboratories, trained cytopathologists, and digital screening facilities in many of the villages, and the diagnoses are accepted at a later date. Moreover, awareness campaigns have not cut through evenly. 1 in 4 women around the world know that HPV causes cervical cancer, according to UNFPA.

High test costs and no reimbursement in private health systems contribute to the barrier. In addition, bottlenecks in the supply chain for HPV test reagents, particularly in Africa and parts of Southeast Asia, have resulted in intermittent stock-outs and the cessation of screening. Clinical reluctance to try new, less proven tests, such as menstrual blood testing, also hampers adoption. Fragmented regulation, with different countries demanding different types and submission processes of clinical evidence, also slows product deployment. These factors together impede the cervical cancer diagnostic tests market penetration, particularly in regions with the highest disease burden. Tackling these structural obstacles will call for investment, policy change, and regulation alignment across borders.

Segmentation Analysis:

By Test Type

Pap testing led the cervical cancer diagnostic tests market in 2024, mainly due to its status as a standard test in clinical practice, widespread availability, and widespread adoption in national cervical cancer screening programs in developed as well as developing countries. It holds a leading position due to its low cost, proven accuracy for cytological abnormalities, and wide insurance reimbursement.

Nevertheless, the HPV testing sector is estimated to grow at the fastest rate over the forecast period 2025–2032 on account of its enhanced sensitivity for high-risk types of HPV associated with the progression of cervical cancer. As HPV DNA-based technologies, such as self-sampling kits and molecular tests, gain awareness and preference, the healthcare system is moving to this more predictive model for early-stage detection and triaging, increasing demand.

By Age Group

The cervical cancer diagnostic tests market is dominated by the 20–40 years segment with a market share of 84.23% in 2024. This prevalence could be due to an overall health-seeking behaviour among the reproductive age women, the government-funded preventive health programs, and increased knowledge about HPV infection among this age group. Further, early-detection campaigns frequently are directed at women in this age range, as a combination of HPV exposure in sexually active years is more frequent. This category is projected to continue its dominance during the forecast period. The Above 40 years age group, though not the largest segment, is projected to grow at a faster pace, attributed to increasing adoption of post-menopausal screening guidelines, rising awareness of cancer recurrence and late discovery, and availability of health insurance among the elderly population.

By End Use

The diagnostic centers dominated the market in 2024 with a share of 46.32% as the patients are increasingly choosing cost-efficient walk-in screening services with faster results and easily accessible advanced molecular testing equipment. Scores of private diagnostic chains are also spreading in semi-urban and urban areas, becoming accessible to people. In addition, diagnosis centers frequently work alongside nationwide and global screening projects for high-throughput screening available at an economical price. Among the other centers, diagnostic centers are expected to be the fastest-growing segment owing to their ability to embrace advanced technologies such as automated liquid-based cytology and analysis integrated with AI, which facilitate quick diagnosis and help in early-stage treatments. This makes them superior when used in both public health settings and for self-directed screens.

Regional Analysis:

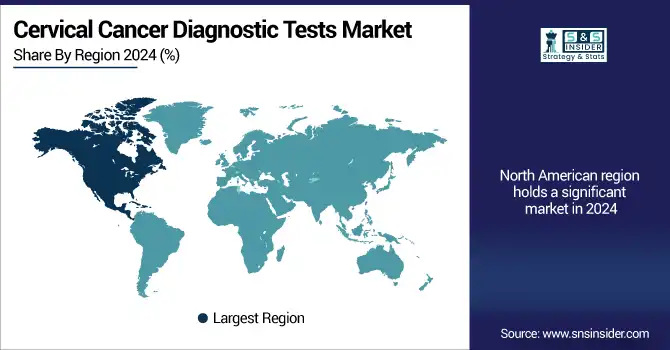

The cervical cancer diagnostic tests market in North America was led by the U.S., with the largest market share in 2024, due to high screening awareness, strong healthcare infrastructure, and early uptake of advanced diagnostics, such as HPV genotyping and AI-driven cytology.

