Emergency Department Information System Market Size & Overview:

Get more information on Emergency Department Information System Market - Request Sample Report

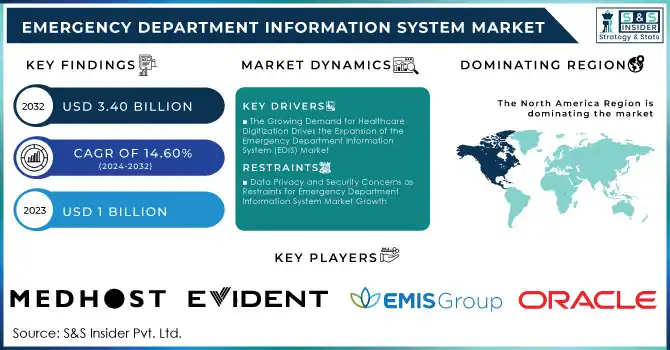

Emergency Department Information System Market was valued at USD 1 billion in 2023 and is expected to reach USD 3.40 billion by 2032, growing at a CAGR of 14.60% from 2024-2032.

The Emergency Department Information System market has tremendous growth as the incidence of healthcare digitalization is rising, and there is also a huge focus on improving outcomes from emergency care. EDIS solutions have improved critical functions like triage, patient tracking, clinical documentation, and order entry, which smoothen the processes and decrease mistakes in acute situations. It is thus driven by the need to manage high volumes of patients and to boost the accuracy and speed associated with care. Therefore, EDIS appears to be an attractive investment for healthcare providers who intend to optimize the efficiency of emergency departments.

Implementing AI in EDIS is poised to change patient care and the operational efficiency of the ED. The power of AI has already been shown to be possible in reducing physicians' administrative workload by some 20%, leaving more space for taking care of patients. For example, physicians now allocate 67 percent of their time toward direct patient treatment up from 50 percent before AI implementation. Predictive AI tools promise a lot, where as high as 50% of hospital admissions can be reduced. AI-powered chatbots will change the face of patient engagement, as they provide round-the-clock support and answer quick questions, whereas EDIS reduces wait time.

The integrated technology of AI and machine learning with cloud-based Emergency Department Information System solutions is going to speed up its adoption. With predictive tools and the integration of telemedicine, better management of healthcare facilities' resources and an extension of care beyond physical limits are possible. Thus, the Emergency Department Information System market experiences more investment and innovation. For example, CCHP leveraged AI-based automation for EDI. It reduced the organization's cost by USD 26,000 per year due to the reductions in manual efforts as well as the avoidance of an additional full-time employee and shows how the use of such technologies can lead to savings and operational efficiency

Emergency Department Information System Market Dynamics

Drivers

-

The Growing Demand for Healthcare Digitization Drives the Expansion of the Emergency Department Information System (EDIS) Market

The growing demand for digitization in healthcare departments makes Emergency Department Information Systems (EDIS) a promising market on the rise. Digital solutions are needed for the better management of patient data, efficient operational workflows, and streamlined clinical procedures as hospitals and health services strive to achieve quality performance in their delivery of healthcare services. This benefits the EDIS in patient triage, clinical decision support, and general efficiency. This technological adoption is in turn helping fulfill the demand for faster and more accurate care in the Emergency Department Information System. With increasing digitization, the need for Emergency Department Information Systems continues to grow.

-

Integration with Other Health Information Systems Enhances the Effectiveness of Emergency Department Information Systems (EDIS)

The integration of EDIS with other health information systems like electronic health records, laboratory information systems, and radiology information systems is the main driving force behind market growth. Integration with these health information systems ensures critical patient data are shared effectively and reduces the time-consuming process of delivering care, at the same time improving the accuracy of such services. It reduces duplication and error, thus making operational workflows better. This enables emergency departments to function more effectively. In the interest of streamlined operations, there is a rising demand for integrated EDIS solutions from healthcare providers. The integration also facilitates on-time decision-making while supporting high-quality care within an emergency setting.

Restraints

-

Data Privacy and Security Concerns as Restraints for Emergency Department Information System Market Growth

EDIS systems involve a lot of sensitive patient information, hence demands a lot on issues of data security and breaches of patient privacy as well as strictness in adherence to regulations like HIPAA in the U.S. and also GDPR in Europe. Such systems tend to necessitate strong encryption as well as robust security measures that can make deployment more costly and complex. The need for a security system for heightened security as well as compliance with privacy laws may delay adoption - particularly in regions where the regulation is stern-owing to fears health organizations have over risks as well as penalties associated with non-compliance.

