Veterinary Microchips Market Size Analysis:

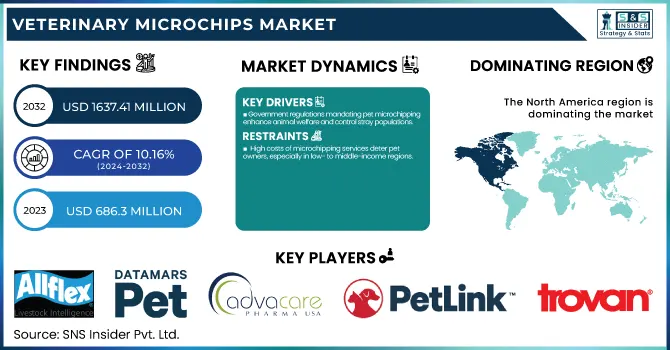

The Veterinary Microchips Market Size was valued at USD 686.3 million in 2023 and is expected to reach USD 1637.41 million by 2032, growing at a CAGR of 10.16% over the forecast period 2024-2032.

To Get more information on Veterinary Microchips Market - Request Free Sample Report

This report offers in-depth statistical data and dominant trends in the Veterinary microchip market while underscoring the global adoption of pet microchipping. It includes incidence and prevalence rates, studies of pet owner's preferences, and regional variations. The research includes regional penetration, key markets, and regulatory involvement. Microchip embedding trends show the chip frequencies of choice, as well as the typical adoption age. The report also looks at pet recovery and reunification rates, including microchipped vs. non-microchipped pets. A look would outline implantation costs and consumer spending patterns. Compliance rates and government policies that are moulding the market are linked to approving developments. This analysis provides a complete picture of industry development, breakthroughs, and insights into future trends in adoption.

The increasing humanization of pets has driven the veterinary microchips with the need for efficient and accurate identification as many countries have implemented laws to identify pets. North America is the largest market for veterinary microchips, accounting for over 34% of the veterinary microchip market. In NA US held market size was USD 182.01 million in 2023. Reflecting its large pet-owning population and stringent regulations regarding pet microchipping. New government numbers show a large increase in pet ownership, with 2023 seeing nearly 92 million dogs owned as pets in the U.S.

Veterinary Microchips Market Dynamics

Drivers

-

Government regulations mandating pet microchipping enhance animal welfare and control stray populations.

Regulations in institutions that require microchipping of pets are a crucial step to take to improve animal welfare and control the roaming of these animals. In England, the biggest legal development came when a new law mandating all cat owners to microchip their animals by June 10, 2024, went into action. Not doing so could lead to a fine of up to £500. This initiative seeks to tackle the worrying statistic that in 2022, less than 2% of stray cats who arrived at Battersea, a leading animal welfare charity, were returned to their owners as a result of microchipping. In addition, 59% of the stray cats were not microchipped at all, further highlighting the importance of such legislation. And the value of microchipping is reinforced by data that show that pets with microchips are three times more likely to be returned to their families than those without chips. With this offer, only about 18% of lost pets arriving at shelters are microchipped, indicating a significant disparity in pet identification practices. In the United States, a study of 7,704 microchipped pets across 53 shelters found that 72.7% of these animals were reunited with their owners. But there was still a long way to go, with 35.4% of unrecovered reunions caused by an incorrect or disconnected mobile straight in the microchip registry, and 9.8% due to microchips not being registered.

These statistics demonstrate why microchipping laws are vital. If governments were to pass these types of laws, the reuniting of pets with their owners could be greatly improved, the number of strays wouldn't be eliminated, but would greatly decrease, and open up room at the shelters. However, for these programs to work, pet owners must keep their contact information updated in microchip registries. All of these measures result in better pet management and improved animal welfare.

Restraint

-

High costs of microchipping services deter pet owners, especially in low- to middle-income regions.

The cost of microchipping pets varies globally, typically ranging from $25 to $50 per animal, depending on factors such as species and service provider. This expense can be a deterrent for pet owners, particularly those in low- to middle-income regions, leading to lower adoption rates of this technology. Despite the benefits of microchipping, such as permanent identification and increased chances of reuniting lost pets with their owners, the initial cost remains a significant barrier. This reluctance is especially pronounced among pet owners with limited disposable income, who may prioritize other immediate expenses over microchipping. Consequently, this cost sensitivity hampers the widespread adoption of microchipping, limiting its potential to enhance pet safety and identification on a global scale. To address this issue, some animal shelters and rescue organizations offer low-cost microchipping services during special events or as part of adoption packages. Additionally, implementing educational programs to highlight the long-term benefits and cost-effectiveness of microchipping can encourage more pet owners to invest in this technology. By alleviating cost concerns and increasing awareness, the adoption rate of pet microchipping can improve, enhancing animal welfare worldwide.

