Cloud OSS BSS Market Size & Overview:

Get more information on Cloud OSS BSS Market - Request Sample Report

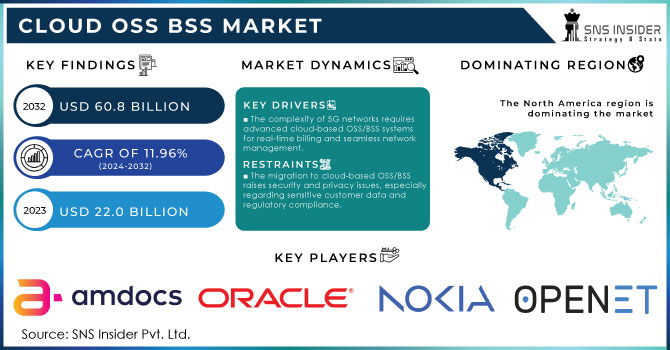

Cloud OSS BSS Market was valued at USD 22.0 billion in 2023 and is expected to reach USD 60.8 Billion by 2032, growing at a CAGR of 11.96% from 2024-2032.

The cloud OSS (Operations Support Systems) and BSS (Business Support Systems) market is growing rapidly, driven by the increasing demand for digital services and the need for agility in telecom operations. OSS deals with network management, fault monitoring, and service provisioning, while BSS handles customer-facing processes like billing, customer management, and order processing. Cloud-based solutions in these areas enable telecom companies to improve operational efficiency, reduce costs, and enhance customer experiences by leveraging the scalability and flexibility of the cloud. One of the key growth factors is the rise of 5G networks, which require sophisticated OSS and BSS platforms to handle the increased complexity of network operations and new use cases like IoT and edge computing. Real-time billing and network management are critical for ensuring seamless 5G service delivery. For instance, Vodafone uses a cloud-native BSS platform to offer flexible, real-time billing for 5G and IoT services.

Another factor driving the market is the growing demand for automation and AI-powered analytics. These technologies enable real-time decision-making, predictive maintenance, and proactive customer service. For example, in 2023, AT&T implemented an AI-driven cloud Operations Support Systems platform to automate network operations, reducing downtime and improving service quality. This shift towards automation has resulted in quicker service deployment and lower operational costs. In addition, telecom operators are increasingly adopting multi-cloud strategies to enhance scalability and resilience. A real-world example is Telefonica, which partnered with Amazon Web Services (AWS) and Google Cloud to move its Operations Support Systems and Business Support Systems to the cloud, improving service innovation and reducing infrastructure management complexity.

Overall, the cloud OSS and BSS market is growing due to the need for telecoms to support new digital services, the rise of 5G, the demand for AI and automation, and the shift towards multi-cloud environments.

Market Dynamics

Drivers

-

The complexity of 5G networks requires advanced cloud-based OSS/BSS systems for real-time billing and seamless network management.

-

AI-driven analytics and automation streamline decision-making, enable predictive maintenance, and reduce operational costs.

-

Demand for real-time insights for customer experience management and network performance boosts the adoption of cloud OSS/BSS platforms.

Demand for real-time insights is one of the key factors driving the telecom companies to migrate towards cloud-based OSS (Operations Support Systems) and BSS (Business Support Systems) platforms. As technologies like 5G, IoT and edge computing are enhancing the complexity of networks performed by telecom operators facing real time management of customer experiences and network performance leading to smooth service delivery. Many traditional OSS/BSS systems, constrained by aging infrastructure often times are too slow and rigid to ingest and respond process data in real time.

OSS/BSS solutions hosted on the cloud allow telecoms to fast-track their data processing capabilities and gain insights with significant actionable value in near real-time. This is particularly critical for customer experience management, with today consumers demanding instant response wherever there are issues such as service interruptions, bill discrepancies or changes in consumption pattern. Providing real-time analytics to monitor customer interactions, anticipate potential issues, and proactively prevent them from impacting customer satisfaction. As an example, if a telecom provider detects network issues in a particular area using real-time insights, it can reroute traffic to avoid service downtime. Network performance management also benefits immensely from real-time analytics. Network operators can monitor network health, KPIs in real-time and spot problems before they turn into major outages. Operators can fine-tune network settings, scale up or down resources on demand and have access to instant deployments of fixes this way, improving the efficiency of the entire network. This will reduce the downtime, minimize latency, and overall improve the reliability of service.

For instance, Vodafone employs a cloud-native BSS platform that supports 5G and IoT with real-time billing and customer management. Through this system, Vodafone can ensure uninterrupted services, and provide billing models based on usage at flexible intervals, resulting in improved customer satisfaction, and operational efficiency. All of this is leading to a faster transition to cloud OSS/BSS platforms in the telecom space, helping telcos make decisions on customer experiences and network performance much quicker than before, providing effective customer services and offering an operationally efficient network.

Restraints

-

The migration to cloud-based OSS/BSS raises security and privacy issues, especially regarding sensitive customer data and regulatory compliance.

-

Telecom operators must navigate complex regulations across regions, which can complicate the deployment of cloud-based OSS/BSS systems.

