Automotive Solenoid Market Report Scope & Overview:

Get More Information on Automotive Solenoid Market - Request Sample Report

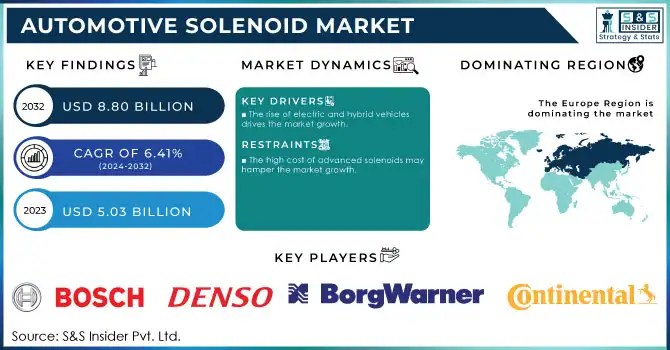

The Automotive Solenoid Market Size was valued at USD 5.03 Billion in 2023. It is expected to grow to USD 8.80 Billion by 2032 and grow at a CAGR of 6.41% over the forecast period of 2024-2032.

The growing adoption of automatic transmissions is a key driver for the automotive solenoid market. The solenoids are an integral part of the transmission operation and do important jobs for controlling smooth and efficient gear shifts. Solenoids are core actuators in the transmission system; they control hydraulic pressure to enable and disable gears depending on driving conditions and vehicle load. This level of precision control improves driving comfort along with fuel economy, two traits that are extremely attractive to consumers today. With global preference-driven changes toward convenience and ease of use, the manual transmission is losing favor to the automatic transmission among drivers. As a result, the demand for automatic transmission vehicles is directly propelling the transmission solenoids market, as automakers need reliable and efficient solenoids for their autonomous vehicles.

According to the U.S. Department of Energy, over 96% of new passenger vehicles sold in the United States in recent years were equipped with automatic transmissions, a dramatic increase from just 62% in the 1980s. This shift underscores the strong consumer preference for automatic transmissions, which is contributing to the rising demand for transmission solenoids essential for their operation.

The trend toward smaller, lighter, and energy-efficient components within automotive increasingly driving the demand for advanced solenoids. Given the automaker's target towards enhancing the performance of the vehicle and reducing fuel consumption, the manufacturers are emphasizing developing power-efficient solenoids that encompass lesser space, as well as cost within the complex mechanism of the vehicle. Because real estate is always at a premium in small, fuel-efficient vehicles, and because weight must be reduced to, ironically, improve mileage and reduce emissions, these small solenoids become invaluable componentry. Moreover, energy-saving solenoids can support vehicle sustainability by drawing less energy from the overall vehicle electrical system, beneficial for electric and hybrid vehicles in particular. With consumers and legislation alike calling for greener technologies, automakers are increasingly turning to solenoid designs that provide higher efficiency, and therefore allow cars to more readily comply with drivers' demands for environmentally responsible vehicles and a more performance-oriented driving experience.

According to the U.S. Environmental Protection Agency (EPA), the average fuel economy for new vehicles reached 25.4 miles per gallon (mpg) in 2021, reflecting a continuous effort by automakers to meet federal fuel efficiency standards. This drive toward higher fuel economy is pushing manufacturers to adopt compact and energy-efficient components, including advanced solenoids, which help reduce vehicle weight and improve fuel consumption.

Automotive Solenoid Market Dynamics

Drivers

-

The rise of electric and hybrid vehicles drives the market growth.

Automotive solenoids are integral to several key functionalities in electric and hybrid vehicles; therefore, the increasing adoption of electric and hybrid vehicles will remain one of the chief driving factors for high demand for automotive solenoids. Solenoids in electric powertrains are used to control the flow of electrical power between the battery and the motor. Solenoids are also used in battery cooling systems, directing the flow of coolant for the proper temperature of high-performance batteries, avoiding overheating and increasing lifespan. Solenoids also play a critical role in regenerative braking systems, a key feature in both hybrid and electric vehicles, to control braking force and energy recovery. With an increasing number of consumers and automakers moving towards electric and hybrid-powered automobiles, the demand for solenoids in these applications will continue to grow, thereby aiding in the overall transition to cleaner, more efficient, transportation technologies.

