Chiplet Market Size Analysis:

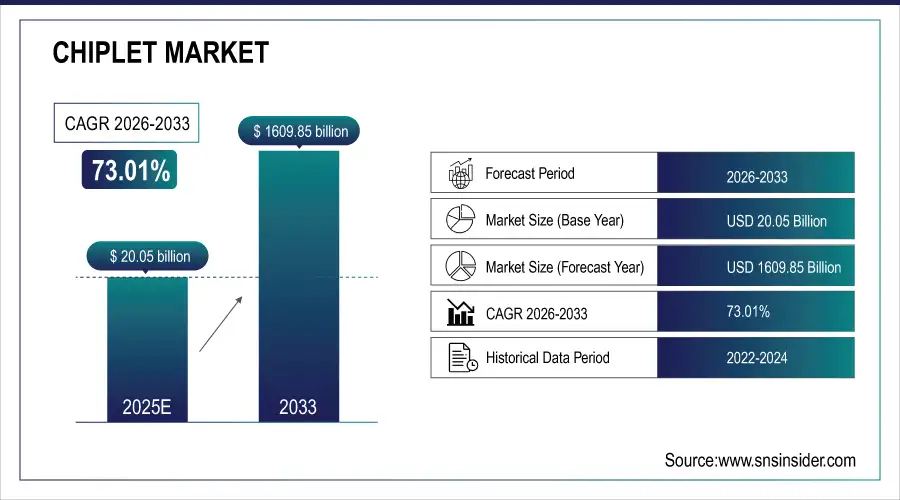

The Chiplet Market Size is estimated at USD 20.05 Billion in 2025E and is projected to reach USD 1609.85 Billion by 2033, growing at a CAGR of 73.01% during 2026–2033.

The Chiplet Market analysis report gives a thorough review of processor modularization techniques, advanced packaging adoption trends, disaggregated semiconductor architectures, and heterogeneous integration in high-performance computing, artificial intelligence, automotive, and enterprise electronics. Strong chiplet adoption is anticipated during the projection period because to factors such yield optimization at advanced nodes, decreased design costs, expedited time-to-market, and rising demand for scalable performance.

Chiplet-based architectures are expected to be deployed across over 3,200 processor platforms by 2025, driven by increasing transistor scaling challenges, rising advanced-node costs, and growing reliance on heterogeneous compute integration.

Market Size and Growth Projection:

-

Market Size in 2025: USD 20.05 Billion

-

Market Size by 2033: USD 1609.85 Billion

-

CAGR: 73.01% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Chiplet Market - Request Free Sample Report

Chiplet Market Trends:

-

Limitations of monolithic SoC scaling below 5 nm are accelerating the shift to chiplet-based architectures for CPUs, GPUs, and AI accelerators.

-

Heterogeneous computing adoption is driving integration of logic, memory, I/O, and accelerator chiplets in a single package, improving performance per watt by 20–30%.

-

Focus on yield optimization and cost reduction is promoting disaggregation of large dies into smaller, reusable chiplets.

-

Advanced packaging technologies like 2.5D interposers, 3D stacking, and fan-out are supporting chiplet commercialization.

-

Standardization initiatives (UCIe) are enabling multi-vendor interoperability and ecosystem growth.

-

Deployment in AI accelerators and data-center processors is driving sustained market expansion, with chiplet adoption expected to grow over 25% CAGR through 2030.

U.S. Chiplet Market Analysis:

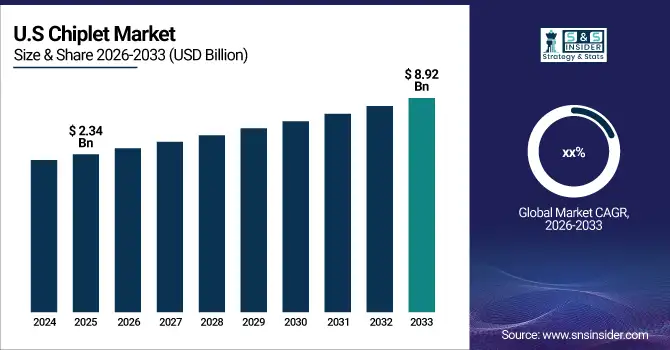

The U.S. Chiplet Market is projected to grow from USD 2.34 Billion in 2025E to USD 8.92 Billion by 2033, at a CAGR of 18.23%. Leadership in cutting-edge processor design, robust demand for AI and HPC, early acceptance of chiplet standards, and significant investments by CPU, GPU, and AI accelerator makers are what propel growth. The U.S.'s market supremacy is further reinforced by federal incentives for innovative packaging and local chip fabrication.

