Cloud Data Warehouse Market Report Scope & Overview:

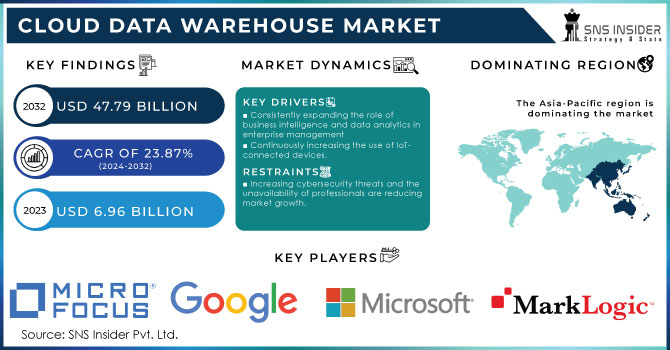

Cloud Data Warehouse Market was valued at USD 6.71 billion in 2023 and is expected to reach USD 43.57 billion by 2032, growing at a CAGR of 23.18% from 2024-2032. This report includes key insights on adoption rates of emerging technologies, customer satisfaction and retention, cost efficiency improvements, and security compliance. Firms are increasingly using cloud data warehouses to increase scalability, automate processes, and minimize costs. Increasing demand for real-time analytics, secure storage of data, and compliance with regulations drives the market. Companies utilize cloud-based solutions to enhance operating effectiveness while maintaining compliance with strict data protection laws. Through improved security capabilities and affordable scalability, cloud-based data warehouses are becoming the norm of data management, allowing organizations to achieve actionable insights and remain competitive in a dynamic business environment.

Get more information on Cloud Data Warehouse Market - Request Sample Report

Market Dynamics

Drivers

-

Cloud Data Warehouses Surge as Businesses Embrace Big Data, Real-Time Analytics, AI Integration, and Scalable, Cost-Effective Solutions.

Organizations are increasingly adopting cloud-based data warehouses to store and analyze large amounts of structured and unstructured data. The growth in big data adoption, along with the requirement for real-time insights, is compelling enterprises to shift from legacy on-premise solutions to scalable, high-performance cloud platforms. Companies use these solutions to improve predictive analytics, optimize decision-making, and incorporate AI and machine learning for sophisticated data processing. The cloud-based architectures' flexibility enables smooth integration with various sources of data, enhancing accessibility and efficiency. With industries focusing on data-driven strategies, the pace of demand for agile, affordable, and smart data warehouse solutions is gathering momentum, further affirming the indispensable role played by cloud infrastructure in contemporary analytics.

Restraints

-

Cloud Data Warehouse Adoption Faces Challenges from Security Risks, Regulatory Compliance, Cyber Threats, and Data Sovereignty Concerns.

As businesses move important data to the cloud, fears of security violations, unauthorized entry, and regulatory requirements are turning into key challenges. Organizations dealing with sensitive financial, healthcare, or personal data need to maneuver strict data protection legislation, which can make the adoption of the cloud difficult. Cyber threats like data breaches and ransomware attacks are significant concerns that necessitate strong encryption, access controls, and compliance models. Furthermore, dependence on third-party cloud vendors creates data sovereignty and potential vendor risk concerns. Businesses have to spend money on sophisticated security technologies and implement compliance with emerging regulations to minimize such risks. Solutions to these challenges are vital for building trust and facilitating widespread use of cloud data warehousing technology across various sectors.

Opportunities

-

AI and Machine Learning Drive Cloud Data Warehouse Growth with Advanced Analytics, Automation, Predictive Insights, and Business Intelligence.

More organizations are embracing machine learning and artificial intelligence to power data processing, automate processes, and inform better decision-making. Cloud data warehousing with embedded AI analytics capabilities supports predictive analysis, anomaly discovery, and instant insights, resulting in improved industry operational efficiency. Automation of data processing large amounts of data with reduced manual interventions speeds up the data-driven plans. AI-assisted optimization is also improving the performance of the queries, enhancing cloud-based platforms' responsiveness as well as lower costs. As businesses pursue the power of intelligent automation, cloud data warehouses are transforming to become strategic resources that not just store information but actually add value to business innovation. This transition is fuelling mass adoption and opening new dimensions in analytics and enterprise intelligence.

Challenges

-

High Migration and Operational Costs Hinder Cloud Data Warehouse Adoption, Requiring Significant Investment, System Reconfiguration, and Skilled Expertise.

Moving from conventional on-premises data warehouses to cloud-based solutions requires significant monetary investment and technical know-how. Companies need to invest in data migration, reconfiguring systems, and employee training, all of which translates into higher operational expenses. Legacy systems with high complexity levels tend to need bespoke integrations, adding to time and cost. External costs associated with cloud storage, computational capacity, and security management are also ongoing, potentially pushing budgets into high gear. Companies need to scrutinize total cost of ownership and return on investment carefully before making the transition. Even with long-term advantages, these financial and operational challenges can impede cloud adoption, and strategic planning and effective execution are needed to realize the benefits of cloud data warehousing solutions.

