Time and Attendance Software Market Report Scope & Overview:

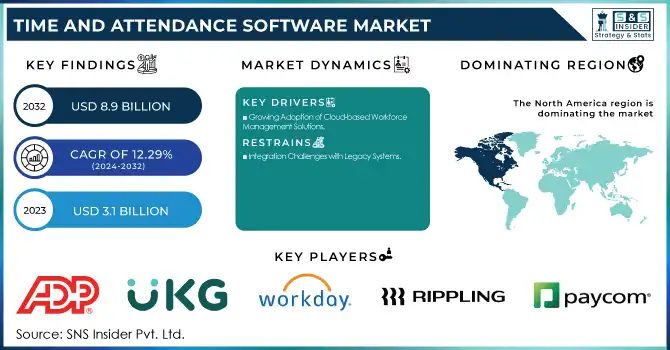

The Time and Attendance Software Market was valued at USD 3.1 Billion in 2023 and is expected to reach USD 8.9 Billion by 2032, growing at a CAGR of 12.29% from 2024-2032. The Time and Attendance Software transformed with AI-powered employee tracking, biometric authentication, and cloud-based work scheduling, to ensure compliance and enhance overall efficiency. It saw an explosion in adoption among corporations and gig workers, integrated into the workflow of HRMS, payroll, and ERP for real-time analytics. AI-based decision-making, workforce optimization, and new R&D initiatives in predictive scheduling, blockchain-enhanced security, and IoT monitoring for better accuracy and automation.

To get more information on Time and Attendance Software Market - Request Free Sample Report

Drivers: Growing Adoption of Cloud-based Workforce Management Solutions

The demand for advanced software solutions is boosted as businesses start concentrating on real-time employee tracking, automated payroll processing, and automated compliance management. This is especially attractive to organizations of all sizes, as cloud-based platforms provide scalability and remote access and enable seamless integration with HR and payroll systems. At the same time, biometric recognition gives you greater precision and speed, reducing time theft and human error. The increasing demand for optimizing workforce utilization along with legal and compliance policies is anticipated to fuel market growth over the next few years.

Restraints: Integration Challenges with Legacy Systems

The Time and Attendance Software Market has some major restraints as integrating new software with existing legacy systems. This is one of the reasons many organizations, particularly large enterprises, continue to use older HR and payroll systems that don't support newer cloud-attendance solutions. Such a multi-platform environment introduces complexities in data synchronization, data accuracy, and workflow automation. Transitioning also means higher costs and technical complexities for businesses, which can slow down uptake. This stimulates API-based integration and customization, as well as strong technical support to mitigate these issues and accelerate growth in the market.

Opportunities: Rising Demand for AI-powered and IoT-enabled Attendance Systems

The increase in the use of artificial intelligence and the Internet of Things in time and attendance software are additional forces that are expected to serve as growth catalysts. Workforce management challenges such as forecasting absenteeism trends and shift scheduling are addressable through AI-driven analytics, helping firms achieve workforce optimization & maximization productivity. Integrating IoT in smart attendance systems like facial detection and RFID-based tracking facilitates accurate and contactless employee monitoring. IoT-driven innovations-based and mobile attendance solutions have demand further fueled by the widespread adoption of remote and hybrid work models. The demands of the modern workplace are rapidly evolving and vendors that incorporate AI and IoT-driven innovations will be at the forefront of solving the challenges of the future.

Challenges: Compliance with Evolving Labor Regulations and System Integration

The need to comply with changing labor laws and regulations across different regions is one of the most important challenges in the time and attendance software market. This causes operational complexities as employers are required to frequently update their systems to comply with the new policies. Moreover, the implementation of time-tracking solutions, together with the complex Integration with already existing HRMS, payroll, and ERP systems, can become quite cumbersome in terms of technical implementation effort& customizations needed with the IT support. Another persistent challenge in the growth of this market is the hurdle of user adoption faced by organizations as employees resist implementation due to privacy and surveillance concerns.

Segment Analysis

By Component

The software segment dominated the market and held the largest market share in 2023, due to the rising adoption of automated tracking in business. Cloud-based and real-time AI-driven software for smooth workforce management is what companies are investing into.

The services segment is projected to grow at the fastest CAGR during the forecast period as enterprises require implementation, customization and training services to ensure optimal utilization of software.

By Enterprise Size

The large enterprise segment dominated the market and accounted for the largest market share of 73%, as they want to focus on optimizing their workforce as much as ensuring regulatory compliance. These organizations deploy high-budget artificial intelligence and cloud-based time-tracking software, as their operations run with massive quality manpower.

Small & Medium Enterprises are projected to witness the fastest CAGR, on the back of digital transformation, the availability of affordable cloud-based solutions, and rising awareness of automation benefits for workforce management. This transition from manual tracking to automated solutions is facilitating more SMEs getting on board.

