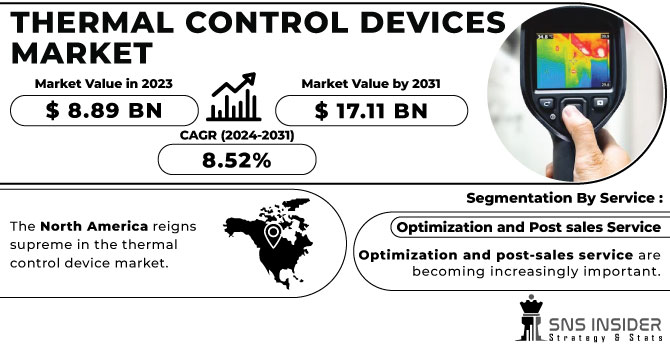

Thermal Control Devices Market Size

The Thermal Control Devices Market Size was valued USD 9.42 billion in 2023 and is expected to reach USD 17.31 billion by 2032 and grow at a CAGR of 7.00% over the forecast period of 2024-2032.

The thermal control devices market is witnessing robust growth, primarily driven by the increasing adoption of renewable energy sources, such as solar power systems and energy storage solutions. As countries transition toward sustainable energy, efficient thermal management has become essential, particularly in applications like solar inverters, battery systems, and power converters. Thermal control devices ensure these systems maintain optimal temperatures, enhancing efficiency and longevity.

Get More Information on Thermal Control Devices Market - Request Sample Report

Innovations like nanofluids, turbulators, and cerium oxide thermal switches are significantly improving thermal performance, while reducing reliance on traditional energy sources. These developments are vital in enhancing energy efficiency in renewable energy systems, such as solar power plants and battery thermal management. The U.S. Department of Energy highlights the role of advanced cooling technologies in optimizing energy systems. For instance, managing temperature fluctuations in solar energy storage systems is crucial to maintaining energy output and minimizing overheating risks. Additionally, high-performance materials like phase change materials (PCMs) and advanced heat sinks are gaining traction for regulating temperatures in solar cells and electric vehicle batteries. As per recent studies, thermal switches are boosting energy storage and harvesting efficiency by up to 60%. The growing focus on clean energy and decarbonization continues to propel the demand for thermal control devices. The market is also driven by the rising adoption of geothermal heating and cooling systems (GHPs) integrated with smart grid technologies. With an expected USD100-150 billion investment in GHPs by 2035, GHP systems are set to serve 7 million homes, tripling U.S. capacity. This growth is aligned with energy sector goals to reduce peak demand and enhance resilience while lowering consumer energy bills. As GHP demand rises, advanced thermal control devices will play a key role in optimizing system performance and supporting renewable energy integration, fueling further market expansion.

Thermal Control Devices Market Dynamics

Drivers

-

Advancements in Thermal Control and Lighting Technologies Drive EV Industry Growth

The automotive industry's shift to electric vehicles (EVs) is fueling the demand for advanced thermal management and lighting solutions, essential for optimizing vehicle performance and efficiency. Effective thermal control is particularly critical for managing the temperature of battery systems, power electronics, and other key components in EVs, as overheating can lead to reduced battery life, performance degradation, or failure. As the adoption of EVs accelerates, the need for specialized thermal management solutions, such as phase change materials, advanced cooling systems, and embedded thermal management technologies, continues to grow. Additionally, innovations in power electronics, such as the use of silicon carbide (SiC) semiconductors, are significantly enhancing energy efficiency and heat management. The automotive industry's focus on sustainable mobility is driving the integration of these thermal solutions to ensure operational safety and improve driving experiences, particularly in extreme weather conditions. At the same time, lighting solutions, including light-emitting diodes (LEDs), play a vital role in modern vehicles, offering efficient brightness control for functions like high beams, brake lights, and turn signals. LEDs require varying brightness levels, which are controlled through pulse width modulation (PWM) circuits, providing energy-efficient lighting. As the EV market expands, the need for high-performance power management systems, such as IC drivers and buck-boost configurations, is rising, enabling smart lighting systems that optimize visibility. The automotive sector’s growth is also reflected in the increasing use of lower conductivity fluids, with a projected need for 880 million liters of fluid in BEV and PHEV cars by 2035. Moreover, the U.S. government’s target of EVs making up 50% of new vehicle sales by 2030 and tax incentives further support the shift to cleaner, more efficient technologies, highlighting the growing importance of both thermal management and LED systems in the future of EVs.

