Protein Crystallization Market Report Scope & Overview:

Get More Information on Protein Crystallization Market - Request Sample Report

The Protein Crystallization Market Size was valued at USD 1.35 billion in 2023 and is expected to reach USD 2.83 billion by 2032 and grow at a CAGR of 8.57% over the forecast period 2024-2032.

The protein crystallization market is seeing significant advancements, particularly in the fields of drug discovery, biotechnology, and biopharmaceuticals. Recent studies have shown that advances in crystallization techniques have drastically improved the efficiency and reliability of protein structure analysis. For example, the use of microgravity crystallization has resulted in up to a 30% improvement in the quality and size of crystals, allowing for more accurate structural data to inform drug development.

Technological innovations such as high-throughput screening, which enables researchers to test thousands of crystallization conditions rapidly, are also contributing to market growth. This method significantly accelerates the crystallization process, increasing the speed at which researchers can obtain useful structural data. Moreover, automated crystallization setups are reported to increase throughput by up to 50%, making the process more efficient and accessible for both academic and commercial applications.

The ongoing rise in biopharmaceuticals is another key driver. In 2023, the U.S. Food and Drug Administration (FDA) approved a record number of biologic drugs, with 12 new molecular entities and 9 biologics reaching the market, highlighting the growing reliance on biologics. This surge in biologic drug development has directly increased the demand for protein crystallization techniques to understand the structure and function of therapeutic proteins. Additionally, the growing interest in personalized medicine, which aims to create customized treatment options based on an individual's protein structure, further bolsters the need for precise crystallization techniques.

Recent developments in protein crystallization monitoring systems have also enhanced the control over crystallization processes. For instance, new monitoring technologies allow for real-time tracking of crystallization dynamics, improving the reproducibility and consistency of results. Research has shown that the application of in-situ monitoring during crystallization can reduce error rates by 25%, improving the quality of final crystals. Collaborations between pharmaceutical companies, academic institutions, and biotechnology firms are accelerating innovations in protein crystallization. These collaborations have led to the development of new crystallization methods and tools that make the process more efficient, reliable, and scalable, further driving the market forward. This collaborative approach is expected to continue fueling growth, as industry and academia increasingly work together to overcome existing challenges in protein crystallization.

Protein Crystallization Market Dynamics

Drivers

-

The protein crystallization market is being driven by several key factors that are enhancing the demand for advanced techniques in drug development, biotechnology, and structural biology.

One major driver is the increasing reliance on biologics in pharmaceutical development. According to a report by the U.S. Food and Drug Administration (FDA), 2023 saw the approval of 12 new biologic drugs, underscoring the growing importance of biologics in treating diseases like cancer, autoimmune disorders, and infectious diseases. Protein crystallization plays a critical role in the discovery and optimization of these biologics by providing precise structural data necessary for drug design. The use of high-throughput screening for crystallization conditions has revolutionized the process, enabling researchers to quickly assess thousands of conditions. This innovation has increased the efficiency of protein crystallization and reduced time-to-results by 40%, allowing faster development of drug candidates. Furthermore, microgravity crystallization has improved crystal quality by up to 30%, supporting better structural insights for drug discovery.

In addition, the rise of personalized medicine is fueling demand for protein crystallization. As the focus shifts toward therapies tailored to individual genetic profiles, understanding protein structures has become crucial for developing targeted treatments. For instance, monoclonal antibodies, a key class of biologics, require precise structural knowledge to ensure specificity and efficacy. As a result, protein crystallization methods are increasingly used in both research and commercial biopharmaceutical settings to support these advances.

Restraints

-

High Cost and Complexity

Protein crystallization techniques often require expensive equipment, specialized reagents, and highly skilled personnel, which can be a barrier for smaller research labs and biopharmaceutical companies, limiting widespread adoption.

-

Challenges in Protein Solubility and Quality

Achieving successful protein crystallization can be difficult due to issues such as poor solubility, aggregation, and the complexity of proteins themselves, leading to high failure rates and inconsistent results in crystallization experiments.

Protein Crystallization Market - Key Segmentation

By Product

In 2023, Instruments dominated the protein crystallization market, accounting for a significant share due to their fundamental role in protein structure analysis. Instruments such as X-ray diffraction systems, crystallization robots, and imaging devices are essential for the crystallization and analysis of proteins, making them crucial in research and biopharmaceutical development. These instruments enable accurate data collection and analysis, contributing to the continued growth in the pharmaceutical and biotech industries. The segment's dominance in 2023 is estimated to be around 45.0%, as instruments are central to the drug discovery process.

The Consumables segment emerged as the fastest-growing category throughout the forecast period. The increasing demand for reagents, crystallization plates, and other consumables used in protein crystallization processes is largely driven by the expanding number of research projects and biopharmaceutical applications. This growth is also fueled by the trend toward more standardized and scalable research environments.

