Clinical Informatics Market Report Scope & Overview:

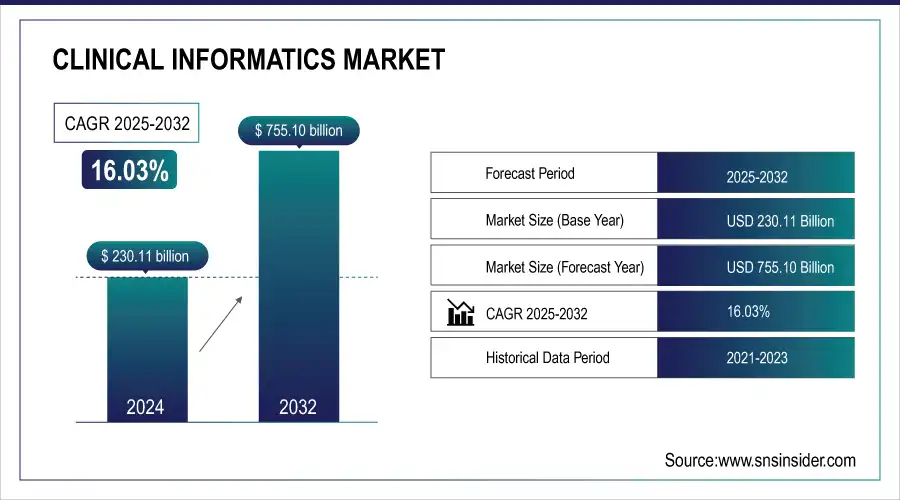

The clinical informatics market size was valued at USD 230.11 billion in 2024 and is expected to reach USD 755.10 billion by 2032, growing at a CAGR of 16.03% over 2025-2032.

To Get more information On Clinical Informatics Market - Request Free Sample Report

The clinical informatics market is gaining strong traction due to the fast digitization of the healthcare domain, increasing demand for data interoperability, and strong government support for the adoption of EHR. Globally, more than 2.5 exabytes of healthcare data are produced every day, and there are hundreds of petabytes of archived healthcare data stored in the U.S. and globally. This surge of data is driving the progression of advanced informatics solutions for predictive analytics, precision medicine, and evidence-based decision making. Health systems and hospitals are using clinical informatics to drive better results for patients and streamline operations. For instance, more than 89% of U.S. hospitals were using a certified EHR system by 2024, according to the ONC. AI, NLP, and big data analytics are now being incorporated into clinical informatics companies' technology platforms to assist with real-time clinical decision-making and care coordination at a distance.

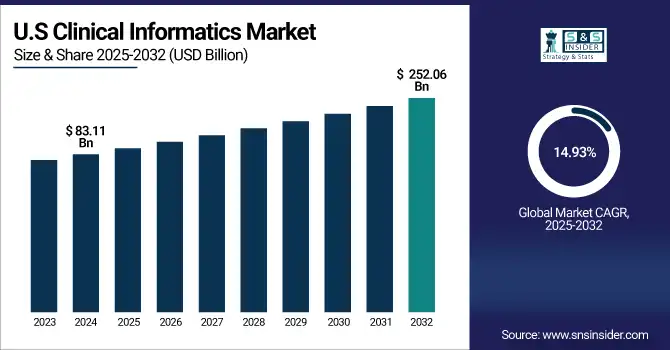

The U.S. clinical informatics market size was valued at USD 83.11 billion in 2024 and is expected to reach USD 252.06 billion by 2032, growing at a CAGR of 14.93% over 2025-2032. The U.S. was the leading country, accounting for the major share, supported by initiatives such as the 21st Century Cures Act and high adoption of advanced informatics solutions and investments of more than USD 15 billion on health IT in 2024. In Canada, national health data platforms and AI in healthcare are also encouraging system integration, while Mexico is adding digitized informatics to urban healthcare centers. The country in the region that is growing the fastest is Canada, owing to the increasing telehealth ecosystem and federal funds being invested in the modernization of digital health.

