Light Commercial Vehicles Market Report Scope & Overview

Get More Information on Light Commercial Vehicles Market - Request Sample Report

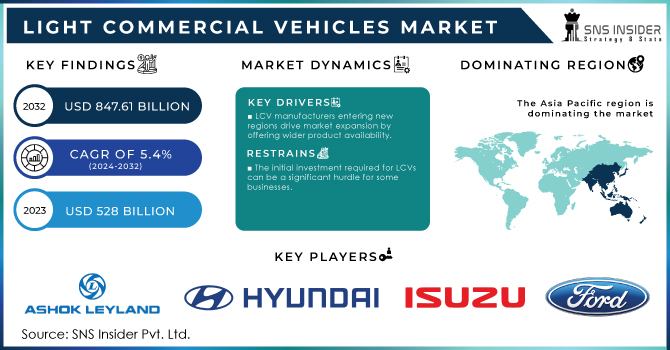

The Light Commercial Vehicles Market size was valued at USD 528 billion in 2023 and is expected to reach USD 847.61 billion by 2032 and grow at a CAGR of 5.4% over the forecast period 2024-2032.

E-commerce, which is an undisputed retail giant has fuelled a 70% increase in demand for last mile delivery solutions resulting in more agile and efficient LCVs. Urbanisation, which accounts for about 35% of world population has intensified intra-city logistics thus increasing the demand for compact and movement LCVs. Strict emission rules have led to a 45% rise in demand for environmentally friendly and electric LCVs as companies aim to minimize their carbon footprint. Moreover, the upswing of construction and infrastructure industries coupled with emergence of small scale enterprises resulted in a 30% increase in LCV purchase indicating that such vehicles are indispensable in work places.

There is an increasing number of electric LCVs that are expected to be electric by 2025, representing about 10% of new LCV sales due to strict emission control measures and government incentives. Moreover, the last mile section of the supply chain is blossoming as a result of which demand for small vans and e-bikes has increased significantly. A noticeable shift in preference towards fuel efficiency and alternative fuels have been noticed with CNG/LPG types occupying a quarter of total market share. Additionally, connected vehicle technology is quickly being integrated into LCVs whereby more than half the recent models have advanced telematics solutions used in fleet management as well as driver safety assistance.

MARKET DYNAMICS:

KEY DRIVERS:

-

LCV manufacturers entering new regions drive market expansion by offering wider product availability.

-

Rising online shopping fuels demand for efficient last-mile delivery solutions, perfectly suited for LCVs.

The rise in e-commerce has increased the demand for efficient and reliable last-mile delivery services. Light Commercial Vehicles (LCVs) are emerging as the perfect solution due to their inherent advantages. Their compact size and movability allow them to navigate congested streets and tight parking spaces with ease, ensuring timely deliveries even in dense urban environments. Thus, compared to larger trucks, LCVs offer greater fuel efficiency, contributing to a more sustainable delivery ecosystem.

RESTRAINTS:

-

LCVs have a smaller payload capacity compared to larger trucks, restricting the volume of goods they can transport in a single trip.

-

The initial investment required for LCVs can be a significant hurdle for some businesses.

The LCVs offer numerous advantages but their adoption can be hindered by the initial investment required. The upfront costs associated with purchasing LCVs can be a significant hurdle for some businesses, particularly smaller operations. This financial barrier can limit their ability to modernize their fleet and embrace the benefits of LCV technology. This financial barrier could potentially slow down the widespread adoption of LCVs in certain sectors.

OPPORTUNITIES:

-

Growing focus on sustainability creates an opportunity for electric LCVs offering eco-friendly deliveries.

KEY MARKET SEGMENTS:

By Vehicle Type:

Pickup Trucks is the dominating sub-segment in the Light Commercial Vehicles Market by vehicle type holding around 40-45% of market share. Pickup trucks offer a unique combination of cargo capacity and passenger space, making them highly versatile for various applications. They are popular in construction, landscaping, and service industries due to their ability to handle rough terrain and tow equipment.

By Fuel Type:

Gasoline-powered LCVs is the dominating sub-segment in the Light Commercial Vehicles Market by fuel type holding around 70-75% of market share. Gasoline remains the dominant fuel type due to its widespread availability, lower upfront vehicle cost compared to electric alternatives, and extensive refuelling infrastructure. However, this trend is expected to shift as electric LCVs become more cost-competitive and government regulations on emissions become stricter.

Get Customized Report as per your Business Requirement - Ask For Customized Report

By End-Use Industry:

Transportation and Logistics is the dominating sub-segment in the Light Commercial Vehicles Market by end-user industry. The ever-growing e-commerce sector and expanding global trade heavily rely on LCVs for efficient last-mile delivery and efficient movement of goods. This segment is expected to maintain its dominance due to the increasing demand for faster and more reliable transportation solutions.

REGIONAL ANALYSES

The Asia Pacific is the dominating region in the Light Commercial Vehicle Market holding around 45-50% of market share. This dominance stems from a confluence of factors. The rising economies are fueling demand for goods, necessitating efficient LCVs for transportation and logistics. The rapid urbanization and infrastructure development are creating opportunities for LCVs in construction and service sectors. North America is the second highest region in the Light Commercial Vehicle Market due to its well-established LCV manufacturing base and strong demand from construction, logistics, and service industries. Europe is experiencing the fastest growth driven by stringent emission regulations promoting electric and hybrid LCVs, a growing focus on sustainable transportation, and investments in upgrading aging infrastructure, which necessitates efficient LCVs for maintenance and construction projects.

KEY PLAYERS

The major key players are Ashok Leyland, Hyundai Motor Company, Ford Motor Company, Isuzu Motors, Gaz Group, General Motors, Honda Motor Company, Renault Group, Tata Motors, Toyota Motors and other key players.

RECENT DEVELOPMENT

-

In March 2023: Rivian teamed up with Morgan Olson to develop electric delivery vehicles. Rivian's advanced tech, including its chassis platform, will be incorporated into custom-made models like the Morgan Olson C250E for Canada Post.

-

In Oct. 2023: Stellantis is electrifying its commercial vehicle fleet in North America with four electric pickups and five electric vans. This expansion will encompass six brands and offer a total of 15 electric vehicles, including a micro-mobility solution.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 528 Billion |

| Market Size by 2032 | US$ 841.67 Billion |

| CAGR | CAGR of 5.4% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Vehicle Type (Vans, Pickup Trucks, Light Trucks) • By Fuel Type (Gasoline-powered LCVs, Diesel-powered LCVs, Electric LCVs) • By End-Use Industry (Transportation and Logistics, Construction and Infrastructure, Agriculture and Farming, Service and Utility, Public Sector and Municipalities) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Ashok Leyland, Hyundai Motor Company, Ford Motor Company, Isuzu Motors, Gaz Group, General Motors, Honda Motor Company, Renault Group, Tata Motors, and Toyota Motors |

| Key Drivers | • Government tax credits, subsidies, and incentives are driving demand for commercial vehicles. • Expansion of the automotive manufacturing sector. |

| RESTRAINTS | • Stringent CO2 emission laws have an impact on industrial costs. • Emission regulations are stricter. |