Clinical Trial Equipment & Ancillary Solutions Market Size Analysis:

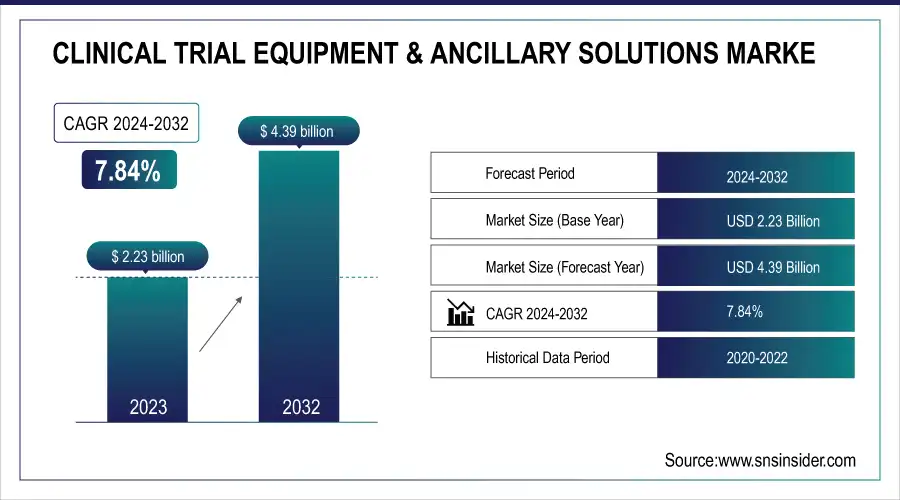

The Clinical Trial Equipment & Ancillary Solutions Market Size was valued at USD 2.23 billion in 2023 and is expected to reach USD 4.39 billion by 2032 and grow at a CAGR of 7.84% over the forecast period 2024-2032. This report brings out the rising trend in clinical trial activity and its constant increase due to increased demand for novel treatments and increasing research endeavors. The analysis takes a closer look at geographic differences in the demand for equipment and ancillary solutions, depicting how various markets are coping with changing clinical trial demands. It also examines trends in clinical trial financing and expenditure at the government, commercial, private, and CRO levels, highlighting how money investments are impacting market growth. Trends in regulations and compliance significantly influence market development since changing guidelines affect trial design, equipment standards, and the approval process. The study also evaluates the effects of digitalization and technological innovation, pointing to advancements in trial equipment, automation, and remote monitoring solutions that are transforming the sector.

To Get more information On Clinical Trial Equipment & Ancillary Solutions Marke - Request Free Sample Report

Clinical Trial Equipment & Ancillary Solutions Market Dynamics

Drivers

-

The increasing number of clinical trials globally, rising R&D investments, and advancements in trial methodologies.

The increase in demand for precision medicine, biologics, and cell & gene therapies has created an increased demand for specialized trial equipment and ancillary materials. ClinicalTrials.gov reports that more than 450,000 clinical trials were registered as of 2023, which indicates a robust market demand. The trend towards decentralized and hybrid trials has made the use of remote monitoring devices, digital data collection tools, and direct-to-patient (DTP) logistics solutions more prominent. Also, the increasing trend of outsourcing by pharmaceutical companies to Contract Research Organizations (CROs) is further driving the market since CROs need effective supply chain and equipment solutions. Increased regulatory requirements for temperature-sensitive biologics have also increased the demand for sophisticated cold chain logistics and storage solutions. The use of AI-based clinical trial management systems and blockchain for secure handling of trial data has improved operational efficiency. In addition, the rising number of chronic illnesses such as oncology, cardiology, and neurology is causing an increase in clinical trials, thereby stimulating the demand for trial equipment and ancillary solutions.

Restraints

-

The market faces several restraints, including high costs of clinical trial equipment and stringent regulatory requirements.

The growing sophistication of international clinical trials necessitates costly real-time monitoring equipment, temperature-controlled storage facilities, and logistics support, which markedly inflate operating expenses. Regulatory compliance with medical devices utilized in clinical trials is also increasingly onerous, resulting in longer approval times and higher compliance expenses. For example, the FDA and EMA have set more stringent requirements for trial equipment validation, which makes it difficult for companies to match changing standards. Inefficiencies are also caused by limited standardization in trial supply chains because different regions have different regulatory needs. In addition, supply chain disruptions, especially caused by global crises like COVID-19 and geopolitical tensions, have affected the timely delivery of trial equipment and ancillary solutions. The lack of adequate professionals with skill sets required to handle sophisticated trial logistics also remains a limitation that slows market growth. Besides this, ethical implications of ensuring data security of the patient as well as using digital technologies for integrating clinical trials raise compliance issues and complicate further market growth.

