Cloud Load Balancers Market Report Scope & Overview:

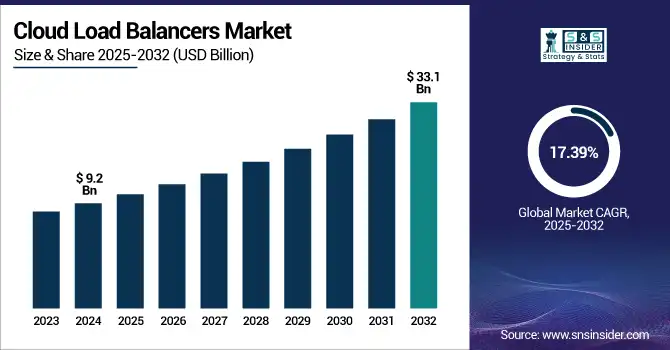

The Cloud Load Balancers Market size was valued at USD 9.2 billion in 2024 and is expected to reach USD 33.1 billion by 2032, growing at a CAGR of 17.39% from 2025-2032.

To Get more information on Cloud Load Balancers Market - Request Free Sample Report

Increasing adoption of cloud computing, combined with the extensive growth of hybrid infrastructures alongside internet traffic globally, is primarily driving the cloud load balancers market growth. With the transition of businesses to the digital world and multi-cloud strategies, the demand has increased for efficient traffic distribution and the availability of services. The cloud load balancers market trend of online gaming, IoT, and 5G brings this even further, all requiring load balancing that is fast, scalable, and highly scalable. The cloud load balancers market analysis demonstrates that performance, security, and reliability have become critical factors that enterprises are now focusing on in their IT infrastructure. Thus, Cloud Load Balancers are increasingly important for managing traffic surges, reducing latency, and avoiding downtime. In addition, factors like AI-based load balancing, edge computing integration, and API based Configurations are defining the market. Cloud Load Balancers Market trends have evolved over the years and continue to do so, which suggests a positive outlook for the market, and the cloud load balancer market is likely to maintain a near-vertical growth curve in the coming years.

The U.S. Cloud Load Balancers Market is projected to grow from USD 1.3 billion in 2023 to USD 5.2 billion by 2032, registering a CAGR of 18.51% during this period. Increasing cloud computing market and hybrid infrastructures are primarily pushing this growth, though they do demand the capability of traffic distribution and service availability as well. That growth is boosted by the increasing bandwidth of broadband services for IoT devices the growing adoption of 5G networks, and the growing demand for scalable and secure application delivery solutions.

Cloud Load Balancers Market Dynamics:

Drivers

-

The rapid adoption of cloud technologies increases the demand for efficient load balancers to ensure scalability, performance, and minimal downtime.

With businesses moving to the cloud, there is a need for load balancing solutions that are both scalable and efficient. With cloud adoption, enterprises can get the infrastructure used for IT optimized along with flexible, scalable, and high-quality performance. Digitally transforming businesses need traffic management solutions to meet these needs. This makes traffic distribution seamless, reduces latency, and improves availability as industries become cloud-centric over time. This is fuelling the need for cloud load balancers, which are essential for ensuring the continuity and enhanced user experiences in an ever-changing digital world.

According to a survey of 40 U.S. chief information officers, 70% anticipate that more than half of their workloads will reside in the cloud by 2026, up from 45% today. Additionally, spending budgets are expected to grow by 11.9% this year, reflecting strong momentum in cloud adoption.

Restraints

-

High costs associated with advanced load balancing solutions limit their adoption, especially among smaller businesses, hindering market growth.

While cloud load balancing tools are so useful, the advanced cloud load balancing solutions, especially integrated with AI and machine learning, incur a substantial cost in deployment and maintenance. This can be expensive in terms of initial costs, particularly for small and medium-sized businesses. Furthermore, its integration with existing infrastructure can also be another complication affecting businesses with no big technical resources. Such a financial barrier could potentially limit the broader adoption of advanced cloud load balancing solutions by the market and some end-use industries.