According to the U.S. Department of Energy, the sales of electric vehicles (EVs) in the United States increased by 72% in 2021, with over 500,000 EVs sold, marking a record year for the segment. This surge in electric vehicle adoption reflects the growing demand for advanced technologies, including solenoids, which are critical for managing electric powertrains, battery cooling, and regenerative braking systems.

Furthermore, the International Energy Agency (IEA) reported that electric cars represented nearly 10% of global car sales in 2022, a significant increase from previous years, further driving the need for solenoids in the evolving electric and hybrid vehicle markets.

Restraint

-

The high cost of advanced solenoids may hamper the market growth.

One of the largest challenges in the implementation of advanced solenoids (especially ones designed for EVs & HEVs) is the high cost of the hardware. These solenoids are typically more complex as well, and they need advanced materials and precise manufacturing techniques to satisfy the strenuous demands of current automotive applications including electric powertrains, battery cooling systems, and even regenerative braking. Unfortunately, these solenoids are foundational in helping to enhance performance and fuel efficiency to next-gen vehicles, but have higher production costs, making them less palatable to OEMs, particularly in price-sensitive markets where cost sensitivity is a key driver. In regions where the incomes of consumers are lower, the relative cost of an electric or hybrid vehicle, which in part will necessitate more expensive solenoids, might keep too many people from being able to embrace these many benefits. In developing markets, there is increased wear and tear for cost-effective solutions, and also, this price constraint can slow down the shift to low-carbon vehicles.

Automotive Solenoid Market Segmentation Overview

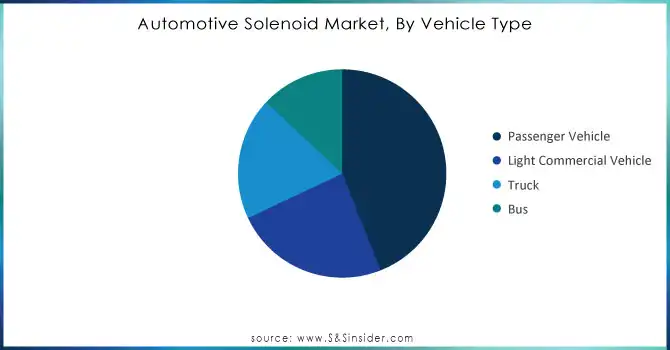

By Vehicle Type

Passenger Vehicles held the largest market share around 44% in 2023. It is owing to the penetration of passenger vehicles and the application of solenoids in various critical systems of a passenger vehicle. In passenger cars, solenoids are used in transmission systems, engine management, braking, HVAC (hеating, ventilation, and air conditioning), safety systems, and other comfort-oriented technologies like power windows and Central Locking technologies. The worldwide upsurge in customer demand for passenger vehicles resulting from the upward push in populace, urbanization, and their growing disposable profits has given delivery to the market for solenoids in passenger vehicles. In addition, the transition to more sophisticated features found in passenger cars, such as automatic transmissions, electric power steering, and advanced driver-assistance systems (ADAS), has also heightened the demand for solenoids. However, the increasing electrification and complexity of passenger vehicles are driving demand for solenoid systems, as these technologies advance toward standardization in many regions, maintaining the largest share of the overall automotive solenoid market.