Chiplet Market Growth Drivers:

-

Rising Advanced Node Costs Are Accelerating Chiplet Adoption Globally

One of the main factors propelling the Chiplet market growth is rising costs and yield issues at advanced semiconductor nodes. Time-to-market, development complexity, and defect risk are all greatly increased when monolithic dies are manufactured at 5 nm, 3 nm, and smaller. By dividing intricate designs into smaller functional components that can be manufactured at optimal nodes, chiplet architectures lessen these difficulties. This method allows for quicker product iterations, increases yield, and lowers overall costs. Chiplets are becoming a fundamental design for next-generation CPUs as performance scaling becomes more challenging using conventional methods.

Chiplet-based processor designs are estimated to reduce total silicon cost by 20–35% compared to equivalent monolithic SoCs.

Chiplet Market Restraints:

-

Complex Packaging and Interconnect Integration Challenges Limit Adoption Globally

Complex advanced packaging and connection issues continue to be major barriers to the chiplet market. Advanced packaging technologies and design know-how are needed for high-density interconnects, thermal control, signal integrity, and power delivery across numerous dies. Adoption among smaller semiconductor companies is further hampered by a lack of advanced packaging capability and greater initial development costs. Multi-vendor integration can also be slowed by interoperability issues outside of standardized ecosystems. Despite high long-term demand, adoption is restrained by these infrastructure and technical issues.

Advanced chiplet packaging solutions increase overall package design complexity by 30–40% compared to traditional single-die implementations.

Chiplet Market Opportunities:

-

AI, HPC, and Automotive Compute Expansion Creates High-Value Opportunities for Market Growth Globally

For the chiplet market, the fast expansion of high-performance computing, AI workloads, and automotive domain controllers offers substantial prospects. Chiplet architectures naturally support the scalable performance, heterogeneous computation, and effective power management required by these applications. Faster customization and product diversification are made possible by the modular integration of computation, memory, and acceleration chiplets. Chiplets have long-term development possibilities for semiconductor and packaging suppliers as AI models get more complicated and automotive electronics move toward centralized computation platforms.

AI and HPC applications are expected to account for over 46% of chiplet deployments by 2026.

Chiplet Market Segmentation Analysis:

-

By Processor, CPU held the largest market share of 34.62% in 2025, while AI ASIC Coprocessors are expected to grow at the fastest CAGR of 21.48% during 2026–2033.

-

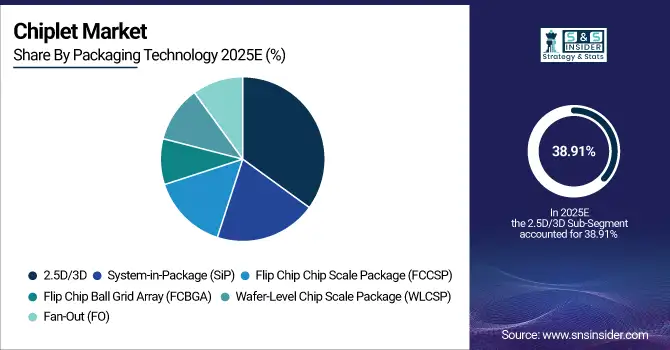

By Packaging Technology, 2.5D/3D packaging accounted for the highest market share of 38.91% in 2025, while Fan-Out (FO) packaging is projected to expand at the fastest CAGR of 19.36%.

-

By End-use Application, Enterprise Electronics dominated with a 36.74% share in 2025, while Automotive is expected to grow at the fastest CAGR of 20.12% through 2026–2033.

By Packaging Technology, 2.5D/3D Dominates While Fan-Out Expands Rapidly

2.5D/3D packaging dominated the market in 2025 owing to its ability to support high-bandwidth interconnects and dense heterogeneous integration. Over 1,600 chiplet products leveraged interposer-based or stacked architectures in 2025 to meet performance requirements.

Fan-Out packaging is projected to be the fastest-growing segment, as it offers cost-effective and high-density integration without traditional substrates. In 2025, Fan-Out adoption expanded across 480 chiplet designs, particularly in consumer, networking, and edge AI applications.

By Processor, CPUs Dominate While AI ASICs Expand Rapidly

CPU chiplets led the market owing to the widespread adoption in data centers, servers, and enterprise computing platforms. Modular CPU architectures enable scalability, core-count expansion, and flexible I/O integration. Over 1,100 CPU platforms adopted chiplet designs in 2025, improving performance per watt and yield efficiency.

AI ASIC Coprocessors segment is expected to be the fastest-growing segment, driven by surging AI training and inference workloads. In 2025, more than 420 AI accelerator platforms utilized chiplet architectures to integrate compute, memory, and networking dies efficiently.

By End-use Application, Enterprise Electronics Dominate While Automotive Expands Rapidly

Enterprise Electronics dominated due to strong demand from servers, networking infrastructure, and cloud data centers. Chiplets enable scalable compute platforms tailored to diverse enterprise workloads. Over 1,500 enterprise processor deployments relied on chiplet architectures in 2025.