Emergency Department Information System Market Segment Analysis

By Application

Computerized Physician Order Entry (CPOE) dominates the Emergency Department Information System (EDIS) market, contributing 39% of the total revenue in 2023. This is because it primarily serves to promote safety among patients, reduce medication errors, and serve as a means to allow for productivity in workflow by facilitating order process streamlining efficient communication among health care providers, and seamless integration with the EHR.

E-prescribing is expected to grow at the highest CAGR of 18.13% during the period from 2024-2032 due to increased demand for more accurate, convenient, and efficient management solutions for prescriptions. The growth of e-prescribing is improving very fast with the increase in regulatory support for e-prescribing and the growing emphasis on reducing medication errors in emergency care.

By Deployment

In 2023, SaaS captured the dominant 66% revenue share in the Emergency Department Information System (EDIS) market, solidifying its position as the leading deployment model. With such cost-effective, easily scalable, and implementable models, SaaS offers healthcare systems versatile, subscription-based models with no such heavy capital investment on infrastructure and subsequent maintenance costs. Moreover, they can be swiftly scaled up and updated without disruption to their operations; hence most prefer a SaaS model.

The SaaS solutions are forecasted to grow at the highest CAGR of 15.34% during 2024-2032 and set up the ideas of embracing cloud-based technologies, real-time access to data, and making healthcare and telemedicine as remote as possible, with various forms of emergency care providers looking to be progressive and cut cost within the scope of operational efficiency.

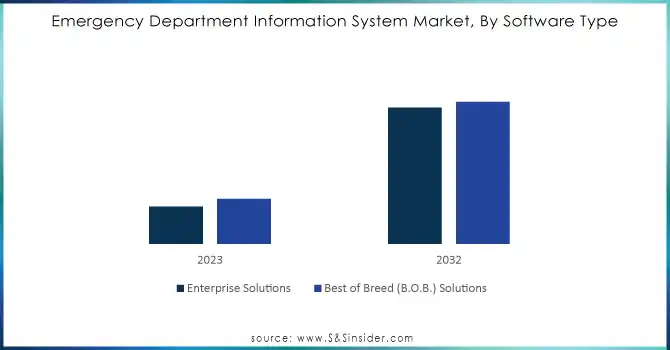

By Software Type

Best-of-Breed (B.O.B.) Solutions remained the leaders in the EDIS market, with 55% of the revenue it gathered in 2023, as these enable strongly specialized and flexible customizable solutions tailored to the uniquely emerging needs of emergency departments. The solutions promise efficiency, advanced technology, and better outcomes among patients; because of this, they are popular among healthcare service providers.

The enterprise solutions are expected to grow at a high CAGR of 15.59% during 2024-2032, as these solutions help in managing all large healthcare facilities on one comprehensive platform that can execute and administer any functionality underneath one roof in the most scalable way. The demand for seamless interoperability, data management, and real-time decision-making facilities for giant health facilities is propelling rapid growth in the market for Enterprise Solutions.

Need any customization research on Emergency Department Information System Market - Enquiry Now

By End Use

Medium-scale hospitals will continue to be the largest users in the EDIS market, with an expected share of 42% of the revenue in 2023, since their critical need is for solutions that can upscale and enhance scalable efficiency in patient management and operational workflows at a capacity matching larger systems but without the cost impact. It remains to require strong but cost-effective EDIS solutions that upscale emergency care yet coexist with increasingly growing patient volume.

The medium-sized hospitals market will have the highest CAGR of 16.30% during the forecast period, 2024-2032, primarily due to increasing demand for digital transformation and increased adoption of cloud-based EDIS platforms in medium-sized hospitals. This growth is essentially driven by the need for enhanced care delivery, better resource management, and the adoption of technologies like AI and predictive analytics to optimize patient outcomes and improve emergency department performance

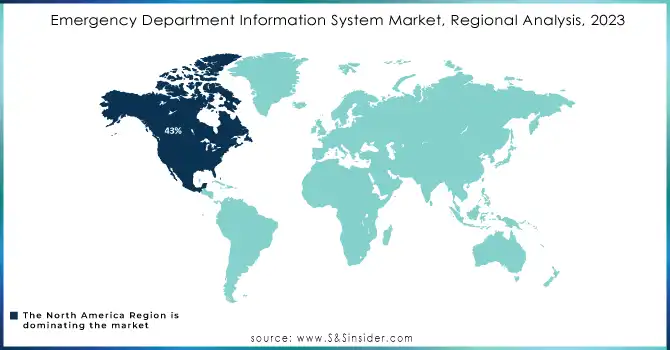

Emergency Department Information System Market Regional Analysis

In 2023, North America captured the highest share of EDIS revenue in the market, at 43%. It is attributed to more advanced health infrastructures and a higher rate of adoption of digital health solutions in the United States and Canada. The region enjoys good governmental support, technological innovation, and an emphasis on patient safety and operational efficiency.