Restraints

-

Challenges in the Thermal Control Devices Market Integration and Maintenance Across Industries

Integrating sophisticated thermal management systems often requires significant engineering efforts, posing challenges for seamless adoption and system optimization. As highlighted in various studies, such as those on integrated thermal controls and third-party controls, the complexity of managing these systems leads to increased operational costs, especially when dealing with custom solutions. High installation and maintenance costs are a major concern, with complex designs requiring skilled workforce and specialized knowledge. indicates that thermal management solutions for power electronics and automotive applications must meet specific demands for efficiency, which complicates the integration process, often causing delays in product launches. Reports also suggest that as industries shift toward electric vehicles (EVs) and smart devices, the adoption of advanced cooling technologies like liquid cooling and phase-change materials increases, further complicating the integration due to higher resource consumption and space constraints. Another critical restraint is the environmental impact and stringent regulations associated with materials like refrigerants in cooling systems, which require continual updates and adaptations. In sectors like aerospace, thermal control, systems must balance performance with weight and space limitations, limiting the design flexibility. Energy-efficient solutions are sought after, but active cooling systems, such as liquid cooling or Peltier devices, can increase energy consumption, affecting overall sustainability. Complex cooling systems for electronics and automotive components may also experience supply chain disruptions, leading to delays in production. This dynamic market is defined by ongoing advancements and increasing demand for energy-efficient cooling solutions across industries.

Thermal Control Devices Market Segment Overview

By Material

The adhesive material segment is the dominant in thermal control devices market, accounting for around 60% of the market share in 2023. Adhesive materials are integral to the thermal management systems used in various industries, including automotive, electronics, and industrial applications. These materials offer efficient heat dissipation and excellent bonding properties, making them ideal for use in components such as heat sinks, thermal interface materials, and semiconductors. Their ability to provide strong adhesion while withstanding high temperatures makes them essential in maintaining device performance and longevity. As the demand for compact, high-performance electronic devices and electric vehicles continues to rise, the adhesive material segment is expected to maintain its leading position, driving innovations in thermal management technologies.

By Devices

The convection cooling devices segment dominates the thermal control devices market, contributing to around 40% of the total revenue in 2023. Convection cooling devices play a crucial role in efficiently managing heat by utilizing the natural or forced movement of air to transfer heat away from components. These devices are widely used across various sectors, including electronics, automotive, and industrial machinery, due to their cost-effectiveness, simplicity, and ease of maintenance. They are particularly effective in applications where space and weight are limited, such as in high-performance computing systems and electric vehicles. With the increasing need for reliable and efficient cooling systems in energy-efficient technologies, the convection cooling devices segment is expected to remain a key player in the market, driving continued demand for effective thermal solutions.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Thermal Control Devices Market Regional Analysis

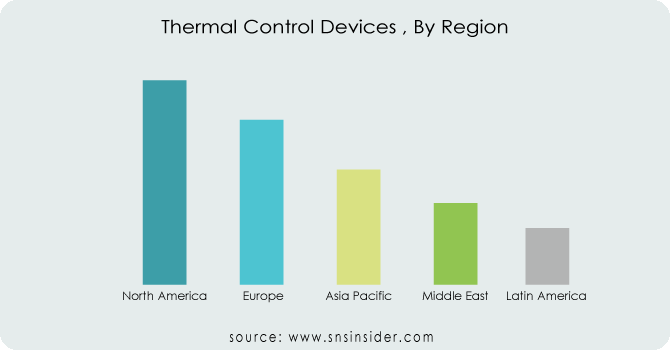

North America dominates the thermal control devices market, contributing to around 40% of the total revenue in 2023. The region's leadership is attributed to strong industrial and technological advancements, particularly in the automotive, aerospace, and electronics sectors. The U.S. and Canada are key drivers, with the rapid growth of electric vehicles (EVs) and energy-efficient technologies boosting demand for advanced thermal management systems. The presence of leading players in the thermal control industry, along with significant investments in research and development, further strengthens North America's market position. Additionally, the region's focus on sustainability and regulatory measures for reducing carbon emissions fuels the adoption of high-performance thermal solutions, ensuring North America's continued dominance in the thermal control devices market.

Asia-Pacific is the fastest-growing region in the thermal control devices market over the forecast period (2024-2032). The region's growth is driven by rapid industrialization, technological advancements, and an increasing demand for electric vehicles (EVs), consumer electronics, and data centers. Countries like China, Japan, South Korea, and India are at the forefront of this expansion. China is leading the way with its massive manufacturing capabilities and strong investments in EV production, while Japan and South Korea are advancing in electronics and automotive sectors, demanding efficient thermal management systems. India's growing tech industry and infrastructure development also contribute to the region's market growth. Furthermore, supportive government policies and initiatives focused on sustainability and energy efficiency are fueling the adoption of innovative thermal control devices, making Asia-Pacific the key growth hub for the industry.

