Surgical Laser Rental Market Report Scope & Overview:

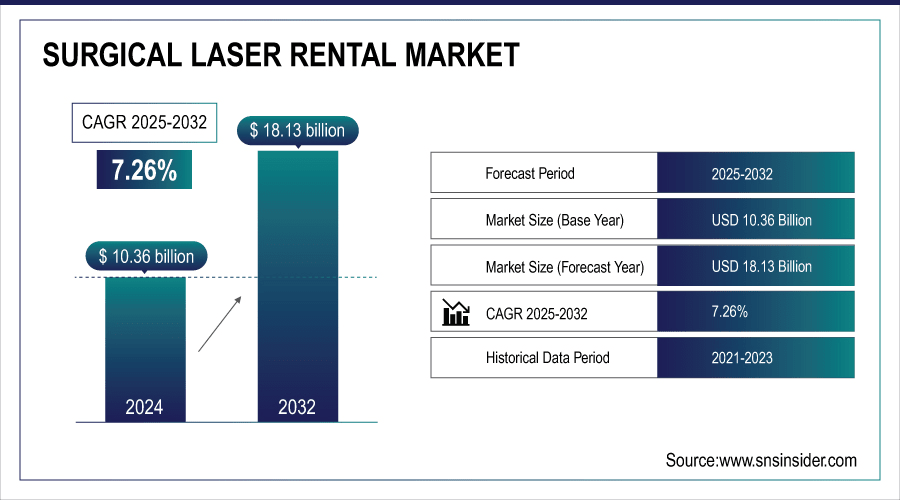

The Surgical Laser Rental Market size was valued at USD 10.36 billion in 2024 and is expected to reach USD 18.13 billion by 2032, growing at a CAGR of 7.26% over the forecast period of 2025-2032.

Laser rental is especially popular in surgical specialties that include urology, gynecology, ENT, dermatology, and ophthalmology, with laser surgery benefiting the most benefited by the technology’s precise, versatile, and minimally invasive modalities of surgery. Hospitals and outpatient facilities are becoming more and more introduce a lease laser model to control capex, be flexible with budget, and get new technology without the burden of ownership. This change is a result of increasing procedure numbers, cost-reduction strategies, as well as demand for scalable systems in both developed and emerging markets. The combination of these elements allows for the global expansion of the surgical laser rental market, providing valuable ‘rentals’ as a business model.

For instance, as of June 2024, solid-state lasers accounted for 43% of surgical laser rentals due to their durability, precision, and broad application across multiple surgical specialties.

To Get More Information On Surgical Laser Rental Market - Request Free Sample Report

Surgical Laser Rental Market Size and Forecast:

-

Market Size in 2024 USD 10.36 billion

-

Market Size by 2032 USD 18.13 billion

-

CAGR of 7.26% from 2025 to 2032

-

Base Year 2024

-

Forecast Period 2025–2032

-

Historical Data 2021–2023

Surgical Laser Rental Market Highlights:

-

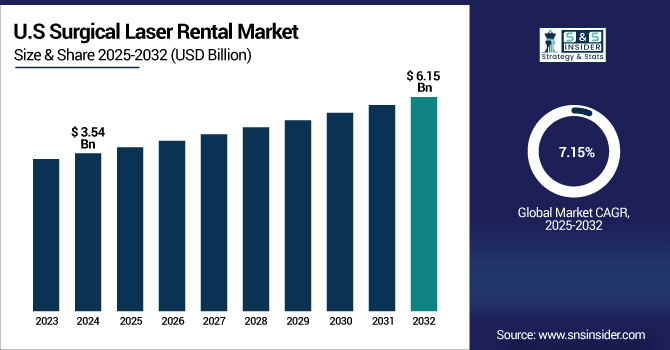

The U.S. surgical laser rental market was valued at USD 3.54 billion in 2024 and is projected to reach USD 6.15 billion by 2032, growing at a CAGR of 7.15% from 2025–2032.

-

Rapid technological advancements, including new-generation scanners with improved accuracy, software integration, and multi-specialty applications, are driving market growth.

-

Hospitals and surgery centers prefer renting advanced laser equipment to avoid high capital investment and obsolescence, gaining access to the latest technology while managing costs.

-

Long-term rentals are increasingly favored, offering maintenance, training, regulatory support, and scalable access for outpatient procedures; 70% of U.S. hospitals preferred leasing in January 2025.

-

Transportation and wear-and-tear of lasers during frequent rentals are major restraints, potentially causing mechanical damage, calibration errors, and reduced equipment lifespan.

-

Concerns over equipment damage and shortened life have made hospitals cautious about expanding rental contracts, impacting market adoption.

