Automotive Cabin Comfort Systems Market Report Scope & Overview:

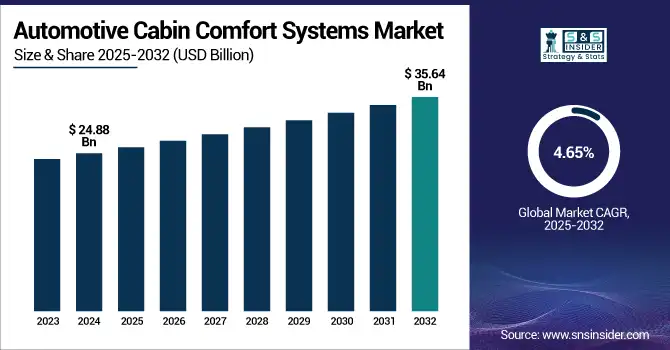

The Automotive Cabin Comfort Systems Market size was valued at USD 24.88 billion in 2024 and is expected to reach USD 35.64 billion by 2032, growing at a CAGR of 4.65% over the forecast period of 2025-2032.

To Get more information on Automotive Cabin Comfort Systems Market - Request Free Sample Report

The global automotive cabin comfort systems market is showing substantial growth due to the increasing need for improved in-vehicle experience, the rising demand for electric vehicles, and advancements in climate control and smart interiors. To enhance passenger experience, OEMs are installing sophisticated HVAC, seat comfort, and ambient lighting systems. Innovation is also being driven by emerging markets and regulatory focus on air quality. The demand for all features mentioned above will be significant by 2032 and is likely to provide revenue for OEM and aftermarket services.

The U.S. automotive cabin comfort systems market size was valued at USD 7.58 billion in 2024 and is expected to reach USD 10.59 billion by 2032, growing at a CAGR of 4.32% over the forecast period of 2025-2032.

The U.S. leads the automotive cabin comfort systems market in North America due to factors such as high levels of vehicle ownership and demand for premium and electric vehicles, coupled with the presence of many of the top global OEMs and a considerable concentration of OEMs and Tier-1 suppliers investing to drive comfort innovations.

Market Dynamics:

Drivers

-

Surge in Demand for In-Vehicle Comfort and Personalization is Driving the Market Growth

The demand for advanced cabin comfort systems is primarily driven by the increasing expectation of consumers of luxury and premium vehicles concerning a personalized driving experience. Things such as climate-control seats, ambient mood lighting, and air-purification systems are being introduced to almost all classes of modern vehicles of all prices. More than 70% of vehicle consumers believe that comfort in the cabin is a key criterion in choosing a car, according to a consumer survey conducted by McKinsey in 2023. This trend is also forcing OEMs to make thoughtful and unique comfort features as standard fit, particularly on mid-range and up vehicles.

-

Expansion of Electric and Luxury Vehicle Markets Is Propelling the Market Growth

An increasing trend within the electric vehicle (EV) and luxury car segments is driving demand for energy-efficient and high-performance cabin comfort technologies. Often, they are used to showcase the latest innovations here, like AI-enabled climate control, adaptive thermal systems, and smart seat ventilation. Global EV sales are now over 14 million this year, versus 10 million in 2022, according to the International Energy Agency (IEA), and folks are starting to get the picture. This segment is becoming a key growth driver for the market as EVs and luxury cars demand more efficient yet upscale cabin solutions.

Restraint

-

High Initial Cost and Complexity Are Restraining the Market from Growing

Adding luxury elements such as multi-zone HVAC, heated and/or cooled seats, and smart systems to the cabin is also a high-level production and technical complexity cost. Such features need specific hardware, such as compressors, sensors, as well as sophisticated materials, raising the cost of vehicles and making long R&D and integration times necessary.

That restraint is especially felt in lower-priced vehicle segments such as budget and mid-range, where price-sensitive consumers may shy away from these offerings. That creates an uphill challenge for manufacturers to justify the added cost without having to push that cost into higher-end vehicle content segments, which would only slow adoption rates of high-end comfort systems in those market segments.

Segmentation Analysis:

By Product

In 2024, Heating, Ventilation, and Air Conditioning (HVAC) was the largest segment of the automotive cabin comfort systems market because HVAC remains one of the most critical components of automotive cabin comfort systems that enables thermal comfort, proper air circulation, and safety for different kinds of vehicles. At this point, HVAC systems are basically a new normal for many floor plans here in the mid-2020s and have come about partly due to evolving regulations requiring defogging, defrosting, and air quality management functions. The segment also benefits from the technology being integrated into many economy and premium vehicles, along with ongoing developments that allow for greater efficiency, reduced noise, and smaller packaging.

