Clinical Trials Market Report Scope & Overview:

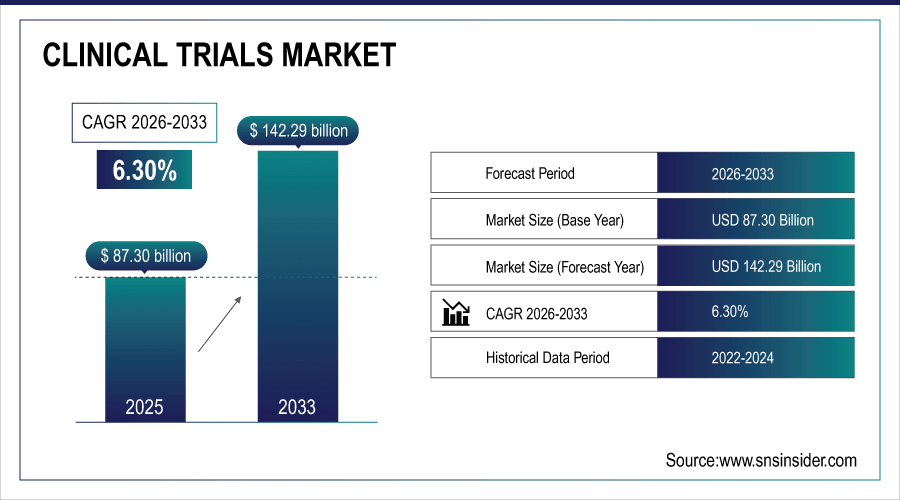

The global clinical trials market size was valued at USD 87.30 billion in 2025 and is projected to reach USD 160.82 billion by 2035, growing at a CAGR of 6.30% during the forecast period 2026–2035.

The global clinical trials market is expanding steadily, supported by over 450,000 registered studies across 220 countries, with oncology accounting for more than 35% of ongoing trials. There are better patient recruitment solutions through digital platforms and decentralized trial models, prevalence of chronic disease is rising, there’s a move toward personalized therapies and investments are being fueled. Pharma and biopharma companies are the biggest users, with CRO collaborations and AI-enabled data management to drive efficiency and drug development globally.

Over 35% of clinical trials are in oncology, with Phase III studies accounting for nearly 55% of total market expenditure.

To Get More Information On Clinical Trials Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 87.30 Billion

-

Market Size by 2035: USD 160.82 Billion

-

CAGR: 6.30% from 2026 to 2035

-

Base Year: 2025

-

Forecast Period: 2026–2035

-

Historical Data: 2022–2024

Clinical trials Market Trends:

-

Oncology will maintain its lead, representing more than 35% of total trial activity in 2027 due to the increasing incidence of cancers and advances in targeted therapy development.

-

Decentralized and virtual trials will grow by close to 40% in the next two years, driven by digital health platforms and remote patient monitoring.

-

In 2025, more than 1,500 clinical trials studied cell and gene therapies, emphasizing a move toward patient-centered medicine.

-

The Asia-Pacific region is forecasted to see a 30% increase in trial activity through 2028 driven by cost benefits, number of patients and regulatory changes.

-

Significant levels of innovation activities are expected within 2029 more than half of leading CROs and pharma companies adopting AI powered trial management systems.

U.S. Clinical trials Insights:

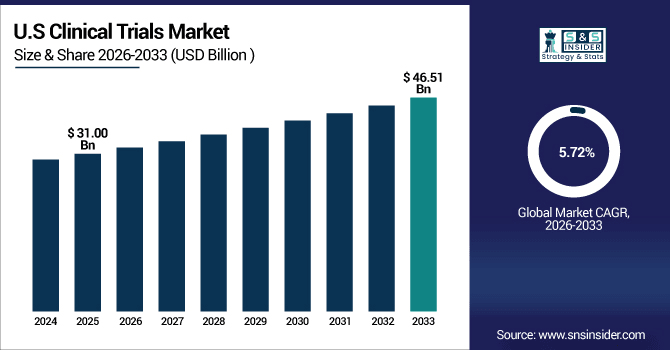

The U.S. leads the North American clinical trials market, valued at USD 31.00 billion in 2025 and projected to reach USD 46.51 billion by 2035, expanding at a CAGR of 5.72%.

The U.S. is the center of the universe for clinical innovation, patient enrollment and rapid therapeutic adoption with an excess of 120,000 active trials registered each year representing over 4,000 research institutions.

Clinical Trials Market Growth Drivers:

-

Increasing Burden of Chronic Diseases Accelerates Global Demand for Large-Scale Clinical Trials and Novel Therapeutics Development.

