Circulating Tumor Cells Market Report Scope & Overview:

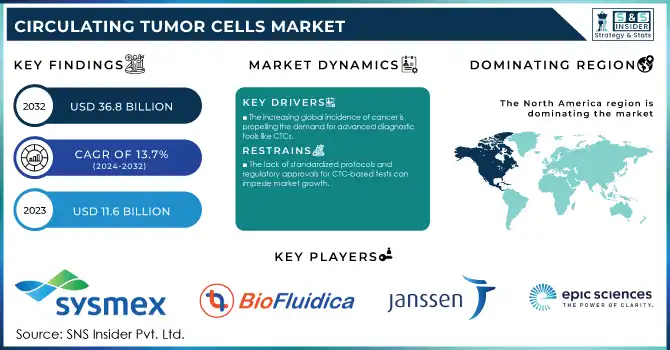

The Circulating Tumor Cells Market Size was valued at USD 11.6 billion in 2023 and is expected to reach USD 36.8 billion by 2032, growing at a CAGR of 13.7% over the forecast period 2024-2032.

To Get More Information on Circulating Tumor Cells Market - Request Sample Report

The Circulating Tumor Cells (CTC) market is propelling due to the rise in cancer population globally, development in cancer diagnostics, and increasing focus on early-stage cancer detection. According to the World Health Organization (WHO), cancer is one of the leading causes of death globally, with approximately 10 million deaths recorded in 2020. In addition, the National Cancer Institute (NCI) reported that 1.9 million new cancer cases were diagnosed in the U.S. in 2023. The increasing number of cancer patients all over the globe is resulting in a need for further solutions to assist with early diagnosis, personalized therapeutic plans, and thus, increasing demand for CTC technologies.

Growing demand and funding from government and private sectors for enhanced cancer detection and treatment technologies are also driving the growth of the CTC market. For example, the National Institutes of Health (NIH) funded research on cancer amounting to more than USD 6.4 billion in 2022, with particular emphasis on CTC detection and its role in more precise oncology. Thus, the growth in research and development funding has driven the use of diagnostic kits and reagents that are based on CTCs, owing to their non-invasive nature of examination of the sourced specimens and availability of valuable information on the metastasis and progression of the malignancy. In addition, the escalating utility of liquid biopsy in cancer diagnosis, coupled with increasing demand for precision medicine is a major impact-rendering driver fuelling the growth of the circulating tumor cell market. Continual CTC market growth is expected from the government's attention to cancer research and the technological advances in diagnostic technologies.

Circulating Tumor Cells Market Dynamics

Drivers

-

The increasing global incidence of cancer is propelling the demand for advanced diagnostic tools like CTCs.

-

Innovations in chip technology have enhanced the sensitivity and accuracy of CTC detection, facilitating early cancer diagnosis.

-

The growing preference for non-invasive diagnostic methods is driving the adoption of CTC-based tests.

One of the key factors that is boosting the CTC market is the increasing number of patients suffering from cancer across the globe. With an overall increase in cancer cases, the demand for early diagnostic tools that will not only provide information about the tumor's progression but also assist in developing the optimum plan for treatment is in demand. There are more than 20 million people diagnosed with cancer globally, and around 10 million people died of cancer in 2023. The increase in the number of cancer patients has resulted in a demand for better diagnostic technologies like CTCs that help to provide a non-invasive real-time monitoring system for cancer patients.

CTCs represent a promising diagnostic, as they offer clinicians the ability to monitor the genetic and molecular characteristics of tumors without the need for invasive tumor biopsies. This is especially helpful in the early stage in scenario of breast, lung, and prostate cancers since as we know these cancers are hard to diagnose in the early stage. For example, CTC detection has been used to predict and monitor breast cancer recurrence during treatment. CTCs also have a potential role in detecting minimal residual disease (MRD) after chemotherapy, which would enable better prognostic assessments as well as treatment directed against MRD. With the increasing frequency of cancer, this non-invasive and individualized method of cancer diagnostics is precious from the planetary move to more precise and personalized treatments.

Restraints:

-

The elevated costs associated with CTC detection limit accessibility, especially in lower-income regions.

-

The lack of standardized protocols and regulatory approvals for CTC-based tests can impede market growth.