-

Relying heavily on a single cloud service provider may lead to vendor lock-in, limiting flexibility and increasing dependency on specific technologies or pricing models.

One of the most critical reasons that is bothering telecom operators for adopting cloud-based OSS (Operations Support Systems) and BSS (Business Support Systems) & that is the vendor lock-in. Single Cloud Provider Limitations — A telecom provider that relies to heavily on a single cloud service provider is bound to have its limits when it comes to flexibility and may find themselves always needing their providers technologies/pricing models. Not being able to easily migrate applications from one cloud provider to another due too custom architecture, APIs and services of deeply integrated cloud platforms.

This dependency can restrict an operator to adapt to changing business needs or technological advances in the cloud OSS/BSS market. If a telecom operator locks itself into a particular vendor for OSS/BSS, they may struggle to migrate away from that vendor if better solutions come along or the market landscape shifts. Financially it is not a small detail when you evaluate and compare the costs of EUR / USD to migrate these data and applications from any platform to another one, in addition to the time and human resources that this process would generate. Further, changing vendors means more time lost on training staff and reconfiguring systems which can lead to operational disruptions and hinder service delivery. Furthermore, vendor lock-in may shift the cost/benefit dynamic. If reliance on a single provider causes pricing terms that are more unfavorable than anticipated, the telecom operator may have limited leverage to negotiate a better deal. With rate increase or modification of service contract, operator might not find alternative solution provider and high operational costs can follow.

Flexibility is the keyword in the fast-evolving telecom landscape with constant changes in technology and customer expectations. If you are a telecom operator, you need to pivot faster to take advantage of technologies for better customer experiences and optimized operations. Moving toward a multi-cloud strategy can help telecom players stay away from vendor lock-in and get full control of their bargaining position, thus helping them to be agile and competitive in the market.

In conclusion, single-provider cloud solutions can provide convenience and short-term advantages but involve risks of vendor lock-in that decrease mobility and amplify dependency, which is why telecom operators have to be prudent regarding their clouds.

Segment Analysis

By Functionality

The functionality segment dominated the market and is forecast to contribute major growth in the coming years. Some of the core functionalities provided by Cloud OSS/BSS solutions include Order Management, Inventory Management, Billing and Revenue Management, Customer Relationship Management (CRM) and Analytics and Reporting. Revenue in this segment is growing at a compound annual growth rate (CAGR) of 13.4% over the forecast period.

The Order Management Segment anticipated to grow at significant CAGR during the forecast period. Driven by, streamlines the process of handling customer orders, from private placement to delivery. Inventory ManagementReal-time visibility into inventory helps businesses to optimize their supplychain and reduce costs. Simplifies processes with Billing and Revenue Management very well automates the billing cycle, enhances the revenue recognition process, and reduces the chances of errors. CRMs help businesses manage their interactions with customers and improve relationships. Finally, Analytics and Reporting capability provides key insights on business activity that empowers factual based decision making.

By Deployment

In 2023, the public cloud segment dominated the market and accounted for the largest share of Cloud OSS/BSS market, owing to benefits such as flexibility, scalability and cost-effectiveness. On the opposite side, private cloud segment is also expected to gain significant momentum due to increasing needs for security and control over data. In addition, the hybrid cloud subsection is expected to grow as companies want to take advantage of both public and private cloud solutions.

The managed services component and segment is anticipated surplus growth, due to the trend towards outsourcing cloud operations to specialized cloud providers. The end-user verticals for public and private cloud include small, medium, and large enterprises. Public Cloud will witness the highest revenue during this period, thanks to its rapid adoption by end-users across global regions. Private cloud, hybrid cloud and managed services are expected to come in a close second. A peek into the deployment model segment indicates that SMEs are likely to prefer public cloud, and Large enterprises tend to use Private cloud. Over the years however, the trend many organizations will follow to reap their cloud infrastructure benefits as fully as possible is the adoption of hybrid cloud solutions. In particular, managed services are expected to become more prominent as enterprises continue moving towards outsourcing their cloud services to experts.

By Industry

The telecommunications segment dominated the market and held for significant revenue share in 2023. Major factor contributing to this growth is the growing adoption of cloud-based OSS/BSS solutions by telecom operators to simplify operations, lower costs and improve customer experience. The media and entertainment industry is also expected to see substantial growth over the next several years, as the popularity of streaming services increases and the need for effective content management and distribution systems becomes a necessity.Additionally, the financial services industry is an evolving vertical for cloud OSS/BSS solutions as banks and other financial institutions continue to seek out opportunities to modernize their IT infrastructure while increasing agility and scalability.

Furthermore, the healthcare sector is expected to continue moving towards adopting cloud OSS/BSS as solutions will allow healthcare providers to improve patient care, reduce costs and enhance operational efficiency.