Opportunity

-

Emerging markets with growing pet ownership present significant growth potential for microchip adoption.

Limited knowledge of microchipping among pet owners regarding its advantages and availability is a major challenge for the international veterinary microchips market. This knowledge gap means that fewer owners utilize the technology, undermining microchipping as an effective tool to identify and recover pets. In areas where it may not be enforced, a majority of pet parents are still unaware of the true benefits of microchipping. For example, In the US, up to 70% of pets are microchipped, according to the American Veterinary Medical Association, but the rate varies around the world, with much of Eastern Europe and some regions of Asia demonstrating very low adoption. This gap is often explained by the public being lack of awareness and understanding of microchipping and care for pet safety.

The impact of this ignorance is reflected in pet recovery statistics. Worldwide, only approximately 48% of lost dogs and a paltry 19% of lost cats are returned to their owners. These abysmally low recovery rates have underlined the vital importance of reliable identification techniques such as microchipping. Additionally, even in areas that have implemented microchipping on a wide-scale basis, problems of improper registration or failure to update contact details still exist, rendering microchips meaningless. This underscores the need for wide-ranging educational campaigns that not only promote the microchipping of pets but also provide an incentive for pet owners to keep their details current.

Challenge

-

Lack of awareness among pet owners about the benefits and availability of microchipping limits market growth.

Limited knowledge of microchipping among pet owners regarding its advantages and availability is a major challenge for the international veterinary microchips market. This knowledge gap means that fewer owners utilize the technology, undermining microchipping as an effective tool to identify and recover pets. In areas where it may not be enforced, a majority of pet parents are still unaware of the true benefits of microchipping. for example, In the US, up to 70% of pets are microchipped, according to the American Veterinary Medical Association, but the rate varies around the world, with much of Eastern Europe and some regions of Asia demonstrating very low adoption. This gap is often explained by the public being lacking in the awareness and understanding of microchipping and care of pet safety.

The impact of this ignorance is reflected in pet recovery statistics. Worldwide, only approximately 48% of lost dogs and a paltry 19% of lost cats are returned to their owners. These abysmally low recovery rates have underlined the vital importance of reliable identification techniques such as microchipping. Additionally, even in areas that have implemented microchipping on a more wide-scale basis, problems of improper registration or failure to update contact details still exist, rendering microchips meaningless. This underscores the need for wide-ranging educational campaigns that not only promote the microchipping of pets, but provide an incentive for pet owners to keep their details current.

Veterinary Microchips Market Segmentation Analysis

By Animal Type

Dogs held the dominant share 44% of the Veterinary Microchips Market in 2023. There are several reasons for this dominance, including the large number of global dog owners and the unique identification needs of dogs. Dogs are the most common pets in many countries, including the U.S., where government statistics show that they are routinely microchipped for identification and recovery purposes. According to the American Veterinary Medical Association (AVMA), microchipping is a very reliable way of identifying a pet, particularly a dog, as it is often mandated by local laws that dogs be microchipped. The emotional connection that owners have to their pets only propels the need for microchipping if a dog is lost, having them microchipped aids in getting them home safely. Government regulations requiring dog microchipping have also been shown to increase dog microchipping rates in some areas. The demand for veterinary microchips is also driven by regulations such as dogs entering the U.S. must be microchipped. The Dog segment held the dominating share in the veterinary microchips market owing to this regulatory scenario, and growing awareness of pet health and safety.

The growing pet humanization trend and rising need for identification will have significant contributions to the growth of the veterinary microchips market. Dawn was in line with the trend of more people taking into consideration their pets as part of the family and willing to pay for identification devices to keep them safe. Countless government projects highlight the need for pet microchipping so that we can keep track of our pets for identification as well as health monitoring reasons.

By Scanner Type

In 2023, the 134.2 KHz scanner type accounted for the majority share in the Veterinary Microchips Market. 134.2 KHz microchips have become the standard for pet identification in many parts of the world, most notably in North America and Europe, resulting in this dominance. This frequency is often required by government regulations or industry standards in order to be compatible with various scanners, ensuring that pets can be identified in any situation. 134.2 KHz frequency is favored due to its reliable and consistent performance, which is why pet and veterinarians wanted for an identification microchip. Their ability to read microchips from different manufacturers streamlines the identification process, a feature iron 134.2 KHz scanners widely available are ultimately compatible with many microchip brands. Government programs that encourage standardized systems of identification for pets also support the use of 134.2 KHz scanners. For example, regulations in the U.S. and Europe, as well as elsewhere, generally require pets to be microchipped at frequencies that can be easily read in order for them to be identified and reunited with their guardians. Standardization achieved by the use of 134.2 KHz scanners in veterinary clinics and animal shelters has further strengthened their position in the market.