The high detection costs are one of the major restraints in the circulating tumor cells (CTC) Market. Although there is an increasing interest in CTC isolation from blood samples for non-invasive diagnosis, the cost associated with CTC detection is a major concern, especially in developing countries. CTC testing can be cost-prohibitive due to the expense of the technological costs for specialized equipment and reagents and labor-intensive processes for sample analysis. Thus, the CTC test has a high cost which limits its accessibility and utilization, especially in resource-limited settings such as developing countries with limited healthcare budgets. Moreover, the expense restricts its use to a more privileged population, generally patients who can afford it, or those with high-end insurance in wealthier areas. CTCs have a tremendous untapped potential for early cancer detection, however, financial affordability is still a major barrier. Lowering the costs associated with CTC testing through technological improvements or more standardized protocols could have a large impact on bringing such tests closer to the standard of care in cancer diagnostics.

Circulating Tumor Cells Market Segmentation Analysis

By Product

In 2023, kits & reagents accounted for the largest revenue share in the CTC market. Reasons contributing to the dominance of the segment include the rising demand for non-invasive cancer diagnostics and the recent development of liquid biopsy technologies. The product segment has made it possible for the market to witness the growth of products such as kits and reagents owing to the approval of various liquid biopsy tests by the U.S. Food and Drug Administration (FDA) in the last few years, according to a recent study. These products find wide applications in CTC detection and analysis which ultimately allow clinicians to monitor the course of the cancer and study the responses to therapy. In 2023, the revenue from diagnostic kits and reagents alone in the U.S. market was around USD 1.5 billion. CTC-based liquid biopsy, which is less invasive, more accessible, and possibly more accurate for early cancer detection than tissue biopsy, is also becoming more widespread. These tests are in high demand due to the ease of sample collection and low risk of complications. Additionally, the continued focus of various healthcare institutions on personalized medicine has increased the dependency on CTC testing for mutation and genetic markers identification; this trend is expected to further fuel the kits and reagents industry. The importance of the different segments of CTCs market is reflected in the increased number of government-backed initiatives for early cancer diagnosis and treatment, which promote this segment as the leading one among the others.

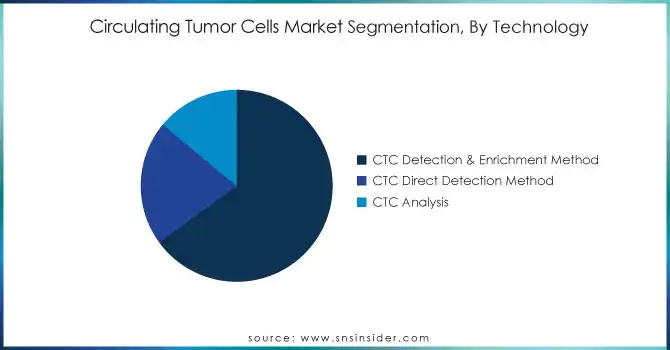

By Technology

In 2023, the CTC detection and enrichment methods segment held the highest revenue share of 65%. The increasing demand for accurate and dependable ways of detecting and isolating circulating tumor cells (CTCs) from blood specimens is expected to drive this segment in this segment. According to the NIH, advances in microfluidics, immunomagnetic separation, and filtration techniques have significantly improved the accuracy and sensitivity of CTC detection. They are key for extracting CTCs from a sample of blood that can later be characterized to learn about metastasis, the prognosis of cancer, and treatment modalities. The increasing interest in personalized medicine and the demand for novel non-invasive cancer monitoring methods have improved the proliferation of CTC detection and enrichment technologies. Over the last few years, several devices specifically designed for CTC isolation and enumeration have been cleared by the FDA based on positive results from numerous clinical trials and research studies supporting the use of CTC-based diagnostics in the U.S. One such development was a microfluidic-based CTC detection platform that gained FDA approval in 2022 and has been used in many oncology research and clinical environments. With hundreds of new research publications targeting CTC detection technologies and increasing numbers of FDA approvals, it is evident that there is a significant turn towards alternatively advanced CTC detection. Continued investment in both public and private sectors is expected to further attract the growth of this segment, as its non-invasive nature along with the insight into the genetic landscape of cancer provided by the technology, are the key points driving the market.