Automotive is the fastest-growing segment, due to the software-defined vehicles, ADAS, and centralized domain controllers. In 2025, approximately 310 automotive compute platforms integrated chiplet-based designs to improve performance, reliability, and thermal efficiency.

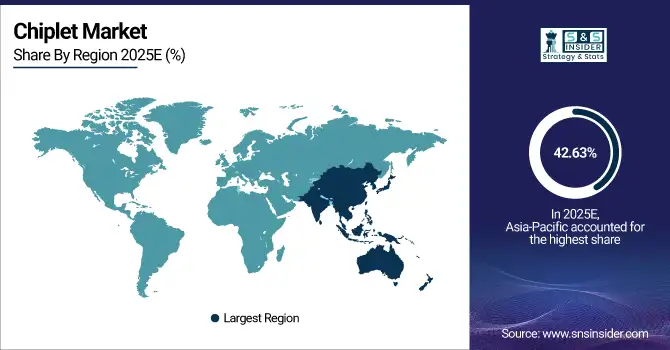

Chiplet Market Regional Analysis:

Asia Pacific Chiplet Market Insights

Asia Pacific dominated the Chiplet Market, holding 42.63% of global market share in 2025. Strong semiconductor manufacturing ecosystems, sophisticated packaging capabilities, and top-tier foundries in China, Japan, South Korea, and Taiwan all contribute to growth. Asia-Pacific is positioned as the global center for chiplet commercialization and heterogeneous integration because to the high adoption of chiplets in consumer electronics, networking equipment, and AI accelerators.

Get Customized Report as per Your Business Requirement - Enquiry Now

-

China Chiplet Market Insights: China is the largest contributor in Asia Pacific, accounting for approximately 35% of regional demand. The market is expanding because to increased demand for scalable computational architectures, enhanced packaging adoption, and a strategic focus on domestic semiconductor capacity. Chiplet commercialization across industrial and cloud computing systems is accelerated by government assistance for AI hardware, heterogeneous integration, and data center deployment.

North America Chiplet Market Insights:

North America is the fastest-growing regional market, projected to expand at a CAGR of 18.94%. Growth is fueled by leadership in processor architectures, AI accelerators, and early adoption of chiplet standards. Strong R&D investment, packaging innovation, and collaborative industry initiatives reinforce North America’s competitiveness in high-performance and next-generation compute solutions.

-

U.S. Chiplet Market Insights: The U.S. dominates the North American market, contributing approximately 70% of regional revenue. Large semiconductor firms, a sizable AI and HPC infrastructure, and the early use of chiplet designs in processors and accelerators all contribute to growth. Chiplet adoption across cloud, AI, and edge computing platforms is accelerated by advanced packaging techniques including 2.5D and 3D integration with an emphasis on performance-per-watt optimization.

Europe Chiplet Market Insights:

Europe’s Chiplet Market is driven by automotive electronics, industrial automation, and high-performance computing (HPC) research initiatives. Countries such as Germany, France, and the Netherlands are adopting chiplets to strengthen sovereign semiconductor strategies, support advanced packaging ecosystems, and enable scalable compute platforms for AI and industrial applications.

-

Germany Chiplet Market Insights: Germany is the largest European contributor, accounting for 28% of regional demand. Innovation in automotive semiconductors, the use of industrial automation, and HPC research initiatives all contribute to growth. Chiplets' integration into industrial processors, edge computing platforms, and AI accelerators enhances Germany's leadership in cutting-edge semiconductor technologies and promotes regional technological sovereignty.

Latin America Chiplet Market Insights:

Latin America is showing emerging growth, driven by growing demand for telecom and industrial automation solutions, the slow adoption of sophisticated computing platforms, and the expansion of electronics manufacturing. Adoption of chiplet-based solutions in targeted industries is supported by regional investment in semiconductor assembly and design capabilities.

-

Brazil Chiplet Market Insights: Brazil leads Latin America, contributing approximately 40% of regional demand. Adoption of new data center projects, industrial electronics, and telecom infrastructure upgrades all contribute to growth. Brazil's status as a major market for chiplet adoption in the region is strengthened by the gradual integration of chiplets in high-performance compute modules and AI-enabled industrial systems.

Middle East & Africa Chiplet Market Insights:

The Middle East & Africa market is developing steadily, driven by investments in data centers, AI infrastructure, and defense electronics. Expansion of smart city projects, high-performance computing adoption, and regional semiconductor initiatives support incremental chiplet deployment.

-

United Arab Emirates Chiplet Market Insights: The UAE is the leading contributor in MEA, accounting for nearly 33% of regional market revenue. Growth is driven by AI infrastructure development, defense electronics programs, and emerging data center deployments. Integration of chiplet-based processors in AI accelerators and industrial computing systems is expected to support sustained adoption across the region.