The U.S. Surgical Laser Rental Market was valued at USD 3.54 billion in 2024 and is expected to reach USD 6.15 billion by 2032, growing at a CAGR of 7.15% from 2025-2032.

Due to the rapid progress of the technology of the laser systems, the surgical laser rental market in the U.S. outperforms others. New-generation scanners that have improved accuracy, incorporated software, and multi-specialty applications are constantly marketed. Hospitals and surgery centers, instead of investing in expensive equipment that may quickly become obsolete, would like to rent newer equipment. This allows access to advanced technology, without the long-term ownership risk, to keep healthcare providers competitive and compliant as they effectively manage costs in a dynamic surgical environment.

Surgical Laser Rental Market Drivers:

-

Hospitals Prefer Long-Term Rentals are Driving the Surgical Laser Rental Market Growth

Long-term Surgical Laser Rentals rather than owning is a growing trend for hospitals looking to eliminate large capital investment, guarantee even more access to current technology, and provide continuous support for surgeries. Maintenance, training, and regulatory support packages help you control costs and focus on whatever your business does best. And as outpatient procedures proliferate, flexible rentals provide scalable access. These types of advantages have substantially added to the success of the surgical laser rental market share, delivering the global expansion at hospitals and ambulatory surgical centers.

For instance, in January 2025, AHA reported that 70% of U.S. hospitals preferred laser leasing for better cost predictability and flexibility in scaling equipment usage.

Surgical Laser Rental Market Restraints:

-

Transportation And Wear-and-Tear are a Significant Restraint on the Surgical Laser Rental Market

Transportation and wear and tear are some of the key restraining factors that will hinder the surgical laser rental market share. Lasers suffer mechanical shock, vibration, and environmental conditions elements with frequent travel, and those elements can cause internal damage and calibration errors. In addition, wear of certain parts of the system, such as handpieces and the optics, is magnified by frequent use by multiple operators. Insufficient servicing and recalibration render the accuracy and safety even more doubtful. Problems like those can cause surgeries to be stopped

For instance, in April 2025, MedTech Insights reported that hospitals are hesitant to expand rental contracts due to concerns over transport damage and shortened equipment lifespan.

Surgical Laser Rental Market Segmentation Analysis:

By End User

Inpatient Facilities are the largest segment of end users for the surgical lasers rental industry, because of their high numbers of surgeries and complicated procedures, and the need for 24/7 availability of sophisticated laser systems. Hospitals favour long-term leases in order to control operational expenses and provide access to equipment for a number of specialties such as oncology, urology, and gynaecology. Value-added services, including but not limited to maintenance, upgrades, and compliance assistance, add to their attractiveness. These are some of the major factors driving the surgical laser rental market growth, as inpatient facilities prefer reliable and cost-effective solutions without making huge investments in owning technology.

Laser rental services by end-user. Outpatient facilities are the largest and fastest-growing end-user segment of the surgical laser rental market, owing to the emerging trend of same-day surgeries, cost-benefit, and the rising demand for minimally invasive surgeries. Short-term or pay-per-use rentals are favored by ambulatory surgical centers and specialty clinics seeking to use state-of-the-art laser systems without the large initial investment. Adoption takes place because they want something flexible, scalable, and low-touch. These are the factors propelling the surgical laser leasing market to growth.

By Type

Solid State Lasers is the dominant segment in the global surgical laser rental market trend, with a 55.40% market share in 2024, owing to their accuracy, dependability, and broad application to fields such as urology, orthopedics, and ophthalmology. Portable strength testers can be used for rental inpatient and outpatient facilities due to their small size, longer life, and reduced maintenance. Their use is increasingly favored by hospitals for procedures that demand uniform power delivery and accuracy, leading to their adoption and position at the pinnacle of the hospital laser rental market.

The Diode Laser System is emerging as the fastest-growing segment with a CAGR of 8.02% in the surgical laser rental market analysis, owing to its small size, low cost, and possibility for use in dental, ENT, and dermatological applications. Because they are easy to use, require minimal maintenance, and can be used in an outpatient-based setting, they are highly appealing as pay-by-the-day rentals. These benefits are driving their adoption, increasing the surgical laser rental market share, and propelling growth in developed and developing healthcare markets.

