Subdermal Contraceptive Implants Market Report Scope & Overview:

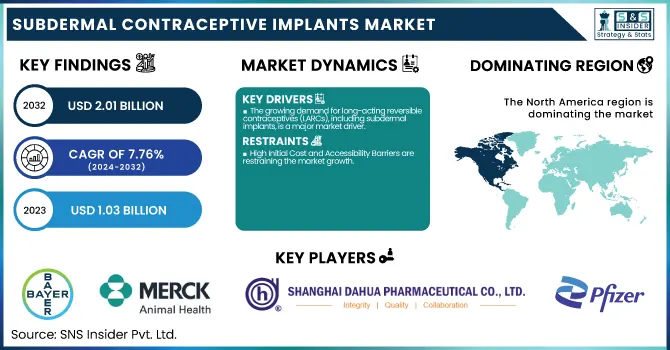

The Subdermal Contraceptive Implants Market was valued at USD 1.03 billion in 2023 and is expected to reach USD 2.01 billion by 2032, growing at a CAGR of 7.76% from 2024-2032.

To Get more information on Subdermal Contraceptive Implants Market - Request Free Sample Report

The Subdermal Contraceptive Implants Market report presents a unique view by centering around the incidence and prevalence of unintended pregnancy and increasing usage of long-acting reversible contraceptives such as subdermal implants. The report offers a thorough examination of prescription trends geographically, showing geographical variations in implant usage. The study also touches on patterns of healthcare expenditure, such as government, commercial, private, and out-of-pocket expenses, to evaluate market accessibility. It further discusses adoption and demographics and considers the extent to which factors such as age, socioeconomic status, and education contribute to the utilization of subdermal contraceptive implants across various markets.

The U.S. Subdermal Contraceptive Implants Market was valued at USD 0.44 billion in 2023 and is expected to reach USD 0.85 billion by 2032, growing at a CAGR of 7.59% from 2024-2032. The United States is the leading player in North America's Subdermal Contraceptive Implants Market, with the highest share because of its superior healthcare infrastructure, extensive availability of contraceptives, and high consumer awareness. The emphasis on reproductive health in the country, along with government and healthcare provider efforts, strongly enhances the use of subdermal contraceptive implants. The US market also enjoys high per capita healthcare expenditure, providing access to advanced contraceptive solutions.

Market Dynamics

Drivers

-

The growing demand for long-acting reversible contraceptives (LARCs), including subdermal implants, is a major market driver.

Subdermal implants provide an effective and convenient method of birth control with minimal user intervention after insertion. With a lifespan of 3 to 5 years, they provide an advantage over daily or monthly options, leading to their growing popularity, particularly in developed markets like North America and Europe. As per the Centers for Disease Control and Prevention (CDC), LARCs constituted around 10% of all contraceptive use in the U.S. in 2020. With increased awareness worldwide, more women are increasingly turning to these implants, which is driving faster market growth. In addition to this, awareness programs conducted by organizations like the WHO and Family Planning Associations are encouraging the uptake of LARCs in developing countries.

-

Government Initiatives and Support for Family Planning are driving the market growth.

Government funding and support for family planning programs are driving the Subdermal Contraceptive Implants Market. Most nations are investing in reproductive health programs, including subsidized access to modern methods of contraception, particularly in middle- and low-income countries. For example, in October 2023, Shanghai Dahua Pharmaceutical Co., Ltd. joined hands with DKT WomanCare to lower the cost of its Levoplant contraceptive implant, so it is accessible at a low price for poor communities. The United Nations Population Fund (UNFPA) says that over 60% of women in developing nations use government-provided contraceptives. This assistance, accompanied by measures to combat high levels of unplanned pregnancies worldwide, is spurring increased use of subdermal implants as an affordable, long-lasting method.

Restraint

-

High Initial Cost and Accessibility Barriers are restraining the market growth.

One of the major constraints for the Subdermal Contraceptive Implants Market is the initial expense and accessibility constraints in low-income areas. Although the overall cost of subdermal implants over time is less than other means, the initial expense of the procedure and the implant itself may be too high for most women, especially in developing nations. While some governments and non-profit entities are attempting to make these implants more accessible, they are not yet widely accessible. In many areas, trained healthcare personnel to place the implants are in short supply, and in rural areas, it is difficult for people to find healthcare facilities to go to. This results in underutilization of existing forms of contraception, which restricts the potential of the market. Furthermore, social and cultural elements may further contribute to access problems in some communities, decelerating adoption.

Opportunities

-

Expansion in Emerging Markets is presenting a significant opportunity to the market.