The increasing burden of chronic diseases is a major driver for the clinical trials market. Chronic diseases are responsible for more than 70% of deaths worldwide annually, while cardiovascular disease alone is the underlying cause of close to 18 million deaths. This growing disease burden requires new treatments, driving over 450,000 clinical studies worldwide. Pharma and biopharma are building more pipelines, CRO collaborations drive faster trial completion, all bode well for on-going clinical activity growth globally.

In 2025, nearly 70% of global clinical trials focused on chronic and non-communicable diseases, establishing them as the leading therapeutic focus driving growth.

Clinical Trials Market Restraints:

-

Patient Recruitment and Retention Challenges Significantly Hinder Clinical Trial Timelines and Global Market Expansion.

Patient recruitment and retention challenges remain a major restraint for the clinical trials market. Almost 80% of trials experience delay in recruitment and about 30% of participants withdraw their involvement from longer duration studies. These barriers add 6 to 12 months to trial durations, causing logjams in drugs and therapy development. Homogenous patient involvement inhibits trials impact due to limiting data efficacy. The consequence is that the inefficiencies of recruitment persist, slowing progress and constraining the global reach of research.

Clinical Trials Market Opportunities:

-

Rapid Adoption of Decentralized and Virtual Trial Models Creates Opportunities, Expanding Access and Accelerating Global Study Participation.

The rapid adoption of decentralized and virtual trial models is creating major opportunities in the clinical trials market. More than 1,500 decentralized trials were registered worldwide by 2025, which increased patient access and diversity. These models decrease attrition by approximately 30% and expedite data collection using online mediums and remote follow-up. Health Boards broader application has facilitated extended geographic reach, particularly for under-developed regions, resulting in rapid patient recruitment, cost savings and internationalization of clinical research activities.

Over 40% of sponsors are adopting decentralized trial models, improving patient recruitment and driving digital innovation globally.

Clinical Trials Market Segmentation Analysis:

-

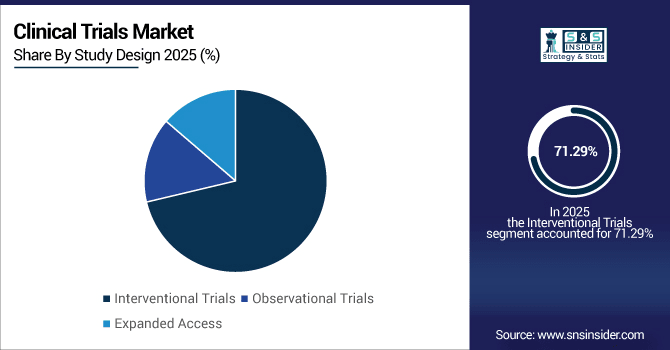

By Study Design, Interventional Trials account for 71.29% in 2025 and Observational Trials grow at a CAGR of 9.38%.

-

By Phase, Phase III has the highest proportion, with 53.47% in 2025, and Phase II holds the highest growth rate at CAGR 10.12%.

-

By Therapeutic Area, the largest segment is Oncology with a 36.84% share in 2025 and the fastest growing one is Immunology at a 11.07% CAGR.

-

By Service Type, Site Management has largest share contribution with 28.36% in 2025 and Data Management grows at fastest CAGR of 12.33%.

-

By End User, Pharmaceutical & Biopharmaceutical Companies is the largest of all with a 61.78% market share in 2025, and Contract Research Organizations (CROs) are among those which grow faster than others at CAGR of 10.89%.

By Study Design, Interventional Trials Dominate While Observational Trials Grow Rapidly:

Interventional trials remain the largest category, accounting for more than 320,000 registered studies globally in 2025, covering drug testing, medical devices, and procedural innovations. Their rigid protocols and regulatory fit assure their continued hegemony. Observational trials are growing rapidly more than 80,000 active studies are monitoring patient outcomes in the real world. Rising emphasis on post-marketing surveillance, long-term safety data and cost-effectiveness analysis is driving demand for observational studies in various therapeutic areas.

By Phase, Phase III Dominates While Phase II Grows Rapidly:

Phase III trials dominate the market, with over 25,000 active late-stage studies worldwide in 2025, reflecting their pivotal role in large-scale patient testing and regulatory submissions. These studies can involve thousands of participants to confirm safety and efficacy. It is Phase II that is growing the fastest, with more than 18,000 trials of experimental drugs to treat specific groups of patients in progress. With the rise in precision medicine pipelines and biologics development, Phase II uptake is increasing across indications.

