Class 4 Truck Market Report Scope & Overview:

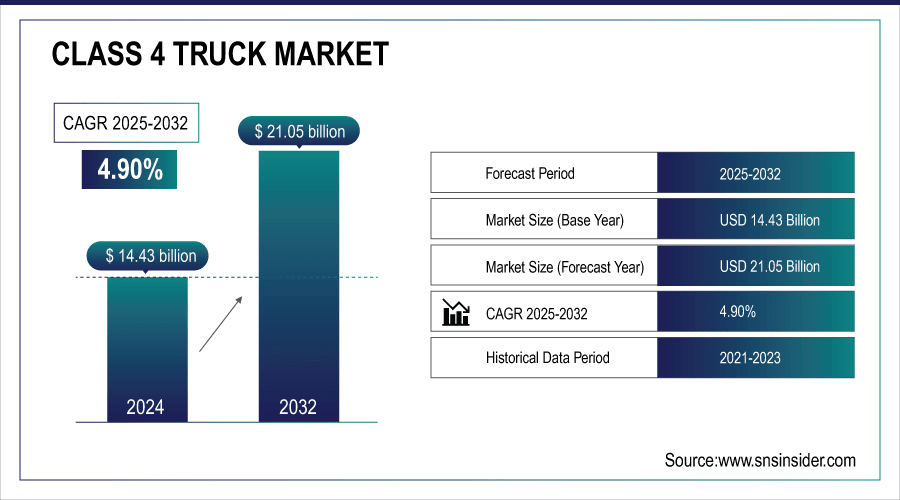

Class 4 Truck Market was valued at USD 14.43 billion in 2024 and is expected to reach USD 21.05 billion by 2032, growing at a CAGR of 4.90% from 2025-2032.

The Class 4 Truck Market is growing due to rising demand for efficient urban delivery solutions, expanding e-commerce, and increasing fleet modernization. Adoption of electric and hybrid trucks driven by stricter emission regulations and fuel efficiency improvements further supports growth. Additionally, infrastructure development, technological advancements in telematics, and government incentives for eco-friendly commercial vehicles are encouraging fleet operators to invest in Class 4 trucks, boosting market expansion globally.

Government initiatives are also encouraging fleet operators to invest in Class 4 trucks. For instance, the Inflation Reduction Act of 2022 allocated $1 billion for investments in clean, zero-emission heavy-duty vehicles and charging infrastructure. Additionally, California's Hybrid and Zero-Emission Truck and Bus Voucher Incentive Project (HVIP) offers point-of-sale discounts to buyers of electric trucks.

To Get More Information On Class 4 Truck Market - Request Free Sample Report

Class 4 Truck Market Trends

-

Rising demand for medium-duty trucks in logistics, construction, and last-mile delivery is driving market growth.

-

Adoption of electric and hybrid Class 4 trucks is increasing due to emission regulations and sustainability goals.

-

Integration of telematics, fleet management, and safety technologies is enhancing operational efficiency.

-

Growth of e-commerce and urban delivery services is boosting demand for versatile medium-duty vehicles.

-

Government incentives and policies for clean transportation are supporting electric truck adoption.

-

Expansion of leasing and rental services is increasing market accessibility.

-

Collaborations between OEMs, technology providers, and fleet operators are accelerating innovation and deployment.

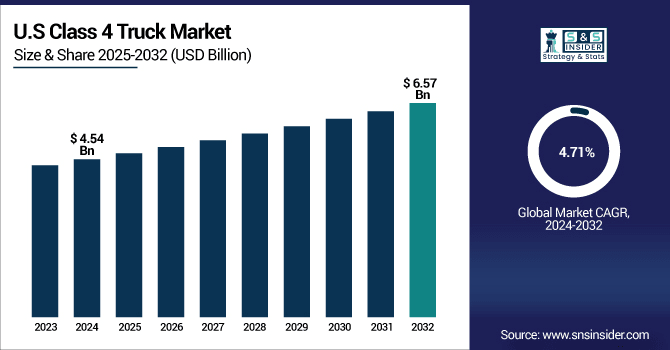

U.S. Class 4 Truck Market was valued at USD 4.54 billion in 2024 and is expected to reach USD 6.57 billion by 2032, growing at a CAGR of 4.71% from 2025-2032.

