Corporate Digital Banking Market Report Scope & Overview:

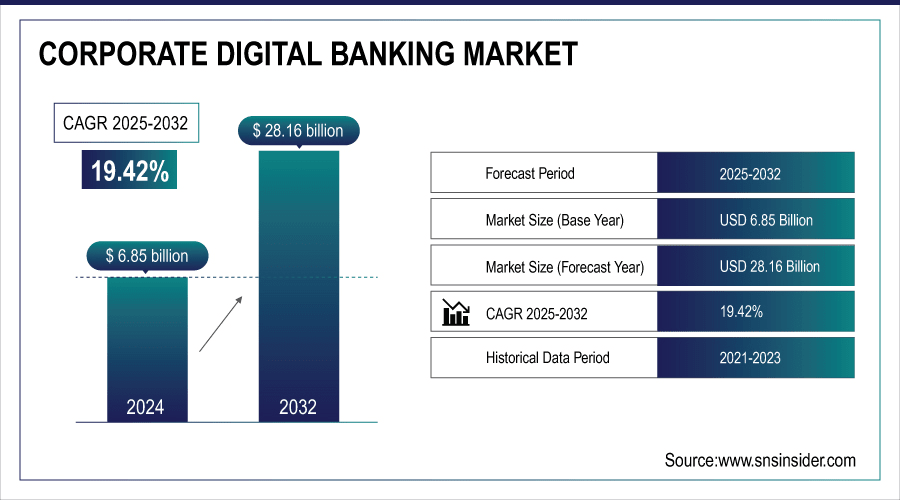

Corporate Digital Banking Market was valued at USD 8.18 billion in 2025E and is expected to reach USD 28.16 billion by 2032, growing at a CAGR of 19.42%. Over the Forecast period 2025-2032

The Corporate Digital Banking Market is growing due to increasing demand for seamless, secure, and real-time banking solutions. Digital transformation initiatives, adoption of AI and automation, enhanced customer experience, and rising need for efficient treasury and cash management drive growth. Additionally, cloud-based platforms, mobile banking integration, and regulatory compliance solutions are accelerating corporate adoption globally.

CBA (Commonwealth Bank of Australia) has ramped up tech investment to nearly US $1.1 billion, with a strong focus on AI, digital infrastructure, and automation. Among its initiatives is a GenAI-powered messaging service designed to enhance customer engagement and operational efficiency.

In the UK, between 2019 and 2024, bank branches declined by 34%, dropping from 10,410 to 6,870, reflecting a shift towards digital-first banking. Customer usage of digital banking channels rose from 33% to 59% over the same period. Major banks such as Lloyds, NatWest, Halifax, and Santander are planning further closures in 2025 as they continue adapting to digital transformation.

To Get More Information On Corporate Digital Banking Market - Request Free Sample Report

Corporate Digital Banking Market Trends

-

Rising demand for seamless digital banking solutions is driving adoption among corporate clients.

-

Integration of AI, analytics, and automation is enhancing transaction processing and risk management.

-

Cloud-based platforms are enabling scalability, real-time reporting, and secure access.

-

Increasing focus on regulatory compliance and cybersecurity is shaping digital banking strategies.

-

Mobile and web-based interfaces are improving corporate customer experience and engagement.

-

Adoption of API banking and open banking frameworks is fostering fintech collaborations and innovation.

-

Growing need for cash management, payments, and trade finance solutions is fueling market expansion.

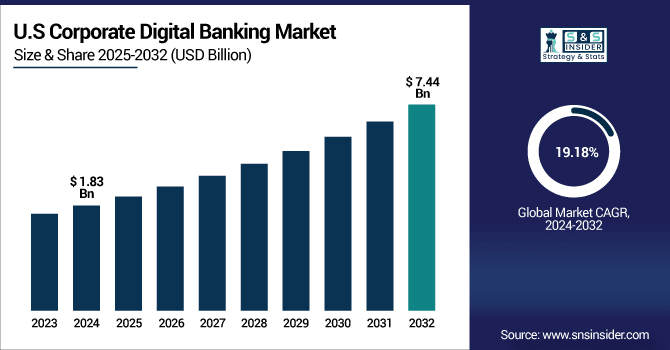

U.S. Corporate Digital Banking Market was valued at USD 1.83 billion in 2024 and is expected to reach USD 7.44 billion by 2032, growing at a CAGR of 19.18% from 2025-2032.