The advanced climate control systems segment is anticipated to be the fastest-growing segment in the market during the forecast period due to increasing consumer demand for personalized and automated comfort attributes. These systems provide zone-based heating, humidity control, and smart sensors, and more recently, AI, to tailor passenger comfort on the fly. The growth of electric and luxury vehicles, along with OEMs pushing to gain differentiation with next-generation cabin technologies and enhance user experience, perceived utility, and associated convenience, will drive the adoption of advanced climate control systems.

By Vehicle

In 2024, the automotive cabin comfort systems market dominated by the passenger cars segment, owing to the type of highest production volume that is experienced globally. Moreover, the continued demand for high-quality comfort and convenience in vehicles has been witnessed around the world. Automakers are also offering advanced HVAC systems, ambient lighting, and seat comfort systems as standard or optional equipment in passenger cars, especially sedans, hatchbacks, and SUVs. The demand for comfort-centric passenger vehicles, as well as factors such as disposable income and urbanization, is contributing to the popularity of personal mobility that continues to keep this market segment in the front position.

Electric Vehicles (EVs) are projected to be the fastest-growing during the forecast period, owing to the accelerated global transition to electrification and sustainability. With the accelerating adoption of EVs, manufacturers are working on improving the energy efficiency of cabin comfort systems to improve energy usage and range. Thermal management, integrated climate control, and low-energy HVAC systems are becoming key EV technologies in their own right. In addition, government incentives, environmental regulations, and increased consumer preference for tech-rich, environmentally sustainable vehicles are creating a fast-expanding supply for comfort systems in the EV segment.

By Technology

The traditional systems segment accounted for the largest share of the automotive cabin comfort systems market in 2024, owing to their large adoption due to lower cost and proven reliability across various vehicle segments. These systems range from manual or semi-automatic HVAC and simple seat comfort devices to common systems found in the mass market and entry-level vehicle segments, which comprise a large part of worldwide vehicle production. The automotive industry also has a deeply rooted legacy of traditional systems that is sustained through low production and maintenance costs.

The smart systems segment is projected to be the fastest-growing segment during the forecast period due to the rising consumer demand for intelligent, automated, and personalized in-cabin experiences. Such systems make use of sensors, artificial intelligence, and IoT technologies to adjust cabin temperature, lighting, and seat settings dynamically according to user preferences and environmental conditions in real-time. With the rise of electric and premium vehicles, OEMs are now fixing their sights on smart technologies and the consumer comfort that storing smart features could provide them to differentiate from the competition. Expansion of technology completion and the movement in the direction of connected and independent businesses further drives the adoption of smart cabin comfort systems.

By Material

In 2024, Textiles led the automotive cabin comfort systems market in 2024, on account of their extensive utilization in seat covers, headliners, door trims, and other interior parts. Because of their warmth, low cost, breathable nature, and overall appeal, textiles have been used for so long, they are a common choice for entry-level and mid-range vehicles. The varied textures, colors and finishes that can be offered give the manufacturers the opportunity to meet diverse consumer needs. In addition to this, the seamless integration with seat heating technology and ventilation technologies has continued to consolidate the position of textiles as the leading material for electrical cabin comfort applications.

The fastest-growing segment during the forecast period is expected to be the composite materials segment, which can be attributed to the automotive sector, which is focused on lightweight, durable, and sustainable materials. The outstanding mechanical properties of composites (high-strength-to-weight ratios), thermal insulation, and design flexibility make them an ideal candidate to be used as an energy-efficient, heat loss-free, energy-effective material for advanced cabin comfort systems, especially in EVs. Expected to amplify their adoption across next-generation vehicle platforms, the growing use of biocomposite materials for structural and decorative interior parts, coupled with continuous advancements in sustainable composites and green manufacturing technologies.

By End-User

The automotive cabin comfort systems market in 2024 was dominated by the OEM (Original Equipment Manufacturer) segment as major automotive brands integrate comfort features into their products at the vehicle production stage. An increasing number of new vehicles, including more passenger vehicles, electric and luxury vehicles, offer factory-installed HVAC, ambient lighting, and seat comfort systems to meet higher consumer expectations. This trend is backed by stringent quality standards, a requirement for seamless design integration, and a preference for high-performance comfort solutions that increase vehicle beauty and brand value when fitted at the factory.

The Aftermarket segment is projected to witness the fastest growth in the forecast duration due to the increasing need from consumers to customize the comfort features of old vehicles. With lifespans of vehicle ownership expanding, consumers are turning to additional purchases such as high-tech seat covers, retrofit HVAC units, and configurable lighting systems to accommodate comfort in the cabin. The greater availability of e-commerce platforms and installation services has facilitated even greater penetration of e-commerce in the aftermarket. Also, this rapid growth of this segment is driven by the adoption by fleet operators and used car owners in demand for better ride quality and passenger comfort.

