Blood-Based Biomarker for Sports Medicine Market Size Analysis:

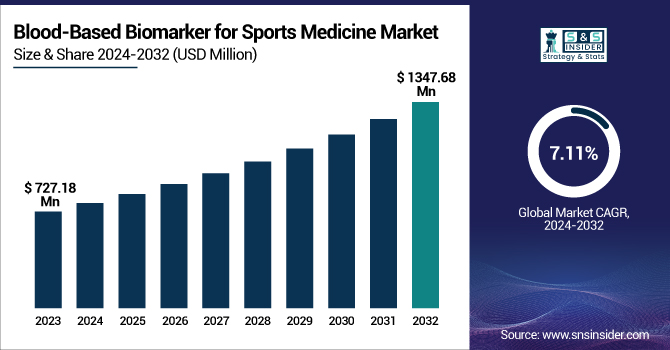

The Blood-Based Biomarker for Sports Medicine Market was valued at USD 727.18 million in 2023 and is expected to reach USD 1347.68 million by 2032, growing at a CAGR of 7.11% over the forecast period of 2024-2032.

To Get more information on Blood-Based Biomarker for Sports Medicine Market - Request Free Sample Report

This report indicates blood-based biomarker testing trends by geography, driven by growing awareness of preventing injury, optimizing performance, and early diagnosis of musculoskeletal disorders. The research analyzes healthcare expenditure on biomarker testing, with increasing investment from sports federations, rehabilitation clinics, and high-performance training centers. It also analyzes adoption trends by sport type, with endurance sports, contact sports, and strength sports exhibiting different levels of demand for biomarker monitoring. The study explores technical progress in areas such as AI-powered analytics and newer biomarker panels, improving diagnosis accuracy and recovery interventions. Regulatory and compliance trends significantly contribute to market dynamics, including the standardization of test protocols and the consideration of ethical implications of sports performance tracking. Additionally, R&D efforts and clinical trials continue to inform innovation, offering evidence-based information on biomarker use in injury risk assessment and recovery tracking.

The U.S. Blood-Based Biomarker for Sports Medicine Market was valued at USD 214.29 million in 2023 and is expected to reach USD 359.07 million by 2032, growing at a CAGR of 5.92% over the forecast period of 2024-2032. In the US, the market is growing with more funding in sports science, more partnerships of biotech companies with sporting organizations, and a high emphasis on customized performance analytics to enhance athlete health and longevity.

Blood-Based Biomarker for Sports Medicine Market Dynamics

Drivers

-

The rising adoption of blood-based biomarkers in sports medicine is driven by their increasing role in injury prevention, recovery monitoring, and performance optimization.

The increasing incidence of sports injuries, with more than 8.6 million sports injuries reported each year in the U.S. alone, has spurred demand for early and accurate diagnostic methods. Biomarkers such as CK, CRP, and IL-6 offer real-time information on muscle damage, inflammation, and metabolic stress, enabling athletes and coaches to adjust training programs accordingly. Advances in biomarker technology, point-of-care diagnostics, and AI-driven diagnostic solutions are also improving accessibility and efficiency. In addition, increased knowledge among professional and amateur sports players regarding the advantages of biomarker-based evaluation is increasing market penetration. International sport governing bodies such as FIFA and the NBA are more actively implementing biomarker tests into regular monitoring programs of the health of their players. The demand is further driven by convergence with wearable health technologies and blood biomarker tests to enable round-the-clock tracking of athletes' performance and recovery factors. Consequently, sports doctors and rehabilitation specialists are increasingly turning to biomarker-based diagnostics to maximize injury management protocols, minimize recovery time, and maximize overall performance. These drivers continue to drive the market forward, making biomarker-based sports diagnostics a key component of contemporary athletic medicine.

Restraints

-

The blood-based biomarker market for sports medicine faces significant challenges, primarily due to high costs and limited insurance coverage.

Most biomarker tests are costly, with advanced panels ranging between USD 200 to USD 500 per test, which may limit their usage across the broad population, especially among recreational athletes and small sport organizations. The lack of standardization in reference values for biomarkers is a significant hindrance, as this could vary by age, gender, and physical fitness, thereby creating inconsistent meanings. Regulatory barriers and complicated approval procedures also delay market growth, as novel biomarker-based tests need extensive clinical validation and FDA approvals prior to commercialization. In addition, limited awareness among non-elite athletes and overall sports medicine professionals limits the scope of the market. Although elite sports teams and research institutions are investing heavily in biomarker-based diagnostics, uptake is comparatively low in amateur and grassroots sports environments, owing to financial and logistical limitations. Concerns regarding data privacy linked to biomarker testing also restrict adoption, as individuals are not likely to provide intimate health information. These restrictions in total impede the mass adoption of blood-based biomarkers in sports medicine, necessitating stakeholders in the industry to address cost reduction, regulatory convergence, and wider education schemes.