Segment Analysis

By Offerings

DWaaS (Data Warehouse as a Service) led the Cloud Data Warehouse Market with the largest revenue share of nearly 61% in 2023 because of its cost savings, scalability, and ease of use. Companies are more inclined towards DWaaS solutions since they do not require on-premises infrastructure, which saves them maintenance costs while improving accessibility. Furthermore, hassle-free integration with AI, machine learning, and real-time analytics features make DWaaS the go-to solution for enterprises seeking agility and efficiency in managing large datasets.

The Data Storage segment is anticipated to expand at the fastest CAGR of approximately 24.41% during 2024-2032, fueled by the exponential growth in data creation across sectors. The growing use of IoT, AI-based analytics, and cloud applications necessitates scalable and efficient storage solutions. Organizations value secure, high-performance cloud storage to manage structured and unstructured data while maintaining regulatory compliance. Increased demand for hybrid and multi-cloud storage solutions further fuels market growth.

By Organization Size

Large enterprises led the Cloud Data Warehouse Market with the largest revenue share of approximately 65% in 2023 because of their large data management requirements and high usage of advanced analytics. Large organizations need scalable, secure, and high-performance solutions to manage large datasets and enable AI-based decision-making. Moreover, compliance, business intelligence integration, and real-time insight needs fuel large-scale investments in cloud data warehousing, rendering it the most desirable option for companies with complicated data ecosystems.

The SME segment will grow at the fastest CAGR of approximately 24.39% during 2024-2032, fueled by mounting cloud adoption and affordable DWaaS offerings. Small and medium businesses are using cloud data warehousing for boosting operational efficiency, automating procedures, and making data-driven decisions without huge infrastructure investments. Greater demand for scalable, pay-as-you-go offerings, combined with the improvement in AI-driven analytics, makes data solutions in the cloud more feasible, driving high growth in the market in this segment.

By Industry Vertical

Healthcare led the Cloud Data Warehouse Market with the largest revenue contribution of approximately 28% in 2023 as the sector is increasingly leaning on data-driven decision-making, electronic health records (EHRs), and AI-based diagnostics. The necessity for secure, scalable, and compliant data storage systems to manage enormous patient records and medical research has fueled aggressive adoption. Besides, stringent regulatory compliance like HIPAA requires sophisticated cloud security features, so cloud data warehousing is crucial for effective healthcare data management.

The BFSI industry will grow at the fastest CAGR of around 25.50% during 2024-2032 due to growing needs for real-time analytics, fraud prevention, and compliance. Banks use cloud data warehousing to facilitate improved risk analysis, automate processes, and efficiently manage huge transactional data. The increasing use of AI and machine learning for predictive analytics, combined with increased digital banking trends, propels the need for secure, high-performance cloud solutions in the BFSI industry.

By Deployment Model

Public cloud led the Cloud Data Warehouse Market with the largest revenue share of approximately 64% in 2023 owing to its cost-effectiveness, scalability, and ease of deployment. Enterprises from all industries like using public cloud solutions for their ease of use, lower infrastructure expenses, and smooth integration with AI-based analytics. The pay-as-you-go computing model as well as managed services offered by prominent cloud vendors further augment take-up. Furthermore, improvements in security and compliance frameworks have made public cloud an easy option for big data management.

The hybrid cloud segment will grow at the highest CAGR of approximately 24.73% during 2024-2032, as organizations prefer a balance between scalability and data control. Enterprises are implementing hybrid cloud models to exploit the efficiency of public cloud and security of private cloud for meeting regulatory compliance. The method promotes seamless data mobility, cost savings, and low latency. As organizations push for flexible, multi-cloud approaches, adoption of hybrid cloud is growing rapidly.

By Application

Business intelligence led the Cloud Data Warehouse Market with the largest revenue share of approximately 34% in 2023 because of increased demand for real-time analytics and data-driven decision-making. According to enterprises across industries, business intelligence cloud-based solutions are used to process large datasets, provide actionable insights, and optimize operational efficiency. AI, machine learning, and predictive analytics are additional driving factors for adoption. Moreover, the need for automated reporting, performance monitoring, and customer analytics further consolidates the dominance of business intelligence solutions.

The data modernization segment is expected to grow at the fastest CAGR of approximately 25.78% during 2024-2032, fueled by the growing requirement to modernize legacy systems and streamline data workflows. Organizations are focusing on cloud-native architectures to enhance scalability, agility, and integration with next-generation technologies. The move toward digital transformation, hybrid cloud usage, and compliance adds further impetus to modernization initiatives. As businesses require greater data governance, automation, and AI-infused insights, cloud-based data modernization offerings rapidly gain popularity.