Regional Analysis:

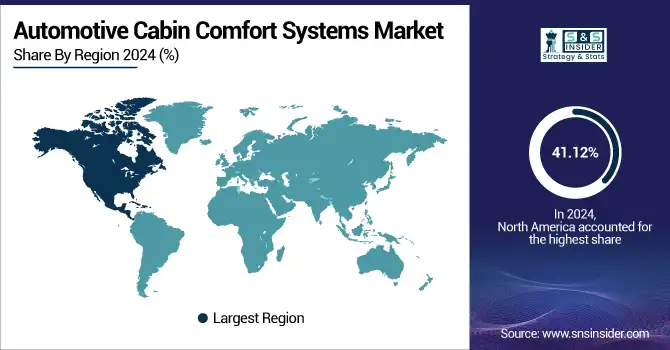

North America dominated the automotive cabin comfort systems market with a 41.12% market share in 2024 due to its mature automotive industry, high consumer demand for technologically advanced vehicles, and the widespread adoption of premium and luxury cars. Consumers in the region prioritize comfort and convenience features, leading OEMs to integrate sophisticated HVAC, ambient lighting, and seat climate control systems. Additionally, the strong presence of key market players, robust R&D investments, and a well-established aftermarket ecosystem further contribute to North America’s leadership in this market.

Asia Pacific is the fastest-growing region with a 4.67% CAGR over the forecast period owing to rapid urbanization, increasing disposable income, and expanding middle-class populations, especially in countries like China, India, and Southeast Asian nations. The surge in automotive production and sales in the region, particularly of electric vehicles, is propelling the adoption of advanced cabin comfort technologies. Government initiatives promoting energy-efficient and air quality-enhancing systems, along with the rising preference for tech-enabled and personalized in-vehicle experiences, are also accelerating market growth across Asia Pacific.

Europe is witnessing significant growth in the automotive cabin comfort systems market due to strong consumer demand for high-performance and sustainable vehicles, as well as stringent environmental regulations promoting advanced HVAC and air filtration systems. The region’s emphasis on vehicle electrification and energy efficiency is driving the integration of smart, adaptive climate control technologies. Additionally, Europe's well-established luxury and premium car segment, along with leading automotive manufacturers based in Germany, France, and Italy, contributes to the region's growing market influence.

Latin America and the Middle East & Africa (MEA) are experiencing moderate growth in the Automotive Cabin Comfort Systems Market, primarily driven by gradual improvements in economic conditions, urbanization, and automotive infrastructure. In Latin America, rising vehicle ownership and growing interest in comfort features among middle-income consumers are contributing to steady market expansion. However, high vehicle costs and limited penetration of premium models somewhat restrain rapid growth.

In the MEA region, market growth is supported by increasing demand for air conditioning and filtration systems, particularly in countries with extreme climates such as the UAE and Saudi Arabia. While the adoption of advanced cabin technologies remains lower in developing regions, growing investments in the automotive sector and an expanding consumer base are creating opportunities for future growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Market Players

Continental AG, Denso Corporation, Robert Bosch GmbH, Magna International, Faurecia (Forvia), Lear Corporation, Gentherm, Valeo, Hanon Systems, Eberspächer, and other players.

Recent Developments

-

April 2024 – Continental AG has revealed its contribution towards the production of crucial components and technologies in the new Mercedes-Benz E-Class. Included among them is Continental's new CoSmA (Connected Smart Access) system, which enables mobile devices, such as smartphones and smartwatches, to serve as digital car keys, aiming to provide enhanced user convenience and vehicle security.

-

September 2023 – DENSO Corporation revealed "Everycool," a future-generation cooling system that aims to provide comfort and energy efficiency, even with a commercial vehicle's engine off. The product will go on sale in Japan from December 2023, via DENSO SOLUTION CORPORATION.

Automotive Cabin Comfort Systems Market Report Scope:

Report Attributes Details Market Size in 2024 USD 24.88 Billion Market Size by 2032 USD 35.64 Billion CAGR CAGR of 4.65% From 2025 to 2032 Base Year 2024 Forecast Period 2025-2032 Historical Data 2021-2023 Report Scope & Coverage Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook Key Segments • By Product (Heating, Ventilation, and Air Conditioning (HVAC), Seat Comfort Systems, Ambient Lighting Systems, Advanced Climate Control Systems, Air Filtration Systems)

• By Vehicle (Passenger Cars, Light Commercial Vehicles (LCVs), Heavy Commercial Vehicles (HCVs), Electric Vehicles (EVs), Luxury Vehicles)

• By Technology (Traditional Systems, Smart Systems, Remote-Controlled Systems, Automatic Climate Control, Adaptive Learning Systems)

• By Material (Textiles, Leather, Metal Components, Plastics, Composite Materials)

• By End-User (OEM (Original Equipment Manufacturer), Aftermarket, Fleet Operators, Individual Consumers, Car Rental Services)Regional Analysis/Coverage North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) Company Profiles Continental AG, Denso Corporation, Robert Bosch GmbH, Magna International, Faurecia (Forvia), Lear Corporation, Gentherm, Valeo, Hanon Systems, Eberspächer, and other players.