By Therapeutic Area, Oncology Dominates While Immunology Grows Rapidly:

Oncology leads clinical trial activity, with more than 160,000 registered studies by 2025, representing the highest disease-specific focus. The overall high presence of cancer and need for targeted therapies, immunotherapies, as well as combination approaches keep this domination. The most rapidly expanding area for discovery is that of immunology, driven by more than 25,000 active trials in autoimmune and inflammatory diseases. Increasing prevalence of rheumatoid arthritis, multiple sclerosis and inflammatory bowel disease are driving the pipeline for new biologics and immunotherapies.

By Service Type, Site Management Dominates While Data Management Grows Rapidly:

Site management services prevail with supervision and compliance of 40,000+ active trial sites/globally by 2025 needing our powerful patient oversight. Data management is also the fastest-growing, and is fuelled by over 10,000 active trials working with cutting-edge electronic data capture (EDC), real-time analytics. Development of remote decentralized trials, digital platforms and AI-driven monitoring are only escalating the requirement for niche data management solutions worldwide.

By End User, Pharmaceutical & Biopharmaceutical Companies Dominate While CROs Grow Rapidly:

Pharmaceutical and biopharmaceutical companies dominate, sponsoring over 65% of global clinical trials in 2025, with pipelines expanding into oncology, neurology, and rare diseases. And their onus in developing drugs and biologics serves to increase demand for large, multi-center trials. Fast-growing CROs manage over 30,000 outsourced studies worldwide. Validating triple-arterial phase (TAP) MDCT for the detection and characterization of nodules within cirrhotic livers intraoperatively will be fundamentally important to ensure early diagnosis based on nonevidence-based screening practices.

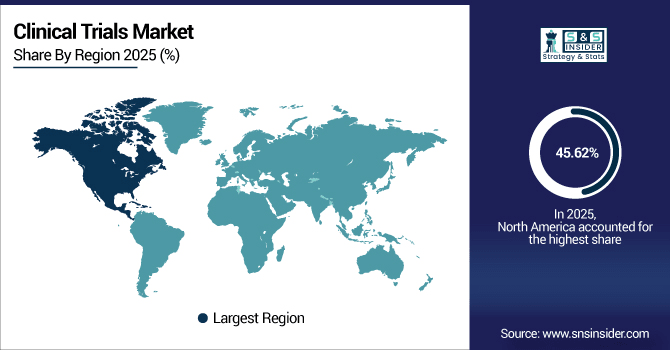

Clinical Trials Market Regional Analysis:

North America Clinical Trials Market Insights:

North America dominates the clinical trials market with a 45.62% share in 2025, establishing itself as the global hub for innovation and research. The region has more than 140,000 active registered trials, and the U.S. contributes to almost 35% of the global number alone. Robust FDA regulations, streamlined patient recruitment solutions, and Canada’s state-of-the-art biopharmaceutical research infrastructure collectively support North America’s dominance in clinical trials conduct and new therapy advancements.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Clinical Trials Market Insights:

The U.S. clinical trials market dominates with over 45% of all global Phase I trial initiations in 2025, highlighting its leadership in early-stage drug development. Over 70% of the world's Top Pharma have their trial HQ and major research hub in the U.S. Leading-edge digital trial platforms and patient recruitment networks with access to largest participant pool (100,000+ annually) worldwide underpin its global leadership in innovative and adoptive clinical trials.

Asia-Pacific Clinical Trials Market Insights:

The Asia-Pacific clinical trials market is projected to grow at a CAGR of 7.26%, making it the fastest-growing region worldwide. There are more than 14,000 active clinical studies in China, India, Japan and South Korea as of 2025. India is registering over 500,000 trial participants each year single-handedly which speaks volume of its huge patient population. With government-mandated R&D incentives, increasing medical tourism and accelerated trial approvals, the region is also becoming a global frontrunner in clinical trials growth.

China Clinical Trials Market Insights:

China dominates the Asia-Pacific clinical trials market with over 6,500 active studies in 2025, the highest in the region. The nation’s capacity to enroll more than 300,000 patients a year is unmatched, and more than 1,200 certified research hospitals provide the infrastructure. Strong government support and collaboration with global pharma render China the regional centre of momentum for trial innovation and conduct.

Europe Clinical Trials Market Insights:

Europe is a key hub in the global clinical trials market, with more than 9,800 active studies running in 2025 across Germany, France, the UK, and Italy. The area has a patient base of more than 500,000 per year and provides excellent trial diversity. Accessibility: More than 92% of the population is under the public health coverage system. With over 2,500 clinical programs supported by significant EU research funding, Europe continues to lead in global trial innovation and execution.