The U.S. Corporate Digital Banking Market is growing due to rising demand for real-time payments, AI-driven financial solutions, enhanced security, and seamless digital experiences. Increased adoption of cloud-based platforms and automation in corporate banking also drives market expansion.

Corporate Digital Banking Market Growth Drivers:

-

Increasing demand for advanced data analytics and AI-driven banking solutions enhancing financial decision-making and risk management in corporations

Increasing demand for advanced data analytics and AI-driven solutions is reshaping corporate digital banking by empowering organizations with actionable financial insights. Corporations rely on AI to predict cash flows, detect fraud, and analyze spending patterns for better planning. Advanced analytics allows treasurers and CFOs to manage liquidity efficiently, ensure compliance, and align banking activities with business strategies. The growing volume of financial data makes manual monitoring impractical, driving the need for intelligent digital tools. With predictive models and automation, banks deliver more personalized services to corporates, enhancing trust and adoption. This evolution significantly accelerates digital banking market growth.

-

The AI-powered Cash Flow Intelligence tool at JPMorgan has reduced manual work by nearly 90% for ~2,500 corporate clients in cash flow forecasting and liquidity management.

-

Mastercard’s AI-based Decision Intelligence analyzes 160 billion+ transactions annually, assigning real-time risk scores in 50 milliseconds, while the enhanced Decision Intelligence Pro leverages behavioral biometrics.

-

A Citizens Bank survey found that 97% of private equity financial leaders use AI for fraud detection, payment automation, risk assessment, and financial analysis, while 75% of CFOs at mid-sized firms rely on AI for cash flow forecasting and finance operations.

Corporate Digital Banking Market Restraints:

-

High implementation and integration costs of digital banking platforms limiting adoption among small and medium-sized enterprises in competitive markets

High implementation and integration costs of digital banking platforms create major barriers, especially for small and medium-sized enterprises with limited budgets. Establishing secure infrastructure, integrating platforms with existing ERP systems, and ensuring compliance with regulatory frameworks demand significant investment. These financial constraints slow down digital adoption among smaller firms, leading them to rely on traditional banking. Additionally, ongoing maintenance, software updates, and cybersecurity expenses further add to costs, making scalability challenging. Larger corporations may absorb these expenses, but SMEs remain cautious. This cost challenge restricts widespread adoption and slows down overall corporate digital banking market growth.

-

In Europe and the Middle East, 80% of MSME (micro, small, and medium enterprise) clients are active on digital banking platforms at least once every 30 days, 17 percentage points higher engagement than retail customers yet most banks offer less than half of the 200 tracked digital capabilities, compared to leaders offering about 85%, indicating significant gaps and high development or integration cost challenges.

Corporate Digital Banking Market Opportunities:

-

Expansion of blockchain and digital ledger technologies offering secure, transparent, and efficient corporate banking solutions across industries worldwide

Expansion of blockchain and distributed ledger technologies creates immense opportunities for the corporate digital banking market by enabling secure, traceable, and tamper-proof transactions. Corporations can benefit from faster cross-border settlements, reduced operational costs, and improved transparency in financial operations. Blockchain enhances trust in corporate banking by minimizing fraud risks, streamlining trade finance, and automating smart contracts for seamless execution. The technology also ensures compliance by offering auditable records. With increasing global trade and complex supply chains, blockchain-driven digital banking solutions promise long-term efficiency. Banks adopting blockchain can deliver value-added services, strengthening client relationships and capturing greater market share.

-

J.P. Morgan’s Kinexys network, in partnership with Chainlink and Ondo Finance, executed a real-time, cross-chain Delivery-versus-Payment (DvP) test settling tokenized U.S. Treasuries against USD deposits demonstrating synchronized on-chain settlement across public and private blockchains, reducing settlement friction and counterparty risk.

-

The Canton Network, a public blockchain consortium launched in 2023 by leading institutions including Goldman Sachs, BNP Paribas, Deutsche Börse, and Microsoft, enables secure, interoperable, and privacy-sensitive transactions. In late 2024, more than 27 institutions completed a pilot to tokenize gilts, eurobonds, and gold, showcasing both scalability and regulatory alignment of blockchain in financial markets.