One of the major opportunities for the Subdermal Contraceptive Implants Market is to widen access to developing markets, especially in Asia Pacific, Latin America, and Africa. With the growing populations, developing family planning awareness, and rising government support for reproductive health, these markets offer untapped potential for subdermal implants. In nations such as India, Brazil, and certain regions of Sub-Saharan Africa, initiatives towards the development of healthcare facilities and the provision of subsidized family planning measures provide a conducive environment for the uptake of subdermal implants. Moreover, global institutions like the United Nations Population Fund (UNFPA) are actively engaged in increasing access to family planning interventions, including subdermal implants, which provide new opportunities for the expansion of markets in such fast-developing regions.

Challenges

-

Social and Cultural Resistance challenging the progress of the market.

One of the major threats to the Subdermal Contraceptive Implants Market is social and cultural resistance towards the acceptance of new contraceptive technologies, particularly in conservative cultures. In certain cultures, mostly in Africa, the Middle East, and Asia, cultural and religious factors could play a role in shaping attitudes towards family planning, creating unwillingness to use contraceptive methods such as subdermal implants. Misconceptions regarding the implants, such as fears over side effects or long-term health effects, also hinder their uptake. Moreover, miscommunication and poor counseling by doctors further contribute to the issue, restraining the expansion of the market. The key to greater uptake and penetration into the market is overcoming these cultural barriers by launching awareness programs and community outreach.

Segmentation Analysis

By Product

In 2023, the Etonogestrel Implant segment dominated the Subdermal Contraceptive Implants Market with 63.10% market share. This is due to several leading factors. Etonogestrel implants like Nexplanon are highly effective long-acting reversible contraceptives (LARCs), which are given for a period of up to three years with over 99% effectiveness in preventing pregnancy. They are "set-it-and-forget-it" products that people who want a low-fuss contraceptive find most appealing. Also, the design of the implant as a single, flexible rod makes insertion and removal easier, increasing user convenience. The high availability and increasing awareness of Etonogestrel implants, especially in developed countries, have also driven their uptake. Furthermore, continued efforts by manufacturers to increase access and affordability, along with support from healthcare providers, have cemented the Etonogestrel Implant segment's market-leading position.

By Distribution Channel

In 2023, the Hospital segment dominated the Subdermal Contraceptive Implants Market by distribution channel with a 55.19% market share because of the availability of extensive medical infrastructure and qualified professionals required to carry out implant procedures. Hospitals are the most important point of care for women in need of long-term contraceptive measures, particularly in urban regions where highly advanced reproductive healthcare services are available. Hospitals tend to be incorporated within national family planning programs and collaborations with institutions such as the WHO and UNFPA to maintain a steady supply of implants at subsidized costs. Such institutions also serve a large population base, including high-risk or complicated cases necessitating specialized medical care during and following the insertion process. The capacity of hospitals to manage both outpatient and inpatient services, as well as postoperative services, has further entrenched their control over implant distribution.

The Gynecology Clinics segment experience the fastest growth over the forecast period with 8.25% CAGR as a result of their growing accessibility, specialization, and patient-friendliness. These clinics provide a more intimate, low-key, and time-saving setting for women who want contraceptive consultation and treatment, an attractive option to hospitals. As women's health awareness grows, especially in cities and semi-cities, increasing numbers of women are approaching gynecology clinics for reproductive healthcare, including subdermal implant consultation. Additionally, the increasing popularity of private clinics and chain clinics dedicated to women's health has increased the availability of services. Such clinics are also more adaptable to new technologies and to marketing newer methods of contraception, which adds to their anticipated high growth rate.

Regional Analysis

North America dominated the Subdermal Contraceptive Implants Market with a 63.10% market share in 2023, owing to several primary factors such as high expenditure on healthcare, strong healthcare infrastructure, and improved access to sophisticated contraceptive technologies. The region is aided by robust regulatory systems that assure the safety and effectiveness of medical products, thus increasing consumer trust in implantable contraceptives. Also, North America possesses a large number of healthcare professionals and specialized clinics that advocate the utilization of long-acting reversible contraceptives (LARCs), such as subdermal implants, which are gaining popularity because they are convenient and effective. The increasing level of awareness regarding family planning, along with a high need for dependable birth control products, further supports the region's leadership in the market.