By Distribution Channel

In 2023, Veterinary hospitals/clinics accounted for the largest share of the Veterinary Microchips Market. This dominance has been attributed to the availability of microchipping services as a standard part of veterinary practice. Many veterinary clinics offer microchipping as part of their services, often during regular check-ups or spay/neutering procedures. Government policies and animal health guidance try to lead veterinarians to promote microchipping as a common routine for identifying pet animals and their safety. Many pet owners are already familiar with their local veterinary hospitals and clinics, as these facilities can also provide microchips for pets. Past government initiatives focusing on animal care and identification also validate the role of the veterinary hospitals/clinics in the microchipping market. For instance, when the government runs campaigns encouraging pet owners to have their pets microchipped, not only have adoption rates increased, but veterinary clinics have proven to be a keystone for these services.

Veterinary Microchips Market Regional Insights

In 2023, North America accounted for a prominent portion of the market share 34%, owing to factors such as robust regulatory support and evolved healthcare facilities. In fact, according to the American Pet Products Association (APPA), the U.S. is leading by a wide margin, with 70% of households possessing pets. The number of pets owned, along with regulations requiring microchipping in many states, has resulted in the technology being widely adopted. The dominance of North America can also be attributed to the presence of major players, such as AVID Identification Systems and HomeAgain, who invest heavily in research and development to remain ahead in microchip technology, as well as in raising awareness of its benefits among pet owners and veterinarians. Microchipping has become more accessible to a wider audience due to competitive pricing in North America, contributing to its market share.

The Asia-Pacific region is expanding at the highest CAGR, and this can be attributable to a surge in disposable income combined with the growing understanding of animal welfare among the populace in nations, such as China and India. The Indian pet economy has grown 40% in 5 years due to the growing pet parent demographic. In addition, the increasing pet welfare initiatives adopted by the governments in the region along with rising demand for microchipping services will also work in favor of the microchip implant industry.

Get Customized Report as per Your Business Requirement - Enquiry Now

Veterinary Microchips Market Key Players

Key Service Providers/Manufacturers

-

Allflex Livestock Intelligence (Microchip, Thermochip)

-

Datamars Pet ID (T-SL Slim Polymer Microchip, T-IS Bio Glass Microchip)

-

AdvaCare Pharma (Microchip Implant Kit, Veterinary Injection Instruments)

-

EIDAP Inc. (12mm ISO Microchip, 8mm ISO Microchip)

-

Pet Pulse (RFID Microchip Implants, RFID Microchip Readers)

-

PetLink (Microchip Registration Services, Pet Recovery Services)

-

Trovan (Unique-ID 100, Unique-ID 200)

-

HomeAgain (Standard Microchip, Universal WorldScan Reader)

-

AVID Identification Systems (FriendChip, MiniTracker 3)

-

Microchip ID Systems (Microchip ID Mini, ProScan 700)

-

Bayer (ResQ Microchip, ResQ Scanner)

-

Virbac (BackHome BioTec Microchip, BackHome Reader)

-

PetID Global (PetID Microchip, PetID Scanner)

-

PeddyMark (Standard Microchip, Halo Scanner)

-

IdentiPet (IdentiPet Microchip, IdentiPet Scanner)

-

Animalcare (Identichip, Identichip Scanner)

-

Pet Travel (ISO Microchip, Universal Scanner)

-

SmartTag Microchips (SmartTag Microchip, SmartTag Scanner)

-

PetSafe (Microchip Cat Flap, Microchip Pet Feeder)

-

Sure Petcare (SureFlap Microchip Pet Door, SureFeed Microchip Pet Feeder)

Recent Developments in the Veterinary Microchips Market

-

In May 2023, Datamars acquired Kippy S.r.l., a leading provider of GPS tracking and activity monitoring systems for dogs, enhancing its service offerings for pet owners globally. This acquisition reflects the growing trend towards integrating advanced technologies into pet care services, including microchipping and tracking solutions.

-

In March 2023, New legislation was introduced to mandate compulsory microchipping for all pet cats, aiming to simplify the process of reuniting lost or stray cats with their owners. This initiative is expected to drive demand for microchipping services and products.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 686.3 Million |

| Market Size by 2032 | USD 1637.41 Million |

| CAGR | CAGR of 10.16% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Animal Type (Dogs, Horses, Cats, Others) • By Distribution Channel (Veterinary Hospitals/clinics, Others) • By Scanner type (134.2 KHz, 125 KHz, 128 KHz) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Allflex Livestock Intelligence, Datamars Pet ID, AdvaCare Pharma, EIDAP Inc., Pet Pulse, PetLink, Trovan, HomeAgain, AVID Identification Systems, Microchip ID Systems, Bayer, Virbac, PetID Global, PeddyMark, IdentiPet, Animalcare, Pet Travel, SmartTag Microchips, PetSafe, Sure Petcare |