Corporate Digital Banking Market Segment Highlights

-

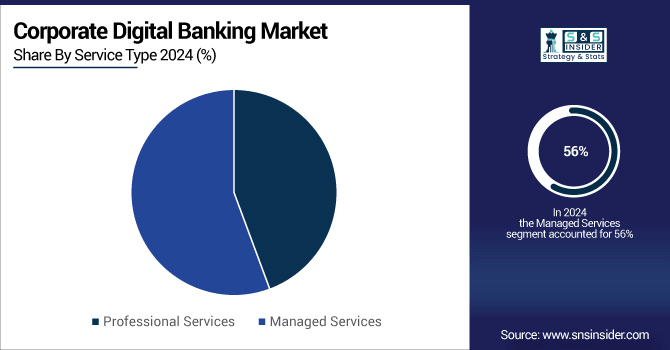

By Service Type, Managed Services dominated with ~56% share in 2024; Professional Services fastest growing (CAGR 20.81%).

-

By Organization Size, Large Enterprises dominated with ~65% share in 2024; Small and Medium Enterprises fastest growing (CAGR 20.75%).

-

By Solution, Payments dominated with ~31% share in 2024; Liquidity Management fastest growing (CAGR 22.19%).

-

By Vertical, BFSI dominated with ~30% share in 2024; Retail fastest growing (CAGR 22.17%).

Corporate Digital Banking Market Segment Analysis

-

By Service Type, Managed Services led while Professional Services are projected to grow fastest

Managed Services segment dominated the Corporate Digital Banking Market with the highest revenue share in 2024 as enterprises preferred outsourcing to reduce operational costs, enhance efficiency, and ensure secure banking processes. Demand for continuous monitoring, compliance support, and end-to-end managed solutions drove organizations to rely heavily on these services for scalability.

Professional Services segment is expected to grow at the fastest CAGR from 2025 to 2032 due to rising demand for consulting, implementation, and integration expertise. Enterprises increasingly seek tailored solutions, training, and advisory services to optimize digital transformation strategies, driving significant adoption of professional offerings across diverse industries worldwide.

-

By Enterprise Size, Large Enterprises dominated while Small and Medium Enterprises are expected to grow fastest

Large Enterprises segment dominated the Corporate Digital Banking Market with the highest revenue share in 2024 as they require complex, scalable solutions for global operations. Their financial strength allows significant investment in advanced digital platforms to enhance treasury management, automate processes, and maintain compliance across multiple jurisdictions, driving strong adoption.

Small and Medium Enterprises segment is expected to grow at the fastest CAGR from 2025 to 2032 driven by their increasing shift toward affordable, cloud-based digital banking solutions. SMEs seek cost-effective platforms for payments, credit, and cash flow management, enabling them to compete more effectively and accelerate financial inclusion globally.

-

By Solution Type, Payments led while Liquidity Management is expected to grow fastest

Payments segment dominated the Corporate Digital Banking Market with the highest revenue share in 2024 as digital transactions, real-time processing, and cross-border payments became critical. Growing corporate demand for faster, secure, and seamless financial transactions positioned payment solutions as the most widely adopted digital banking service across industries worldwide.

Liquidity Management segment is expected to grow at the fastest CAGR from 2025 to 2032 as corporations increasingly focus on optimizing cash flow and working capital. Advanced analytics, forecasting tools, and automation are driving adoption of liquidity management platforms to improve financial resilience, strategic planning, and profitability in volatile market conditions.

-

By End-User, BFSI dominated while Retail is expected to grow fastest

BFSI segment dominated the Corporate Digital Banking Market with the highest revenue share in 2024 as financial institutions rapidly digitized operations to improve efficiency, customer experience, and compliance. Their early adoption of advanced banking platforms and heavy investment in automation and security positioned BFSI as the leading sector in digital banking.

Retail segment is expected to grow at the fastest CAGR from 2025 to 2032 driven by rising demand for personalized digital services, seamless payments, and loyalty integration. Increasing e-commerce penetration, mobile banking adoption, and customer-centric platforms make retail enterprises a key driver of future digital banking market expansion.