Asia Pacific is the fastest-growing region in the Subdermal Contraceptive Implants market with 8.60% CAGR throughout the forecast period, spurred on by drivers such as rising population, expanding healthcare access, and changing social norms. In much of Asia, there is an emerging emphasis on reproductive health and family planning, supplemented by government support encouraging the use of contraceptives. Having a high and heterogeneous population, Asia Pacific countries are experiencing large changes towards newer forms of contraceptives such as subdermal implants, particularly in rural and remote locations where older forms are not as available. In addition, urbanization and the increasing middle class in India, China, and Southeast Asia are driving the demand for convenient, long-term contraceptives, further boosting the growth rate of the market at a fast pace.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Market Players

-

Bayer AG (Nexplanon, Implanon NXT)

-

Merck & Co., Inc. (Implanon, Organon Nexplanon)

-

Shanghai Dahua Pharmaceutical Co., Ltd. (Sino-implant (II), Levoplant)

-

Pfizer Inc. (Sayana Press, Depo-Provera)

-

Mithra Pharmaceuticals (Estelle, Donesta)

-

HLL Lifecare Limited (Mala-N, Norplant)

-

SmPC Ltd. (Norplant, Levonorgestrel Implant)

-

Zhejiang Xianju Pharmaceutical Co., Ltd. (Levonorgestrel Implant, Xianju Contraceptive Stick)

-

Shanghai Pharmaceutical Co., Ltd. (Levonorgestrel Subdermal Implant, SP Implant II)

-

Reckitt Benckiser Group plc (Durex Invisible, Durex RealFeel — supporting sexual health segment)

-

Mylan N.V. (a Viatris company) (Medroxyprogesterone Acetate Injectable, Mylimplant)

-

Gedeon Richter Plc. (Levonorgestrel-Releasing Implant, Rigevidon Support Implant)

-

Teva Pharmaceutical Industries Ltd. (Plan B One-Step, Levonorgestrel Implant)

-

Actavis (a division of Teva) (NorLevo, Subdermal Levonorgestrel Implant)

-

Johnson & Johnson Services, Inc. (Evra Patch, ORTHO EVRA)

-

Sino Biopharmaceutical Limited (Subdermal Contraceptive Implant, Levonorgestrel Insertion Kit)

-

BioFarma S.p.A. (Levonorgestrel Subdermal Rod, BioPlant-Rod)

-

Population Council (Levoplant, Norplant)

-

Piramal Enterprises Ltd. (Contraceptive Implant System, FemProtect)

-

Cipla Ltd. (Ciplimplant, Levogest Implant)

Suppliers (These suppliers primarily provide biocompatible polymers, excipients, and specialized chemical formulations used in the manufacturing of subdermal contraceptive implants, ensuring controlled drug release, stability, and safety for extended durations.) In the Subdermal Contraceptive Implants Market.

-

BASF SE

-

Eastman Chemical Company

-

Evonik Industries AG

-

Covestro AG

-

Dow Inc.

-

Lubrizol Corporation

-

Mitsubishi Chemical Corporation

-

Solvay S.A.

-

DSM Nutritional Products

-

Corbion N.V.

Recent Development

-

February 2024: Bayer AG allied with Daré Bioscience to create a hormone-free monthly contraceptive. This deal is to broaden the options available in the non-hormonal contraceptives category, and this may make a big difference in the subdermal contraceptive implants market.

-

February 2023: The Family Planning Association of India (FPAI) promoted the use of Implanon NXT, a single-rod subdermal contraceptive implant marketed by Organon, a spin-off of Merck & Co., Inc., indicating Merck's indirect contribution to promoting subdermal contraceptive options.

-

October 2023: Shanghai Dahua Pharmaceutical Co., Ltd., in collaboration with DKT WomanCare, cut the price of its two-rod contraceptive implant, Levoplant, to around USD 6 for qualifying purchasers. This effort is aimed at increasing access to high-quality contraceptives, especially in low-income areas.

Subdermal Contraceptive Implants Market Report Scope:

Report Attributes Details Market Size in 2023 US$ 1.03 Billion Market Size by 2032 US$ 2.01 Billion CAGR CAGR of 7.76 % From 2024 to 2032 Base Year 2023 Forecast Period 2024-2032 Historical Data 2020-2022 Report Scope & Coverage Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook Key Segments • By Product (Etonogestrel Implant, Levonorgestrel Implant)

• By Distribution Channel (Hospital, Gynecology Clinics, Community Health Care Centers, Others)Regional Analysis/Coverage North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) Company Profiles Bayer AG, Merck & Co., Inc., Shanghai Dahua Pharmaceutical Co., Ltd., Pfizer Inc., Mithra Pharmaceuticals, HLL Lifecare Limited, SmPC Ltd., Zhejiang Xianju Pharmaceutical Co., Ltd., Shanghai Pharmaceutical Co., Ltd., Reckitt Benckiser Group plc, Mylan N.V. (a Viatris company), Gedeon Richter Plc., Teva Pharmaceutical Industries Ltd., Actavis (a division of Teva), Johnson & Johnson Services, Inc., Sino Biopharmaceutical Limited, BioFarma S.p.A., Population Council, Piramal Enterprises Ltd., Cipla Ltd.