The U.S. Class 4 Truck Market is growing due to increasing e-commerce, demand for efficient last-mile delivery, fleet modernization, adoption of fuel-efficient and hybrid trucks, and supportive government incentives promoting eco-friendly commercial vehicles across urban and regional logistics.

Class 4 Truck Market Growth Drivers:

-

Adoption of Advanced Fuel-Efficient and Hybrid Technologies is Strengthening Class 4 Truck Market Demand Worldwide

Improvements in fuel efficiency and emission control are encouraging fleet operators to adopt Class 4 trucks with hybrid and electric powertrains. These vehicles reduce operational costs significantly while complying with stricter emission standards globally. Government incentives for clean transportation further support adoption, prompting manufacturers to launch technologically advanced trucks. Companies focusing on lightweight materials, aerodynamics, and telematics integration are enhancing vehicle performance. Fleet operators are increasingly replacing older diesel trucks with new efficient models to cut costs, improve reliability, and meet urban delivery requirements. This continuous technological innovation is a key factor driving the market forward.

-

Under the EPA–DOT Heavy-Duty Phase 2 GHG standards (covering model years 2021–2027), advanced trucks are projected to reduce CO₂ emissions by up to 25%, save vehicle owners a total of USD 170 billion in fuel costs, and prevent up to 2 billion barrels of oil consumption yielding a net societal benefit of USD 230 billion.

-

The California Hybrid and Zero-Emission Truck and Bus Voucher Incentive Project (HVIP) administered by CARB is a primary example of how government incentives accelerate adoption of advanced Class 4-sized technologies.

-

As of December 2024, approximately 2,580 hybrid trucks and over 9,495 zero-emission trucks/buses have been supported via HVIP.

-

In total, around 15,100 clean vehicles have been deployed through the program, with estimated reductions of 1.357 million metric tons of CO₂e, 2,064 tons of NOₓ, 33.6 tons of hydrocarbons, and 80.5 tons of particulate matter.

-

In early 2025, over 5,000 HVIP-funded ZEVs were in production, accompanied by 16,327 charging and hydrogen fueling points installed statewide highlighting infrastructure growth alongside vehicle adoption.

Class 4 Truck Market Restraints:

-

High Purchase and Maintenance Costs of Class 4 Trucks are Limiting Market Expansion and Adoption

Class 4 trucks involve high initial purchase prices and significant maintenance costs, which can deter small and medium fleet operators. The cost of spare parts, fuel, insurance, and repair adds to the total cost of ownership, making adoption challenging for new entrants. Additionally, operators in developing regions often face limited access to financing options, restricting fleet expansion. Despite long-term operational savings, the upfront investment required for advanced hybrid or electric Class 4 trucks can slow market growth. These cost constraints continue to act as a barrier, especially for smaller logistics and delivery companies.

Class 4 Truck Market Opportunities:

-

Growing E-Commerce and Urban Logistics Expansion Present Strong Opportunities for Class 4 Truck Market Growth

The rapid rise of e-commerce and demand for efficient urban delivery solutions presents significant opportunities for Class 4 trucks. Their smaller size compared to heavy-duty trucks allows easier maneuvering in congested cities while maintaining high payload capacity. Fleet operators can expand their delivery networks cost-effectively using Class 4 trucks. Additionally, companies investing in electric and hybrid models can capitalize on growing environmental awareness and government incentives. Partnerships between logistics providers and truck manufacturers to develop customized solutions for urban deliveries further enhance market opportunities, creating avenues for innovation, product differentiation, and long-term revenue growth.