In June 2025, Cerner Corporation entered into a partnership with NVIDIA to integrate generative AI with its clinical informatics suite, to improve diagnostic support and automate clinical documentation, a key move impacting the clinical informatics market growth.

Digital health investment reached more than USD 33 billion in 2024, with clinical informatics as a major recipient area, partly because of its facilitating effect on value-based care models. Demand both in non-EU/EEA markets and within the EU/EEA is being heavily influenced by the ABDM in India and the European Health Data Space initiative from the European Commission. In addition, R&D investment in healthcare IT increased beyond USD 12.6 billion in 2024, and also the submission of patents for clinical informatics saw a year-on-year rise of 14.7%, evidencing sound development. Regulatory encouragement, such as the U.S. FDA’s Digital Health Software Precertification Program and the 21st Century Cures Act’s mandates for interoperability, is also driving the clinical informatics market analysis. Such trends are anticipated to massively drive the global clinical informatics market growth in the coming years.

Allscripts Healthcare Solutions implemented a cloud-native informatics platform for a large UK health system in May 2025, leading to scalable analytics and the ability to share real-time data, which represents the beginning of the next generation of clinical informatics market trends.

Table: Trends Shaping the Clinical Informatics Market (2024–2026 Forecast)

|

Trend |

Description |

Anticipated Impact by 2026 |

|

AI & GenAI Integration |

Automation of documentation and alerts |

35% reduction in clinician administrative burden |

|

Rise in Remote Patient Monitoring (RPM) |

Increased use of ePRO and cloud platforms |

40% increase in home-based data reporting |

|

Big Data & Real-world Evidence (RWE) |

Linkage of clinical and claims data |

Expanded use in life sciences informatics |

|

Interoperability Frameworks |

TEFCA, PRSB, EU Health Data Space rollouts |

Improved cross-border patient data access |

|

Consumer-Centric Care Platforms |

Growth of patient portals and self-service access |

Improved satisfaction and engagement |

Market Dynamics:

Drivers:

-

Advancing Digital Health Infrastructure and AI Integration Propels Market Growth

Rise in adoption of Health Care IT, AI-powered decision making, and government incentives for health data integration across care settings are the factors contributing to the clinical informatics market growth. The increasing need for personal and population health management is driving hospitals to invest in informatics solutions that integrate clinical, operational, and financial data. AI in healthcare could generate more than USD 100 billion in annual savings through better clinical processes, including more accurate diagnostics and operational efficiencies, which will further impel the growth of the clinical informatics market. Further, in 2024, over 60% of global healthcare executives will also increase investment in digital health solutions, as clinical informatics leads priorities.

The WHO’s Global Strategy on Digital Health 2020–2025 and the EU’s Digital Decade programme are advocating the establishment of large-scale health data exchange systems. The U.S. Department of Health and Human Services passed the final HTI-1 rule in April 2025, which focuses on beefing up EHR certification and interoperability that are crucial for increasing the clinical informatics market share. Pharma companies are also joining hands with health IT companies to connect clinical trials to real-world data (RWD) and drive demand. These trends in regulations, technologies, and investments play a significant role in driving the global clinical informatics market, and thereby, are an essential part of a healthcare system ready for the future.

Table: Use of Artificial Intelligence in Clinical Informatics (2024–2025)

|

AI Application Area |

Adoption Growth (YoY) |

Clinical Benefit |

|

Automated Documentation |

+38% |

Reduces charting time and errors |

|

Predictive Risk Modeling |

+46% |

Early intervention in high-risk patients |

|

Natural Language Processing |

+41% |

Translates clinical notes into structured data |

|

Clinical Workflow Automation |

+33% |

Streamlines care coordination |

Restraints:

-

Data Silos, Privacy Concerns, and Skill Gaps Hamper the Market Expansion

Despite its promise, the clinical informatics market is hindered by several pivotal limitations, such as ongoing data silos, patient privacy concerns, and skilled labor shortage. In most, particularly developing and semi-digital hospitals, legacy systems tend to run in isolation with non-universal data interface formats, resulting in interoperability barriers when trying to integrate them seamlessly.