By Specimen

The blood specimen segment dominated and held the largest share of revenue in the CTC market, In 2023. The shift away from traditional tissue biopsies towards blood-based diagnostic tests has helped this segment take the lead in the market. CTC analysis using blood specimens is characterized by its easy access, repeatability, and non-invasivity, which enable continuous monitoring of cancer progression and response to therapy. Liquid biopsy, especially based on assessing blood specimens, is emerging as a potential diagnostic approach for many types of cancer including those of the breast, lung, and colon (American Cancer Society). According to ACS, over 20,000 lung cancer cases were diagnosed through blood-based tests in just 2023. This change in the diagnostics paradigm is aiding the blood specimen segment to hold a dominant position. In addition, blood samples are usually simple to obtain and unlikely to complicate the life of the patient in comparison to tissue biopsies, which makes them particularly appealing for the patients. Governments worldwide, such as the U.S., have heavily invested in liquid biopsy technologies, with the NIH spending over USD 1 billion on liquid biopsy research in the last two years. Recent efforts to enhance diagnostic precision and patient outcomes continue to drive the popularity of blood specimen-based CTC testing. As liquid biopsy techniques continue to evolve, the blood specimen segment is expected to maintain its dominant position in the market for years to come.

By End Use

In 2023, the research and academic institutes segment held the largest revenue share. Such growth in this region is primarily attributable to enhanced cancer research funding, especially for early detection, individualized therapies, and nanomedicine. In 2023, the U.S. commitment to cancer research exceeded USD 7 billion, according to the National Cancer Institute (NCI), with a substantial portion of funding dedicated to CTC-based diagnostic technologies. Academic laboratories and research institutions are major catalysts for new discoveries related to CTC biology and application to cancer biology. Such studies are key for the discovery and advancement of ongoing approaches for CTC isolation, enrichment, and subsequent analysis, which then counterbalance the commercial sector through the development of new tools. In fact, the presence of CTCs-based diagnostic tools in both clinical and research fields is relatively fast compared to the maturity of related technologies, and academic institutions are, of course, frequent early adopters of new things. In addition, the advanced collaborations between various research institutes and emerging biotech companies have produced new CTC detection technologies that show promise in improved sensitivity and specificity. The role of academic and research institutions is strengthened in the CTC market by the presence of government funding and initiatives supporting cancer research. Ongoing demand for breakthroughs in diagnostic techniques and relentless cancer research investments are expected to fuel the growth of this segment of research and academic institutes.

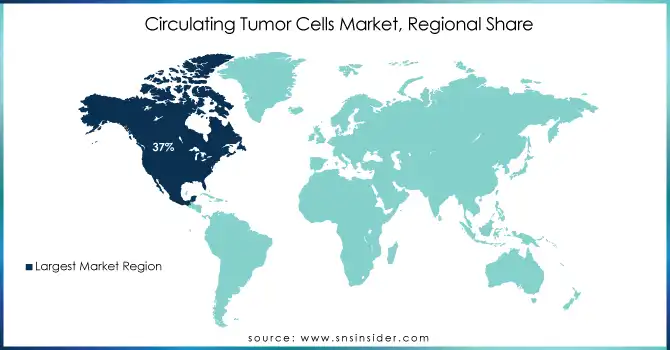

Regional Insights

North America held the largest global CTC market share 37% in 2023. The region has been leading because of the very high burden of cancer as well as the well-established healthcare infrastructure and the availability of advanced diagnostic technologies. As CTC testing is an essential part of advanced cancer diagnostic tools, there is an increase in demand due to more than 1.9 million new cancer cases, being diagnosed in the U.S. in 2023 according to the ACS (American Cancer Society). Additionally, North America has experienced major public and private sector investment in CTC technology advancements. By 2023, over USD 2 billion was directly invested by the National Cancer Institute (NCI) to the research in liquid biopsy and CTC biomarker findings. The market is also expected to grow due to the robust regulatory environment, particularly FDA approvals of CTC detection platforms, in the region.

In contrast, Asia-Pacific is projected to record the highest CAGR during the future years. Factors like increasing government efforts to reduce cancer, growing healthcare investments, and the rising burden of cancer in countries like China, and India are expected to boost the market growth. Over 4.5 million new cancer cases were reported in China alone in 2023, highlighting the increasing demand for novel diagnostic solutions.