Class 4 Truck Market Segment Highlights

-

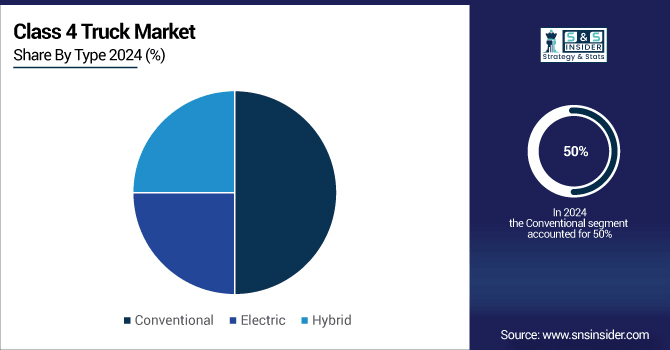

By Propulsion Type, Conventional dominated with ~50% share in 2024; Hybrid fastest growing (CAGR).

-

By Application, General Delivery dominated with ~41% share in 2024; Refrigerated Transportation fastest growing (CAGR).

-

By GVWR, 10,001 – 12,500 lbs dominated with ~50% share in 2024; 14,501 – 16,500 lbs fastest growing (CAGR).

-

By Body Type, Dry Van dominated with ~36% share in 2024; Refrigerated Van fastest growing (CAGR).

-

By Fuel Type, Diesel dominated with ~56% share in 2024; Electric fastest growing (CAGR).

Class 4 Truck Market Segment Analysis

By Type, Conventional trucks dominated the Class 4 Truck Market in 2024, while Hybrid trucks are projected to grow fastest from 2025-2032.

Conventional trucks dominated the Class 4 Truck Market in 2024 due to their proven reliability, established infrastructure, and lower upfront costs. They are widely preferred by fleet operators for general delivery and commercial applications, providing durability and ease of maintenance, making them a practical choice for urban and regional logistics operations.

Hybrid trucks are expected to grow the fastest from 2025-2032 as companies increasingly adopt fuel-efficient and environmentally friendly vehicles. Rising emission regulations, government incentives, and advancements in battery and hybrid technologies encourage fleet modernization. Hybrid trucks offer lower operational costs and reduced emissions, driving their rapid adoption in urban deliveries and last-mile logistics.

By Application, General Delivery led in 2024, with Refrigerated Transportation expected to grow fastest due to rising cold chain logistics demand.

General Delivery dominated in 2024 due to the surge in e-commerce, requiring efficient last-mile transportation. Class 4 trucks provide the right balance of payload capacity and maneuverability for urban areas, allowing faster delivery times, reduced operational costs, and reliable performance, making them the preferred choice for logistics and courier companies.

Refrigerated Transportation is expected to grow the fastest from 2025-2032 due to increasing demand for cold chain logistics. Rising online grocery, pharmaceutical, and perishable goods delivery requires temperature-controlled trucks. Companies are investing in advanced refrigerated Class 4 trucks with energy-efficient cooling systems to meet urban delivery demands and maintain product quality.

By Payload Capacity, the 10,001–12,500 lbs segment dominated in 2024, while 14,501–16,500 lbs is projected to grow fastest for heavier commercial loads.

The 10,001 – 12,500 lbs segment dominated in 2024 because these trucks provide optimal payload for urban deliveries while maintaining fuel efficiency and maneuverability. Fleet operators prefer this range for general commercial applications, offering a cost-effective solution for transporting moderate loads in congested city environments.

The 14,501 – 16,500 lbs segment is expected to grow the fastest from 2025-2032 due to increasing demand for heavier payloads in commercial logistics. Businesses are expanding delivery capacities for bulk goods, construction, and specialized transportation, making this segment ideal for operators seeking higher efficiency without upgrading to larger, more expensive trucks.

By Body Type, Dry Van trucks led in 2024, while Refrigerated Van trucks are expected to grow fastest for temperature-sensitive deliveries.

Dry Van trucks dominated in 2024 due to their versatility, low maintenance requirements, and suitability for a wide range of goods. They are widely used for general deliveries, retail transportation, and e-commerce logistics, offering secure cargo protection and cost efficiency, making them a standard choice for fleet operators in urban and regional transport.