The 2024 HIMSS survey reported that 43% of health care organizations reported "lack of system interoperability" as a major barrier to the implementation of informatics. Moreover, amidst growing fears over data privacy, in particular following the spike in healthcare-related cyber-attacks (which increased globally by 60% in 2024), trust in digital health ecosystems is being called into question. HIPAA and GDPR, and individual national cybersecurity frameworks make this complex and slow adoption.

In addition, the talent void is substantial; the U.S. alone will have a shortage of more than 35,000 trained clinical informaticians by 2026, according to the AMIA. Moreover, small or mid-sized healthcare providers sometimes do not have the resources to modernize the older system or to buy into an AI-enabled informatics platform. Restricted R&D investment among low-income economies acts as an additional barrier to innovation and scaling solutions. Such bottlenecks can restrict clinical informatics market analysis and real-world impact, stifling progress despite high demand. Tackling these barriers will require a multi-stakeholder approach to invest in education, strengthen data governance, and develop more open, interoperable technologies and tools throughout the care delivery process.

Segmentation Analysis:

By Type

In 2024, electronic health records were the dominant product segment of the clinical informatics market, having contributed an estimated 36.4% towards market share, attributed to the lucrative mandates globally for maintaining digital records, enhanced clinical documentation, and government-endorsed efforts to promote interoperability. Because of their ability to connect patient data from several care points, they have become a critical piece of infrastructure in the digital health landscape.

The fastest-growing segment is electronic patient-reported outcomes (ePRO) on account of increasing uptake of remote monitoring solutions and decentralized clinical trials. ePRO solutions enable real-time feedback from patients that is key, especially in chronic disease management, personalised care, and post-discharge follow-up, improving engagement and adherence to treatment.

By Component

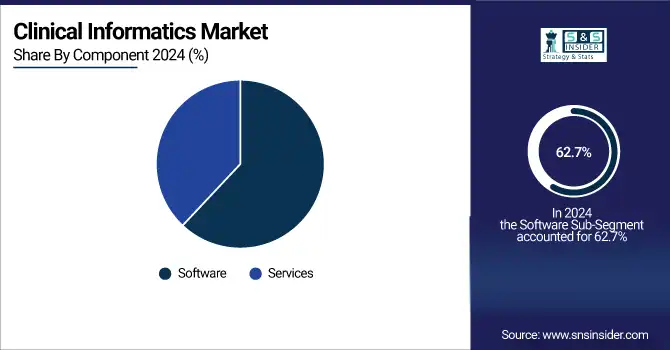

Software was the largest segment in 2024, accounting for a share of about 62.7% as the growing adoption of AI, analytics, and integration solutions for EHRs, CDMS, and CTMS platforms, with advances in technology. Healthcare providers need customizable, scalable, and interoperable software that assists in real-time clinical analysis.

Services emerged as the fastest-growing, with demand for implementation assistance, system integration, user education, and analytics consultancy growing, especially at smaller and midsize providers that cannot afford an in-house IT team.

By Deployment Type

The Cloud-Based segment is the fastest-growing deployment model in 2024, attributed to its scalability, lower initial costs, and rising need amongst organizations to access data remotely. The interoperability to span devices and healthcare networks also bodes well for future expansion.

However, On-premise had the largest market share of 55.2 % in 2024 due to large hospitals and research institutes preferring more control over data security and infrastructure for customization.

By End User

Hospitals were the largest market in 2024 and held 68.9% of the market share owing to increasing adoption of integrated clinical informatics systems for inpatient and outpatient care, along with regulatory compliance and revenue cycle management. Their ability to have big IT budgets and clinical data volume helps lead to this.

The Ambulatory Surgery Centers (ASCs) are the fastest-growing end user segment, & are driven by the trend of outpatient, the requirement of real-time reporting, and the implementation of compact, cloud-based informatics solutions that enhance procedural efficiency and reduce administrative hassles.

