Cleanroom Robots In The Healthcare Market Scope:

Get More Information on Cleanroom robots in the healthcare market - Request Sample Report

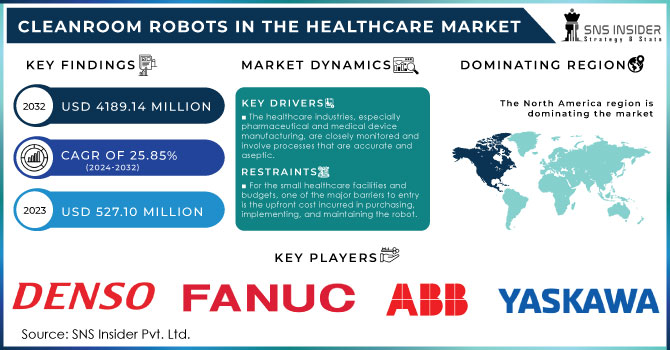

The Cleanroom Robots in the Healthcare Market size is projected to reach USD 4189.14 million by 2032 and grow at a CAGR of 25.85% over 2024-2032. The market was valued at USD 527.10 million in 2023.

Several key drivers drive the demand for cleanroom robots in the healthcare market, all contributing greatly to the growth of the market. First, with the growing concern about maintaining ultra-clean hygiene standards and reducing human contamination in pharmaceutical and biotech industries, the growing adoption has resulted in roughly 45% of healthcare facilities enhancing their automation processes using cleanroom robots. The growth in medical device manufacturing, accounting for almost 35% of demand, continues to fuel the need for precision and homogeneity in production environments. Regulatory pressure has also been promoting this trend of changeover to robotics because, with regard to new guiding principles for reducing the risks of contamination, more than 50% of pharmaceutical companies have adopted such technologies. Apart from that, increasing personalized medicine and growing biologics are other major drivers. Cleanroom automation in the biologics sector jumped by 40% for the preservation of the integrity of the product.

Moreover, high throughput and efficient laboratory workflow create further demand, having spiked the adoption of cleanroom robots in sample handling and preparation by 30%. In healthcare institutions, investment is also being made in automation technologies there is a 25% increase in budget allocation towards robotic solutions that seek to cut down operational costs while improving patient outcomes. Other key factors include the integration of AI and machine learning into robotic systems, as about 20% of all healthcare providers use them to make cleanroom robots more functional and adaptive, thus pushing the market further. These metrics prove that cleanroom robots would play a critical role in changing healthcare operations through the impetus of need for precision, compliance, and efficiency.

Market Dynamics:

Drivers:

-

The healthcare industries, especially pharmaceutical and medical device manufacturing, are closely monitored and involve processes that are accurate and aseptic.

-

The handling of contamination-free products is highly related to patient safety. Cleanroom robots minimize human intervention and the consequent risk of contamination, thereby ensuring the integrity of the product.

-

With an increasing labor cost and lack of skilled workers in specific geographies, healthcare facilities are looking to automate their services.

Increasing labor costs and a considerable shortage of skilled labor in certain regions are forcing healthcare facilities to move toward adopting cleanroom robots. Labor costs in the healthcare industry alone have increased by about 15-20% over the last five years, thereby adding additional strain to operational budgets. At the same time, due to a shortage of skilled technicians, countries like North America and Europe are facing a gap of about 25% in demand versus supply.

This gap has compelled health institutions to look for solutions in automation in order to keep up with the set standards of delivery. Cleanroom robots, which are designed to be applied in sterile environments, are fast being institutionalized as a strategic solution. Their implementation has increased by over 30% in facilities that face challenges in labor. Moreover, deployments of these robots have contributed to reducing human error by 40%, thus ensuring a much higher compliance with the stringent regulations that govern healthcare.

Restrains:

-

For the small healthcare facilities and budgets, one of the major barriers to entry is the upfront cost incurred in purchasing, implementing, and maintaining the robot.

-

Healthcare facilities have to operate under very strict regulations concerning cleanliness, sterilization, and patient safety. Ensuring that these standards are met with the use of cleanroom robots may be complex and time-consuming.

The deployment of cleanroom robots in health facilities is theatrically challenging because such facilities are exposed to very strict regulation in terms of cleanliness, sterilization, and, most of all, patient safety. Following this, the robots must be certified as meeting the highest standards applicable, a process that, however, takes a lot of time. In this context, the adoption of automation to satisfy sterilization requirements by some 65% of healthcare providers in the cleanroom robots in healthcare market has increased with the regulatory demand growing by 30% over the past decade. On the other hand, 70% of such facilities described that labor shortages sped up the pace of cleanroom robot adoption and 58% said that stiffening prices for labor were a very important factor in making the decision to plow capital into automation.

And all this time, with these challenges, 48% of hospitals now were able to implement cleanroom robots with the latest regulations, hence increased patient safety and operational inferences. In the light of shifting regulatory tides within the healthcare sector, this demand for those cleanroom robotics compliant with regulations is expected to increase, further bringing out the imperative on accuracy and compliance of standards within such critical environments.

Key Market Segments:

By Type

The traditional industrial robots’ segment, driven by their precision and repeatability in handling delicate tasks, held a share of approximately 60% in the total market share of the Cleanroom Robots in Healthcare Market. These robots find major End-Use in highly accurate and contamination-controlled environments, typically part of pharmaceutical manufacturing and medical device assembly.