Regional Analysis

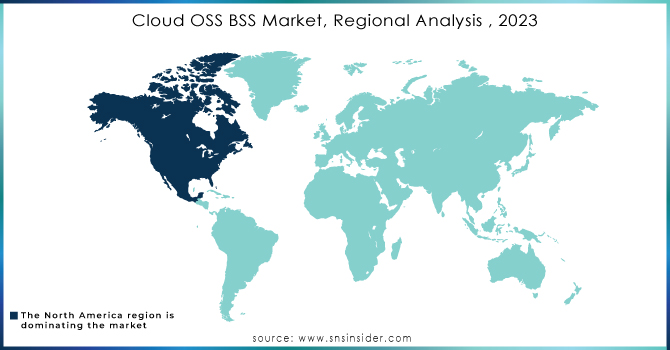

The North America dominated the market and held the significant revenue share in 2023, driven by several key factors. The presence of major cloud service providers and advanced technological infrastructure supports the widespread adoption of cloud-based solutions. Additionally, increasing demand for enhanced customer experience and operational efficiency among telecom operators is pushing investments in innovative OSS/BSS systems. The ongoing digital transformation across various industries, coupled with the rise of 5G networks and Internet of Things (IoT) applications, further accelerates this trend.

The Asia Pacific region is poised for substantial growth in the Cloud OSS/BSS market, driven by several key factors. The rapid expansion of telecom networks, particularly with the rollout of 5G technology, is increasing the demand for efficient cloud-based solutions. Additionally, the rising adoption of Internet of Things (IoT) devices and smart technologies across various sectors is propelling the need for robust OSS/BSS systems to manage complex operations. Furthermore, government initiatives promoting digital transformation and increased investments in IT infrastructure are enhancing market potential.

Need any customization research on Cloud OSS BSS Market - Enquire Now

Key Players

The major key players are

-

Amdocs - Amdocs Billing and Revenue Management

-

Oracle Corporation - Oracle Communications Billing and Revenue Management

-

SAP SE - SAP Convergent Charging

-

Nokia Corporation - Nokia CloudBand

-

Ericsson - Ericsson Revenue Manager

-

IBM Corporation - IBM Cloud Pak for Communications

-

Cisco Systems, Inc. - Cisco Cloud Services Router (CSR) 1000V

-

CSG International - CSG Billing

-

Netcracker Technology Corporation - Netcracker Revenue Management

-

Comarch S.A. - Comarch OSS/BSS Suite

-

Tata Consultancy Services (TCS) - TCS Digital BSS

-

Hewlett Packard Enterprise (HPE) - HPE GreenLake

-

Accenture - Accenture Cloud Services

-

Fujitsu - Fujitsu Network Function Virtualization (NFV)

-

Huawei Technologies Co., Ltd. - Huawei CloudCore

-

ZTE Corporation - ZTE CloudStudio

-

Openet - Openet Policy Manager

-

Cerillion Technologies - Cerillion Convergent Charging

-

Mavenir - Mavenir Cloud-Native BSS

-

Amdocs Openet - Amdocs Openet Policy Control

Cloud computing provider

-

Amdocs Cloud

-

Oracle Cloud Infrastructure

-

SAP Business Technology Platform

-

Nokia CloudBand

-

Ericsson Cloud Core

-

IBM Cloud

-

Cisco Cloud Services

-

CSG Cloud

-

Netcracker Cloud

-

Comarch Cloud

-

TCS Cloud Services

-

HPE GreenLake

-

Accenture Cloud

-

Fujitsu Cloud Service K5

-

Huawei Cloud

-

ZTE Cloud Studio

-

Openet Cloud Services

-

Cerillion Cloud

-

Mavenir Cloud Services

-

Amdocs Openet Cloud

Recent Developments

In February 2023, Huawei launched its CloudCampus 3.0 solution, which includes a comprehensive set of cloud-based OSS/BSS solutions for managing and optimizing campus networks.

In March 2023, Nokia released its Digital Operations Center (DOC), a cloud-based OSS/BSS solution designed to help communications service providers (CSPs) manage their networks and services in real time.

| Report Attributes | Details |

| Market Size in 2023 | USD 22.0 billion |

| Market Size by 2032 | USD 60.8 Billion |

| CAGR | CAGR of 11.96% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Deployment (Public Cloud, Private Cloud, Hybrid Cloud, Managed Services) •By Functionality (Order Management, Inventory Management, Billing and Revenue Management, Customer Relationship Management, Analytics and Reporting) •By Organization Size (Small and Medium-Sized Businesses, Large Enterprises) •By Industry (Telecommunications, Media and Entertainment, Financial Services, Manufacturing, Healthcare) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles |

Amdocs , Oracle Corporation , SAP SE , Nokia Corporation, Ericsson, IBM Corporation, Cisco Systems, Inc., CSG International, Netcracker Technology Corporation, Comarch S.A |

| Key Drivers | •Demand for real-time insights for customer experience management and network performance Increasing •AI-driven analytics and automation streamline decision-making, enable predictive maintenance, and reduce operational costs. •The complexity of 5G networks requires advanced cloud-based OSS/BSS systems for real-time billing and seamless network management. |

| Market Restraints | •The migration to cloud-based OSS/BSS raises security and privacy issues •Telecom operators must navigate complex regulations across regions •Relying heavily on a single cloud service provider may lead to vendor lock-in |