Regional Analysis:

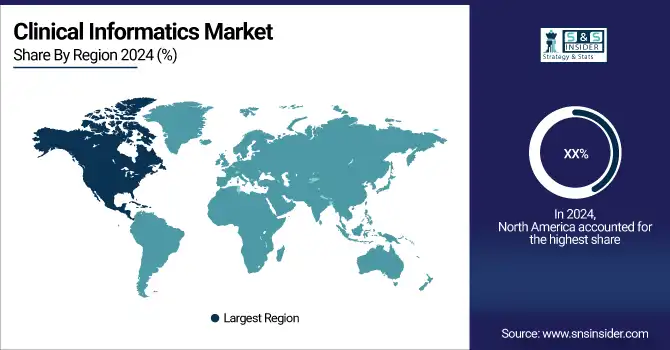

North America accounted for the largest share of the global clinical informatics market in 2024, due to higher digital health penetration, excellent healthcare infrastructure, and strong policy support for the adoption of EHR and interoperability.

Get Customized Report as per Your Business Requirement - Enquiry Now

Europe is a mature yet growing clinical informatics market that is driven by GDPR (regulatory compliance), the European Health Data Space initiative, and key public sector digitization initiatives. Germany led in 2024 due to the DVG, which promotes digital health applications and eHealth infrastructure. At least one clinical informatics application was installed in more than 70% of German hospitals in 2024. The UK and France also make large contributions due to national EHR adoption and AI for the NHS. Italy is the fastest-developing market in Europe, tasked with the vision to drive digital momentum as part of the National Recovery and Resilience Plan (PNRR), investing in hospital modernisation and cloud-based national health systems.

The Asia Pacific is projected to register the highest CAGR of the clinical informatics market during the forecast period, with growth primarily attributed to the increasing patient population, the need to manage healthcare data digitally, and government support for the adoption of healthcare IT.

China was a leading market in the region as a result of the implementation of smart hospitals and its Health China 2030 programme that involves a strategic thrust towards AI and informatics. In 2024, China had more than 300 AI-based hospital projects in place. India is blazing out with the fastest digital infrastructure through the Ayushman Bharat Digital Mission (ABDM), which is encouraging interoperability and access to patient data. On one hand, the Japanese and South Korean governments are establishing national health databases and recognizing AI-powered EHR systems, which is stimulating the market. India, both due to its size and increased funding for public-private digital health partnerships, is the second fastest-growing country market in this region.

Table: Regulatory & Governmental Impact on Clinical Informatics Market (Select Countries, 2023–2025)

|

Country |

Key Initiative |

Implementation Year |

Market Impact |

|

U.S. |

HTI-1 Final Rule & TEFCA Interoperability |

2023–2025 |

Boosted certified EHR adoption |

|

Germany |

Digital Healthcare Act (DVG) Expansion |

2024 |

Accelerated digital app reimbursement |

|

India |

Ayushman Bharat Digital Mission (ABDM) |

2023–ongoing |

Rapid health data exchange deployment |

|

Saudi Arabia |

Vision 2030 Smart Hospital Strategy |

2024 |

Infrastructure modernization in public health |

Key Players:

Leading clinical informatics companies in the market include McKesson, IQVIA, Cerner, Veradigm, Health Catalyst, AdvancedMD, SAS Institute, Wipro, Dedalus, and NVIDIA Corporation.

Recent Developments:

-

In May 2025, Kathiravan Kalaivan, a graduate of Duke’s Master of Management in Clinical Informatics program, emphasized leading through complexity, melding technical innovation with clinical workflow integrity.

-

In February 2025, Philips and Mass General Brigham announced a strategic collaboration to create a unified, near-real-time data and AI insights platform.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 230.11 billion |

| Market Size by 2032 | USD 755.10 billion |

| CAGR | CAGR of 16.03% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Electronic Health Records, Clinical Trial Management System, Clinical Data Management System, Randomization and Trial Supply Management, Electronic Trial Master File, and Electronic Patient Reported Outcomes) • By Component (Software, Services) • By Deployment Type (Cloud-Based, On-premise) • By End User (Hospitals, Ambulatory Surgery Centers, and Other End Users) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | McKesson, IQVIA, Cerner, Veradigm, Health Catalyst, AdvancedMD, SAS Institute, Wipro, Dedalus, and NVIDIA Corporation. |