It is expected that the Collaborative Robots segment will register huge growth during the forecast period attributed to rising demand for flexible and safe automation solutions within healthcare settings. Working side by side with human operators, cobots have only recently gained momentum, with the number of units deployed across hospitals and laboratories estimated to have risen by 40% over the past three years. This has been largely due to the potential of robots to minimize human errors while increasing productivity looking forward, particularly with a view to maintaining stringent cleanroom standards.

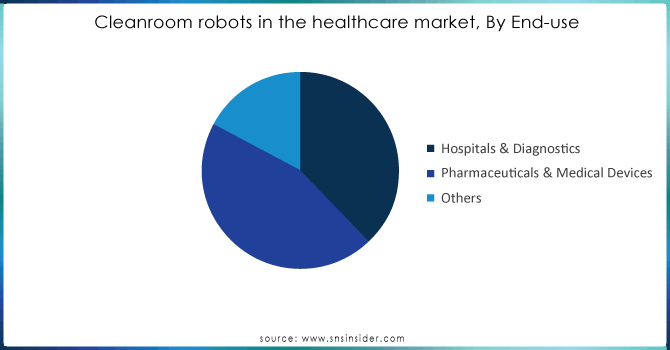

By End-use

The Hospitals & Diagnostics segment is likely to capture a share of about 38% because rising automation helps get rid of the 'human factor' and its associated failures during diagnosis. This segment's growth is further supported by an increasing interest in superior, sophisticated robotics systems that can manage delicate samples and carry out functions with high accuracy in sterile conditions. The Pharmaceuticals & Medical Devices segment accounts for about 45% of the market and is seeing wide adoption due to strict regulatory requirements and demand for contamination-free manufacturing processes.

These robots play a crucial role in automating drug production, packaging, and the assembly of medical devices, thus minimizing the risk of contamination and increasing production efficiency. The Others segment consists of research laboratories and biotechnology companies that make up about 17% of the market. This segment is driven by the demand for reducing manual intervention in the research and development processes primarily in handling hazardous materials and experiments that involve a high degree of precision.

Need any customization research on Cleanroom Robots In The Healthcare Market- Enquiry Now

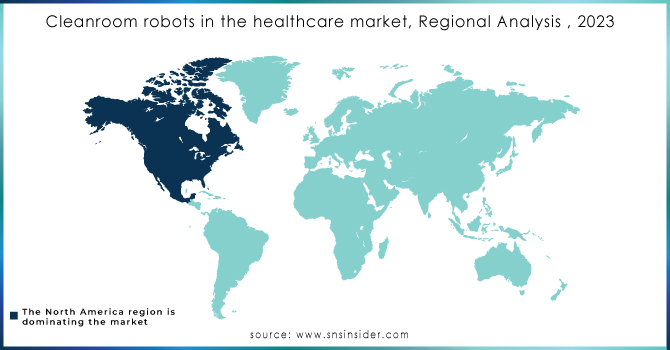

Regional Analysis:

In the North American regional analysis section, a set of several trends and quantitative insights of the cleanroom robots in healthcare market are studied by SNS Insider. The demand for cleanroom robots has increased at a higher rate for the past few years because labor costs have risen, and there is a diminishing number of people with enough expertise to handle such precise equipment. The adoption of cleanroom robots within healthcare facilities in the U.S. risen at a growth of around 18% y-o-y a solid effort in automation to make operations more efficient and accurate.

Recent government data shows the rate of technology adoption within the country's hospitals and diagnostics surged by 22% in the last five years on incentives and other support given for the installation of highly advanced and automated robotic solutions. Investments are also highly rising, by about 25% in the healthcare sector, particularly for flexible and seamlessly integrable technologies into the existing workflows, such as collaborative robots. Investments in traditional industrial robots have also risen by 20% in the pharmaceutical and medical devices sectors, underlining a more general trend toward automation.

Key Players:

The major key players are ABB, Denso Corp, FANUC Corp, Kawasaki Heavy Industries, Yaskawa Electric Corp, Aerotech, Nachi Fujikoshi Corp and others.

Recent Developments:

ABB: A new portfolio of clean designed control robot models to provide enhanced precision, speed, and load.

Omron: Extended the AMR lineup to include versions designed to meet the specific needs of cleanroom operations; can be provisioned with an optional UV-C disinfection system.

FANUC: Developed collaborative robots capable of carrying out cleanroom operations, including those related to assembly and packing, alongside human

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 527.10 Million |

| Market Size by 2032 | USD 4189.14 Million |

| CAGR | CAGR of 25.85% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Traditional Industrial Robots, Collaborative Robots) • By Component (Robotic Arms, End Effectors, Drives, Controllers, Sensors, Power Supply, Motors, Others) • By End-use (Hospitals & Diagnostics, Pharmaceuticals & Medical Devices, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ABB, Denso Corp, FANUC Corp, Kawasaki Heavy Industries, Yaskawa Electric Corp, Aerotech, Nachi Fujikoshi Corp |

| Key Drivers | • With an increasing labor cost and lack of skilled workers in specific geographies, healthcare facilities are looking to automate their services. |

| RESTRAINTS | • Healthcare facilities have to operate under very strict regulations concerning cleanliness, sterilization, and patient safety. Ensuring that these standards are met with the use of cleanroom robots may be complex and time-consuming. |