-

By Deployment Mode, Cloud led and is projected to grow fastest

Cloud segment dominated the Corporate Digital Banking Market with the highest revenue share in 2024 and is expected to grow at the fastest CAGR from 2025 to 2032 due to its scalability, flexibility, and cost-effectiveness. Corporations increasingly adopt cloud-based platforms to streamline operations, enable real-time data access, and enhance security. Rising demand for remote accessibility, faster deployment, and seamless integration with enterprise systems positions cloud solutions as the preferred choice. Continuous innovation in cloud technologies further accelerates adoption across industries worldwide.

Corporate Digital Banking Market Regional Highlights

-

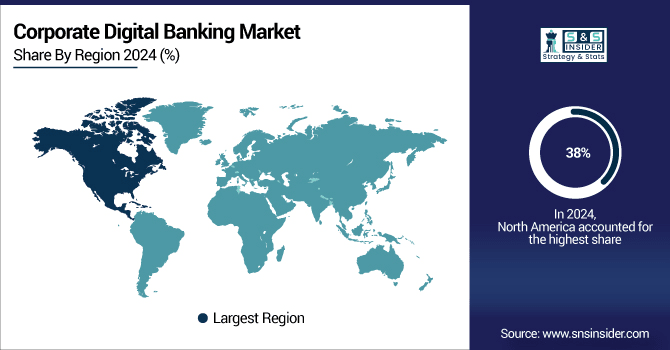

By Region, North America dominated with ~38% share in 2024; Asia Pacific fastest growing (CAGR 21.47%).

Corporate Digital Banking Market Regional Analysis

North America Corporate Digital Banking Market Insights

North America dominated the Corporate Digital Banking Market with the highest revenue share in 2024 due to early adoption of advanced financial technologies, strong digital infrastructure, and presence of leading banking institutions. High corporate demand for secure, efficient, and automated banking platforms, along with stringent regulatory frameworks supporting digital transformation, positioned the region as a leader in innovation, driving large-scale investments and widespread adoption across industries.

Get Customized Report as Per Your Business Requirement - Enquiry Now

Asia Pacific Corporate Digital Banking Market Insights

Asia Pacific is expected to grow at the fastest CAGR from 2025 to 2032 driven by rapid digitalization, increasing smartphone penetration, and rising adoption of cloud-based banking solutions. Expanding small and medium-sized enterprises, government initiatives promoting financial inclusion, and growing demand for real-time payments fuel strong growth. The region’s large, diverse corporate base and evolving fintech ecosystem make Asia Pacific the fastest-expanding market for digital banking adoption.

Europe Corporate Digital Banking Market Insights

Europe held a significant share in the Corporate Digital Banking Market in 2024 driven by robust regulatory frameworks like PSD2, which encouraged open banking adoption and innovation. Strong presence of multinational corporations, advanced financial infrastructure, and high demand for secure, seamless digital solutions supported growth. Additionally, rising collaborations between banks and fintechs, coupled with accelerated digital transformation initiatives across enterprises, positioned Europe as a key regional contributor to the market’s expansion.

Middle East & Africa and Latin America Corporate Digital Banking Market Insights

Middle East & Africa is witnessing steady growth in the Corporate Digital Banking Market supported by rising digital transformation initiatives, government-led financial modernization, and increasing demand for mobile and cloud-based banking solutions. Growing investments in fintech and infrastructure are driving corporate adoption, though challenges like uneven connectivity and regulatory diversity remain. Latin America is expanding rapidly, fueled by increasing digital payment adoption, fintech innovation, and corporate demand for efficient banking solutions across diverse economies.

Corporate Digital Banking Market Competitive Landscape:

Bank of America

Bank of America is a key player in the Corporate Digital Banking Market, offering comprehensive digital solutions for cash management, payments, and treasury services. Leveraging advanced AI, analytics, and secure mobile platforms, the bank enhances corporate clients’ operational efficiency and financial decision-making. Its focus on innovation, real-time transaction processing, and integrated digital tools strengthens customer engagement, supporting seamless banking experiences and driving growth in the U.S. and global corporate banking sector.