Opportunities

-

The rising adoption of decentralized clinical trials (DCTs) and digital transformation presents significant opportunities for market players.

The DCT market will expand at a high growth rate, fueling the need for remote patient monitoring devices. Telehealth solutions and real-time data analytics are also in high demand. The application of AI and machine learning in managing trials is improving data accuracy and trial duration, making it a highly profitable area to invest in. Further, the growth of interest in novel therapy areas such as gene therapy and personalized medicine is fueling demand for sophisticated trial equipment including bioreactors, cryopreservation systems, and molecular diagnostics devices. Increased partnerships between pharmaceutical businesses and technology providers to promote clinical trial efficiency is another huge opportunity. Increased clinical trials in growth markets with inexpensive patient recruitment and quicker regulatory clearance is drawing investments in trial logistics and equipment. In addition, the adoption of blockchain technology within clinical trial supply chains is also on the rise, maintaining data integrity, transparency, and security. Firms that invest in environmentally friendly trial supply solutions, like green packaging and reusable instruments, are likely to also improve their competitive positioning as the industry becomes more environmentally friendly with green clinical trials.

Challenges

-

The market faces operational and logistical challenges that hinder efficiency and scalability.

A major challenge is real-time visibility in the supply chain since most clinical trials have various global sites that have varying regulatory compliance. Delays in delivering temperature-sensitive medication and trial equipment continue to be a challenge with customs delays, transportation disruptions, and poor cold chain infrastructure in some areas. Another key challenge is equipment maintenance and calibration because clinical trials have high-accuracy instruments that must comply with rigid standards of compliance. The increasing cybersecurity threats in electronic trial management systems also present risks, as patient data security and regulatory compliance have to be ensured at all times. The service provider fragmentation in the clinical trial equipment market creates complexity, with various vendors managing sourcing, logistics, and equipment rental, resulting in inefficiencies. Moreover, site readiness inconsistency and variability in investigator site capabilities delay trial initiation. The reliance on third-party suppliers of clinical trial supplies also poses risks in the supply chain, especially in sudden demand changes or geopolitical conflicts. To counter these issues, firms need to invest in sophisticated supply chain management tools, effective risk mitigation techniques, and integrated trial solutions to increase market resilience.

The U.S., specifically, is home to the largest share of clinical trials worldwide with streamlined FDA approval processes and the wide-scale adoption of decentralized and hybrid trial models. Furthermore, the rising need for complex logistics, temperature control packaging, and remote monitoring capabilities has further cemented the region's supremacy.

Clinical Trial Equipment & Ancillary Solutions Market Segmentation Analysis

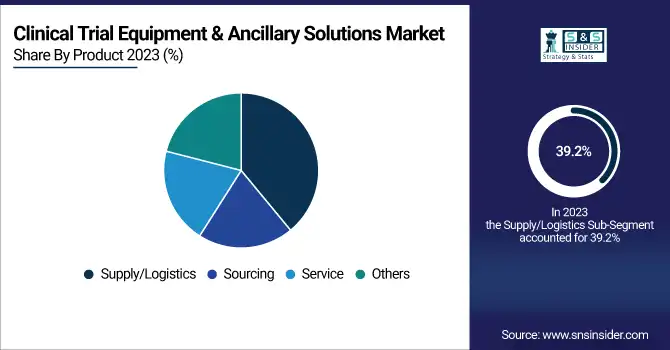

By Product

The logistics/supply segment dominated with a share of 39.2% in total revenue in 2023. This is because global clinical trials are becoming increasingly complex and need effective supply chain management for on-time delivery of trial machinery, biological samples, and temperature-sensitive products. The increasing uptake of decentralized and hybrid clinical trials has also added to the need for sophisticated logistics solutions such as cold chain storage, direct-to-patient (DTP) delivery models, and real-time tracking systems.

The sourcing segment is projected to see the most robust growth up to 2032, led by growing dependence on expert suppliers for clinical trial hardware and ancillary solutions. Increased outsourcing practices among biotech and pharmaceutical firms, coupled with the emerging trend towards single-vendor supply models, are driving demand at a faster rate. Furthermore, technological improvements in procurement technologies and vendor management systems are optimizing sourcing operations, minimizing costs, and enhancing supply chain resilience.

By Phase

The Phase III segment dominated the market in 2023, with the largest share based on the massive resource needs and extensive patient recruitment of this stage of clinical trials. Being the most important phase prior to regulatory approval, Phase III trials need considerable investments in site management, trial equipment, and logistics. The growing volume of late-stage trials for complex and chronic diseases, including oncology and neurology, further established this segment's market leadership.