Key Players

Some of the Major Key Players in Thermal Control Devices along with their product:

-

Honeywell International Inc. (Thermal management systems, heat exchangers, thermal switches)

-

3M (Thermal interface materials, heat sinks, thermal tapes)

-

Advanced Cooling Technologies Inc. (Liquid cooling systems, heat pipes, heat exchangers)

-

Thermacore Inc. (Custom thermal solutions, heat pipes, thermal foams)

-

Laird Thermal Systems (Peltier thermoelectric coolers, thermoelectric modules)

-

Finland Cooling Systems (Air-cooled heat exchangers, liquid-to-air cooling systems)

-

STMicroelectronics (Thermal sensors, semiconductor cooling systems)

-

CUI Inc. (Peltier thermoelectric modules, cooling fans)

-

Vicor Corporation (Thermal management modules, power thermal solutions)

-

Aavid Thermalloy (Heat sinks, cold plates, thermal interface materials)

-

Kerafol Keramische Folien GmbH (Ceramic thermal interface materials, heat sinks)

-

NexTek, Inc. (Phase-change materials, thermal interface materials)

-

Delta Electronics, Inc. (Cooling fans, power supply thermal solutions)

-

SABIC (Thermal management materials, engineered plastics)

-

Colder Products Company (Thermal couplings, connectors for fluid cooling)

-

Xerox Corporation (Heat exchangers for office equipment, electronic cooling)

-

Asetek (Liquid cooling solutions for gaming and high-performance computing)

-

Schneider Electric (Thermal management systems, data center cooling solutions)

-

United Heat Exchangers Pvt. Ltd. (Industrial cooling systems, heat exchangers)

-

Dynatron Corporation (CPU cooling fans, thermal solutions for electronics)

-

Applied Materials, Inc. (Semiconductor thermal management, ion implantation cooling systems)

-

Cooltech Solutions, Inc. (Thermal management for electronics, Peltier modules)

-

Intel Corporation (Heat sinks, thermal interface materials for microprocessors)

-

Parker Hannifin Corporation (Thermal control components, fluid cooling systems)

-

Wakefield-Vette (Heat sinks, cold plates, thermal interface materials)

-

Body Corporation (Thermal solutions for industrial applications, heat exchangers)

List of suppliers that provide raw materials and components for the thermal control devices market:

-

Alfa Aesar

-

BASF SE

-

DuPont

-

Thermal Solutions Products, Inc.

-

Saint-Gobain

-

Momentive Performance Materials Inc.

-

Laird Technologies

-

Dow Inc.

-

Nippon Chemical Industrial Co., Ltd.

-

Mitsubishi Chemical Corporation

-

NexTek, Inc.

-

Dow Corning

-

Samsung SDI

-

Schreiner Group

-

Aavid Thermalloy

-

SABIC

-

Huntsman Corporation

-

Trelleborg Group

Recent Development

-

Dec 2024 – 3M has increased its use of recycled content in acoustic materials from 17% to 30%, aiming to exceed 70% by 2027. This initiative is part of the company’s broader sustainability mission, focusing on recyclability and environmental responsibility.

-

Sep 2024 – STMicroelectronics has introduced its fourth-generation 750V SiC MOSFET technology for EV traction inverters, with the 1200V class expected to be qualified by Q1 2025. The company is also developing a new SiC substrate manufacturing facility in Catania, set to begin production in 2026.

-

October 2024 – Delta Electronics is expanding its footprint in India’s industrial automation sector with a strong focus on the electric vehicle (EV) industry, investing in advanced solutions for EV manufacturing and battery production to enhance efficiency and reliability.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 9.42 Billion |

| Market Size by 2032 | USD 17.31 Billion |

| CAGR | CAGR of 7.00% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material (Adhesive Material and Non-Adhesive Material) • By Device (Conduction Cooling Devices, Convection Cooling Devices, Advanced Cooling Devices and Hybrid Cooling Devices) • By End User (Aerospace & Defense, Automotive, Servers & Data Centers, Consumer Electronics, Enterprises, Healthcare and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Honeywell International Inc., 3M, Advanced Cooling Technologies Inc., Thermacore Inc., Laird Thermal Systems, Finland Cooling Systems, STMicroelectronics, CUI Inc., Vicor Corporation, Aavid Thermalloy, Kerafol Keramische Folien GmbH, NexTek Inc., Delta Electronics Inc., SABIC, Colder Products Company, Xerox Corporation, Asetek, Schneider Electric, United Heat Exchangers Pvt. Ltd., Dynatron Corporation, Applied Materials Inc., Cooltech Solutions Inc., Intel Corporation, Parker Hannifin Corporation, Wakefield-Vette, and Body Corporation are prominent players in thermal management and cooling solutions across various industries. |

| Key Drivers | • Advancements in Thermal Control and Lighting Technologies Drive EV Industry Growth. |

| Restraints | • Challenges in the Thermal Control Devices Market Integration and Maintenance Across Industries. |