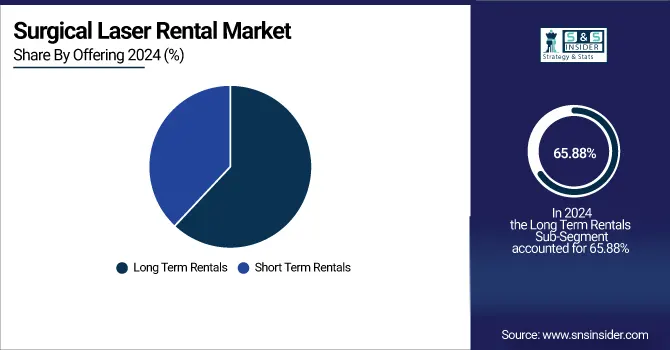

By Offering

In 2024, the long-term rentals dominated the surgical laser rental market trend with a 65.88% market share. Because of the hospitals' desire for predictable costs, minimized capital investment, and permanent access to state-of-the-art technology. “Contracts often bundle other services, which can include maintenance, training, and upgrades, all of which help maintain operational reliability and reduce downtime. This system is perfect for high surgical volumes and future planning, effectively increasing the surgical laser rental market share by providing a cost-efficient, turnkey solution to healthcare professionals.

The short-term rentals are the fastest growing aspect of the surgical laser rental market analysis, owing to their ease of use, low initial costs, and appropriateness of operation at ambulatory centers and short-term surgical needs. They provide clinics and ambulatory centres. The benefits of the latest laser technology are without a long-term financial outlay. Added to this are seasonal procedural peaks, trials, testing, and demonstrations. This flexibility is helping short-term rentals gain traction and drive growth in the surgical laser rental market in a range of specialties.

By Application

Surgical controls the global surgical laser rental market, with 55.82% market share of the surgical laser rental industry in 2024, owing to its broad use in various specialties, including urology, gynecology, ENT, and oncology. Laser technology is becoming dominant in the hospital and operating room because lasers offer precision, reduced morbidity, and shorter recovery times. Increasing number of surgical procedures and easy availability of advanced tools without hefty capital investment are boosting adoption of rentals, and are one of the major contributing factors to the rising global surgical laser rentals market.

Dentistry is expected to grow at the fastest rate in the global surgical lasers rental market owing to increasing demand for minimally invasive procedures, cosmetic dental procedures, and soft-tissue procedures. Dental offices love to rent diode lasers as they are both cost-effective, portable, and accurate. The move toward patient-friendly, painless treatments and the surge of services supplied by private dental practices are major influences. This development has a huge impact on the surgical laser rental market growth as more and more clinics begin using shorter-term and more flexible rentals to accommodate rapidly changing patients’ needs.

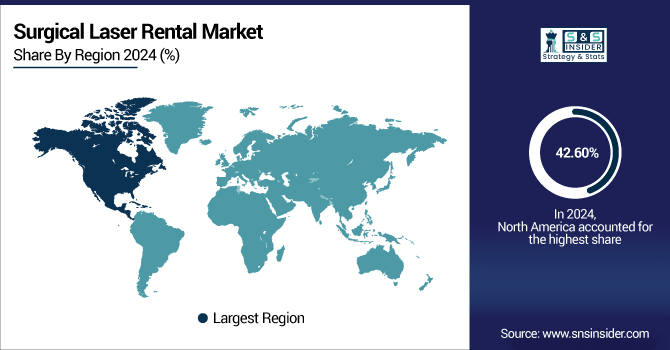

Surgical Laser Rental Market Regional Analysis:

North America Surgical Laser Rental Market Insights

In 2024, the North American region holds the largest market share of the surgical laser leasing industry and dominates the market with a 42.60% market share, owing to its strong healthcare environment, high surgical volumes, and concentration of rental retailers such as Agiliti and MedOne. Increasingly, hospitals and outpatient centers prefer rental models to control capital costs and gain access to the latest in laser technologies. Factors such as the strong regulatory and regulatory framework and rapidly growing demand for minimally invasive surgeries in the region, rapid growth of ambulatory surgical centers to drive the adoption their adoption. Together with these factors, North America must be able to maintain its top status in the global market.

Get Customized Report as Per Your Business Requirement - Enquiry Now

Europe Surgical Laser Rental Market Insights

The second largest share of the surgical laser rental market is held by Europe, the growth node of the rental market in this region is attributed to strong public and private hospital networks, a rise in the number of minimally invasive surgeries performed, and a preference towards cost-effective equipment access. Nations such as Germany, France, and the U.K. are implementing advanced surgical technology without taking on significant capital expense. Favorable reimbursement policies, an ageing population, and increasing outpatient surgeries are other factors driving rental demand.

Asia-Pacific Surgical Laser Rental Market Insights

Asia-Pacific emerges as the fastest-growing region with the highest CAGR of 8.03%. on account of its burgeoning healthcare economy, growing number of surgical procedures, and a surge in demand for futuristic medical devices. Minimally invasive procedures are highly demanded by countries such as China, India, Japan, and South Korea in various specialties, including urology, ophthalmology, and dermatology. But the expensive nature of surgical lasers sees hospitals and clinics moving towards rental models for the sake of cost-effectiveness. Increasing influence of private healthcare, medical tourism, and the efforts of the government to upgrade healthcare infrastructure are some other factors driving this trend. Increasing clinician awareness, as well as greater access to training and a burgeoning presence of international rent-to-service providers in the region, is also driving adoption. This trend places Asia-Pacific as the fastest-growing region in the global surgical laser rental market.