Opportunities

-

The blood-based biomarker market for sports medicine presents numerous opportunities, especially with the growing integration of AI, machine learning, and big data analytics in sports diagnostics.

Emerging fast, point-of-care biomarker tests facilitate in real time, and monitoring has become much easier for the assessment of recovery, fatigue, and injury risks for athletes at any moment. Improvements in microfluidic devices and non-invasive biomarker detection would make the market newsworthy through the minimization of venous blood draws and make biomarker testing convenient and easy. Furthermore, rising partnerships among biotechnology firms, sporting organizations, and research institutions are fueling novel biomarker findings with athlete-specific applications. The increased popularity of personalized medicine for sports also offers a potential for biomarker-based performance enhancement programs. Firms are introducing home-testing biomarker kits so that athletes can keep track of their well-being without recurrent hospital visits. In addition, regulatory authorities of professional sports leagues are looking into making biomarker-based testing compulsory for injury prevention programs, yet another growth driver for the market. The growing application of biomarkers in anti-doping campaigns to ensure the safety of athletes and prevent any kind of unfair benefit further supports demand. With ongoing innovation, increasing regulatory backing, and greater availability, the market is ready for tremendous growth across professional and amateur sports segments.

Challenges

-

The blood-based biomarker market in sports medicine faces several challenges, particularly regarding test accuracy, ethical concerns, and regulatory complexities.

One of the primary issues is that there are no universally accepted thresholds for biomarkers, and therefore, inconsistent diagnoses may result, influencing clinical decision-making. Biomarker levels can also vary because of factors independent of sports injury, including diet, hydration status, and genetic makeup, creating doubts about test reliability. Ethical concerns also exist, as sporting organizations and teams can abuse biomarker information to make career-changing decisions for players, resulting in issues of privacy and consent. Additionally, the market is hampered by regulatory differences between regions, as biomarker tests have to comply with different approval processes, complicating global commercialization. Slow uptake among general practitioners and non-specialist healthcare professionals is another significant challenge, as they might not be trained to interpret biomarkers. While top sports teams spend vast amounts on biomarker-based performance evaluation, smaller groups of organizations and lone athletes usually can't afford, or gain access to, economical and trustworthy testing solutions.

Blood-Based Biomarker for Sports Medicine Market Segmentation Analysis

By Type

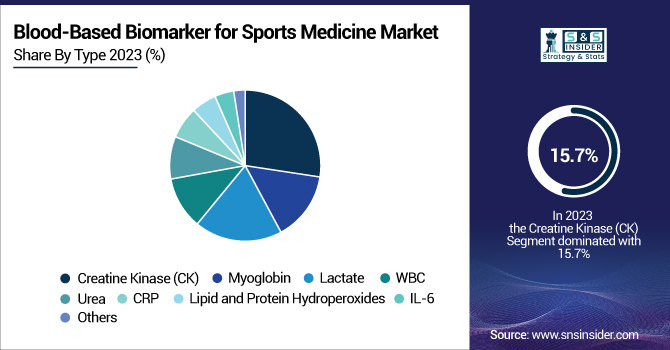

In 2023, the Creatine Kinase (CK) segment led the blood-based biomarker for sports medicine market with a 15.7% share due to its pivotal role in diagnosing muscle damage, overtraining, and exertional rhabdomyolysis. CK testing is extensively applied in elite sports, rehabilitation clinics, and performance monitoring laboratories to evaluate muscle stress and recovery, thus being the most established biomarker in the market. Its widespread adoption by sports physicians and trainers has made it the dominant segment.

The C-Reactive Protein (CRP) segment was the most rapidly growing as a result of its increased application in the detection of inflammation, prevention of injury, and management of recovery. CRP is becoming more popular for its capability to identify early stages of muscle inflammation and overuse injuries, which has resulted in its extensive use in sports medicine clinics and high-performance training programs. The demand is also driven by the increasing focus on preventing injury and ensuring athlete well-being.