By Deployment

The cloud segment dominated the market and accounted for a significant revenue share of the time and attendance software market in 2023, due to the scalability, economic advantages, and accessibility of cloud-based time and attendance software and solutions as compared to on-premises options. As remote and hybrid work models become the new normal, organizations also move to the cloud to have a smooth tracking of their workforce.

The hybrid segment is projected to register the fastest CAGR as organizations aim for a mix of on-premise security and cloud accessibility. Hybrid models are particularly being adopted by businesses in highly regulated industries like healthcare and BFSI to comply with legal obligations while retaining control over their data.

By Industry Vertical

The BFSI segment dominated the market and accounted for the largest share of the workforce management market, as there is a high demand for tracking the workforce, compliance management, and payroll automation. Precise time management systems are indispensable to banks and financial institutions that are required to keep employees productive, while still ensuring safety and compliance with work-hour regulations.

The healthcare segment is expected to register the fastest CAGR during the forecast period since it requires smooth shift scheduling, labor law compliance, and real-time monitoring of workforce trends. Hospitals and other healthcare facilities are rapidly adopting biometric time tracking and mobile workforce solutions.

Regional Landscape of Time and Attendance Software Market

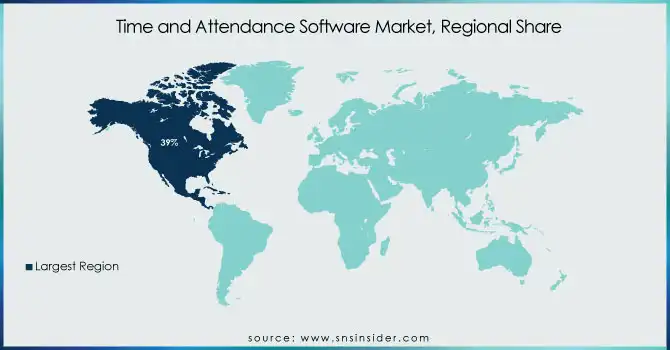

North America dominated the market and accounted for a revenue share of more than 39% in 2023, Due to the increasing usage of AI-enabled workforce management solutions and the availability of cloud-deployed solutions. Moreover, the growing remote work culture and stringent labor laws are expected to boost market growth. Biometric and automated attendance tracking systems are being widely used in industries like BFSI, healthcare, and IT, with the U.S. and Canada being toe-hold early adopters from the same region; these factors are expected to drive the growth of the market in the region.

Asia-Pacific is projected to register the fastest CAGR during the forecast period, owing to the increasing adoption of workforce automation in developing economies such as - India, China & Japan. Cloud-based time and attendance solutions are gaining traction among SMEs in the region, which is expected to complement the growing demand for workforce efficiency. Moreover, rising investments in HR technology, growing IT infrastructure, and increasing labor force regulations are contributing to the market expansion in this region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

The major Time and Attendance Companies are

-

ADP, Inc. – ADP Time & Attendance

-

UKG Inc. (Ultimate Kronos Group) – UKG Ready

-

SAP SE – SAP SuccessFactors Time Tracking

-

Workday, Inc. – Workday Time Tracking

-

Oracle Corporation – Oracle Workforce Management

-

Paycom Software, Inc. – Paycom Time & Attendance

-

Rippling – Rippling Time & Attendance

-

Deputy – Deputy Workforce Management

-

Replicon Inc. – Replicon Time & Attendance

-

TCP Software – TCP TimeClock Plus

-

Ceridian HCM, Inc. – Dayforce Time & Attendance

-

Zenefits – Zenefits Time Tracking

-

BambooHR – BambooHR Time Tracking

-

Paylocity Holding Corporation – Paylocity Time & Attendance

-

QuickBooks (Intuit Inc.) – QuickBooks Time

Recent Developments

-

In November 2024, Edison Partners acquired Fingercheck, a payroll and HR software company, for $115 million. This acquisition aims to support growth among "deskless" workers, such as plumbers, electricians, and home healthcare aides.

-

In October 2024, Paycom Software reported a third-quarter revenue of $452 million, surpassing Wall Street expectations. The growth was driven by strong demand for its employee management services and its self-service payroll and automation product, Beti, which the company plans to expand to Ireland.

|

Report Attributes |

Details |

|

Market Size in 2023 |

USD 3.1 Billion |

|

Market Size by 2032 |

USD 8.9 Billion |

|

CAGR |

CAGR of 12.29% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Component (Software, Service) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

ADP, Inc., UKG Inc. (Ultimate Kronos Group), SAP SE, Workday, Inc., Oracle Corporation, Paycom Software, Inc., Rippling, Deputy, Replicon Inc., TCP Software, Ceridian HCM, Inc., Zenefits, BambooHR, Paylocity Holding Corporation, QuickBooks (Intuit Inc.) |