The U.S. cervical cancer diagnostic tests market size was valued at USD 2.01 billion in 2024 and is expected to reach USD 2.89 billion by 2032, growing at a CAGR of 4.71% over 2025-2032. The U.S. has one of the highest penetrances of insurance and CDC-supported screening guidelines, with over 70% turnout in regular Pap and HPV testing, as the most dominant country. Companies like Hologic, BD, and Quest Diagnostics help foster regional innovation. There’s also screen progress in Canada that can be attributed to initiatives led by governments, such as the Canadian Partnership Against Cancer’s screening campaigns and acceptance of self-collection HPV kits. There is increasing use in Mexico through public health programs such as "Jornada Nacional de Salud Pública" and WHO-based cervical screening.

Table: Patient Behavior and Screening Preferences Survey Results (2024)

|

Preference Type |

% Respondents |

Regional Highlight |

Insight/Trend |

|

Prefer self-sampling kits |

63% |

North America, Europe |

Indicates a need for home-based diagnostics |

|

Comfortable with AI-screening |

48% |

Europe, South Korea |

Acceptance of AI-supported decisions is rising |

|

Need awareness about HPV |

71% |

Africa, India |

Education gap still significant |

|

Prefer blood-based testing |

39% |

Urban APAC regions |

Trend toward less invasive, non-pelvic testing |

|

Trust government programs |

55% |

LATAM, Europe |

High trust fuels participation |

Europe is a well-established and growing cervical cancer diagnostic tests market, with extensive screening programs and almost universal healthcare access. Germany is the most prominent in the region by having a compulsory 2-year screening for 20–65-year-old women and usage of co-testing (Pap and HPV). In France and the UK, government-organised national cervical screening programmes with recall systems and population coverage are in place. The UK replaced liquid-based cytology with HPV primary screening across the country, increasing sensitivity and decreasing false negatives. Both Italy and Spain have boosted participation through regional initiatives and AI-driven cytology pilot schemes. Eastern Europe, particularly Poland and Turkey, is experiencing increasing demand owing to the availability of EU funding, awareness programmes, and developments in women’s access to gynecological health services.

Asia Pacific to register fastest growth in cervical cancer diagnostic tests market due to increasing number of cervical cancer cases, growing diagnostic infrastructure, and government focus on cancer control. This expansion is being led by China and India. India’s cervical cancer burden contributes almost a quarter of deaths worldwide and justifies big investments like DNA Wellness’s plan to build 100 screening labs. Indian government Ayushman Bharat and state health programs, among others, are also increasing the coverage of HPV screening. In China, national screening programs are being expanded, and urban access to health care is improved, which in turn is increasing demand for LBC (liquid-based cytology) and HPV DNA testing. Japan and South Korea are also heavily automating diagnosis and pushing public-private partnerships to boost screening uptake.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

Leading companies operating in the market are Abbott Laboratories, Qiagen N.V., Thermo Fisher Scientific Inc., Carl Zeiss AG, Becton, Dickinson and Company, Hologic Inc., CooperSurgical Inc., Siemens Healthineers, Agilent Technologies, and Bio-Rad Laboratories.

Recent Developments:

-

In June 2025, Hera Biotech officially acquired Herafem, a point-of-care cervical cancer diagnostic platform, to integrate rapid, on-site screening capabilities, with plans to commercialize this technology across emerging markets.

-

In May 2024, IOTA Diagnostic received CDSCO approval in India for its innovative M‑Strip menstrual blood self-sampling device, empowering women to collect samples at home for cervical cancer screening using menstrual fluid, marking a key regulatory milestone for novel non-invasive diagnostics.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 5.09 billion |

| Market Size by 2032 | USD 7.95 billion |

| CAGR | CAGR of 5.75% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Test Type (Pap Testing, HPV Testing, Colposcopy, Cervical Biopsies, and Cystoscopy) • By Age Group (20-40 years, Above 40 years) • By End Use (Hospitals, Laboratories, and Diagnostic Centers) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Abbott Laboratories, Qiagen N.V., Thermo Fisher Scientific Inc., Carl Zeiss AG, Becton, Dickinson and Company, Hologic Inc., CooperSurgical Inc., Siemens Healthineers, Agilent Technologies, and Bio-Rad Laboratories. |