Opportunities

-

AI and machine learning integration in load balancers improves traffic management and efficiency, boosting demand for advanced solutions.

AI and ML technologies-based cloud load balancing systems provide significant opportunities for growth over the forecast period. Such technologies, in turn, can help load balancers predict traffic patterns, making it worthwhile to use them for traffic optimization and performance in real time. In addition, AI-powered systems can predict traffic surges, automate load adjustments, and improve decision-making, providing a more efficient and economical solution for companies to handle increasing volumes of traffic. The growing need for organizations to work more efficiently will spearhead the demand for load balancing solutions using AI.

Challenges

-

Complex integration of cloud load balancers across infrastructures creates technical challenges, limiting wider adoption.

One key hurdle the contact tracing app market needs to overcome is sustaining user engagement long-term. Most people who downloaded these apps either deleted or stopped using them after a few weeks, following spikes in downloads during health crises, and for the same reasons: notification fatigue, doubts of sufficient utility, and perceptions that the threat has receded. In addition, buggy updates, unfriendly UIs, and software bugs could make things worse. Addressing this is not going to be an easy task and will require developers to make constant upgrades with attributes such as wellness tracking, national health updates, and gamification to keep the user engaged. However, without effective user retention strategies, it will be difficult for even the best-designed app to achieve a measurable public health impact.

According to Aviatrix's 2024 report, 62.6% of organizations struggled to hire cloud-skilled talent, 65.7% lacked training resources, and 45% faced visibility and troubleshooting issues, underscoring the challenges in integrating cloud load balancers.

Cloud Load Balancers Market Segmentation Analysis:

By Component

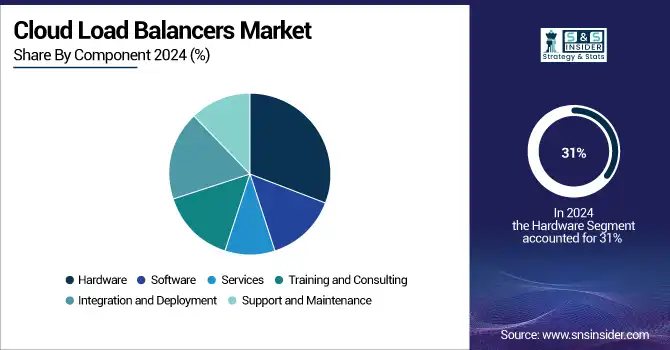

The hardware segment dominated the market and accounted for 31% of the cloud load balancers market share. This is due to the inherent nature of hardware load balancers for handling tasks such as SSL offloading, DDoS protection, and high-speed traffic processing. Large enterprises love hardware-based load balancers because they are reliable and secure and can scale in complexity and volume workloads. This is exactly why a lot of businesses from the financial and healthcare sectors can't keep away from their infallible backbone that provides better performance and compliance.

The support and maintenance are exhibiting the fastest growth. As cloud infrastructure continues to scale and grow more complex, companies are giving up full days in managed services with expert talent, with optimization, security, and up-time all fully covered parts of the service. It reduces the burden on internal IT and ensures that the systems are up to date and meet the evolving requirements of the network. The need continuous track of performance and measurement before it turns into a costly form is leading to a large-scale adoption.

By Vertical

The IT and telecom segment dominated the Cloud Load Balancers Market and accounted for a significant revenue share in 2024, due to their requirement for major network infrastructure and the need to serve customers without interruptions. As the data-heavy apps grow, the 5G networks become available, and more organizations migrate services to the cloud, traffic needs to be managed, and load needs to be balanced efficiently. In this domain, Load balancers are paramount for the high availability, scalability, and performance of services.