From the ability to provide CBCT, diagnosis using AI, and availability of small, portable X-ray systems, technology has rapidly made accurate, easily accessible diagnostic aids available (pardon the pun) even in rural or underserved areas. Furthermore, increasing preference for dental checkups in the Asia Pacific as a dental tourism spot is also propelling demand for advanced diagnostic machines. Lastly, in a less regulated marketplace with less market access lag, faster uptake of novel imaging technologies can occur. These factors collectively are driving its market, which is projected to almost double by 2030, solidifying its position as the fastest-growing market for dental digital X-rays.

Latin America Surgical Laser Rental Market Insights

The surgical laser rental market in Latin America is expected to gain traction over the coming years, as the requirement for competitive surgical solutions expands in Brazil, Mexico, and Argentina. Budget constraints and hefty initial investment costs drive healthcare providers towards multi-user rental models. An increasing number of studies, outpatient surgeries, advancement in healthcare infrastructure, and slow adoption of newer technology are driving the market growth. All these factors cumulatively are responsible for the Latin American surgical lasers rental market growth on lease.

Middle East & Africa Surgical Laser Rental Market Insights

Surgical Laser Rental Market in Middle East and Africa is poised to witness a growing trend in the rental services of surgical laser systems over the analysis period due to the rising investment in healthcare infrastructure and the surgical procedures to be conducted, a strong growth in private healthcare sectors in countries such as the UAE, Saudi Arabia and South Africa. Expensive equipment will force hospitals to transition to advanced surgical laser rental. Furthermore, medical tourism, more specifically in the Middle-East countries, has also been a key factor driving the demand, which has in turn led to the surgical laser rental market growth in the region.

Surgical Laser Rental Market Key Players:

-

Agiliti Health, Inc.

-

MedOne Surgical, Inc.

-

US Laser, Inc.

-

Sharplan Lasers

-

Soma Technology, Inc.

-

Laser Service Solutions

-

Total Laser Care

-

TriMed LLC

-

Vital Med

-

HealthTronics, Inc.

-

Advanced Surgical Technologies

-

LASErent

-

Southland Surgical Laser Rental

-

Southeast Laser Systems, Inc.

-

Mobile Med Surgical Inc.

-

Laser Surgical of Florida, Inc.

-

Lynton Surgical

-

Phoxton

-

Laser 2000 GmbH

-

Laser Medical Systems

Surgical Laser Rental Market Competitive Landscape:

US Laser, Inc., established in 1997 and headquartered in Columbia, South Carolina, is a privately held company specializing in printer repair, supplies, hardware, and toner cartridge recycling. The company provides cost-effective and efficient printing solutions, helping businesses manage their printing needs with a dedicated team of trained professionals.

-

In December 2024, US Laser, Inc. added AI-assisted laser calibration tools to its rental fleet and expanded its technician team to enhance precision, reduce downtime, and meet growing nationwide demand.

Total Laser Care of NC, Inc. is a privately held company founded in 2000 and headquartered in Raleigh, North Carolina. Specializing in copier and printer repair services, the company offers maintenance and repair solutions for businesses of all sizes. As a certified service center for Sharp, HP, and Xerox, Total Laser Care provides IT support and managed services, including network computer service, antivirus protection, endpoint monitoring, backups, and cloud-based office management solutions. The company is committed to delivering timely and reliable services to ensure the smooth operation of business machines across North Carolina.

-

In February 2025, Total Laser Care launched a preventive maintenance app that allows clients to schedule and monitor laser servicing, improving equipment uptime, reliability, and overall satisfaction with rental services.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 10.36 billion |

| Market Size by 2032 | USD 18.13 billion |

| CAGR | CAGR of 7.26% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Solid State Lasers, Gas Laser System, Diode Laser System, Others) • By Offering (Short Term Rentals, Long Term Rentals) • By Application (Surgical, Dentistry, Ophthalmology) • By End User(Inpatient Facilities, Outpatient Facilities)" |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles |

Agiliti Health, Inc., MedOne Surgical, Inc., US Laser, Inc., Sharplan Lasers, Soma Technology, Inc., Laser Service Solutions, Total Laser Care, TriMed LLC, Vital Med, HealthTronics, Inc., Advanced Surgical Technologies, LASErent, Southland Surgical Laser Rental, Southeast Laser Systems, Inc., Mobile Med Surgical Inc., Laser Surgical of Florida, Inc., Lynton Surgical, Phoxton, Laser 2000 GmbH, Laser Medical Systems |