Germany Clinical Trials Market Insights:

Germany dominates the European clinical trials market with more than 3,000 active studies in 2025, spanning oncology, cardiovascular, and rare diseases. More than 85 specialist trial centres with good participation in EU-funded research mean innovation is fast. This impressive structure firmly establishes Germany at the forefront of clinical research excellence in the region.

Latin America Clinical Trials Market Insights:

Latin America’s clinical trials market is expanding, with more than 4,500 active studies registered in 2025, primarily in Brazil, Mexico, and Argentina. Brazil and it has already over 2,000 trials running by more than 100 credited research institutions. Increased government backing, more patient participation and overseas collaboration are fast tracking the region’s place in global clinical research.

Middle East and Africa Clinical Trials Market Insights:

The Middle East and Africa clinical trials market is progressing, with more than 1,200 active studies in 2025 across Saudi Arabia, UAE, and South Africa. A growing commitment by government of support for health care, in addition to development over 300 of specialized research centers are stimuluses that encourage participation. Moreover, growing medical tourism with over a million patients annually bolsters the region’s trial system.

Transcatheter Clinical Trials Competitive Landscape:

IQVIA commands the clinical trials market with well over 4,000 active studies in 2025 including oncology, rare diseases and chronic disease. Distributed within its real-world data platform are 800 million patient lives, supporting precision recruitment and adaptive trial design. And by using AI and predictive modeling, IQVIA slashes trial timelines by 20%, making it the world’s best provider of global clinical development solutions operating in over 100 countries.

-

In September 2025, IQVIA launched its AI-enabled Clinical Trial Financial Suite across 200+ geographies to streamline budgeting and payments in trials.

Labcorp dominates clinical trials through its integrated diagnostics and drug development platform, managing more than 2,500 active studies in 2025. This global laboratory network supports our bio-pharma clients in executing trials and attaining their drug development milestones with superior biomarker expertise from translational, through clinical to commercialization. With 70% of top 20 pharma companies served, Labcorp shortens trial-to-market timelines by 15%, making it a force in precision medicine and complex therapeutic studies.

-

In February 2025, Labcorp expanded its Global Trial Connect platform to improve study delivery with biopharma sponsors and sites.

ICON plc has cemented its leadership in clinical trials by conducting 1,800+ studies across 50 therapeutic areas in 2025. With the purchase of PRA Health Sciences, it enlarged its scope to 93 countries and a staff of 40,000. ICON which is focused on decentralized clinical trials reports remote monitoring has increased patient participation rates by 18%. Through their digital health integration, ICON is leading the way for flexible, efficient and patient-centric clinical trial delivery across the globe.

-

In March 2025, ICON plc was ranked a top CRO for Phase 1 trials in an ISR benchmarking report.

Clinical Trials Market Key Players:

Some of the Clinical Trails Market Companies are:

-

IQVIA

-

Labcorp Drug Development (Covance)

-

ICON plc

-

Syneos Health

-

Parexel International

-

Charles River Laboratories

-

Medpace Holdings, Inc.

-

WuXi AppTec

-

PPD (Thermo Fisher Scientific)

-

PRA Health Sciences

-

SGS SA

-

Pharmaceutical Product Development, LLC

-

Clinipace, Inc.

-

Worldwide Clinical Trials

-

PSI CRO AG

-

Advanced Clinical

-

Covalent Medical Research

-

CMIC Holdings Co., Ltd.

-

PRACTICAL Clinical Trials Solutions

-

TFS HealthScience

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 87.30 Billion |

| Market Size by 2035 | USD 160.82 Billion |

| CAGR | CAGR of 6.30% From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Phase (Phase I, Phase II, Phase III, Phase IV) • By Study Design (Interventional Trials, Observational Trials, Expanded Access) • By Therapeutic Area (Oncology, Cardiovascular Diseases, Infectious Diseases, CNS Disorders, Immunology, Others) • By Service Type (Site Management, Data Management, Patient Recruitment & Retention, Regulatory & Compliance, Others) • By End User (Pharmaceutical & Biopharmaceutical Companies, Medical Device Companies, Academic & Research Institutions, Contract Research Organizations [CROs]) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | IQVIA, Labcorp Drug Development (Covance), ICON plc, Syneos Health, Parexel International, Charles River Laboratories, Medpace Holdings, Inc., WuXi AppTec, PPD (Thermo Fisher Scientific), PRA Health Sciences, SGS SA, Pharmaceutical Product Development, LLC, Clinipace, Inc., Worldwide Clinical Trials, PSI CRO AG, Advanced Clinical, Covalent Medical Research, CMIC Holdings Co., Ltd., PRACTICAL Clinical Trials Solutions, TFS HealthScience |