Need Any Customization Research On Automotive Solenoid Market - Inquiry Now

By Application

The Body Control & Interiors segment held the largest market share around 32% in 2023. This is owing to trends towards vehicle comfort, safety, and convenience features in modern vehicles. Solenoids are embedded in most of the body control systems like power windows, door locks, seat adjustment, and sunroofs. Solenoids in these systems help drive precise and efficient control of these electronic components, improving the driving experience. With consumers opting for features that provide extra comfort these days, automobile companies are bringing these technologies into the mid-range and premium segments. The keyless entry system segment, which uses solenoids for locking and unlocking doors as well as vehicle security, also is growing, which has helped to maintain the segment's dominance. The use of smart interiors coupled with a greater need for vehicle personalization is anticipated to drive further growth in body control and interior solenoid applications, continuing its dominance position.

By Function

Fluid Control held the largest market share around 38% in 2023. Solenoids are used extensively as control elements in hydraulic and pneumatic systems including automatic transmissions, braking, power steering, and suspension systems. In automatic transmissions, solenoids regulate the flow of transmission fluid to allow for smooth engagement and disengagement of the gear, an important aspect for both performance and ride comfort. In the same way, solenoids control the flow of brake fluid in your braking systems, which allows the driver to stop the car quickly, an important measure for vehicle safety. Fluids control solenoids are also important in power steering where they control the fluid pressure for easy steering. With more advanced and precision vehicle systems, the need for solenoids that control the flow of fluids has also increased, for example, the growth of electric vehicles and hybrids. Fluid control solenoids hold the largest share of the overall automotive solenoid market due to the rising requirement for fluid management across all the major automotive functions.

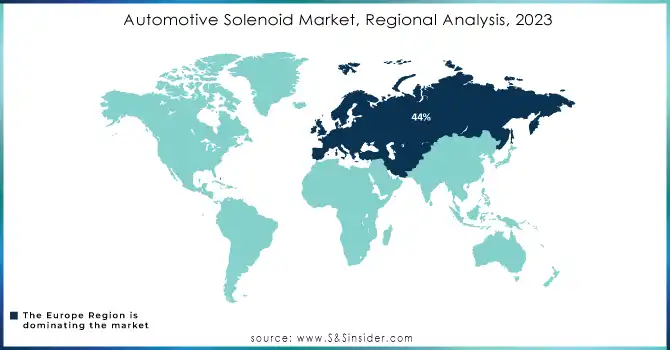

Automotive Solenoid Market Regional Analysis

Europe region held the highest market share around 44% in 2023 due to the strong automotive base of the region, technology, and stringent regulatory standards, that exist there. A large portion of the automotive industry is concentrated in Europe, with some of the largest automakers in the world, including Volkswagen, BMW, Mercedes Benz, and Audi, investing heavily in next-generation vehicle technologies including electric and hybrid vehicles, applications where solenoids will be key components. The demand for solenoids from electric powertrains and regenerative braking and fluid control systems between Fuel-efficient and environmentally-friendly especially high-performance automotive systems solutions is being sought within the region which increasingly focuses on innovation. Moreover, the strict emission norms and focus on carbon footprint reduction by Europe will drive the demand for advanced vehicle technologies as solenoids are critical components for high efficiency and performance. Moreover, the EU supports the electric vehicle market with various incentives and infrastructure investments aimed at accelerating the adoption of electric and hybrid vehicles, which is in turn driving demand for solenoids in electric and hybrid vehicles, thus establishing Europe as the largest automotive solenoid market.

According to the European Automobile Manufacturers Association (ACEA), Europe’s share of the global electric vehicle (EV) market reached over 30% in 2022, with over 2.3 million electric cars sold, marking a 28% increase from the previous year. This surge in electric vehicle sales is a direct result of Europe’s strong regulatory push for reduced emissions and sustainable transportation solutions.

Furthermore, the European Commission has set a target to make at least 30 million electric cars on the road by 2030, with new vehicle emissions standards pushing automakers to adopt more fuel-efficient technologies, including solenoids.