The Phase I segment is also expected to develop at the fastest rate during the forecast period due to the growth in early-stage trials, especially in precision medicine, biologics, and gene therapies. The growth in adaptive trial designs and early-phase outsourcing to Contract Research Organizations (CROs) has driven demand for specialty clinical trial equipment and ancillary solutions in this segment. Furthermore, increasing investments in first-in-human trials and fast-track drug development strategies are also driving the growth of Phase I trials further.

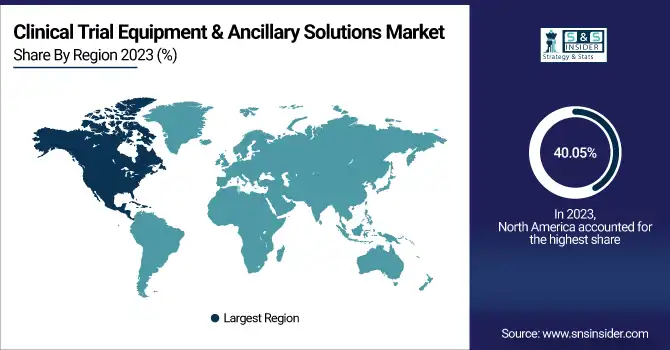

Clinical Trial Equipment & Ancillary Solutions Market Regional Insights

North America led the clinical trial equipment & ancillary solutions market in 2023, with a 40.05% revenue share. The leadership of the region is attributed to a well-established pharmaceutical and biotechnology industry, high R&D spending, and a large number of clinical trial activities. Key market players, sophisticated healthcare infrastructure, and encouraging regulatory policies are additional factors driving North America's strong market leadership.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia-Pacific is expected to be the fastest-growing region until 2032, led by the growing number of clinical trials, growing pharmaceutical outsourcing, and increasing healthcare infrastructure. China, India, and South Korea are becoming key clinical trial locations because of reduced trial costs, quicker patient recruitment, and government support for R&D investment. The expansion of regional CRO operations, enhanced regulatory convergence, and progress in electronic trial technology further propel the market forward. In addition, Asia-Pacific's escalation in biosimilar and cell & gene therapy studies is also stimulating the requirement for bespoke clinical trial hardware and logistic services.

Key Players and Their Products in Clinical Trial Equipment & Ancillary Solutions Market

-

Ancillare, LP – Clinical Trial Ancillary Supply Chain Solutions, Trial Equipment & Logistics Services

-

Imperial CRS, Inc. – Ancillary Supplies Management, Trial Logistics & Storage Solutions

-

Woodley Equipment Company Ltd. – Medical & Laboratory Equipment Rental, Temperature-Controlled Storage Solutions

-

Thermo Fisher Scientific, Inc. – Clinical Trial Equipment & Lab Instruments, Cold Chain Logistics & Packaging

-

Parexel International (MA) Corporation – Clinical Trial Supply & Logistics Services, Medical Device & Equipment Management

-

Emsere (formerly MediCapital Rent) – Clinical Trial Equipment Rental & Leasing, Site-Specific Equipment Solutions

-

Quipment SAS – Equipment Rental & Calibration Services, Remote Monitoring Devices

-

IRM (International Resource Management) – Clinical Trial Supply Chain Management, Equipment & Ancillary Solutions

-

Marken – Clinical Trial Logistics & Distribution, Temperature-Controlled Supply Chain Solutions

-

Myonex – Clinical Trial Drug & Equipment Supply, Global Site Equipment Management

-

Yourway – Direct-to-Patient (DTP) Logistics, Clinical Trial Supply Chain & Ancillary Services

Recent Developments in the Clinical Trial Equipment & Ancillary Solutions Market

-

In Jan 2025, Ancillare launched its advanced Cold Chain Management services to enhance the safe handling and transport of temperature-sensitive clinical trial supplies. This fully integrated solution ensures optimal product conditions while complying with stringent global regulatory standards.

-

In March 2024, Myonex announced the acquisition of Creapharm’s Clinical & Commercial Packaging and Bioservices business, expanding its global footprint. The deal includes operations in France (Reims, Bordeaux, Bailly-Romainvilliers) and Marietta, Georgia, USA, strengthening Myonex’s clinical trial supply capabilities.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.23 billion |

| Market Size by 2032 | USD 4.39 billion |

| CAGR | CAGR of 7.84% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product [Sourcing (Procurement, Rental), Supply/Logistics (Transportation, Packaging, Others), Service (Calibrations, Equipment servicing, Others), Others] • By Phase [Phase I, Phase II, Phase III, Phase IV] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Ancillare, LP, Imperial CRS, Inc., Woodley Equipment Company Ltd., Thermo Fisher Scientific, Inc., Parexel International (MA) Corporation, Emsere, Quipment SAS, IRM (International Resource Management), Marken, Myonex, Yourway. |