Refrigerated Van trucks are expected to grow the fastest from 2025-2032 as demand rises for temperature-controlled deliveries. Growth in pharmaceuticals, food, and perishable goods e-commerce drives adoption. Advanced cooling systems and energy-efficient designs enable safe, timely delivery, supporting expansion of cold chain logistics and specialized urban transportation services.

By Powertrain, Diesel trucks dominated in 2024, whereas Electric trucks are expected to grow fastest driven by environmental regulations and urban logistics adoption.

Diesel trucks dominated in 2024 due to established fuel infrastructure, lower upfront costs, and high torque suitable for various payloads. They are preferred by fleet operators for reliability and long-distance transport, providing cost efficiency, durability, and ease of maintenance across urban, regional, and commercial logistics applications.

Electric trucks are expected to grow the fastest from 2025-2032 due to increasing environmental regulations, rising fuel costs, and government incentives. Advances in battery technology, reduced total cost of ownership, and growing adoption in urban logistics make electric Class 4 trucks attractive, accelerating their integration into last-mile and commercial delivery operations.

Class 4 Truck Market Regional Analysis

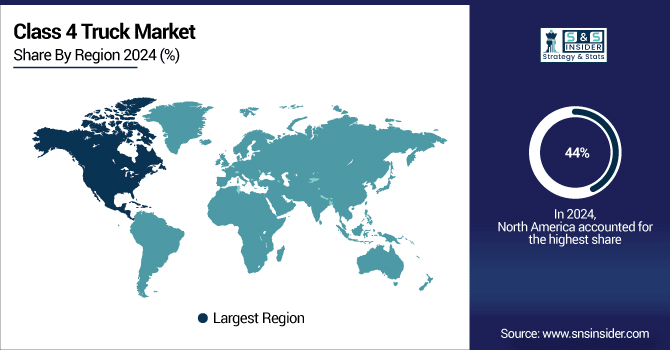

North America Class 4 Truck Market Insights

North America dominated the Class 4 Truck Market with the highest revenue share of about 44% in 2024 due to its well-established logistics infrastructure, high e-commerce penetration, and widespread fleet modernization. Strong demand for last-mile delivery vehicles, supportive government policies, and the presence of leading truck manufacturers further strengthened market adoption and revenue dominance in the region.

Get Customized Report as Per Your Business Requirement - Enquiry Now

Asia Pacific Class 4 Truck Market Insights

Asia Pacific is expected to grow at the fastest CAGR from 2025-2032 due to rapid urbanization, increasing e-commerce activities, and expanding logistics networks. Rising demand for efficient last-mile delivery, government incentives for eco-friendly vehicles, and growing industrialization drive fleet expansion. These factors position Asia Pacific as the fastest-growing region in the Class 4 Truck Market over the forecast period.

Europe Class 4 Truck Market Insights

Europe holds a significant share in the Class 4 Truck Market due to stringent emission regulations, advanced transportation infrastructure, and growing demand for efficient urban logistics. Adoption of electric and hybrid trucks is rising, supported by government incentives. Increasing e-commerce and fleet modernization by logistics companies further drive market growth across key European countries.

Middle East & Africa and Latin America Class 4 Truck Market Insights

Middle East & Africa show moderate growth in the Class 4 Truck Market due to expanding urbanization, infrastructure development, and rising demand for commercial delivery vehicles. Latin America is witnessing steady market growth driven by increasing e-commerce, logistics modernization, and government initiatives supporting fleet expansion. Both regions present emerging opportunities for Class 4 truck adoption and market development.

Class 4 Truck Market Competitive Landscape:

Ford Motor Company

Ford Motor Company is a key player in the Class 4 Truck Market, offering reliable and fuel-efficient medium-duty trucks for commercial and urban delivery applications. Its lineup, including models like the F-Series, provides durability, advanced safety features, and low operational costs. Continuous innovation, strong dealer networks, and focus on electric and hybrid variants enhance its market presence and competitiveness globally.