-

2025 — Digital interactions reached a record 26 billion, a 12% increase, as over 20 million clients engaged with Erica and CashPro Chat, highlighting Bank of America’s deepening penetration of AI-driven digital banking.

-

2024 — Bank of America unified five separate apps—banking, investing, retirement—into a single personalized mobile experience, now serving 57 million users and winning Celent’s Model Bank award for innovation.

-

2024 — Launched CashPro Insights, a digital analytics tool within its corporate CashPro platform, empowering clients with actionable treasury intelligence for informed decisions, cost savings, and efficiency gains.

JPMorgan Chase

JPMorgan Chase & Co. is a leading player in the Corporate Digital Banking Market, providing advanced digital solutions for payments, treasury, and cash management. Utilizing AI, machine learning, and cloud-based platforms, the bank delivers real-time insights, streamlined operations, and enhanced security for corporate clients. Its innovative tools, such as intelligent analytics and automated workflows, improve financial efficiency, support strategic decision-making, and strengthen customer engagement, driving growth in the global corporate banking sector.

-

2025 — JPMorgan Chase and Coinbase launched a strategic partnership enabling direct bank-to-wallet transfers, Ultimate Rewards redemption for crypto funding, and Chase credit card usage on Coinbase streamlining crypto access for mutual customers.

Citigroup

Citigroup is a prominent player in the Corporate Digital Banking Market, offering integrated digital solutions for payments, treasury, and cash management. Leveraging AI, advanced analytics, and secure cloud platforms, Citigroup enhances operational efficiency and decision-making for corporate clients. Its innovative tools, including real-time transaction monitoring and automated workflows, provide actionable insights, improve financial management, and strengthen client engagement, positioning the bank as a key driver of growth in global corporate digital banking.

-

2025 — Citigroup continues its global rollout of CitiDirect® Commercial Banking, now serving over 57% of its commercial clients. The AI-enhanced platform delivers seamless account access, proactive guidance, streamlined KYC renewals, and ERP integration.

-

2025 — Citi entered a strategic partnership with Palantir to modernize its wealth management technology, enhancing onboarding, account management, and delivering real-time insights across its wealth platform.

-

2023 — Citi launches Citi Token Services, piloting tokenized deposits and smart contracts for 24/7 programmable cash management and trade finance solutions for institutional clients.

-

2023 — The bank invested in Icon Solutions and expanded its adoption of the Icon Payments Framework to modernize its payments micro-services architecture, aimed at flexibility, regulatory readiness, and cloud readiness.

Key Players

Some of the Corporate Digital Banking Market Companies

-

JPMorgan Chase & Co.

-

Wells Fargo & Company

-

Citigroup Inc.

-

HSBC Holdings plc

-

BNP Paribas

-

Barclays plc

-

Deutsche Bank AG

-

UBS Group AG

-

Goldman Sachs Group, Inc.

-

Royal Bank of Canada

-

Toronto-Dominion Bank

-

Mitsubishi UFJ Financial Group, Inc.

-

Sumitomo Mitsui Financial Group, Inc.

-

ING Group

-

Credit Suisse Group AG

-

Société Générale S.A.

-

Banco Santander, S.A.

-

Standard Chartered PLC

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 6.85 Billion |

| Market Size by 2032 | USD 28.16 Billion |

| CAGR | CAGR of 19.42% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Solution Type (Cash Management, Payments, Liquidity Management, Trade Finance, Others) • By Service Type (Professional Services, Managed Services) • By Deployment Mode (On-Premises, Cloud) • By Enterprise Size (Small and Medium Enterprises, Large Enterprises) • By End-User (BFSI, Retail, Manufacturing, IT and Telecommunications, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | JPMorgan Chase & Co., Bank of America Corporation, Wells Fargo & Company, Citigroup Inc., HSBC Holdings plc, BNP Paribas, Barclays plc, Deutsche Bank AG, UBS Group AG, Goldman Sachs Group, Inc., Morgan Stanley, Royal Bank of Canada, Toronto-Dominion Bank, Mitsubishi UFJ Financial Group, Inc., Sumitomo Mitsui Financial Group, Inc., ING Group, Credit Suisse Group AG, Société Générale S.A., Banco Santander, S.A., Standard Chartered PLC |