Asia Pacific is to grow at the fastest AGR of 16.81% from 2024-2032, mainly due to rapid modernization of healthcare and investments in healthcare IT. The growing population and increasing urbanization in this region have consequently increased the demand for efficient emergency care solutions. Also, government initiatives toward digitization of healthcare and enhancing access to care are set to bolster the EDIS market.

Latest News -

-

Veradigm's 2024 update integrates natural language processing (NLP) with EHR data, improving clinical insights for better decision-making in Emergency Department Information Systems (EDIS) and enhancing patient outcomes.

-

Oracle Health Data Intelligence’s 2024 update focuses on reducing emergency department length-of-stay using AI to analyze order turnaround times, improving efficiency and minimizing bottlenecks in emergency care.

Key Players

-

Oracle (Cerner) (Cerner PowerChart, Cerner FirstNet)

-

EMIS Group plc. (EMIS Web, EMIS Enterprise)

-

Epic Systems Corporation (Epic Emergency Department, Epic Systems)

-

Evident Software (Evident EHR, Evident Emergency Department)

-

Logibec Inc. (Logibec ERM, Logibec EDMS)

-

MEDHOST (MEDHOST EDIS, MEDHOST EHR)

-

Medical Information Technology, Inc. (Meditech Expanse EDIS, Meditech Emergency Department)

-

Medsphere Systems Corporation (OpenVista, Medsphere ED)

-

The T System, Inc. (T-System ED, T-System EHR)

-

Veradigm LLC (Veradigm EHR, Veradigm Emergency Department)

-

McKesson Corporation (McKesson ED, McKesson Paragon)

-

Allscripts Healthcare Solutions, Inc. (Allscripts ED, Allscripts Sunrise EDIS)

-

Siemens Healthineers AG (Siemens Syngo, Siemens ED Solutions)

-

Philips Healthcare (Philips IntelliSpace, Philips ED Solutions)

-

EPOWERdoc (EPOWERdoc ED, EPOWERdoc EHR)

-

Wellsoft Corporation (Wellsoft ED, Wellsoft EHR)

-

Softek Illuminate (Softek ED, Softek Illuminate EHR)

-

EDM Systems (EDM EDMS, EDM Clinical Solutions)

-

Optum (UnitedHealth Group) (Optum EHR, Optum ED Solutions)

-

Athenahealth, Inc. (Athenahealth EDIS, Athenahealth EHR)

-

TriTech Software Systems (TriTech EDIS, TriTech EHR)

-

Infor (Infor Cloverleaf, Infor EDIS)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1 Billion |

| Market Size by 2032 | USD 3.40 Billion |

| CAGR | CAGR of 14.60% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Computerized Physician Order Entry, Clinical Documentation, Patient Tracking & Triage, E-Prescribing, Others) • By Deployment (On-Premises, Software-as-a-Service) • By Software Type (Enterprise Solutions, Best of Breed Solutions) • By End-User (Small Hospitals, Medium-Sized Hospitals, Large Hospitals) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Oracle, EMIS Group plc., Epic Systems Corporation, Evident Software, Logibec Inc., MEDHOST, Medical Information Technology, Inc., Medsphere Systems Corporation, The T System, Inc., Veradigm LLC, McKesson Corporation, Allscripts Healthcare Solutions, Inc., Siemens Healthineers AG, Philips Healthcare, EPOWERdoc, Wellsoft Corporation, Softek Illuminate, EDM Systems, Optum, Athenahealth, Inc., TriTech Software Systems, Infor. |

| Key Drivers | • The Growing Demand for Healthcare Digitization Drives the Expansion of the Emergency Department Information System (EDIS) Market • Integration with Other Health Information Systems Enhances the Effectiveness of Emergency Department Information Systems (EDIS) |

| Restraints | • Data Privacy and Security Concerns as Restraints for Emergency Department Information System Market Growth |