-

In 2025, Ford Motor Company Unveiled the Ranger Super Duty, a factory-built heavy-duty mid-size pickup offering 4,500 kg gross vehicle mass, robust towing (4,500 kg), and combined mass (8,000 kg), plus integrated smart features like onboard scales and device mounts.

-

In 2024, Ford Motor Company Revealed the Ranger Plug-In Hybrid, introducing electrified capability to mid-size truck segment. Equipped with Pro Power Onboard, it offers zero-emission driving and worksite power from a hybrid powertrain.

-

In 2023, Ford Motor Company Introduced advanced 4WD systems on the Ranger and Everest featuring electronic shift-on-the-fly and 4A (automatic) mode, enabling seamless off-road capability and adaptability for diverse work conditions.

General Motors

General Motors is a prominent player in the Class 4 Truck Market, providing versatile and reliable medium-duty trucks for commercial applications. Its Chevrolet lineup is designed for durability, fuel efficiency, and operational flexibility, catering to urban delivery, construction, and specialized transportation needs. Strong after-sales support, advanced safety features, and continuous innovation in truck design strengthen its market presence and competitiveness globally.

-

In 2025, General Motors (Chevrolet) Announced the all-new Chevrolet Low Cab Forward lineup, offering multiple GVWR options up to ~33,000 lbs, a wide 31.5-ft turning radius, extensive wheelbase choices, and upfit flexibility for diverse vocational needs.

Volvo Group

Volvo Group is a leading player in the Class 4 Truck Market, offering durable and technologically advanced medium-duty trucks for commercial and urban logistics. Its vehicles emphasize fuel efficiency, safety, and driver comfort, catering to diverse applications such as delivery, construction, and specialized transportation. Strong global presence, continuous innovation, and focus on sustainable solutions enhance Volvo Group’s competitiveness and market share in the Class 4 truck segment.

-

In 2024, Volvo Group Launched the second-generation Volvo VNL Class 8 truck in North America, with digital mirrors, full-digital dash, faster I-Shift transmission, aerodynamic upgrades, and trims tailored for efficiency and driver comfort.

Key Players

Some of the Class 4 Truck Market Companies

-

Ford Motor Company

-

General Motors

-

Stellantis

-

Isuzu Motors Ltd.

-

Hino Motors Ltd.

-

Daimler Trucks North America LLC

-

Volvo Group

-

Navistar International Corporation

-

Mitsubishi Fuso Truck and Bus Corporation

-

PACCAR Inc.

-

Iveco

-

MAN Truck & Bus AG

-

Scania AB

-

Tata Motors

-

Mahindra & Mahindra Ltd.

-

Freightliner

-

Chevrolet

-

Ram Trucks

-

International Trucks

-

Hercules Truck & Bus Co.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 14.43 Billion |

| Market Size by 2032 | USD 21.05 Billion |

| CAGR | CAGR of 4.90% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type(Conventional, Electric, Hybrid) • By Application(General Delivery, Construction, Hazardous Material Transportation, Refrigerated Transportation) • By Payload Capacity(10,001 - 12,500 lbs, 12,501 - 14,500 lbs, 14,501 - 16,500 lbs, 16,501 - 18,500 lbs) • By Body Type(Dry Van, Flatbed, Refrigerated Van, Dump Truck, Box Truck) • By Powertrain(Diesel, Gasoline, Electric) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Ford Motor Company, General Motors, Stellantis, Isuzu Motors Ltd., Hino Motors Ltd., Daimler Trucks North America LLC, Volvo Group, Navistar International Corporation, Mitsubishi Fuso Truck and Bus Corporation, PACCAR Inc., Iveco, MAN Truck & Bus AG, Scania AB, Tata Motors, Mahindra & Mahindra Ltd., Freightliner, Chevrolet, Ram Trucks, International Trucks, Hercules Truck & Bus Co. |