The healthcare segment is expected to be the fastest-growing sector while using the Cloud Load Balancers Market, owing to the growing digitization of healthcare services and the requirement for secure, reliable access to critical applications. As the adoption of EHRs, telemedicine, and other digital health solutions increased and new applications entered the ecosystem, the traffic on the network spiked, needing efficient load balancing to ensure the systems remain performant and data secure. Stringent regulatory standards such as HIPAA mandate compliance, proving the need for a strong load balancing solution in this area of business.

Regional Analysis:

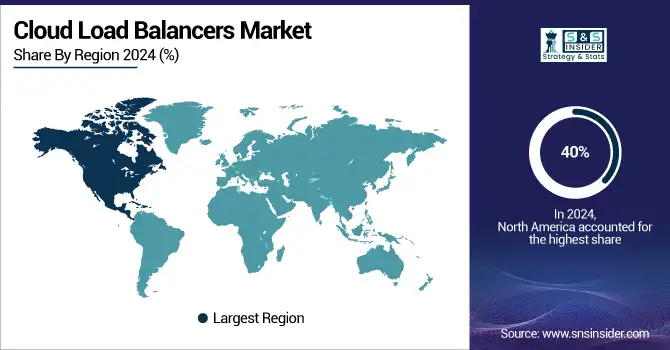

North America dominated the Cloud Load Balancers Market and accounted for 40% of revenue share, due to the presence of relevant large technology players. Also, due to the wide-ranging IT ecosystem and the growing demand for scalable, secure, and high-performance solutions in IT, telecom, and BFSI, North America is solidified even more in this position.

The Asia-Pacific region is expected to register the fastest compound annual growth rate in the cloud load balancers market. The expansion of the market is driven by the increasing e-commerce, the growing rate of internet penetration, and the amount of investment made in the cloud infrastructure by countries like China, India, and Japan. The growing implementation of Internet of Things devices and the rising need for flexible IT architectures also drive the growth of the market.

India, the fastest-growing country in Asia, will continue to grow at pace thanks to strong domestic demand, the expansion of digital infrastructure, and significant über government initiatives such as the IndiaAI Mission. GDP increased 7.8% in Q1 2024, and 6.6% is expected for FY25. Impetus for Demand of Digital Services The need for digital services, as continued investment in technology, smart cities, and cloud infrastructure, is likely to create room for more advanced digital services like the cloud load balancing solution.

The European cloud load balancers market has witnessed stable growth on the back of growing adoption of cloud-native applications, rising demand for continuous digital services, and increasing adoption of integration of AI and IoT technologies for network optimization. With European enterprises fast-tracking digital transformation, demand for intelligent, highly scalable load-balancing solutions is set to increase across sectors.

Germany leads the European cloud load balancers market owing to scalable cloud infrastructure, aggressive propagation of a digital environment helping businesses, and early adoption of upcoming technologies. As demand for high-performance, secure digital services grows, continued investment in AI-powered cloud solutions and a strong industrial base will help Germany to retain its leadership, Benchalal forecasts.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The major cloud load balancers market companies are F5 Networks, AWS (Amazon Web Services), Microsoft Azure, Google Cloud, Citrix Systems, A10 Networks, Radware, Kemp Technologies, NGINX (by F5), Cloudflare, and others.

Recent Developments:

-

February 2025: Google Cloud Introduced backend mutual TLS (mTLS) for Application Load Balancers, ensuring secure communication by requiring both the load balancer and backend to verify each other's identities.

-

November 2024: Azure Load Balancer introduced the Admin State feature, enabling users to override health probe behavior for each instance, simplifying maintenance operations.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | US$ 9.2 Billion |

| Market Size by 2032 | US$ 33.1 Billion |

| CAGR | CAGR of 17.39 % From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Software, Services, Training and Consulting, Integration and Deployment, Support and Maintenance), • By Vertical (BFSI, IT and Telecom, Healthcare, Retail, Government and Defense, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | F5 Networks, AWS (Amazon Web Services), Microsoft Azure, Google Cloud, Citrix Systems, A10 Networks, Radware, Kemp Technologies, NGINX (by F5), Cloudflare and others in report |