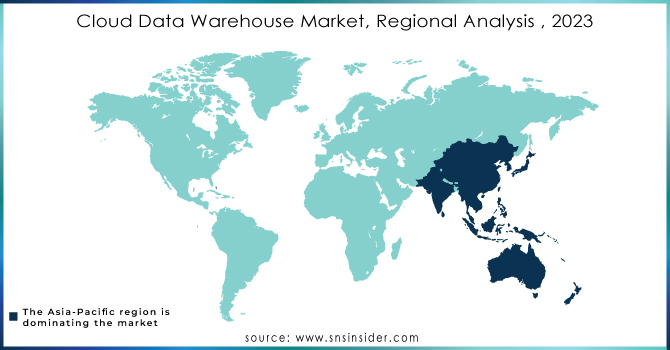

Regional Analysis

North America led the Cloud Data Warehouse Market with the largest revenue market share of approximately 39% in 2023 because major cloud providers have a strong presence and there is early adoption of advanced analytics. Enterprises of various sectors invest heavily in AI-based data solutions, business intelligence, and digital transformation programs. The demand for strong cloud data warehousing solutions is also fueled by rigorous regulatory compliance and data security requirements. The region's established IT presence and increasing requirement for real-time analytics further entrench its grip.

The Asia Pacific region is anticipated to grow at the fastest CAGR of approximately 25.06% during 2024-2032, owing to swift digitalization, rising cloud adoption, and growing enterprise data requirements. Rising investments in AI, IoT, and big data analytics across sectors drive demand for scalable cloud data warehousing solutions. The growth of e-commerce, financial services, and smart city initiatives also boosts adoption. Moreover, government initiatives in favor of cloud infrastructure development further boost market growth in the region.

Need any customization research on Cloud Data Warehouse Market - Enquiry Now

Key Players

-

Amazon Web Services, Inc. (Amazon Redshift, AWS Snowflake)

-

Cloudera, Inc. (Cloudera Data Platform, Cloudera Data Warehouse)

-

Google LLC (BigQuery, Google Cloud Storage)

-

International Business Machines Corporation (IBM Db2 Warehouse, IBM Cloud Pak for Data)

-

Microsoft Corporation (Azure Synapse Analytics, Azure Data Lake Storage)

-

OpenText Vertica (Vertica in Eon Mode, Vertica Accelerator)

-

Oracle Corporation (Oracle Autonomous Data Warehouse, Oracle Exadata)

-

SAP SE (SAP Data Warehouse Cloud, SAP BW/4HANA)

-

Snowflake Inc. (Snowflake Data Cloud, Snowflake Secure Data Sharing)

-

Teradata Corporation (Teradata Vantage, Teradata QueryGrid)

-

Micro Focus (Vertica, Enterprise Data Management)

-

1010Data (1010Data Analytics Platform, 1010Data Data Warehouse)

-

Pivotal (Pivotal Greenplum, Pivotal Cloud Foundry)

-

Yellowbrick (Yellowbrick Data Warehouse, Yellowbrick Analytics)

-

Veeva Systems (Veeva Vault QMS, Veeva Vault RIM)

-

Actian (Actian DataCloud, Actian Avalanche)

-

Marklogic (MarkLogic Data Hub, MarkLogic Enterprise NoSQL)

-

Netavis Software (Netavis Command Center, Netavis Video Management)

-

Solver (Solver BI360, Solver Cloud)

-

Accur8 Software (Accur8 Data Analytics, Accur8 Cloud)

-

AtScale (AtScale Intelligent Data Virtualization, AtScale Adaptive Analytics)

-

Panoply (Panoply Data Platform, Panoply Cloud Data Warehouse)

-

SingleStore (SingleStore DB, SingleStore Cloud)

-

Transwarp (Transwarp Data Lake, Transwarp Enterprise Data Hub)

Recent Developments:

-

March 2025 – IBM announced updates for Db2 Warehouse on Cloud, enhancing security, resolving scaling issues, and improving the Database Assistant's search functionality.

-

AWS re:Invent 2024 introduced major updates, including Amazon SageMaker Lakehouse for unified analytics, Amazon Q in QuickSight for faster scenario analysis, and a new zero-ETL integration between DynamoDB and SageMaker Lakehouse. AWS Clean Rooms now supports multi-cloud data collaboration, while Amazon Connect added generative AI and WhatsApp Business integration for enhanced customer experiences.

-

September 2024 – Oracle announced the Intelligent Data Lake as part of its Data Intelligence Platform, integrating AI-powered analytics and open data formats to enhance data management and governance.

| Report Attributes | Details |

| Market Size in 2023 | USD 6.71 Billion |

| Market Size by 2032 | USD 43.57 Billion |

| CAGR | CAGR of 23.18% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Offerings (DWaaS, Data storage) • By Organization Size (Large enterprises, SME) • By Deployment Model (Public cloud, Private cloud, Hybrid cloud) • By Application (Customer analytics, Data modernization, Business intelligence, Predictive analytics, Others) • By Industry Vertical (Healthcare, Government, BFSI, IT & Telecom, Retail & consumer, Manufacturing & automotive, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Amazon Web Services, Inc., Cloudera, Inc., Google LLC, International Business Machines Corporation, Microsoft Corporation, OpenText Vertica, Oracle Corporation, SAP SE, Snowflake Inc., Teradata Corporation, Micro Focus, 1010Data, Cloudera, Pivotal, Yellowbrick, Veeva Systems, Actian, Marklogic, Netavis Software, Solver, Accur8 Software, AtScale, Panoply, SingleStore, Transwarp |