Do You Need any Customization Research on Circulating Tumor Cells Market - Enquire Now

Recent Developments:

-

In November 2023, Biocept Inc. (San Diego, CA) announced the launch of a new CTC-based liquid biopsy test for enhanced early detection of breast cancer, representing a promising evolution in cancer diagnostics.

-

In September 2023 Menarini Silicon Biosystems received FDA clearance for its CTC enrichment platform, giving an additional resource for researchers and clinical professionals in the oncological space.

-

In July 2023, prominent CTC player, Celsee formed a partnership with major cancer research institutions to improve the impact of its liquid biopsy solutions, driving forward advancement in CTC detection.

Circulating Tumor Cells Market Key Players

Key Service Providers/Manufacturers

-

Sysmex Corporation (CellSearch CTC System, OncoBEAM CTC)

-

BioFluidica (Microfluidic CTC Detection, CTC Capture and Analysis System)

-

Janssen Diagnostics (CellSearch CTC Kit, CellSearch CTC System)

-

Epic Sciences (Epic CTC Detection, Epic CTC Assay)

-

Advanced Cell Diagnostics (ACD) (RNAscope, CTC-Chip)

-

Angle PLC (Parsortix CTC System, Parsortix Cell Separation)

-

Greiner Bio-One (CTC Capture Kit, CTC Detection System)

-

Miltenyi Biotec (CTC Collection Kit, MACSxpress)

-

Avesthagen (CTC Isolation and Analysis Kit, Avesthagen CTC Platform)

-

F.Hoffmann-La Roche Ltd. (Roche CTC Kit, Cobas CTC Detection)

-

Sakura Finetek Japan Co., Ltd. (Pathfinder CTC Kit, Pathfinder CTC Detection System)

-

Fluidigm Corporation (C1 System, BioMark HD System)

-

Thermo Fisher Scientific (Oncomine CTC Kit, Ion Proton System)

-

Menarini Silicon Biosystems (DEPArray System, CellSearch CTC System)

-

Biocept, Inc. (Biocept CTC Platform, CTC Liquid Biopsy)

-

QIAGEN (QIAamp CTC Kit, QIAamp DNA Blood Mini Kit)

-

Lucence Diagnostics (CTrac CTC Detection, CTrac CTC Assay)

-

Celsee, Inc. (Celsee CTC Isolation System, CTCchip Detection)

-

ThermoGenesis Holdings (AutoXpress CTC Isolation, Xtract CTC Detection)

-

Canaan Partners (CTC Microfluidic Chips, Liquid Biopsy Platforms)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 11.6 Billion |

| Market Size by 2032 | USD 36.8 Billion |

| CAGR | CAGR of 13.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (CTC Detection & Enrichment Methods, CTC Direct Detection Method, CTC Analysis) • By Specimen (Blood, Bone Marrow, Other Body Fluids) • By Product (Kits & Reagents, Blood Collection Tubes, Devices or Systems) • By Application (Clinical/ Liquid Biopsy {Risk Assessment, Screening and Monitoring}, Research {Cancer Stem Cell & Tumorogenesis Research, Drug/Therapy Development}) • By End-use (Research and Academic Institutes, Hospital and Clinics, Diagnostic Centers) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Sysmex Corporation, BioFluidica, Janssen Diagnostics, Epic Sciences, Advanced Cell Diagnostics (ACD), Angle PLC, Greiner Bio-One, Miltenyi Biotec, Avesthagen, F.Hoffmann-La Roche Ltd., Sakura Finetek Japan Co., Ltd., Fluidigm Corporation, Thermo Fisher Scientific, Menarini Silicon Biosystems, Biocept, Inc., QIAGEN, Lucence Diagnostics, Celsee, Inc., ThermoGenesis Holdings, Canaan Partners. |

| Key Drivers | • The increasing global incidence of cancer is propelling the demand for advanced diagnostic tools like CTCs. • Innovations in chip technology have enhanced the sensitivity and accuracy of CTC detection, facilitating early cancer diagnosis. |

| Restraints | • The expense associated with sophisticated virology specimen collection technologies can limit their adoption, particularly in resource-constrained settings. • The development and validation of alternative testing methods may pose challenges to the virology specimen collection market. |