Chiplet Market Competitive Landscape:

Intel Corporation, founded in 1968, this top semiconductor business is based in Santa Clara, California, and specializes in microprocessors, chipsets, and data-centric solutions. Intel provides hardware, software, and integrated platforms to a variety of industries, including data centers, personal computers, AI, 5G, and autonomous systems. Intel is well-known for its advancements in memory and processor technology, which continue to influence computing performance globally.

-

In September 2025, Intel launched its 14th Gen Core processors with advanced AI acceleration and improved energy efficiency for desktops and laptops.

Advanced Micro Devices, Inc. (AMD), founded in 1969 and based in Santa Clara, California, designs high-performance computing, graphics, and visualization technologies. AMD develops CPUs, GPUs, and adaptive system-on-chip solutions for gaming, data centers, AI, and professional visualization markets. With a strong focus on high-performance computing, AMD competes globally with innovative architectures and energy-efficient designs, serving consumer, enterprise, and research sectors.

-

In November 2025, AMD released the MI400 series GPUs, optimized for AI workloads and HPC applications, boosting compute performance and energy efficiency.

Apple Inc., founded in 1976 in Cupertino, California, this multinational technology leader provides digital services, software, and consumer products. iPhones, Macs, iPads, wearables, and services, such as iCloud, Apple Music, and the App Store are all part of Apple's ecosystem. Apple continues to grow in AR/VR, health tech, and AI-driven services for consumers and businesses. The company is well-known for its innovative design, smooth user experience, and ecosystem integration.

-

In October 2025, Apple introduced the Vision Pro 2, an upgraded mixed-reality headset with enhanced spatial computing, improved sensors, and longer battery life.

IBM (International Business Machines Corporation), founded in 1911, this multinational technology and consulting firm has its headquarters in Armonk, New York. IBM offers enterprise software, cloud computing, AI, quantum computing, and IT infrastructure to companies globally. IBM, which is renowned for its innovation in AI-driven analytics, hybrid cloud platforms, and enterprise-grade solutions, is using next-generation computing technologies to revolutionize a number of industries, including manufacturing, healthcare, and finance.

-

In June 2025, IBM launched WatsonX.ai Enterprise Suite, offering advanced generative AI capabilities integrated with hybrid cloud for enterprise decision-making and automation.

Marvell Technology, Inc., based in Santa Clara, California, and founded in 1995, creates semiconductor solutions for networking, storage, data infrastructure, and artificial intelligence applications. Marvell serves the cloud, 5G, automotive, and enterprise markets with their high-performance silicon, which includes processors, ASICs, and SoCs. In order to enable next-generation computing, storage, and communication technologies worldwide, the business focuses on low-power, high-efficiency architectures for contemporary data-centric applications.

-

In March 2025, Marvell launched the OCTEON Fusion processors, delivering enhanced 5G and AI networking performance for telecom infrastructure and cloud-edge deployments.

Chiplet Market Companies are:

-

Intel Corporation

-

Apple Inc.

-

IBM

-

MediaTek Inc.

-

NVIDIA Corporation

-

Achronix Semiconductor Corporation

-

Ranovus

-

Netronome

-

Cadence Design Systems, Inc.

-

SiFive, Inc.

-

ALPHAWAVE SEMI

-

Eliyan

-

Ayar Labs, Inc.

-

Tachyum

-

X-Celeprint

-

Kandou Bus SA

-

NHanced Semiconductors

-

Tenstorrent

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 20.05 Billion |

| Market Size by 2033 | USD 1609.85 Billion |

| CAGR | CAGR of 73.01% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2021-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Processor (Field-Programmable Gate Array (FPGA), Graphics Processing Unit (GPU), Central Processing Unit (CPU), Application Processing Unit (APU), Artificial Intelligence Application-specific Integrated Circuit (AI ASIC) Coprocessor) • By Packaging Technology (System-in-Package (SiP), Flip Chip Chip Scale Package (FCCSP), Flip Chip Ball Grid Array (FCBGA), 2.5D/3D, Wafer-Level Chip Scale Package (WLCSP), Fan-Out (FO)) • By End-use Applications (Enterprise Electronics, Consumer Electronics, Automotive, Industrial Automation, Healthcare, Military & Aerospace, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Intel Corporation, Advanced Micro Devices, Inc., Apple Inc., IBM, Marvell, MediaTek Inc., NVIDIA Corporation, Achronix Semiconductor Corporation, Ranovus, Netronome, Cadence Design Systems, Inc., SiFive, Inc., ALPHAWAVE SEMI, Eliyan, Ayar Labs, Inc., Tachyum, X-Celeprint, Kandou Bus SA, NHanced Semiconductors, Tenstorrent. |