By Technology

X-ray Crystallography remained the dominant technology in 2023, holding the largest market share. This technology is considered the gold standard for determining protein structures at atomic resolution, making it indispensable in both academic research and drug development. It allows researchers to analyze the three-dimensional structure of proteins with high precision, which is essential for the development of biologic drugs. X-ray crystallography accounted for approximately 55.0% of the protein crystallization market in 2023 due to its proven reliability and long-standing presence in structural biology.

Cryo-electron Microscopy (Cryo-EM) is anticipated to be the fastest-growing technology segment over the forecast period. While X-ray crystallography is still the dominant technology, Cryo-EM has gained significant traction due to its ability to analyze proteins that are difficult to crystallize. Cryo-EM allows for the study of proteins in their natural, hydrated state, making it a breakthrough in structural biology.

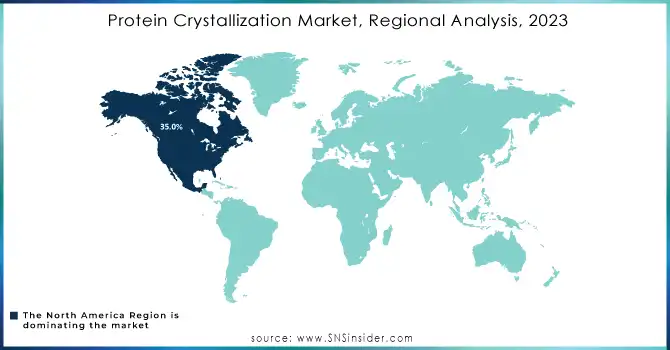

Protein Crystallization Market Regional Analysis

North America dominated the protein crystallization market in 2023, accounting for over 35.0% of the global share. The region's leadership can be attributed to its well-established pharmaceutical and biotechnology industries, significant investment in research and development (R&D), and the presence of key market players. The U.S. is a major contributor, driven by advancements in drug discovery, widespread adoption of advanced crystallization technologies like X-ray crystallography and Cryo-EM, and robust funding for structural biology research. Additionally, collaborations between academia, biotech firms, and pharmaceutical companies further propel the market in this region.

Europe held the second-largest market share in 2023. The region's growth is driven by its strong focus on biopharmaceutical research and increasing demand for biologics. Countries like Germany, the U.K., and France are leading contributors, benefiting from government initiatives to boost R&D in life sciences. The European Union’s investments in cutting-edge research infrastructure and projects, such as Horizon Europe, have facilitated the adoption of advanced protein crystallization techniques in academic and commercial settings.

Asia-Pacific is predicted to be the fastest-growing throughout the forecast period. The rising demand for biologics, increasing investments in healthcare infrastructure, and growing focus on drug discovery are major factors driving growth. China, Japan, and India are at the forefront, supported by government policies promoting biotechnology and pharmaceutical advancements. Additionally, the expansion of contract research organizations (CROs) in the region has made protein crystallization more accessible to global pharmaceutical companies, further boosting the market.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

-

XtaLAB Synergy-R (X-ray diffraction system)

-

HyPix-6000HE (X-ray detector)

2. FORMULATRIX

-

Rock Imager (crystallization imaging system)

-

NT8 Protein Crystallization Robot

3. METTLER TOLEDO

-

Crystallization Workstation

-

EasyMax for crystallization screening

-

Corning 96-Well Crystallization Plates

-

Advanced Optics for crystallography

5. Greiner Bio-One International GmbH

-

CrystalQuick X Plates (96-well crystallization plates)

-

CELLview slides for microscopy

6. HAMPTON RESEARCH CORP

-

Crystal Screen Kits

-

VDX Crystallization Plates

-

JBScreen Crystallization Screens

-

Crystal Plates for hanging-drop and sitting-drop methods

8. Bruker

-

D8 VENTURE (X-ray diffraction system)

-

METALJET (X-ray source for protein crystallography)

9. Creative Proteomics

-

Protein Structure Analysis Services

-

Crystallization Reagents

10. Molecular Dimensions

-

ProPlex Crystallization Screens

-

MRC Maxiplate for high-throughput screening

Recent Development

In Feb 2024, FORMULATRIX launched Volume 4 of the MANTIS automated liquid dispenser, designed for precise low-volume dispensing in scientific workflows. This advanced system enhances research reproducibility, boosts laboratory efficiency, and increases throughput, offering an affordable solution for modern labs.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.35 Billion |

| Market Size by 2032 | USD 2.83 Billion |

| CAGR | CAGR of 8.57% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Instruments, Consumables, Software & Services) • By Technology (X-ray Crystallography, Cryo-electron Microscopy, NMR Spectroscopy, Others) • By End-User (Pharmaceutical and Biotechnology Companies, Academic and Research Institutes) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Rigaku Corporation, FORMULATRIX, METTLER TOLEDO, Corning Incorporated, Greiner Bio-One International GmbH, HAMPTON RESEARCH CORP, Jena Bioscience GmbH, Bruker, Creative Proteomics, Molecular Dimensions, and Others |

| Key Drivers | • The protein crystallization market is being driven by several key factors that are enhancing the demand for advanced techniques in drug development, biotechnology, and structural biology. |

| Restraints | • High Cost and Complexity • Challenges in Protein Solubility and Quality |