Key Players in Automotive Solenoid Market

-

Robert Bosch GmbH (Fuel Injection Solenoid, Transmission Control Solenoid)

-

Continental AG (Electronic Valve Solenoid, Exhaust Gas Recirculation Solenoid)

-

Denso Corporation (Starter Solenoid, Fuel Pump Solenoid)

-

Delphi Technologies (Fuel Injection Solenoid, Variable Valve Timing Solenoid)

-

BorgWarner Inc. (Turbocharger Wastegate Solenoid, Variable Cam Timing Solenoid)

-

Mitsubishi Electric Corporation (Starter Solenoid, Transmission Control Solenoid)

-

Hitachi, Ltd. (Fuel Injection Solenoid, Variable Valve Timing Solenoid)

-

Johnson Electric Holdings Ltd. (Transmission Solenoid, Engine Control Solenoid)

-

Nidec Corporation (Throttle Control Solenoid, HVAC Control Solenoid)

-

Valeo S.A. (Heater Control Solenoid, Fuel Injection Solenoid)

-

Magneti Marelli S.p.A. (Variable Valve Timing Solenoid, EGR Solenoid)

-

Aisin Seiki Co., Ltd. (Transmission Control Solenoid, Engine Solenoid)

-

Mahle Group (Fuel Injection Solenoid, Exhaust Gas Recirculation Solenoid)

-

ZF Friedrichshafen AG (Shift Control Solenoid, Transmission Oil Pressure Solenoid)

-

Cummins Inc. (Fuel Shutoff Solenoid, EGR Solenoid)

-

CTS Corporation (Transmission Control Solenoid, Fuel Injection Solenoid)

-

Hitachi Astemo Ltd. (Variable Valve Timing Solenoid, Fuel Injector Solenoid)

-

Keihin Corporation (Throttle Control Solenoid, Fuel Injection Solenoid)

-

Eaton Corporation (Turbo Wastegate Solenoid, Transmission Shift Solenoid)

-

NOK Corporation (Hydraulic Control Solenoid, Transmission Shift Solenoid)

Recent Development:

-

In 2023, Bosch launched a new generation of solenoids for hybrid and electric vehicle applications. These solenoids are designed to optimize powertrain performance and energy efficiency, catering to the increasing demand for electric vehicle (EV) components. The new solenoids are smaller, lighter, and more energy-efficient, supporting the ongoing shift toward cleaner transportation solutions.

-

In 2023, Aisin, a key player in automotive components, expanded its solenoid product line for advanced transmission systems. These solenoids are engineered to improve the performance and durability of transmission systems in hybrid and electric vehicles, which are becoming more prevalent in the global automotive market.

-

In 2022, BorgWarner introduced a new solenoid-based actuator for electric and hybrid vehicles that improves the performance of regenerative braking systems. The actuator helps manage energy recovery more efficiently, which is essential for optimizing the battery life and range of electric vehicles.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 5.03 Billion |

| Market Size by 2032 | US$ 8.80 Billion |

| CAGR | CAGR of 6.4% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Vehicle Type (Passenger Vehicle, Light Commercial Vehicle, Truck, Bus) • By Application (Fuel & Emission Control, Body Control & Interiors, Engine Control & Cooling System, Safety & Security, HVAC, Others) • By Function (Fluid Control, Gas Control, Motion Control) • By Valve Design (2-Way, 3-Way, 4-Way, 5-Way, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Robert Bosch GmbH, Continental AG, Denso Corporation, Delphi Technologies, BorgWarner Inc., Mitsubishi Electric Corporation, Hitachi, Ltd., Johnson Electric Holdings Ltd., Nidec Corporation, Valeo S.A., Magneti Marelli S.p.A., Aisin Seiki Co., Ltd., Mahle Group, ZF Friedrichshafen AG, Cummins Inc., CTS Corporation, Hitachi Astemo Ltd., Keihin Corporation, Eaton Corporation, NOK Corporation and Others |

| Key Drivers | • The rise of electric and hybrid vehicles drives the market growth. |

| Restraints | • The high cost of advanced solenoids may hamper the market growth. |