Regional Insights

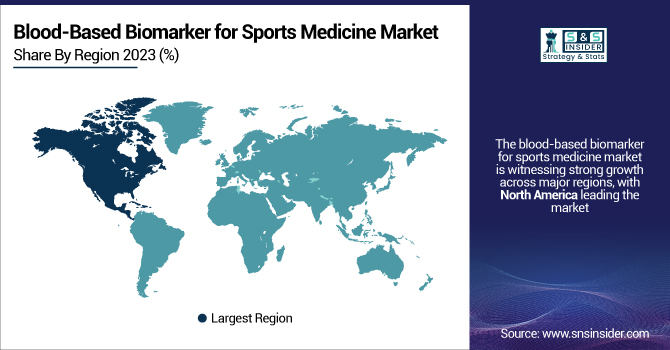

The blood-based biomarker for sports medicine market is witnessing strong growth across major regions, with North America leading the market due to the high adoption of advanced sports diagnostics, the presence of elite sports organizations, and well-established healthcare infrastructure. The United States accounts for the largest share, driven by widespread biomarker testing among professional leagues like the NFL, NBA, and MLB, along with growing investments in athlete health monitoring and sports rehabilitation programs. Europe follows closely, with countries like Germany, the UK, and France witnessing increased adoption due to the rising emphasis on player safety and injury prevention in football (soccer) leagues such as the English Premier League and Bundesliga.

Asia-Pacific is the fastest-growing region, fueled by the expansion of sports science programs, rising participation in professional sports, and increasing government initiatives to enhance athlete performance. Countries like China, Japan, and India are investing heavily in sports medicine research and biomarker-based diagnostics, with China alone seeing a 27% increase in sports-related healthcare spending over the past five years. The rising popularity of endurance sports, combat sports, and esports in Asia is further driving demand for biomarker-driven performance optimization. Latin America and the Middle East & Africa are also showing steady growth, with increasing sports infrastructure and healthcare advancements supporting market expansion.

Get Customized Report as per Your Business Requirement - Enquiry Now

Blood-Based Biomarker for Sports Medicine Market Key Players

-

Abbott – Architect C System, Total Bilirubin2 assay

-

BIOMÉRIEUX – VIDAS TBI test

-

F. Hoffmann-La Roche Ltd. – Elecsys β-Amyloid (1-42) CSF II, Elecsys Phospho-Tau (181P) CSF, Benzodiazepines II test

-

ARUP Laboratories – Comprehensive diagnostic testing services

-

Siemens Healthineers AG – CardioPhase hsCRP test, ADVIA Centaur immunoassay system, Atellica Solution, Aptio Automation

-

RayBiotech, Inc. – ELISA kits, protein arrays

-

Thermo Fisher Scientific, Inc. – DRI Tricyclics Serum Tox Assay, Microgenics products

-

Bio-Rad Laboratories, Inc. – Bio-Plex multiplex immunoassay system, QX200 Droplet Digital PCR System

-

Beckman Coulter, Inc. – Access Total βhCG (5th IS), Access Vitamin B12 assay

-

Randox Laboratories Ltd. – Comprehensive diagnostic solutions

Recent Developments

-

In Dec 2024, Fujirebio Holdings, Inc. and Eisai Co., Ltd. signed a memorandum of understanding for joint research and social implementation of novel blood-based biomarkers targeting neurodegenerative diseases. This collaboration aims to advance biomarker-based diagnostics for early disease detection and management.

-

In Oct 2024, Sunbird Bio presented new clinical data showcasing its proprietary alpha-synuclein (α-synuclein) blood-based biomarker technology, which accurately detects Parkinson’s disease through a simple blood draw. The findings, shared at the CTAD conference on October 31, highlight the potential for blood-based diagnosis of multiple neurodegenerative diseases with high accuracy.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 727.18 million |

| Market Size by 2032 | USD 1347.68 million |

| CAGR | CAGR of 7.11% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type [CK, Myoglobin, Lactate, WBC, Urea, CRP, Lipid and Protein Hydroperoxides, IL-6, Others] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Abbott, BIOMÉRIEUX, F. Hoffmann-La Roche Ltd., ARUP Laboratories, Siemens Healthineers AG, RayBiotech, Inc., Thermo Fisher Scientific, Inc., Bio-Rad Laboratories, Inc., Beckman Coulter, Inc., Randox Laboratories Ltd. |